Mobile-first European banking startup N26 has announced that it will launch in the U.K. in the first half of 2018.

The news comes less than two weeks after the Peter Thiel-backed startup also revealed plans to roll out in the U.S. next year.

Founded out of Berlin in 2013, N26 offers online-only bank accounts through mobile apps and the web. The company aims to offer speed and efficiency in the digital age, promising customers the ability to open an account within eight minutes of applying. Originally launched in Germany and Austria, N26 has been slowly expanding across the Eurozone and now claims more than 500,000 customers in 17 countries.

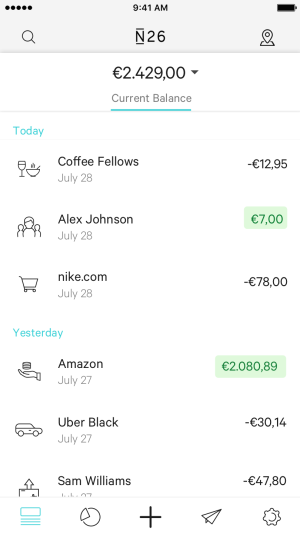

Above: N26 Account

N26 has raised more than $50 million in funding from notable backers such as Peter Thiel’s Valar Ventures, which led its series A round in 2015 and rejoined for N26’s $40 million series B a year later. This money will go some way toward helping the company expand into its first non-euro currency markets — the U.S., and now the U.K.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“We believe the U.K. population will discover N26 as the first bank they’ll love to use,” noted N26 CEO and cofounder Valentin Stalf, speaking at the NOAH conference in London today. “Offering the best financial products to our customers with the best user experience is our top priority and the key to our success.”

N26 is inviting U.K. customers to register through its website today for the chance to gain early access. Once approved, they’ll be able to gain access to a full GBP current account and Mastercard.

Though the U.K. will be the first of N26’s non-euro currency European markets, in theory the launch should be fairly straightforward, given that the U.K. is part of the same financial regulatory system as other European Union (EU) markets already supported by the fintech firm. But with the U.K. on course to exit the EU, things could become a little trickier for fledgling startups such as N26.

“Though there’s still a lot of uncertainty on the outcome of the Brexit negotiations, we are aware of the possibility that it could affect the EU passporting in the long term, [which has] yet to be evaluated by regulatory bodies,” an N26 spokesperson told VentureBeat. “If so, we will of course be prepared to deal with the regulatory setup then and find solutions to continue to service our U.K. customers.”

In other words, despite the U.K.’s alarming trajectory in nosediving out of the EU, the country still represents a major opportunity as “one of the most advanced markets in Europe in terms of digital payment methods,” according to a statement issued by N26. “These advancements in technology have fueled strong demand for a fully fledged mobile banking experience,” it added.

It’s worth noting here, however, that N26 may be a little late to the table, as a number of well-funded digital banking startups are already plying their trade in the U.K. These include Monzo, which has raised around $46 million to date, and Starling Bank, which has raked in around $70 million.