Updated

Contrary to what you may have heard elsewhere, venture capital investment is still growing, at least according to the latest MoneyTree report from PricewaterhouseCoopers and the National Venture Capital Association.

Yes, that’s pretty much the exact opposite of what Dow Jones VentureSource concluded last week — that a potential VC rebound had stalled. It looks like the disagreement has less to do with the Q3 numbers, where MoneyTree shows a total of $4.8 billion in venture capital investment, compared to $5.1 billion shown by VentureSource, and more with Q2, where there was a much bigger gap in the numbers (MoneyTree: $4.1 billion, VentureSource: $5.4 billion).

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Tracy Lefteroff, global managing partner of venture capital at PricewaterhouseCoopers, said the difference boils down to varying methodologies. VentureSource includes debt financing while the MoneyTree report doesn’t, he said, so MoneyTree is a better indicator of “permanent investment.” Let’s hope that’s true, since MoneyTree shows a nice, steady increase in VC investment since last year’s financial crash, when venture capital plummeted along with everything else. [Update: VentureSource says that’s not true — it doesn’t include debt financing in its numbers.]

But even if we look at things optimistically and believe the numbers will continue going up, that doesn’t necessarily mean things will eventually return to the high investment levels of the last few years.

“We’ve returned to more of a historical norm for venture capital, one that’s not only sustainable, but will go up for here,” Lefteroff said.

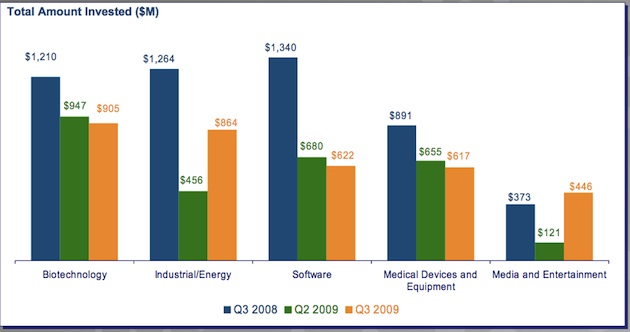

In terms of industry, cleantech saw the serious growth, with an increase of 89 percent of Q2, to $898 million invested in 57 deals. Software, meanwhile, dropped 9 percent to $622 million invested in 122 deals. This may reflect some permanent changes in the software industry, Lefteroff said, as startup work shifts from big, ambitious platforms to smaller applications.