About four years ago, Jerry Cuomo and other technologists at IBM started to study blockchain, thanks to the phenomenal rise of Bitcoin and later Ethereum — cryptocurrencies based on the decentralized ledger that is both secure and transparent.

Now Cuomo is vice president of IBM Blockchain, and he interacts with more than 1,500 blockchain experts at Big Blue. Working with the Linux Foundation, IBM created its own fast and secure Hyperledger Fabric to build a more robust version of blockchain that can scale up to the demands of modern commerce and its millions of transactions per second. Hyperledger Fabric is gaining momentum as the infrastructure for created trusted networks in a wide variety of industries. Earlier this week, IBM said it is providing the IBM Blockchain Platform for Hu-manity.co to use blockchain to enable consumers to exercise control over the use of their personal data.

And Cuomo is spreading the word about the benefits blockchain offers all sorts of industries. Recently, IBM cut a deal with shipping giant Maersk to create a blockchain-based supply chain where you could instantaneously track shipped goods back to the original source in a couple of seconds. Already, 94 companies have joined the effort.

IBM is working with Walmart and others to pinpoint sources of contaminated food to the original source in an effort to reduce hundreds of thousands of deaths per year. Big Blue is working with the U.S. Food and Drug Administration to explore how blockchain can ensure patient consent for the transfer of health data.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Here’s an edited transcript of our interview.

VentureBeat: Do you do blockchain, or cryptocurrency, or both?

Jerry Cuomo: I’m blockchain. I’m an equal opportunity employer of whatever sort of application you want to write on top of blockchain.

VentureBeat: How long have you been focused on that?

Cuomo: Since 2014. That was the big wake-up for everybody. I was a CTO for IBM’s middleware business. A big part of that was products that deal with transaction processing. While we were doing many things — cloud and AI and mobile — the transaction processing side of the business had flattened a bit. Not many big new things happening. But I always had my eye on things that were new evolutions in transaction processing.

When I really got to see what was happening under Bitcoin, I got excited, as excited as anyone on the crypto side. But I was really excited about applying this to other uses. IBM certainly caters to business and enterprise. I became very curious about how we can apply this technology to allow businesses to collaborate. It’s not a complete secret, or hard to imagine. Typically, in the world, a group of institutions or people can achieve more than any individual member of that group. One plus one equals three, or whatever you want to call the adage about the power of the group. It seemed like this could be a unique way to transform a supply chain, on one side of the fence, or how trade financing works, on the other side of the fence.

We got the spark of what could be. Once we started practicing this with some of the conventional technology of 2014–in blockchain years that was a long time ago. Ethereum was the gold standard, and it’s still very popular today. It’s great at what it does. But it’s what it didn’t do that started striking our fears. We’re trying to set up a decentralized network between institutions, but this institution needs to be accountable. The EU, pre-GDPR data privacy, or I have a HIPAA requirement–many of those networks require the members to be known and have some level of accountability. I need to be able to prove to an auditor that these events took place and I behaved this way. That’s what started making us scratch our heads. How do we do this with the conventional blockchain?

We came up with a set of ideas and we tried to apply them to Ethereum. We ran into a couple of roadblocks, one being the lack of modularity in the early code base of Ethereum. The other is the licensing model. It was an LGPL license. In IBM, or in any institution that wants to commercialize something, it would be very hard to commercialize something with an LGPL license. Last but not least, there was really no unified governing board for Ethereum.

Long story short, we decided we needed to take another path. The path we took was to start building a blockchain for business from the ground up. We didn’t try to do that by ourselves. We went to the Linux Foundation and they introduced us to several like-minded companies. Together we formed the Hyperledger Project. Within that project there’s a number of open-source projects, one of them being Hyperledger Fabric. IBM has been contributing quite a bit to that project, as well as State Street and Fujitsu and Hitachi and several other companies. We’re very invested in that.

Above: IBM and Maersk are teaming up.

That forms the foundation of IBM Blockchain, which is a platform as a service offering. It forms the foundation of several solution ventures we’ve built with the likes of Wal-Mart and Nestle and Unilever. TradeLens, which is a trade finance network with the likes of Maersk. That’s our strategy. As I said, blockchain for business isn’t just a slogan. There’s some real hard engineering things that we had to do to provide the enterprise qualities needed.

