Violin Memory and its super-fast Flash memory service is hurtling toward a highly successful IPO.

Bloomberg Businessweek reported today that the Silicon Valley company filed to go public under the Jumpstart Our Business Startups (JOBS) act. This allows Violin Memory to keep its public offering under the radar until three weeks prior to the roadshow; for this reason, it has not yet appeared in the U.S. Securities and Exchange Commission.

According to Bloomberg, the valuation on the table is a sky-high $2 billion.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Spokesperson Suzanne Chan declined to comment on Violin Memory’s filing.

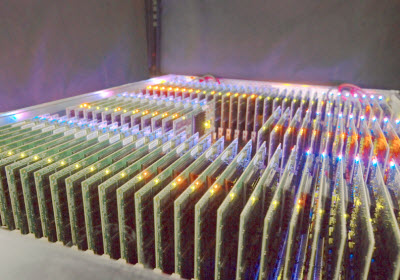

Violin’s storage device are in Oracle’s and Cisco’s products, and it recently announced an alliance with Symantec. As we reported, Violin became a storage system maker in August — a major step up in the electronics food chain.

This spring, it raised a $50 million fourth-round, bringing its total venture capital funding to $172 million. At that time, it was valued at more than $800 million.

With the enterprise technology space on the upswing, this will be the second IPO this summer. Workday confounded expectations with its ass-kicking public offering. In early trading, the human resources software maker soared 72 percent.