Chris DeWolfe did OK as a founder of MySpace. But it didn’t turn out to be Facebook. But he can’t complain. DeWolfe is now CEO of Jam City, a Los Angeles company that has become one of the most powerful mobile game companies in the world.

Today, the company is launching Family Guy: Another Freakin’ Mobile Game, as a simple match-3 title that uses the Family Guy characters and its humor. It is one of six titles the company plans to launch this year, and DeWolfe believes it will be big because it uses humor pulled directly from the popular television show’s writers.

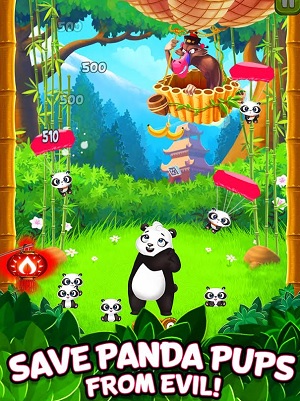

DeWolfe’s company is thriving on casual games like Cookie Jam, Panda Pop, and Family Guy: The Quest for Stuff. It has more than 50 million players a month, and its titles have been downloaded more than 800 million times. I caught up with DeWolfe recently for an interview in San Francisco.

He said the company reaped more than $300 million in revenue in 2016, and that growth is targeted at $450 million in 2017. Hopefully, some of that freakin’ money will come from the new Family Guy game, as well as the recently launched Snoopy Pop title. Here’s an edited transcript of our interview.

Above: Chris DeWolfe of SGN

Chris DeWolfe: We’ve had some seminal moments in each of the last several years of the company, from beefing up our development capabilities to seeing the fruits of that in 2014, with Cookie Jam being game of the year, and Panda Pop exploding to become the number one bubble-popping game. In 2015 we brought in a $130 million investment from NetMarble. This last year we made our acquisition of TinyCo.

This year is going to see six game launches. Each of the last two years, we had only one game launched. Last year we launched Genies and Gems, which is steadily going up the charts. It’s doing very well. The year before was Juice Jam. We’ve said publicly that we have another Family Guy game coming out. We also have a Peanuts game. About half of our games, moving forward, will use third-party IP. TinyCo especially does a great job interpreting the television format into mobile gaming. We’re working very closely with the writers at Fuzzy Door that work on Family Guy. They riff back and forth with our writers on Second Street, as well as the TinyCo writers. That works out very well. Likewise, the TinyCo guys work closely with David X. Cohen and Matt Groening on Futurama.

It’s important that we choose games where we’re working closely with the keepers of the brand to make sure it’s an authentic experience for the end user. The number one customer support request for the Family Guy game was actually for TinyCo to make a Futurama game.

Above: Snoopy Pop

GB: Do you see that as an advantage of being in Los Angeles, closer to the IP owners?

DeWolfe: I don’t think it’s essential, but I think it’s a reason we’ve done four games with Fox. Fox bought MySpace, so I have a close relationship with a lot of folks there. My co-founder was actually on the acquiring team that bought MySpace. We’re close with Fox, Disney, Warner Bros. We see them all on a regular basis. If we need to work something out, it’s only an hour’s drive, like everything in Los Angeles.

It’s an advantage, because you have more constant contact. There’s more serendipity, running into folks that may have worked on a piece of content or own content. There might be an up and coming celebrity who could be very interesting that you hear about first in Los Angeles. You’re more likely to have a deeper understanding of the cultural zeitgeist in Los Angeles. But the same is true in San Francisco. More than half of our employees are in San Francisco. There are big advantages to having a major nexus here. This is the talent center of the world for mobile gaming.

We like to be spread out. It’s good to have our headquarters in Los Angeles, great studios in Los Angeles, and then the majority of our game development teams here in San Francisco, where you have that rich heritage. Then we have San Diego folks who have a rich heritage from Sony. At one time or another, virtually every employee in our San Diego office spent time at Sony. There are also a lot of Zynga offices down there as well. We’ve gotten the best of the best in every city, including Seattle.

Above: Family Guy has another freakin’ mobile game, indeed.

We have about 500 people altogether. We expect to do about $450 million in revenue this year. We did $330 million audited last year. A mild growth year puts us up to $450 million. The biggest challenge this year is going to be taking six games to market. We’ve never done that before. The most we’ve ever taken to market in a year is two or three. To take six games to market properly will be big. We’ve staffed up to do that, to make sure everything goes well.

We’re bringing in additional marketing professionals. We brought on a head of publishing who used to work at EA. We brought on a VP of consumer insights from EA. We’ve started an artificial intelligence team. Between our marketing professionals and our deep technology professionals, we’ve become a much stronger company over the last year, a lot more precise in terms of the games we make and the likelihood of outsized success.

GB: It’s interesting that you can grow to such a large company in terms of employees, but it’s still hard to do something like launch six games. It takes more people per game now, it seems like?