I typically distill it down to four. There’s probably a few more, but four real succinct attributes. One is accountability. We get that through permissioning. You may have heard of permission blockchain. Simply put, members apply for a membership card, a public and private key issued through a decentralized certificate authority. Now you’re accountable. You’re known to the network. While you’re known to the network, the second one is privacy. While you’re known, you should be able to interact privately. In finance, there’s a lot of bilateral contracts and things like that. You don’t need everyone in the network to see your business. You just need the folks who are involved, who have a need to know.

The other is around performance and scalability. It’s known that Ethereum and Bitcoin purposefully don’t perform at high transaction rates. They’re designed not to because of how mining works and how they want to ensure–in a very clever way, blockchain networks are all about building trust. Those blockchains build trust while maintaining anonymity. It works for that use case, for currency, something trying to emulate cash, which is a bearer instrument. But they had to work in safety nets, like the group with the biggest computer couldn’t overrun the network. They put throttles in which hinder performance. But an enterprise blockchain has to support an immense volume of transactions, thousands per second potentially. That was the third.

The fourth is security. A blockchain network has to just keep running. It has to tolerate fault. In other words, it needs to keep running if there are bad actors in the network, and still roughly come up with the right answer. Or even sloppy actors, which in a permission blockchain are probably more the case. You have someone running on less reliable hardware that fails from time to time. The network can’t stop because one member is disappearing every so often.

Those are the four qualities we’ve built into Hyperledger Fabric. We started that with the Linux Foundation and the Hyperledger Project–it was announced in 2015. Three years into it, we’re really starting to see the first live networks happening, which is exciting. There are all sorts: big enterprises, small startups. There are hundreds of networks out there that are using Hyperledger Fabric. We have 70 of them on our radar right now that we consider live, meaning they consider that system the system of record. They have multiple institutions transacting on a daily basis on that network.

Some of them are small scale. Some of them are big scale. Some of them are small scale with big dreams. [laughs] Some are big scale with humongous dreams. We see everything in between. One of the things I’ve been talking about is–the exciting part about working on blockchain is working on middleware and helping usher in the transactive web. In the late ‘90s and early ‘00s, that was very interesting. I became a huge fan of some of the users of Java-based middleware. Many websites that we use daily still use that technology. But I couldn’t say necessarily that that technology was for good.

What I see happening with blockchain–while there’s all kinds of uses of it, I do see a theme in blockchain for good. It’s being used to protect people’s personal identity, or ensure that the information being fed into a clinical trial is correct. A drug that you’re taking hasn’t been counterfeited, or the food that has salmonella in it can be recalled quickly without affecting more people and without shutting down the whole U.S. production of spinach. These are all things that are good for you and I, not just for the industry.

VentureBeat: I’ve wound up in an interesting spot on blockchain. Most of what I do is supposed to be games, and then about 20 percent is tech, everything else. I cover a lot of big companies like IBM. That 20 percent has now been filled up. It’s a few blockchain stories a week now. It’s given me some knowledge, but it’s also confused me a bit as well.

Cuomo: What’s confusing, would you say?

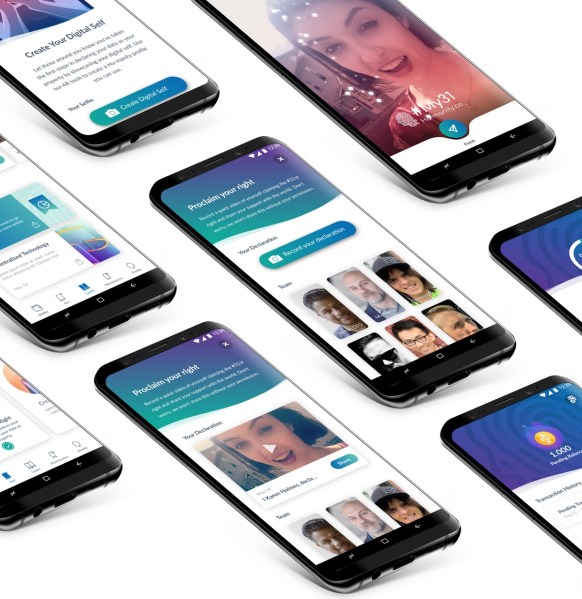

Above: IBM is working with Hu-manity.co to secure your right to control your personal data.

VentureBeat: I see the basic tradeoff of security and transaction speed. The original Bitcoin was not built for transaction speed, as you said. There’s different parties saying they have the next-generation answer to that. But they all seem very fragmented. I wrote quite a bit about Hedera Hashgraph, which is fascinating, but it’s just one of many. How many different slices of this do we really need? Do the banks need to do their own blockchain systems? Do the shipping lines need their own? Everybody’s taking a different whack at similar problems, depending on how much they care about security and transaction speed.

