Shipments don’t necessarily paint a complete picture of sales, but a new smartwatch shipment report from Canalys suggests that the Apple Watch has maintained its global leadership position for the second quarter of 2018. There’s also a surprise: Apple’s more expensive cellular model is proving popular, and even helping some carriers retain their customers.

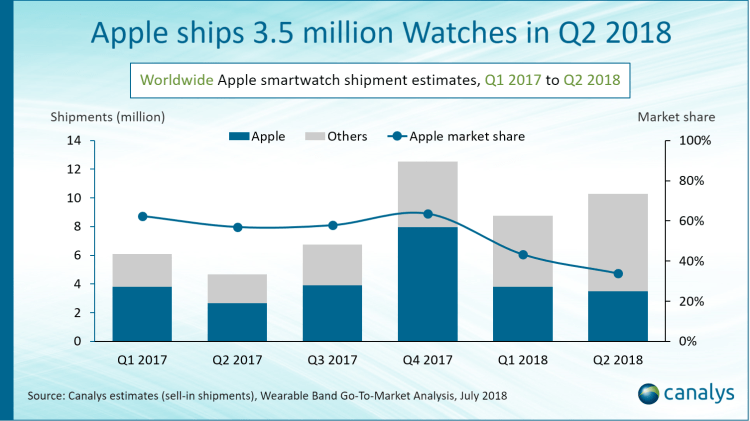

According to Canalys, Apple was the world leader in smartwatch shipments during the quarter, jumping 30 percent year over year to 3.5 million units. Yet its total share of the market dipped from 43 percent to 34 percent as rivals including Fitbit and Garmin mounted successful comebacks, targeting “distinct customer segments” with new products.

Earlier this year, Canalys declared that Apple had “won the wearables game,” but the competition clearly isn’t close to finished. Today’s report suggests that “stellar” work by Apple’s competitors had led the category to global quarterly sales of over 10 million units, up markedly over the prior quarter, though below 2017’s record holiday quarter.

While only 250,000 of the Apple Watches were shipped to Asia (notably excluding the large market in China), Canalys noted that around 60 percent were the LTE version of the Apple Watch Series 3. That was enough to make the cellular model “the best-shipping smartwatch in Asia” for the quarter, Canalys said, which was unexpected to say the least: Materials aside, the LTE model is Apple’s most expensive version of the Watch, and the only one that requires ongoing monthly service charges after the initial purchase (to say nothing of its limited one-hour cellular talk time).

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

The popularity of the LTE model is said to come from Apple’s deals with Asian cellular carriers, who are willing to sell the Watch to generate extra data revenue — as well as to retain “high-value” customers who might otherwise leave due to cut-throat competition. Until now, there wasn’t much evidence that wearables could handcuff customers to carriers, but Canalys suggests the strategy is even working with premium customers in India, where Apple has struggled to gain iPhone market share.

Not all the news is good for Apple. Canalys says that the threat from competitors is growing, as they’re reaching economies of scale thanks to million-unit quarterly shipments, while adding new health, coaching, and mapping features to draw potential Apple Watch customers away. It also believes that new Samsung and Google watches will be entering the market, leaving Apple with a need to win both replacements and new customers.

The Apple Watch Series 4 is expected to be released in September, improving the existing models’ screens, battery, and health functionality. A new Samsung Galaxy Watch is also likely to debut in the very near future, with similar features to the company’s earlier Gear-branded devices.