Watch all the Transform 2020 sessions on-demand here.

Nvidia reported earnings that beat expectations and showed that the company’s focus on artificial intelligence is still paying off. For the past decade, Nvidia has been rising above graphics chips for gamers, expanding to parallel processing in data centers and lately to artificial intelligence processing for deep learning neural networks and self-driving cars.

The company reported earnings per share of $1.33 (up 60 percent from a year ago) on revenue of $2.6 billion (up 32 percent), beating Wall Street’s expectations.

The company’s stock price is up more than 100 percent in the past year on the popularity of artificial intelligence. But it slumped during the day on Thursday, along with the broader market. Analysts had expected the Santa Clara, California company to report earnings of 94 cents a share on revenues of $2.36 billion. A year ago, Nvidia reported 83 cents a share earnings on revenues of $2.0 billion.

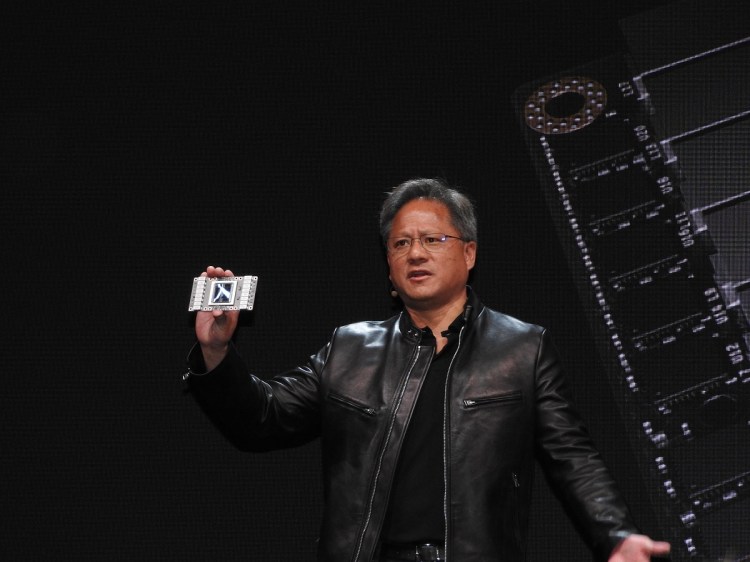

“We had a great quarter across all of our growth drivers,” said Jensen Huang, CEO of Nvidia, in a statement. “Industries across the world are accelerating their adoption of AI.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

He added, “Our Volta [graphics processing unit] GPU has been embraced by every major internet and cloud service provider and computer maker. Our new TensorRT inference acceleration platform opens us to growth in hyperscale data centers.”

Nvidia’s biggest business is still gaming, accounting for $1.56 billion of revenue in the third fiscal quarter ended October 31. But data center revenue is now $501 million, up 109 percent from a year ago. The balance of revenue comes from professional visualization, automotive, and original equipment manufacturers and intellectual property.

Above: If you have a lot of money, you can build your PC with Star Wars.

In Nvidia’s more traditional markets, GeForce and Nintendo Switch are seeing strong growth, he said. And Nvidia’s new Drive PX Pegasus supercomputer for self-driving cars (dubbed robotaxis) has been adopted widely, Huang said. Nvidia provides the main chip for the Nintendo Switch game console, and its GeForce chips are the graphics chips for gaming PCs.

Nvidia shares were up slightly in after hours trading to $205.61 a share.

Nvidia’s shares have risen in part because graphics processing units (GPUs) are becoming popular beyond gaming. They’re being used in data centers to handle non-graphics parallel processing tasks. They’re being used for artificial intelligence and self-driving car applications. And they’re also being used to mine cryptocurrencies. Bitcoin recently hit an all-time high of $7,300 for one Bitcoin.

Nvidia always faces uncertainty and competition, as it’s a giant living among even bigger giants. Nvidia is competing with Apple TV via its Shield 4K set-top box, which now has Google Assistant technology built into it. Tesla also hinted this week that it was possibly going in new directions with its hardware for autonomous devices, with rumors suggesting Tesla is trying to create its own AI chips in partnership with Advanced Micro Devices — rather than use Nvidia AI chips. But Nvidia also recently said it would work with China’s Alibaba and Tencent to provide technology for their vast data centers.

And this week, there was news when AMD’s graphics chief Raja Koduri resigned and then said he would become the chief architect for core and visual computing at Intel. Intel said it would move into high-end graphics chips, where Nvidia is the dominant player.

In the quarter ahead, Nvidia expects more growth, with revenue of $2.65 billion and strong gross profit margins of 59 percent.