Mobile banking startup N26 has raised $160 million in a series C round of funding led by Allianz Group’s investment arm Allianz X and Chinese tech titan Tencent, with participation from other existing shareholders.

Founded in 2013 as Number26, the Berlin-based startup rebranded as N26 two years ago when it obtained its own banking license. The company serves 850,000 customers across 17 European markets with online-only bank accounts that can be accessed through Android and iOS apps. The underlying promise is speed and efficiency, as people can open an account within minutes of applying.

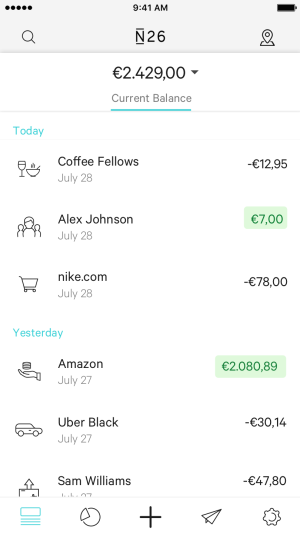

Above: N26 Account

N26 had previously raised around $55 million from some notable investors, including Peter Thiel’s Valar Ventures, which led its series A round. With another $160 million in the bank, the company said it plans to double down on its global growth efforts.

N26 had already announced plans to launch in the U.S. later this year in what could be the company’s first non-Eurozone market, though it also plans to introduce the service in the U.K. this year.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

The company’s longer-term goal is to hit 5 million customers by the end of 2020.

Strategic investment

Nabbing financial services giant Allianz is a major win for N26, and it won’t be too surprising if this strategic investment is a precursor to something a little more integrated further down the line. Upstart fintech companies are an attractive proposition to larger incumbents, as it gives the latter access to innovation and top technical talent. Spanish banking giant BBVA, for example, snapped up U.S. fintech startup Simple in a $117 million deal four years ago.

“N26 is a clear frontrunner in mobile banking,” noted Solmaz Altin, chief digital officer at the Allianz Group. “N26’s banking platform is modernizing traditional business models of financial services, ultimately providing a better customer experience.”

Alternatively, Allianz could just view N26 as the perfect vehicle through which to sell some of its own products, such as insurance. N26 has made no secret of its plans to create a modern bank constructed from various financial technologies and services. N26 previously partnered with peer-to–peer money-transfer firm TransferWise, and it went on to launch a new investment product in conjunction with Vaamo and a savings account with Raisin. It’s already offering insurance, too, via a tie-up with German insurance platform Clark.

As one of the most valuable technology companies in the world, Tencent requires little introduction, and it has already invested in hundreds of companies around the globe — from Tesla to Snap. Its connections and experience across the technology spectrum will be particularly appealling to N26, which wants to invest in artificial intelligence (AI) to make the “banking experience even smarter and more personalized,” according to a statement it released. Tencent, as it happens, has been investing significantly in AI.

“We are very pleased to have Allianz X and Tencent leading our series C,” added N26 cofounder and CEO Valentin Stalf. “Not only are they powerhouses in their respective fields of financial and internet services, but they also understand the power of intelligent technology and design to disrupt industries.”