While Silicon Valley is known as the heart of tech and home to the world’s top tier venture capital firms, other states and cities in the U.S. are beginning to show flourishing startup scenes — and VCs are noticing. Entrepreneurs in states like Texas, Colorado, Utah, and Ohio are quietly bootstrapping powerhouse companies. What’s more, the star-studded accelerator program Y Combinator has recently handpicked startups from states that include Missouri, Michigan, and Tennessee.

With this trend in mind, VentureBeat sought to quantify just how much of an increase in VC funding startups outside of coastal hubs have seen thus far in 2017, if any, using numbers from venture capital database PitchBook.

For the purposes of this article, the U.S. “Heartland” is defined as all states except those that make up the West Coast (California, Oregon, Washington, Hawaii, Alaska) and the Mid-Atlantic region (New York, New Jersey, Maryland, Pennsylvania, Virginia, West Virginia, and Delaware). According to PitchBook, these are the two regions that traditionally rank first and second in terms of VC funding.

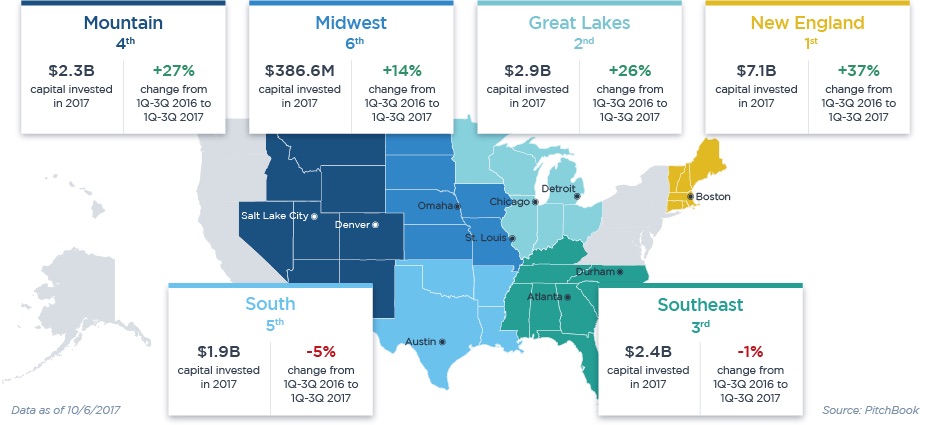

Altogether, startups in the six regions below — the Mountain, Midwest, Great Lakes, New England, South, and Southeast regions — have raised nearly $17 billion from the beginning of Q1 to the end of Q3 in 2017. That’s nearly $5 billion more than startups in these regions raised during the same period last year.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Naturally, the coasts still seem to have a touch of Midas, even outside of New York and San Francisco. The New England region has attracted the most capital this year ($7.1 billion), according to PitchBook, mostly thanks to Boston.

