Watch all the Transform 2020 sessions on-demand here.

Intel has been on an artificial intelligence (AI) buying spree lately. On the heels of its Nervana, Mobileye, and Movidius acquisitions, it today announced that it’s buying Vertex.ai, a startup developing a platform-agnostic AI model suite, for an undisclosed amount.

Vertex.ai will join the chipmaker’s Artificial Intelligence Products Group, according to a note on its website, where it’ll “support a variety of hardware” and work to integrate PlaidML, its “multi-language acceleration platform” that allows developers to deploy AI models on Linux, macOS, and Windows devices, with Intel’s nGraph machine learning backend. It’ll continue to develop the PlaidML, which is open source, under the Apache 2.0 license.

“Intel has acquired Vertex.ai, a Seattle-based startup focused on deep learning compilation tools and associated technology,” Intel said in a statement. “The seven-person Vertex.ai team joined the Movidius team in Intel’s Artificial Intelligence Products Group. With this acquisition, Intel gained an experienced team and IP to further enable flexible deep learning at the edge. Additional details and terms are not being disclosed.”

Vertex.ai was founded in 2015 by Jeremy Bruestle and Choong Ng, with the mission of creating a framework that bridged the gap between hardware and AI-enabled software. It attracted seed money from Curious Capital and Toronto, Canada-based Creative Destruction Lab, among other investors.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“Today’s CPUs and GPUs are powerful and efficient enough for many intelligent applications … [but] that’s about where the good news stops,” Ng wrote on the eve of the company’s launch in 2016. “The lack of portable, developer-friendly tools prevents most organizations from realizing the power of deep learning for their business … A year ago we saw a way to solve the compatibility and portability problems all at once, for all platforms, using a new software approach. It’s required rethinking how we implement the algorithms, and it’s been a challenge to engineer — but the payoff is worth it.”

For Intel, it’s another notch in the company’s AI belt that will (with any luck) position it to capture the $200 billion AI market.

The chipmaker’s acquisition of Altera brought field programmable gate array (an integrated, reconfigurable circuit) into its product lineup, and its purchases of Movidius and Nervana bolstered its real-time processing portfolio. Of note, Nervana’s neural network processor, which is expected to begin production in late 2019, can reportedly deliver up to 10 times the AI training performance of competing graphics cards.

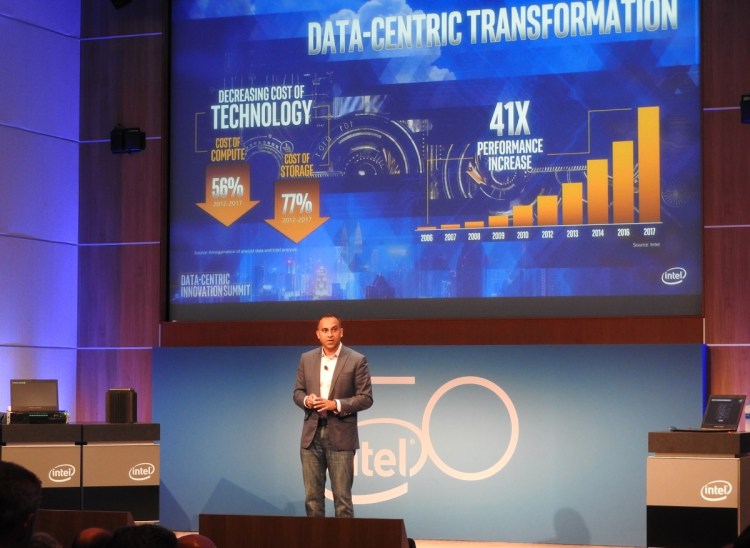

“After 50 years, this is the biggest opportunity for the company,” Navin Shenoy, executive vice president at Intel, said at the company’s Data Centric Innovation Summit this year. “We have 20 percent of this market today … Our strategy is to drive a new era of data center technology.“