Beating long-standing predictions that it would be one of the first clean technology companies to go public in the next year, cylindrical solar-panel maker Solyndra has filed for an IPO that could amount to as much as $300 million.

Beating long-standing predictions that it would be one of the first clean technology companies to go public in the next year, cylindrical solar-panel maker Solyndra has filed for an IPO that could amount to as much as $300 million.

Based in Fremont, Calif., Solyndra has been the frontrunner among venture-backed solar companies since it received a $535 million loan guarantee from the U.S. Department of Energy at the beginning of September. The news is a happy surprise for both the solar industry and Silicon Valley’s growing clean energy industry.

Proceeds from a public sale — which would list the company under the symbol SOLY — would be funneled into construction of the company’s manufacturing plant (also in Fremont), slated to churn out 500 megawatts worth of panels a year (enough to power as many as 250,000 homes). The loan guarantee is only covering 73 percent of the construction costs. The $300 million could be enough to cover the rest, expediting production and the creation of as many as 3,000 short-term and 1,000 long-term jobs in the local area.

Like A123Systems, the first cleantech IPO in 2009, breaking the seal on the sector after many months of no activity, Solyndra is actually losing money. In the last nine months, it posted a loss of $119.8 million. Sure the margin is tightening (it lost $179.8 million over the same period in 2008), but it’s still a ways away from digging itself out of the red.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

This hasn’t deterred investors in the past. A123 even underbilled itself with its IPO, opening at a share price of $13.50, which was run up to $20.29 by closing time on its first day. As solar heats up, and the IPO market thaws even more, it might not be such a bad idea for Solyndra to be a bit ambitious. It could use the working capital, after all.

Many believe that A123 blazed the trail for green companies like Solyndra, and maybe eventually Silver Spring Systems, to make it to market. If Solyndra successfully turns around a well-priced IPO, it could make it that much easier for other green companies, particularly solar players, to do the same.

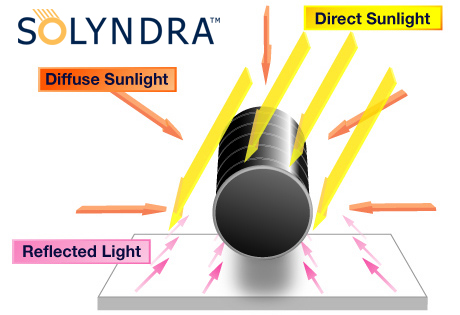

Solyndra has distinguished itself from competitors like SunPower and Suntech mostly with its technology. Its photovoltaic systems, suited for residential and commercial rooftop installations, are cylindrical in shape, using mirrors to concentrate more sunlight on more surface area, upping efficiency and total output. A novel idea, it certainly seems to have impressed the right people.

Solyndra is backed by Argonaut Ventures, U.S. Venture Partners, CMEA Ventures, Redpoint Ventures and RockPort Capital Partners. In September, it received a generous $198 million in capital from Argonaut, which now owns a 36 percent stake in the company. It will have the ability to buy up to 15 percent of shares at the IPO price.

Here’s a simple schematic of Solyndra’s product: