Real estate site Trulia‘s stock has popped about 40 percent in early trading on its first day as a public company, with the stock trading about $7 over its $17-per-share IPO price.

Trulia filed for a $75 million IPO on Monday, despite consistent losses. The site competes with Zillow in up-to-date real estate listings and helpful tools for prospective renters and buyers.

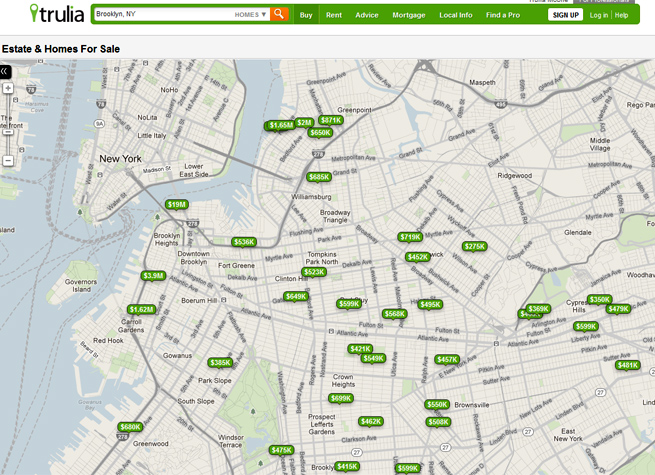

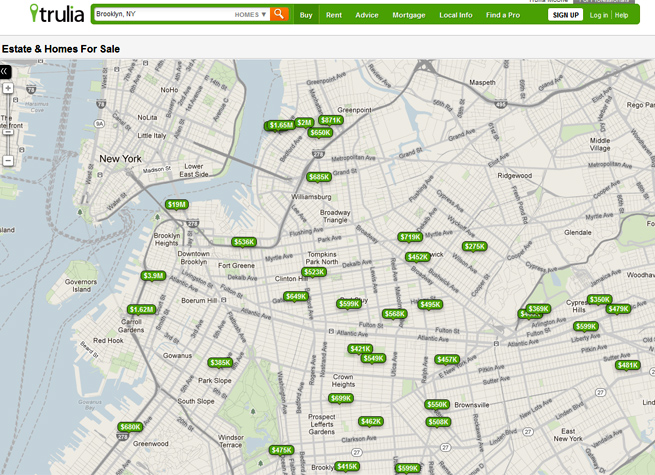

The company has more than 4.5 million homes listed for sale and rent and a database of more than 110 million properties. Its listings include info about nearby schools and crime, but mostly Trulia is helpful for buyers and renters with its ability to easily search, visualize, and track homes and apartments. The map above shows a search I performed today for properties for sale in Brooklyn.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Subscriptions make up the majority of Trulia’s revenues, with more than 21,000 current subscribers. The company’s revenues for the first six months of 2012 amount to $29 million versus $16 million for the same period a year ago. Net losses are also growing for Trulia — its net loss in the first six months of the year are $7.6 million versus $6.2 million a year ago.

Prior the IPO, San Francisco-based Trulia raised about $33 million in funding from Sarofim Fayez, Accell Partners, Sequoia Capital, and other investors.