DeWolfe: In the game development business, not every game launches exactly when you think it’s going to launch. A couple of games we thought would launch next year will launch toward the end of this year. One of the games we thought would launch in the last quarter of last year is going to launch this year, because we happen to be adding a meta-layer. Things happen.

GB: Game development is still unpredictable in some ways?

DeWolfe: Revenues and profits are predictable. Game launch dates are still unpredictable. It’s a creative endeavor. If you want to have a high quality, polished product that breaks through the noise of a million other games on the app stores, you can’t launch a game before its time. The KPIs and the soft launch markets tell you when it’s time. If you don’t hit those KPIs, you don’t launch.

Another thing we do that’s different from some other folks is that everything we do is in-house. All of our studios we own 100 percent. We believe it’s necessary to do that in order to consistently produce and distribute polished games that can break the top of the charts. Right now King and Jam City are the only companies with six games in the top-grossing 100. It’s important for us to have that consistency and de-concentration of revenue.

But by the same token you have games like Panda Pop and Cookie Jam. Cookie Jam has done well over a half a billion in revenue, and it’s hitting all-time highs this year. So is Panda Pop. They’re both three and a half years old, and they’re very different games from when we launched them. The whole notion of a game as a service—a game is a living organism that continues to evolve. Our games will continue to get deeper, even our casual games, and we’ll see more mid-core elements associated with some of our newer releases.

We think that’s where the market is going in 2018 and 2019. The casual gaming market is ready to take off the training wheels and jump into deeper gaming experiences. That’s the thesis for our upcoming games, along with approximately half of them coming from third-party IP. We’d love to do one more acquisition in the next 12 months, a meaningful acquisition that takes us into a different genre. We don’t believe in experimenting a lot with new genres in our own organization. We try to stay in our own lanes, do what we do best, and own that genre.

Above: Jam City’s Cookie Jam game

GB: Did NetMarble help you in any way that changed how you do things?

DeWolfe: They’re very heads-down with their IPO and have been for quite a while. They’re helpful in providing a board presence that understands what we go through on a daily basis. It’s almost like a symphony. You have game developers, game designers, artists, animators, and they all have to work in concert. Thing don’t always go how you think they will. To have a partner with a big seat at the table who understands what you’re going through in a board meeting is super helpful.

They’ll be helpful if and when we go through our IPO process, which we may do next year. We’re fortunate that we’re growing very rapidly and that we’re profitable. We can run our own race and choose when we decide to do that. If we do, they’ll have gone through it, and they’ll give us sage advice about what they did right and what they did wrong. We think their bar for quality is very high. We love being exposed to game mechanics that work in Korea. It’s always interesting to see what works in other countries and get their perspective on what may or may not work in Japan or China, because they’ve launched a lot of games in those countries.

We’ve been very successful in Japan, but we haven’t done so well in Korea or China. To get their experience in Korea and China has been helpful.

GB: Is Cookie Jam still the major game you’ve tried to do in China?

DeWolfe: Right. We did that through a publishing deal with NetEase. Quite frankly, it didn’t go that well. The game could have done great there and NetEase is a great publisher, but I think they’re a great publisher of male mid-core games. It was just a mismatch between the type of game they decided to publish and the type of game they had experience publishing.

With our future games, we’d love to work with Tencent. That’s our ideal partner to work with over there, but they don’t publish that many games. You have to deliver something special, which I think we have coming toward the second part of this year. We’ll be making an announcement on a very large IP game in the next 30 or 60 days. It’s one of the biggest IP in the world, and we’ll have the only mobile game associated with it. That could be very interesting for Tencent, but we’ll see. It’s very global in nature. Another one of our games that we haven’t announced is a casual game with deep mid-core features. They’re very interested in that. That may be a good candidate for release in China.

When you boil it all down, one thing we’ve learned from NetMarble is not to build a big team in China like some other companies have. They’ve gotten very distracted by the big shiny object, by 3 billion people. Your actual chances of making real revenues and real profits are quite low, unless you have a great publishing partner. We don’t currently have any revenues or profits forecasted for 2017 or 2018 from China, but that could change if we end up doing a big publishing deal with one of our new games coming out. The new game we launch in China will have to be a global IP. It won’t be like Family Guy or Futurama. It has to be something much bigger.

Above: Family Guy: Another Freakin’ Mobile Game

GB: There are still a few companies that publish even fewer games than you do. Machine Zone hasn’t done a new one in quite a while. King is maybe a bit more like you guys. I still find it odd that those kinds of leaders in the industry are still the most financially successful.

DeWolfe: We’re still at the top of the industry. We have a diversified portfolio, but we don’t have 15 games out there. We’re not like a Glu Mobile. It all depends on where you want to take your company. I don’t think you can take your company public with two games. I’m not sure what Machine Zone wants to do. They were interested in something to do with urban planning? I don’t know much about urban planning. Maybe their strategy works out really well for that. Supercell seems to do quite well with whatever they try. They make great games, and if they launch one of those every two years it seems to work for them, but I think they’re somewhat of a unicorn.