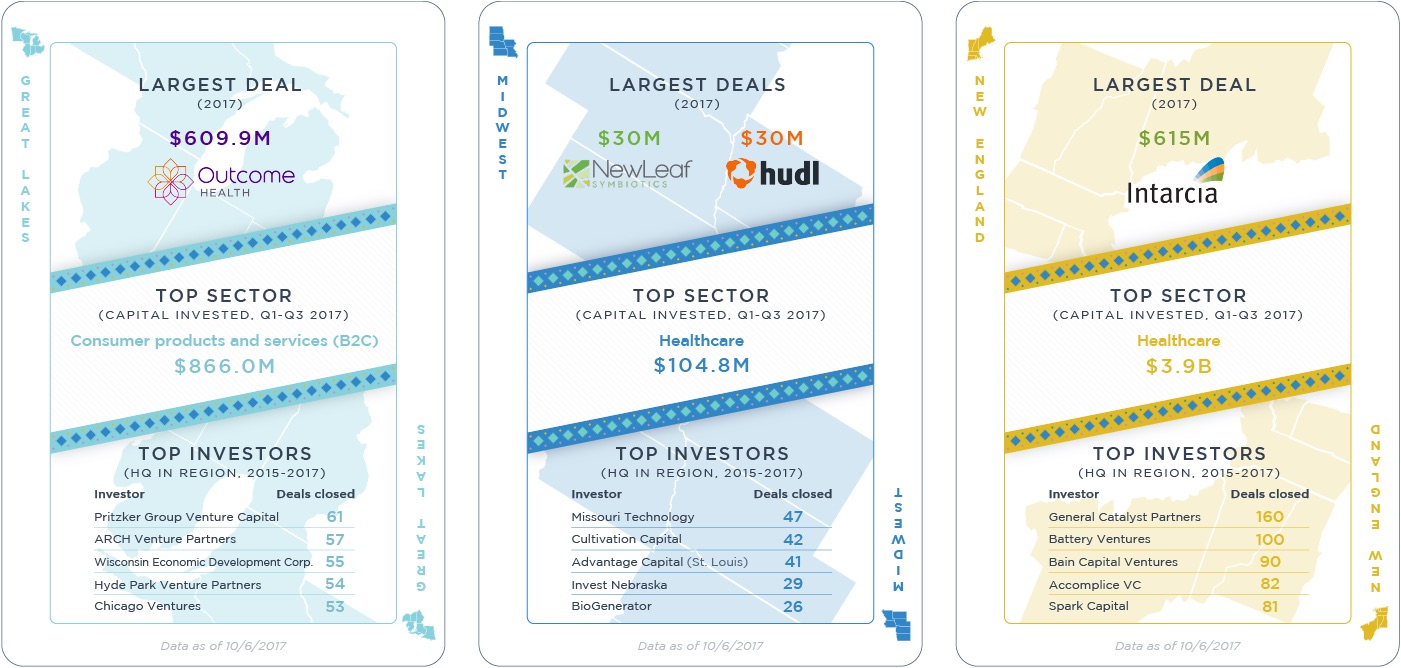

The Great Lakes region, which includes Chicago, came in second, with $2.9 billion in capital raised this year. The region has also seen a considerable boost as funding has increased 26 percent since 2016, thanks predominantly to Outcome Health, which became a darling of the Chicago startup scene after receiving a whopping $500 million in funding last May. However, the startup is now being sued by some of its investors.

While Northern states are showing good numbers, Southern states seem to be lagging. The South, which includes Louisiana, Oklahoma, Arkansas, and Texas, has seen a five percent drop in funding over the past year. The Southeast has seen a similar single-digit decrease — even though states like Florida, North Carolina, and Georgia seem to be doing well, other states are finding it hard to keep up.

Hot deals

Although health care startups like Intarcia Therapeutics have won big recently, other sectors have also managed to get a piece of the pie. Nebraska-based Hudl recently raised $30 million for its AI-powered sports analytics platform, drawing in investments from heavyweights like Accel.

Top VC firms outside of the Valley all seem to be headquartered in New England, which isn’t surprising in light of the vibrant health care scene there. These firms include General Catalyst Partners, Battery Ventures, Bain Capital Ventures, and Spark Capital. Chicago also hosts some good names, like Hyde Park Venture Partners and Chicago Ventures.

The wolf of Main Street

One surprising move this year came from former Piper Jaffray research analyst Gene Munster, who set up a VC firm, Loup Ventures, in Minneapolis. (Well, not that surprising, actually, as Munster and one of the other managing partners, Andrew Murphy, are both from Minneapolis.)

“The startup scene here is much bigger than it gets credit for,” Munster wrote, in an email to VentureBeat. “Recent data from accounting firm CliftonLarsonAllen shows $7 billion in combined exit value from Minnesota tech companies in the last ten years. I’d bet that number will at least double in the next ten years.”

The VC scene, however, is lagging behind, according to him. “It’s far from Silicon Valley, but we like it that way,” he added. Though Loup Ventures is based in Minneapolis, the managing partners spend most of their time between the Bay Area and New York, plugging into their respective networks to source deals. The firm focuses primarily on artificial intelligence, robotics, virtual reality, and augmented reality.