Cuomo: There’s a balance. What excites me, because I’ve seen trends evolve over time–I know a few things for sure, or at least my history suggests these things very strongly. One is, what we know today is going to be very different. For companies like IBM, I believe we’re doing very well in the blockchain space. In order for us to continue leading, we’re going to have to change. It’s evolving.

The material thing to measure–usage and community. Let me explain. The most lasting blockchain technologies are going to be the ones that are built in the open and that provide a fair platform for innovators, for people who have an idea. I’m not going to be locked out if there’s a small group that’s running the board on this. That’s why we like working with the Linux Foundation. They can be really tough sometimes on the way they govern, but it’s good for the technology. It usually breeds winners. Again, they’re blind faith over there. They don’t care if you’re |BM or a small startup. The rules are the rules. There’s a church and state separation between the governing board and the technical board.

What’s measured on the technical side are contributions: not dollar contributions, but code contributions. You can contribute financially, you can contribute via code, or some combination of the two. That fosters a lasting environment. Again, it may not be what’s here today, but those things–I believe, for example, that the Hyperledger project will evolve to be amongst the winners. It’s Darwinian, the way they do it.

VentureBeat: I can see how it’s not simple, in a lot of ways. You would think that you want to join up with all the banks, but what if somebody out there disrupts the banks and they’ve got better ideas than the banks?

Cuomo: I see technology platforms out there like R3 Corda, which I think is a very strong–one particular ex-IBMer joined that early on was very influential and very intelligent in their decisions. But I don’t see it being managed in an open governance process. That’s one thing. The second thing is adoption. You can build the best technology in the world, but sometimes VHS wins over Beta. Does anyone even remember that? It doesn’t have to be the best, necessarily. It has to be what’s adopted.

When I see Hyperledger Fabric adopted by Microsoft, Amazon, Google, Alibaba, Oracle, SAP, and IBM–again, not necessarily a recipe for winning, but that’s a good start. It creates an environment of–dating happens before marriage. A user of the technology can start on one vendor and have recourse to go to another. That opens the market up for usage, and then usage drives the next metric, which is how many live networks are on this technology. I know Hedera, and I think it’s really interesting technology. I don’t know how many live networks are yet up and running on it.

See these gray hairs on my head? They weren’t there in 2014. I had brown hair. The lessons learned to stand something up–it was one thing to talk about the web. It was another thing to do the Olympics. IBM was involved in the 1996 Nagano Olympics. We had to stand up the first real time scoring website. Now it’s like, really, are you gonna brag about that? But it almost killed people! Again, blockchain, the lessons learned from standing up real blockchain solutions will whip the technology into shape in record form.

Again, I can’t claim to have the crystal ball on how things will be written. But history says that if you follow these rules, the odds tend to be in the favor of the things you’re on. If not, we have our eyes open. For example, we started with Ethereum. Many people start their blockchain journey on Ethereum. There is now an Ethereum smart contract processor, an EVM, that has been donated to the Hyperledger Project, called Project Burrow. We’ve integrated Burrow into Hyperledger Fabric. Now you can build an Ethereum network, but permissioned with Hyperledger Fabric. That cross-pollination is an example of–you need an environment lends itself to taking innovations and jumping the tracks.

It’s hard to say where it’s going to go. I do know that we’re holding on, and we’re very serious about the things that we’re working on. But we’re not afraid to pivot either. The winners will pivot in this space. In the end, measure live networks. I think that’s really the critical piece.

VentureBeat: The other thing that becomes difficult for me is that sometimes it’s a small company that comes up with an innovative idea, but those also tend to be more likely the ones that are some kind of too-good-to-be-true ICO fraud. It makes you wary of getting too excited about any one thing.

Cuomo: We see innovation coming on all sides. To me, the real blockchain innovator is not–I was listening to a talk from the head of the Linux Foundation. He gave this completely underwhelming statistic, which is, there’s been 1,000 contributors to Linux to date. I thought, “That’s it? That can’t be right.” But what he meant was, literally, the Linux kernel has had 1,000 code contributors, or something on that order. It seems so underwhelming. But you don’t track contributors. You track users. This set-top box or that smartphone, it all has Linux in it. That’s the measure of success.

