CashShield, a startup that wants to help businesses combat online fraud by turning the risk into a revenue potential, announced today that it has received $5.5 million in funding. The round was led by GGV Capital, with participation from private equity firm Heliconia Capital Management, gaming lifestyle brand Razer, venture capital firm Stream Global, and Tony Fadell, “Father of the iPod.”

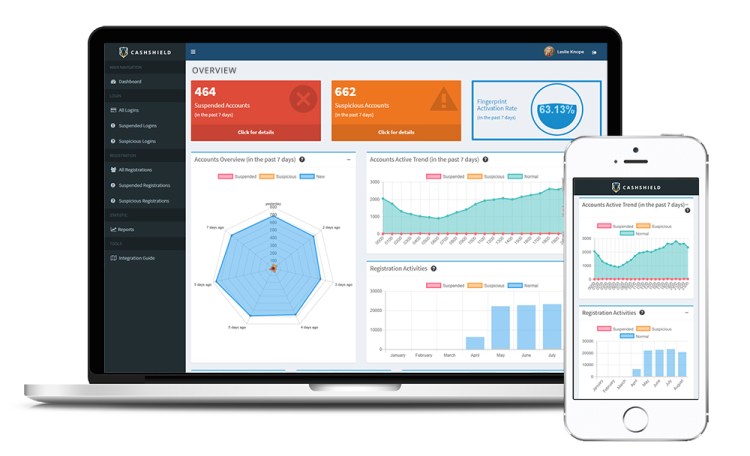

The Singapore-based startup provides software as a service (SaaS) that businesses connect to through an API integration. CashShield claims to use Wall Street trading tools to analyze transactions, drawing on the connection between accepting an online transaction and investing in a stock.

“Considering that 0 percent risk gives you 0 percent returns, fraud risk is to be managed rather than eliminated completely,” wrote CashShield founder and CEO Justin Lie, in an email to VentureBeat. “We often tell our merchants that by simply increasing their fraud rates from 0.1 percent to 0.2 percent, they might be able to increase their potential revenue by a further 10 percent.”

CashShield claims to have 40 to 50 customers, which include Razer and SquareEnix. According to another report, Chinese tech giant Alibaba is also a customer. The startup charges a flat fee per transaction, which depends on the unique risk, industry risk, and transaction volumes of the merchant. Other fraud detection solutions include Riskified, Signifyd, and Sift Science.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Lie founded CashShield in 2008, bootstrapping it for the first few years when the focus was on research and development (R&D). The startup launched in 2014 and is now aggressively expanding across different markets, with offices in Singapore, San Francisco, Berlin, Jakarta, and Shanghai.

CashShield has a current employee base of 35 and will use the new funds to expand into additional markets.