Jackpot

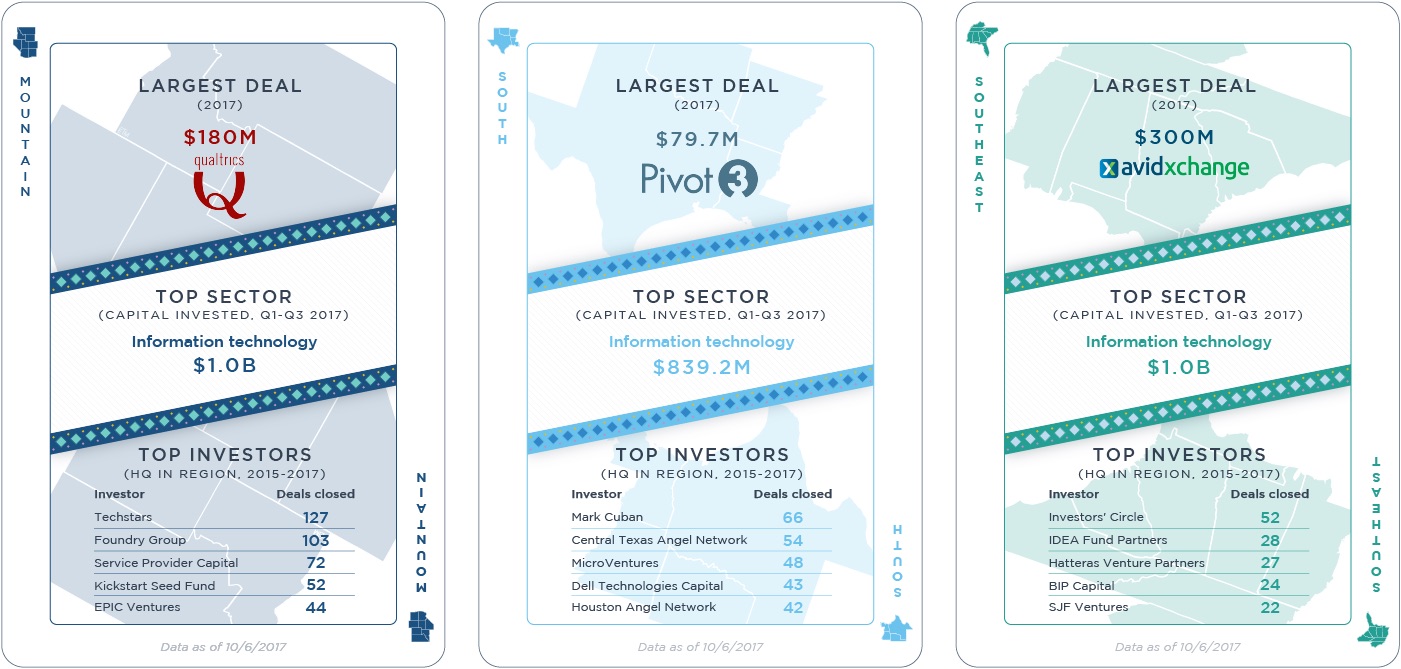

One of the biggest deals of the year in the Heartland came out of Utah. Qualtrics, which provides software to survey employees, markets, and customers, recently announced a $180 million deal, from investors that include Accel, Insight Venture Partners, and Sequoia Capital.

When asked whether it was challenging to raise capital from top tier investors while being based in Utah, Qualtrics cofounder and CEO Ryan Smith replied: “No. You can build a great business anywhere — great VC firms want to invest in great businesses no matter where they are. Truthfully, we didn’t seek out investment. We bootstrapped for 10 years and investors came to us.”

The Mountain region surrounding Utah is home to international accelerator program Techstars and VC firm Foundry Group, both based in Boulder, Colorado.

Heading south to Texas, one investor who stands out is Shark Tank celebrity entrepreneur Mark Cuban, who has closed 66 deals this past year, including an investment in Austin-based Meta SaaS.

So there you go — things are happening in the Heartland. And one notable advantage these startups have is being able to identify and address the needs of the general U.S. population, outside of the bubble that is Silicon Valley.