Take one helping of Facebook: social, status updates, friends, and games. Add any online brokerage: stocks, money, charts, and choices. Mix them together, and you’ve got Motif Investing.

Take one helping of Facebook: social, status updates, friends, and games. Add any online brokerage: stocks, money, charts, and choices. Mix them together, and you’ve got Motif Investing.

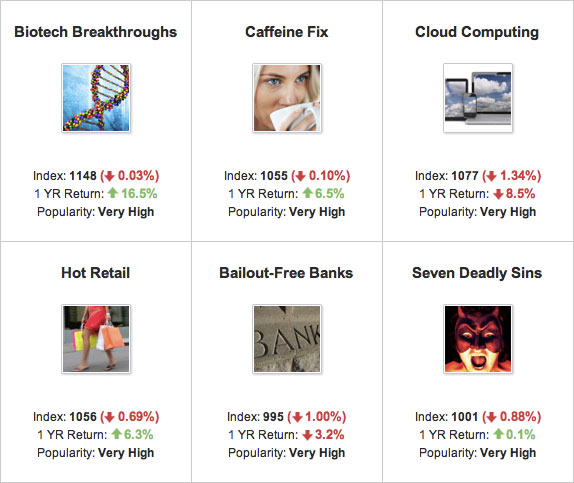

Launching Monday, Motif allows investors to easily build portfolios of companies grouped around topical themes. For example, among the 52 “motifs” in the initial launch stage are “Mobile Internet Tsunami” and “The 7 Deadly Sins.” The first is a collection of companies that are critical to the growth of the mobile web; the second is your standard collection of gambling, cigarette, alcohol, and entertainment companies.

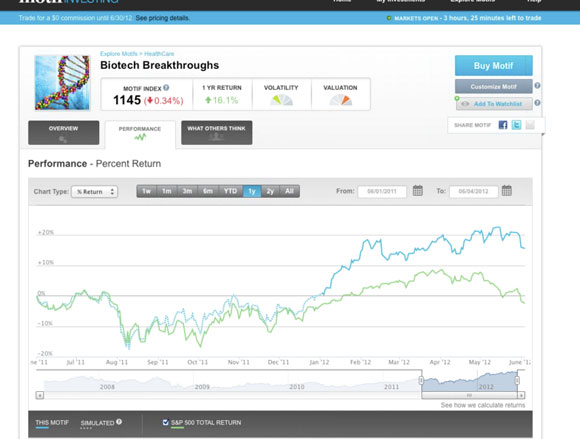

Above: Pick a motif, start investing

Investors choose themes based on their own interests and expertise or what their friends recommend. As CEO Hardeep Walia told VentureBeat this morning, this is superstar investor Peter Lynch’s key rule: invest in what you know.

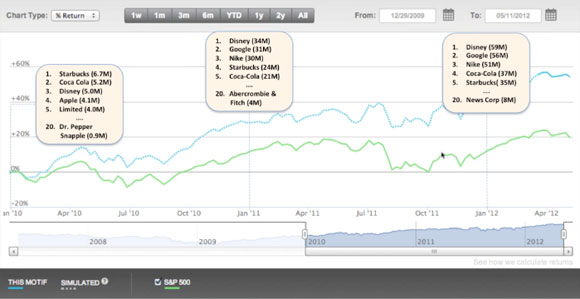

For many people in social media, that might be Facebook. And indeed, there is a “Lots of Likes” motif that tracks the financial performance of companies that get the most likes on Facebook. Walia said, “they would have beaten the S&P 500 by 42 points last year.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Above: The blue line is most-liked companies; green is the market index.

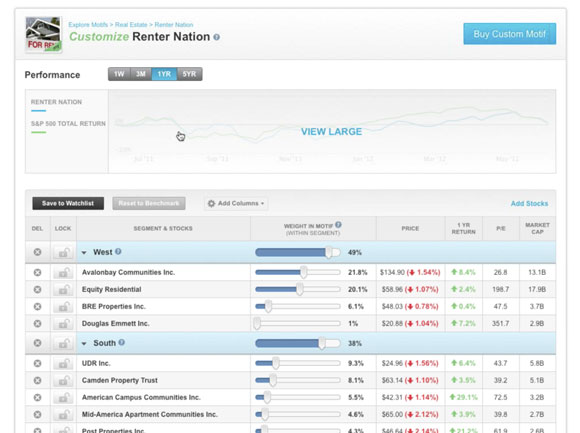

Another example: If you think the effects of the U.S. housing meltdown will continue for years to come, invest in that future by buying Renter Nation:

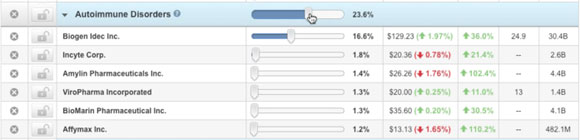

Building customized portfolios of stocks based on market trends is ridiculously easy. Each motif can contain up to 30 stocks, a number which Walia said optimizes your diversification. The true power of the platform, however, lies in the fact that within each motif, you can adjust the weight of group of stocks and individual stocks.

This can lead to startling results. For example, a group of doctors that Walia was meeting with during the beta test phase didn’t like Amgen, and felt that cancer was not the best place to invest. By tuning their specific version of the biotech motif, they significantly increased their return:

Tuning a motif’s exact investment ratios is child’s play. A user adjust the dial, as you can see below. It’s hard to overstate how simple this makes investing. What once was complicated now is a snap:

Fortunately, it’s not just the doctors who can benefit from their insights into biotech. Thanks to the fact that Motif is a social environment, other investors can as well. Starting this summer, anyone will be able to build and share a motif, or customizations of motifs. Users can decide to make their motifs public, shared to a designated group, or keep them private. There’s a discussion board, and invited users can view current progress and results.

Motif is based in San Mateo, California, and is backed by $26 million in venture capital from Ignition, Norwest Venture Partners, and Foundation Capital. The company announced today that former Securities and Exchange Commission chairman Arthur Levitt is joining as an advisor to the board, and former Bank of America and Citigroup executive Sallie Krawcheck is joining the board.

Trades are $9.95 each, which is a significant discount over most online brokerages since a motif contains multiple stocks, and many brokerages charge per stock.

Chart image courtesy ShutterStock