Watch all the Transform 2020 sessions on-demand here.

Ampere is coming out of stealth today as a maker of ARM-based server microprocessors that will compete with Intel for a slice of the lucrative datacenter chip market. The company is backed by private equity investment firm The Carlyle Group and led by CEO Renee James, former president of Intel. Ampere has a prototype 3.3-Ghz ARM-based processor, which it plans to launch later this year.

James’ new job will be to take some market share away from Intel, the world’s biggest chip maker, or to at least put a small dent in Intel’s 99 percent market share in servers. She hopes to do that with the ARM architecture that is used in the world’s smartphones and that is known for its efficiency in providing performance at very low power levels.

Santa Clara, California-based Ampere, which was built from the ashes of Applied Micro, wants to take ARM into a space where it currently has promise but little market share: the 64-bit chips that power servers and storage devices in the world’s datacenters. Ampere has hundreds of employees, including 300 that it acquired from Applied Micro through an acquisition. It’s placing a big bet.

“There aren’t a lot of people doing new CPUs,” said James, in an interview with VentureBeat. “We’re pretty unique. We’re building microprocessors for servers.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Above: Renee James is CEO of Ampere and former president of Intel.

The category of 64-bit ARM server chips went through its own hype cycle a few years ago, with companies such as Advanced Micro Devices and Applied Micro trying to design chips based on ARM instead of Intel’s x86 architecture, which powers almost all of the world’s Windows PCs and Macs. But those companies failed. AMD shut its ARM project, and Macom acquired Applied Micro in 2016. The Carlyle Group bought the ARM central processing unit (CPU) division of Applied Micro from Macom in 2017. The acquisition was finalized a few months ago, and James took over as CEO, leaving her position as an operating executive at The Carlyle Group.

James stepped down from her role as Intel’s president in February, 2016. She joined The Carlyle Group to make investments and found that semiconductor companies were becoming more popular as investments again. But she said that the amount of money required to bring chips to market is huge, and it required private equity backing from The Carlyle Group to get Ampere off the ground. James isn’t saying exactly how much.

“To do this kind of work, it takes a tremendous amount of investment. We raised quite a bit of money,” she said.

James knows she has a big job to do. Applied Micro worked for years trying to move ARM chips into the enterprise.

“They’ve been on a very long journey, but now they’re out of the dark. In addition to those guys, we’ve hired people from Apple, people from Intel, people from AMD. We have a senior fellow from AMD. We have a really interesting group, a lot of really talented folks,” James said.

Above: Atiq Bajwa, chief architect at Ampere.

Former Intel chip architect Atiq Bajwa is Ampere’s chief architect, while former AMD chip architect Greg Favor is a senior fellow at Ampere.

“As Calxeda, AppliedMicro, Marvell, Samsung, and Broadcom found, competing against Intel in the datacenter is a challenging and expensive proposition,” said Patrick Moorhead, analyst at Moor Insights & Strategy. “The market does want more companies with competitive offerings and if Ampere has the funding and time, it appears the company has recruited some solid talent, so the outcome could be different.”

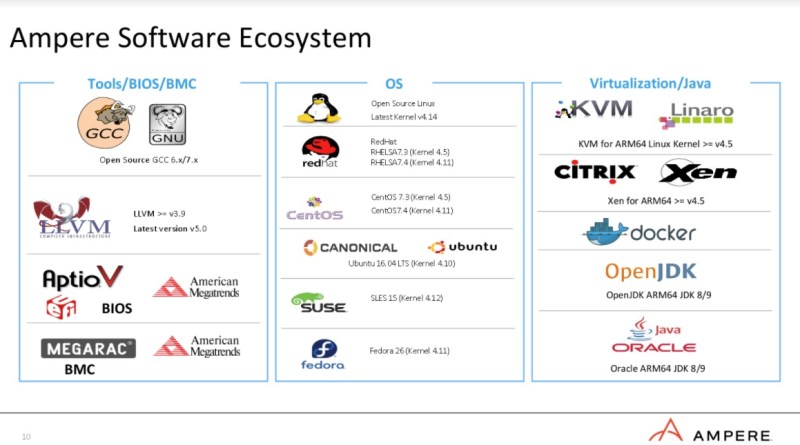

While others have faltered in the past, the market may be more ready now. And Ampere has alliances with big companies that are supporting the ARM server ecosystem, including Microsoft, Oracle, Lenovo, Red Hat, ARM, and TSMC.

