Advanced Micro Devices posted a GAAP second-quarter loss of 2 cents a share and 2 cents a share profit on an adjusted basis, even as it continued with the launch of its most competitive chips in a decade. But in the third quarter, AMD expects revenues to rise 23 percent above Q2 levels.

Depending on how you look at those results, it’s both good news and bad news, which is where AMD has pretty much been for the past decade. From AMD’s point of view, the future will only get better. Investors have driven AMD’s stock price up 7 percent in after-hours trading.

AMD has been stuck around the breakeven level for a while, but the new Ryzen chips launched as early as March didn’t really help the company much so far. That’s the bad news. But the good news is that the pipeline of getting chips into new computers and in the hands of customers takes a while, and AMD is in the middle of that. AMD’s results were close to breakeven, but they were slightly better than expectations.

The Sunnyvale, California-based chip maker is the No. 2 maker of PC processors behind Intel, and its results are a bellwether for the PC industry. The company is in the midst of launching its Ryzen desktop processors and Epyc server processors, which AMD claims will take the performance crown away from Intel for the first time in a decade. AMD has also announced its new Vega graphics processing units for high-end computers in competition with graphics chip maker Nvidia.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“Our second quarter results demonstrate strong growth driven by leadership products and focused execution,” said Lisa Su, AMD president and CEO, in a statement. “Our Ryzen desktop processors, Vega GPUs, and Epyc data center products have received tremendous industry recognition. We are very pleased with our improved financial performance, including double digit revenue growth and year-over-year gross margin expansion on the strength of our new products.”

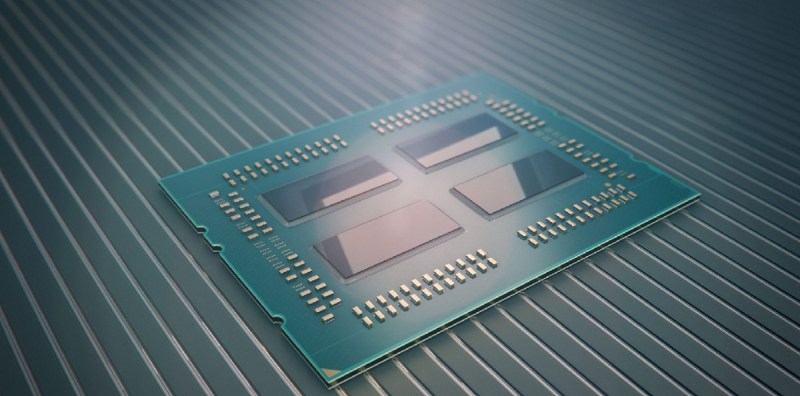

The Ryzen and Epyc families are based on AMD’s Zen cores, which are 52 percent faster per clock cycle than AMD’s previous generation. The chips represent AMD’s core strategy of trying to out-innovate Intel, which has enormous financial, manufacturing, and manpower advantages.

Analysts expected AMD to report a loss of 3 cents a share on a GAAP basis, and a breakeven quarter on an adjusted basis. In the same quarter a year ago, AMD reported a profit of 8 cents a share.

Above: AMD Epyc server chip

Analysts also expected AMD to report sales of $1.16 billion. Actual revenue in the second quarter was $1.22 billion, up 19 percent from a year ago. Sales were driven by the first full quarter of Ryzen processor sales. Average selling prices were up significantly from a year ago.

The GAAP net loss was $16 million compared to net income of $69 million a year ago and a net loss of $73 million in the prior quarter. Loss per share was 2 cents, compared to 8 cents a year ago. On an adjusted basis, net income was $19 million compared to a net loss of $40 million a year ago and a net loss of $38 million in the prior quarter. Diluted earnings per share was 2 cents, compared to a loss per share of 5 cents a year ago and a loss per share of 4 cents in the prior quarter.

AMD said that semi-custom chip sales, which include chips for game consoles, were down 5 percent from a year ago.

“AMD blew away actuals for Q3 and raised expectations for the future,” said Patrick Moorhead, analyst at Moor Insights & Strategy, in an email to VentureBeat. “This came primarily on the back of the first full quarter of Ryzen desktop sales and also on some graphics improvements. AMD has a lot to look forward to as none of their actuals incorporates sales of Epyc server parts, only limited sales of the new Radeon Vega and none of the Ryzen notebook parts. Positive operating profit was icing on the cake and was expected.”

AMD recently announced pricing and availability for its Ryzen 3 and Ryzen Threadripper consumer desktop processors, and the chip maker touted prices that undercut Intel’s comparable central processing units (CPUs) by as much as $1,000. But those chips started shipping in the third quarter, after the June 30 end of the second quarter.

AMD also unveiled the pricing and launch dates for its two Ryzen Threadripper CPUs for high-end desktops. The models include a 12-core, 24-thread Ryzen Threadripper 1920X with a 3.5-GHz base speed and 4.0-GHz boost; and a 16-core, 32-thread Ryzen Threadripper 1950X at a 3.4-GHz base and 4.0-GHz boost. Those chips will be available in early August. The 1920X sells $800 and the 1950X sells for $1,000.

For the third quarter of 2017, AMD expects revenue to increase approximately 23 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in third quarter 2017 revenue increasing approximately 15 percent year-over-year. AMD now expects annual revenue to increase by a mid to high-teens percentage, compared to prior guidance of low double-digit percentage revenue growth.

“Given our first half 2017 performance, and our visibility into the third quarter, we are happy to report we are progressing ahead of our annual revenue guidance and we look forward to a strong year overall,” said Su, in a call with analysts after the earnings were announced.

During the third quarter, AMD will get the benefit of increasing sales of new Ryzen chips as well as the Epyc server chips. AMD also launched new Vega chips in June, and sales from that launch will likely build in Q3.

Also this fall, AMD is supplying the processor for the new Microsoft Xbox One X game console that ships in October.

Above: AMD’s Ryzen chip