testsetset

For the first time ever, a private company has placed in the top 10 most active acquirers of businesses.

For the first time ever, a private company has placed in the top 10 most active acquirers of businesses.

In 2012, 2,357 private technology companies were bought for a combined total of $84 billion, according to a new report from research firm PrivCo. That’s up 22 percent from 2011, but the real surprise is who is doing the acquiring.

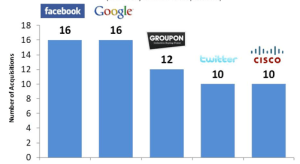

Above: Most active buyers for 2012

The most acquisitive companies of 2012, Facebook and Google, each bought 16 companies. Surprisingly, the I’m-not-dead-yet Groupon bought 12, and even more surprisingly, Twitter tied with Cisco, a $112 billion perennial acquirer, with 10 purchases in the year.

Twitter, of course, is still a private company itself.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“Twitter actually buying as many companies last year as giant Cisco — and more than Apple, Oracle, SAP, Hewlett Packard, and other tech giants – that’s a first,” PrivCo chief executive officer Sam Hamadeh said in an email.

PrivCo plans to release its full 400-page report on mergers and acquisitions of private tech companies on Feb. 14. But the research firm gave VentureBeat a sneak peek today.

2012 was the biggest year for private tech company acquisitions since 2009, Hamadeh said. Companies like Facebook and Twitter rose to the top in part due to the phenomenon of “aqui-hiring,” buying a company simply — or mostly — to acquire its employees. In Facebook’s case, PrivCo’s report highlights that a lot of that happened before its May IPO, which of course, was a major carrot to dangle in front of the targeted companies.

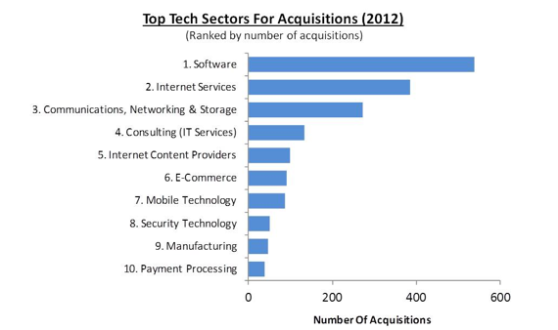

The biggest category? Think enterprise.

Software beat out Internet services for the top spot, PrivCo says, with nearly 600 deals. Internet services ranked second with just over 400 deals, followed by communications, networking, and storage with about 300, and consulting with about 150.

The top two categories combined outweighed all the other categories combined:

Above: Top tech sectors for acquisitions – 2012

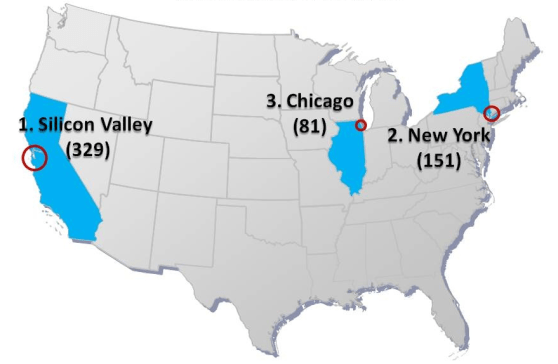

As per usual, Silicon Valley ranked highest in terms of number of deals, with 329. New York was second with 151, and Chicago ranked third at 81 acquisitions. That’s a surprise, to an extent, but remember that Groupon, which ranked third in terms of number of acquisitions in 2012, is based in Chicago.

In addition, PrivCo says, Chicago is home to Thoma Bravo, which “ranked as the No. 1 most active private-equity firm acquirer of private tech companies last year.”

Average deal volume was $36 million.