Cape Analytics, a company that meshes computer vision with geospatial imagery to bring property intelligence to U.S. insurance companies, has raised $17 million in a series B round of funding led by insurance-centric VC fund XL Innovate. The round includes participation from a number of Cape Analytic’s own insurance customers and partners, including The Hartford, Nephila, CSAA Insurance Group, Cincinnati Financial, and State Auto Labs Fund.

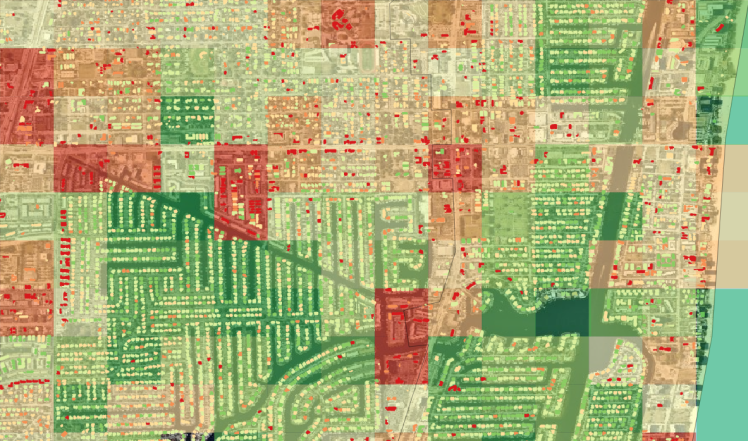

Founded in 2014, San Francisco-based Cape Analytics aims to improve the property underwriting process for insurance companies through automation. It uses aerial images of a home to establish value and enables insurance companies to provide informed quotes more quickly. The platform taps geospatial imagery from partner bodies, such as Nearmap, and then uses these images to extract structured data — things like the size of a property, whether it has solar panels, and the condition of the roof.

Using computer vision and machine learning, Cape Analytics effectively transforms existing geospatial imagery into a structured property information database, with data available on more than 70 million U.S. buildings — thanks in part to its nationwide expansion a few months back.

In crude terms, if the insurance industry was to build its own Google Earth, it would look a little something like this.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Above: Cape Analytics

Ultimately, it’s about saving insurance firms from having to send someone out to inspect a property manually, which can be a resource-intensive process. The platform can detect, for example, if changes have been made to a property since a previous valuation was made, with imagery updates pushed out several times a year.

Above: Cape Analytics

Cape Analytics had raised $14 million in a series A round back in 2016, with notable investors including Khosla Ventures, Lux Capital, and Formation 8. With its fresh cash injection, the company said it plans to expand its sales and AI product development teams. It is also looking to expand into new markets and explore other applications in the insurance realm, according to a statement issued by the company.

“We had the privilege to choose the entities that invested in this round of funding,” said Cape Analytics CEO and cofounder Ryan Kottenstette. “As such, we have deliberately prioritized forward-thinking customers who provide critical product insight and reflect our customer-driven philosophy. This funding also recognizes our leadership in the residential property intelligence space as the only provider of accurate, instant, and up-to-date property data.”

Technology is increasingly infiltrating the insurance, real estate, and construction industries to improve operations, covering aspects such as project management, property management, bid procurement, and more. And we’ve seen numerous drone companies nab investments over the past year, including PrecisionHawk, DroneBase, and Kespry. This type of technology is popular with insurance and building companies seeking to capture aerial imagery of construction sites, for example, where computer vision helps automate tasks traditionally reserved for humans.

“I’ve seen a number of large-scale business success stories that were contingent on strategic inflection points within the insurance industry,” added XL Innovate partner Martha Notaras, who will also now serve as a director on Cape Analytics board. “Cape Analytics is presaging the next major shift in insurance, toward the use of AI and real-time analytics.”