In blockchain it’s the innovator. We had a guy on our team that came from Wells Fargo. It’s the perfect storm of innovation, where he understood the core technology, the disruptive powers of blockchain, but he had industry experience. He worked on Apple Pay and all this stuff. He understood the extreme inefficiencies of the payments business. He was able to jump the tracks and pull the two together. Applying blockchain to cross-border payments, for example.

I have this little blockchain talk show, and I’m going to have on the founder of a small company called True Tickets. Again, they’ve found massive inefficiencies in events and ticketing. If a ticket becomes really hot, the people in the middle make all the money. It doesn’t flow back to the originator, the artist or the venue or the sports team. By having this ticketing platform built on blockchain, where smart contracts dictate the maximum or minimum price, or how much of the total revenue should flow back to the originator–this platform could really change things.

Now, is there going to be one blockchain technology to rule them all? Well, why? There’s not one operating system. There’s not going to be one blockchain. It’s about what people are doing with it. Look at the evidence here in 2018. Yes, we always like to look at the moon shots. But the moon shots take a long time. It’s the Apollo programs that are in place, like True Tickets, that are taking one slice at a problem and trying to solve it. Those are the ones to watch. They’re going to grow up. They’re going to have their Apollo one and two and eventually get to the part to where they’re fulfilling the big piece.

Yes, it is confusing, but it gives me hope. I’m fortunate to see these things on a daily basis. There’s also a lot to be concerned about. There’s a lot of choices out there. There’s a lot of folks jumping on the bandwagon. But there are real signs of adoption.

Above: IBM and Maersk

VentureBeat: The regulators are still barely catching up.

Cuomo: I’ve had the fortune of seeing that up close and personal. I’ve testified to Congress twice now on blockchain, most recently on Valentine’s Day this year. It’s interesting to see–I think it was 18 months prior to that, when every question was about Bitcoin. This time, the understanding of blockchain as a platform for B-to-B interaction was much better.

One of the co-testifiers was Frank Yiannas from Wal-Mart. He had to pitch to the Wal-Mart board about why blockchain, and they did an experiment with tracking back sliced mangoes from a Wal-Mart store to the farm. The control environment was doing it manually, and it took seven days to do that tracking. In this food network we have, it took 2.2 seconds. Congress clapped when he said that. It became evident that if you have a salmonella outbreak, it takes seven days. You see it go around. It makes a big difference if you can do it in 2.2 seconds instead.

We want the government focusing on the broad use. Yes, there is one use around cryptocurrency, and I don’t want to belittle that use. It’s a transformative use. You do a lot around gaming. There’s a game theory, or a behavioral economic behind blockchain, that is at the essence of it. Some people call it mining, but every network, even in a permissioned non-currency, there needs to be some motivational economic in the middle of that network to make it tick. There has to be an ecosystem of buyers and sellers or data providers and consumers that creates an incentive to have a seat at that network. It can’t just all be for the benefit of IBM, or the three companies that founded it. There has to be that–what is it? The Nash motivational economic system.

VentureBeat: One thing I wanted to learn more around is the notion of anonymity and security, and how both of those things can happen with blockchain. One company called Authenteq just raised some money last week. They talked about having an account verification system for online games. You sign up through them and they authenticate who you are through a picture of yourself and a picture of your ID. They associate the two together and come up with a hash string for the blockchain. If Twitter needs to verify who I am, they go to that hash string and it says yes, this is a real person. But they may also get a reminder that I’m a real person they banned last week. That person now cannot open a second account on Twitter. But Twitter never handles those details, the photo or the personal information. They just get an answer from the blockchain.

Cuomo: That’s a wonderful use.

VentureBeat: It helped me a bit better how you can preserve the anonymity of someone’s data while doing what needs to be done for the sake of security.

Cuomo: There’s two uses of the word anonymity. In Bitcoin’s blockchain, the referees of the network, the trust anchors in the network, the miners, are anonymous. Again, what makes a blockchain a blockchain, whether it’s permissioned or permissionless, is building trust through a consent model. Bitcoin’s consent model is almost like a college fraternity hazing process, where they test the intestinal fortitude, the determination of a member to be part, by giving them tough problems to solve. In solving those problems you burn real energy, compute energy. If you keep doing it, they say, “This person must want to be in, so I’ll trust them.” That’s how it cleverly builds trust despite anonymity.