“The software ecosystem has completely changed in the last several years,” James said.”If you were building an ARM part to go into legacy enterprise with a calcified legacy software stack, that’s a tough row to hoe. If you’re building a new part with a new approach to memory and bandwidth and throughput for cloud workloads like in-memory databases and Java and containers and AI, that’s a very different machine.”

The idea is to provide better memory throughput and capacity with the lowest total cost of ownership (TCO). Ampere is trying to address engineering problems such as memory performance, cost, space, and power constraints. It is targeting “hyperscale cloud applications” and next-generation datacenters, which will provide processing power for private and public clouds.

In addition to Intel and AMD, Ampere faces other rivals in the space, including Qualcomm, which is also working on ARM-based CPUs. But The Carlyle Group has made plenty of big bets in its history, backing companies like Nielsen, Freescale Semiconductor, Hertz, and many others. It has more than $56 billion in assets under management, and it has generated $76 billion in returns since 1990.

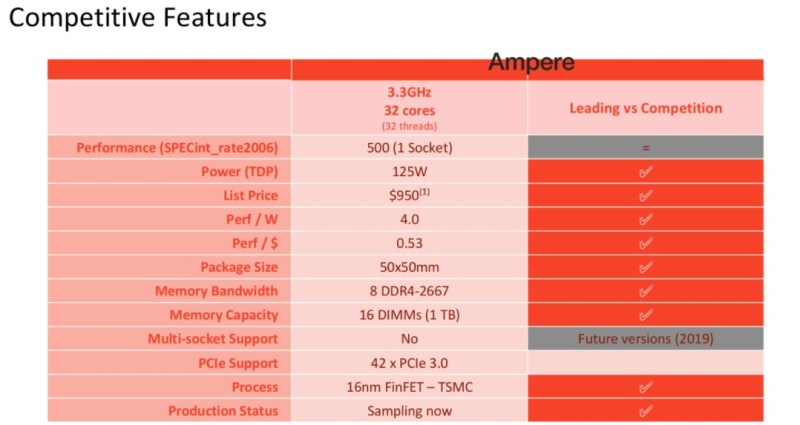

Above: Ampere’s first chip has some impressive specs.

I asked James what it’s like to compete with Intel.

“I don’t actually look at it that way. I look at it as investing in what comes next,” she said. “We’re not building quantum computing. We’re not building high-performance computing. We’re not building legacy enterprise. We’re not building PCs. The list of things I’m not doing that Intel does it long. Intel is the best at what they do, and no one knows that better than I do. I would never start a company and raise this much money to go do what Intel does. That’s ridiculous.”

She added, “I’m doing what I think comes next. I think this is the next platform for the cloud. I’ve had people say, ‘But it’s too late. It’s already done’. I have to remind them that I worked on the project to make Pentium Pro into an enterprise product when everyone told me that enterprise was done. ‘It’s done. We use Sun. We use DEC. It’s done’. Not so done, actually. I don’t think we’re over. I think we get to invent the next thing.”

Ampere has an architecture license with ARM and is designing its own custom cores for its ARMv8-A 64-bit server chip. The first prototype operates at 3.3 GHz and uses 1 terabyte of main memory while drawing about 125 watts. The chip has 32 cores, and it will target the “sweet spot of the server market,” James said. The chip will be in production in the second half of 2018.

Above: Ampere’s partners

Ampere has collected supporting quotes from all of its partners. Lenovo said it plans to bring a new generation of servers to market with Ampere.

“We’re excited to welcome Ampere Computing to the Arm64 server ecosystem,” said Leendert van Doorn, distinguished engineer at Microsoft Azure, in a statement. “As a new company with a leadership team that has years of experience, Ampere Computing helps increase innovation in the Arm64 server ecosystem, and their roadmap is well-aligned with the needs of our hyperscale cloud workloads.”

TSMC is making the first chip in a 16-nanometer manufacturing process. The second-generation chip will be made in a 7-nanometer process, James said.

James served at Intel for decades. I met her when she was a technical assistant in the 1990s for then-CEO Andy Grove. He inspired her to move into management, and she climbed through the ranks and became president, the No. 2 job, in 2013. She announced she was leaving in mid-2013 and departed in February 2016.

Regarding Grove, James said, “I remember every word he ever uttered. In fact, he and I discussed this before he passed away. He said to me, ‘There’s a lot of easier businesses in the world than this one, but this is worthy’. I remember everything he taught me, or I wouldn’t be doing this.”