Cookie Jam is no slouch. It’s done more than half a billion dollars, and it’s hitting all-time highs in revenue every year. Our biggest and best team in our company is still working on Cookie Jam, building new levels and creating new events every week. They’re creating new features, new blockers, new power-ups, new advertising strategies within the game. By no means are we forgetting our library games. They’re some of our most important. Playtika is doing something similar. They’re not growing their DAU, but they’re growing their revenue.

There’s a much bigger focus on live game management – how you run your sales, how you run your events, getting those activities automated to the degree we can and running them as efficiently as possible – to increase retention. When you get really good at that, your games can be evergreen like ours, like Candy Crush, like Game of War, like Clash of Clans. All of these games have been in the top 25 for three years, at least.

We’ve expanded our capacity and done acquisitions. We think it’s smart to do acquisitions because it gives us expertise outside of our genre. The guys at TinyCo know how to build big storytelling builder games. They were the first ones to do that successfully with third-party IP with Family Guy. They’re doing it again with Futurama and another game we haven’t announced that’s going to be three times bigger than both of those combined.

Staying focused is the right plan. But you need to keep innovating and diversifying.

Above: The Quest for Stuff enables players to build their own versions of Quahog.

GB: Is there anything you’d like to say about the three games you have coming out, these three licensed IP projects?

DeWolfe: With Snoopy Pop, historically Jam City has had the number one bubble-popping games in the world. We’ve pioneered that type of game mechanic. This is going to be a bigger and better game than anything that’s ever been done in bubble-popping. It has the Snoopy IP associated with it, which has been tested with bubble-popping audiences. They absolutely love it. All the Snoopy characters are used. It appeals to a wide demographic. There’s a huge nostalgia factor to that game. Combined with the awesome game mechanics and how we interpret bubble-popping and power-ups, we think it’s going to be the biggest bubble-popping game ever. At least it could be as big as Panda Pop.

Futurama is in the works at TinyCo. It’s super authentic to the original show, the original characters. It has a massive fan audience built in. We have millions of preregistrations for that game. It’s going to hit the ground running. It’ll have a smaller audience to work with, but it’ll be a much more engaged audience that will be playing more often with deeper gameplay and storytelling. David X. Cohen and Matt Groening, the creators, are very involved. We’re giving fans a core game loop with the quests and the characters and the humor they want. It has elements from Simpsons, elements from Family Guy, but definitely deeper from a content perspective.

Family Guy is a match three game. Typically match three skews a bit more toward women. This is a match three game that both men and women can play. The hardcore Family Guy fan will want to play this game, because men are looking for an excuse to play a match three game. This is a match three game for them. It has great balancing, mechanics, power-ups, as well as a full storyline with all the characters from Family Guy. You get the match three audience and the Family Guy audience.

It’s a bit further out there on the risk scale. Normally you’d have cookies, candy, pastel colors in your match three game. Clouds and unicorns and all that. This is very true to the Family Guy story, to the essence of the original writing. It’s somewhat adult in its humor. You’re collecting and having fun with the characters while you play a match three game.

Each of these games take risks in their own ways. We like the different levels of innovation in all three.

Above: Family Guy: Another Freakin’ Mobile Game

GB: Is there an approach to creativity that you take at the highest level? You have seasoned teams doing what they’re good at, but with such a large enterprise, you want to make sure that every game coming out is a hit. Is there anything you try to standardize in your process?

DeWolfe: Absolutely. The team working on a game has to be passionate about the mechanics and the IP. We’ll typically say, “We think we have access to these IP. Is there anything special you’d do with any of them?” They’ll go back to the drawing board amongst themselves. It could be two or five or 10 people. They’ll come back with a concept.

Then we go to our consumer insights group and test the concept, along with the IP. We’ll get some feedback and give it to the team. If they like the feedback, they’ll build a prototype. That usually takes a couple of weeks. Then they demonstrate the prototype and we’ll ask ourselves, “Is this fun? Is this differentiated? Can it monetize? Is it innovative? How long will it take?” If the answer is a big thumbs up on everything, then we move on to a slice. If it seems a lot like a game someone else did six months ago, we’ll go back to the drawing board, either with a different concept or a different IP or whatever it may be.

At any point in that process, it can get killed. But if it makes it past the prototype process, that group will present to a larger group of seven or eight people, the founders included, along with the GM of the studio. Then they’ll go on and build that slice, which could be one level or one quest that demonstrates the core game loop. That could take three months or so. Then we’ll ask ourselves the same questions again. If it feels kind of like a me-too game, we’ll ask how we can differentiate it and make it really special. If we can figure that out, they’ll keep working on the slice and move on to building a full game. At that point it can get greenlit.