But that’s just doing transaction validation. That’s not saying, “I have an account and I want to transfer this and that around it.” You can’t be anonymous at that level and still have an account. Companies have to do AML and KYC. You have to be able to do something like that. You can’t say, “I’m lending money to someone anonymous.” It could be drug cartels or the Taliban. That part, the user part of the blockchain, that’s privacy. How do you deal with privacy?

In Hyperledger Fabric, we have some clever privacy constructs. Again, there’s the permissioning system that the trust anchors use, but then for the users we have privacy. For example, we have the equivalent of Slack channels for blockchain. You can set up a specific topic as a transaction type and you invite members to that. If you’re not a member, you’re not privy to that class of transaction. It’s done privately. What you just described is the crypto anchor approach, where you create a hash of something: put the hash on chain, but keep the data off chain. That’s important, because GDPR requires the right to be forgotten. Any blockchain worth its salt, you shouldn’t be able to delete anything. It’s append only. In order to deal with privacy issues like GDPR, you keep the anchor on, the fingerprint, the hash, and it’s fine, because if you delete the source the hash can stay. It points to nothing and it’s not causing any harm.

The third class is the magic class. It’s zero knowledge proof. It’s a form of privacy, a deep cryptological form of privacy. It allows you to prove a fact without divulging the data associated with it. I can prove I’m over 21 in a bar without telling you my age. I’m giving you the data encrypted. You’re running an algorithm over that data. It never decrypts, but you get your answer. The answer isn’t 24. The answer is yes or no. That’s zero knowledge proof, and that’s one of the things we support in Hyperledger Fabric.

What you talked about, also, is something really interesting, which is the melding of the digital and non-digital worlds. You’re talking about two-factor authentication through a picture and a driver’s license, and then using that as an anchor on a blockchain.

Above: IBM and Hu-manity.co hope an app can make us aware of our 31st human right.

VentureBeat: There was interesting tech there that detected whether you were holding up a picture of somebody else. It could figure out that part. If you’re going to take a selfie, it has to be of a human face. That was an interesting twist.

Cuomo: What then happens with this privacy stuff is that–in your case, the blockchain is used as a digital rights management system of sorts. Your privacy data is like your music or a piece of art you made. Now I can license this art to different users under certain terms of conditions. It’s the same thing with my privacy data. You can have access to it under these conditions.

If I rent an apartment, you hand me a rental agreement and I have to give up every aspect of my life. Why do you need my mother’s maiden name? Instead, I’m not going to give you any of that. I’ll give you rights to ask members of my network questions, once. I’ll give those members of my network rights to answer the questions, once. And you’re not going to know who they are. This might be my bank, but you won’t know who I bank with. You’ll just know that a tier one financial institution answered this question. Then the network provider doesn’t know either. That’s called triple blind data exchange. The National Institute of Standards and Technology loves this kind of stuff. But up until blockchain, these types of identity systems hadn’t been possible. Or at least they were very cumbersome to build.

The system that your colleagues have built has a lot of promise in being able to set up a privacy system on a blockchain that keeps the end user in mind. We’re announcing something on Thursday with a startup called Humanity. They’re pursuing the 31st human right, which is the right of any human to control their digital data. They’re trying to get that passed as a bill, and they’re creating a platform around that, but also a platform of commerce around that information.

If I have clinical data, or if I’m going to participate in a clinical trial–I might not even know what clinical trials are out there, but this network can help me match with the right clinical trial. Maybe I want to match because I just want to do good, or maybe I’m having trouble making my insurance premium payments. By sharing this information I can get compensated. What Humanity is doing, again, is setting up this digital identity information network, but doing it in a way that’s self-sovereign, so the end user stays in control, and you can also conduct commerce. There’s almost a marketplace around it.

VentureBeat: I was looking at another story I did recently, a company called Verses? Blockchain-based property rights in augmented reality. If you have your house and somebody goes and creates an AR world, they might put a virtual strip club on top of your house. They have things like designated areas for certain things. In the area of a school, the school owns the rights to the AR presence around that space. You can’t put a liquor store in the school zone. Or I would own the AR environment around my home, so nobody could plant something on top of it the way Pokemon Go has put PokeStops everywhere. They’d use blockchain in this process to figure out who owns what and where.

Then it becomes a question of, which virtual world is the one that gets the ownership of my space? You run into so many interesting ideas. We have asset-based token sales happening for real estate now, too.