You try to put in as many steps in place as you can between the ideation phase and the greenlight phase, where it can be killed in those first three months. We had a game last year that made it to month 14 or 16 before it got killed. That doesn’t usually happen, but occasionally it does. It got to about 15 people. That was tough, but we just didn’t like it. It didn’t make it to soft launch. It was probably two months away when we decided we’d be better off working on something else. The game wasn’t differentiated. It didn’t test well with focus groups.

Now that we have a consumer insights team, we can get this wonderful qualitative and quantitative information much sooner than we could before. We’re not shooting from the hip as much. The one thing we won’t do, though, we won’t say, “We have this IP. We want to do a storytelling builder game. It’s Star Wars. You guys will do it.” “We don’t even like Star Wars!” “You’re the team that’s open right now and we have to do it now because we hit the bid on the IP.” The group has to come to us and love the IP and want to engage with it. They have to interpret the IP into a mobile game and work with the writers behind the IP. They won’t be able to do that if they don’t have passion and knowledge around it.

GB: How do you deal with some of the counter-pressures there, like time? Maybe you have to meet a movie release. You want to move faster than competitors. There’s urgency in your business, but game development sometimes takes longer.

DeWolfe: I would have answered you completely differently three years ago. Back then I would have said that it was really important to meet deadlines, even if we sometimes miss them by a few months. Now, given the opportunity costs of making a game—if you have 15 or 20 people on a game for 18 months, the opportunity costs for something like Cookie Jam could be several billion dollars throughout the life of the game. You can’t afford to be wrong or to rush a game to market

That’s why we tend not to do games associated with movies, because there usually is that deadline. You don’t want to face a deadline right now. There are just too many games out there. If it’s not ready it’s not ready. If you rush a game to market, you’ll see a big spike in the first couple of weeks before it sinks like a rock. Traditionally, if you look at the shape of our games, they don’t go way up and then down. They don’t go up very steeply at all. It’s a slow and steady build up the top-grossing charts. That’s how we do it.

We’re going to increasingly have bigger go-to-market strategies now that we’ve professionalized our marketing department. But still, we’re not going to spend millions of dollars on a launch and see what happens. We’re not going to just ignore it if it doesn’t virally take off. That doesn’t work. You have to make sure a game is hitting its KPIs and you have the LTV to support an ongoing user acquisition campaign. You have to have buy-in from the platforms so they’ll feature you. We’re fortunate to have more than 50 million uniques in this awesome cross-promo network to launch a game as well.

Clearly we’re taking our time on all of our games this year. We’re not as worried about deadlines. We’re fortunate to be in that position because we’ve been profitable for a long time. If you’re running out of money, you have a lot more pressure on to just launch a game and cross your fingers.

Above: Jam City’s Panda Pop

GB: Is it coincidence that all six games are hitting in a relatively narrow window?

DeWolfe: Yeah, it’s more coincidence. In a perfect world I think we’d launch something more like three games. But we’re not going to hold on to games that we feel are baked and that are the best in breed compared to their competitors. When they’re ready they’re going, even if that means we do two launches in the same month. If they’re not ready they’ll stay in soft launch until they’re 100 percent from a retention perspective and a monetization perspective.

GB: At this point who do you look to for companies to model after, companies to be inspired by?

DeWolfe: I don’t think anyone in the industry wouldn’t say Supercell. I was talking to those guys at GDC. They were saying that Clash Royale has a total of 15 people running the entire game. It’s amazing. Maybe six people build a game like that. They’ve gotten really good at building a core game loop with replayability. They don’t have to staff up to 100 people in a given game to crank out new content every week. They’re just really smart in how they do that. We look up to them in a big way.

I love the cooperative spirit they have. They’re very willing to share information. It’s something of a Finnish custom. All the Finnish game companies are very open about what they’re working on. Maybe in a way it’s karma that they’re doing so well, because they’re so open and helpful to their brothers in the mobile game industry.

In spite of the fact that Activision has acquired King, King is still a great company. They make very fun games. They’re still breaking new ground. Some of the social casino companies like Playtika are doing well, but they’re grinding it out, more like. I’m not a big social casino guy personally. I don’t enjoy making those kinds of games. I don’t claim to understand the fun factor. But I very much respect what Playtika is done in operating Slotomania from a live game management perspective.

Certainly Tencent. NetMarble has done a great job, especially in Korea. They have five or six of the top 10 games. I respect what they’ve done from an acquisition standpoint. It was a gutsy move to come in here and buy Kabam. I love the folks that are mixing and matching different game mechanics.

I like what we’re doing a lot. I’ll compare us favorably to any startup in Los Angeles. We have predictable revenues, predictable, EBITDA, a history of growth. I think we’re a great candidate for an IPO.