Cuomo: I said there were thousands of uses of blockchain, and crypto is one of them. I think tokenization is on that spectrum of crypto, but it’s not. We see many of the networks build around a digital token. Asset-backed tokens are very popular. We worked with a company in Canada called Interac. They’re doing carbon credits, almost gamified carbon credits. You can basically tokenize your carbon savings. Interac is the premier payment card provider in Canada. They have relationships with all these retailers. As a loyalty point almost, you can exchange your carbon credits. They’ve created this token and this incentive system. The asset-based token thing is a big deal.

VentureBeat: How does IBM figure out, here’s what we want to put a billion dollars behind? So many things are flowering and fragmenting.

Cuomo: My boss quoted this statistic, and it kind of floored me at first. She recently counted up the number of people we had working on blockchain at IBM. She came up with about 1,500. It’s quite the investment on an emerging area. Predominantly, those folks are engagement-oriented. They’re client-facing. But investing in blockchain–simply put, once a business process is executed on a blockchain, there’s no going back to a traditional model. The question is, how do we help shepherd in this era of blockchain in a way that’s prudent?

There is a core investment that has to occur. There was no foundation in 2014 to build a blockchain for business. Today there are multiple choices, but in 2014 there wasn’t a lot of ways to do permission blockchain. We had to go out and help build that. There is a sunk cost investment. I think overall, we’re looking to not just talk the talk at IBM, but walk the walk.

What I mean by that is, we’re going to have traditional IBM businesses. We’ll have consulting. We’ll have technology platforms. That will help pay off some of the investment we have. That’s talking the talk. But as important–Ginni Rometty, our CEO, is hell bent on us being a blockchain business, meaning that–No business runs in isolation day. We’re no different. We have many business partners and suppliers. We must apply blockchain to provide, first and foremost, better efficiency, marketing, advertising networks like Mediaocean. In many aspects of our business, we’re not going to wait. We’re going to help convene those networks. We’re going to sit there and say, “There’s a better way to do this.”

We have a channel finance network that we’re a part of. We lend out $44 billion a year in channel financing for computer suppliers. At any given time, there’s $150 million locked up in disputes. It’s simple. A supplier supplied a buyer. The supplier says, “When do I get paid?” The buyer says, “I’ll get paid when I get the item.” Supplier says, “I sent it two weeks ago!” We have to reconcile — your books, my books, his books — to figure out what happened. It takes 44 days to resolve a dispute, on average.

With this blockchain-based dispute mechanism that we have sitting next to the supplier network, we can now resolve disputes in 10 days or less. As a lender, we want to put our money back to work. And then the question is, with 4,000 partners and suppliers in that network–right now only about a dozen or two have been invited. We’re rolling it out slowly. It’s a long tail, where 20 percent of the suppliers do 80 percent of the transacting and then it flattens out. We’re trying to get the bigger ones on the blockchain first. But who wants to be tied up in a dispute? We don’t. They don’t. It’s good for everyone.

Being a blockchain business is the cherry on top for us. From an investment perspective, it’s a multidimensional investment. Yes, we have to invest in core technology where it doesn’t exist. Yes, there will be winners and losers, but there won’t be just one winner. We know how that game is played. We’ve played it before. There’s no guarantee, but we’ll use the Darwinian principles we’ve learned before. We’ll provide a service to make blockchain easy for enterprise, which we have in the IBM blockchain platform. We’re going to invest in networks like the food network, like TradeLens. That will justify the investment, and hopefully make returns on our investment to our shareholders.

As I said before, about blockchain for good–I’ve been working technology for quite some time. This is a technology where I can see it impacting society, with Humanity as the latest example. It’s the kind of thing that’s inspiring about this technology. It’s not just a technology. It’s a way to behave. It’s about the group accomplishing something that would be very difficult for one individual member to do by themselves. That’s what leads to good. You can’t get visibility across your food supply chain and do a recall if it’s just one company. Even Wal-Mart.

I also talk about blockchain for good meaning that it’s here for good. It’s here to stay. That’s the other side to it. I really think blockchain is changing everyday life. It’s not that it will or it can or it might. We’re not at the moon shot yet, the super big things, but there’s enough evidence on a daily basis to make me smile.

Above: IBM and Hu-manity.co are coming up with a way to verify who can access your data.

VentureBeat: That was one of my last thoughts too. How much do you need to have consumer adoption and institutional investors coming into this? That’s generally what I hear about the crypto world, that they want everybody to have a consumer wallet app so they can turn around goods on their phones. They have all these institutional investors putting money in things like ICOs because all the fraud has been rooted out.

Cuomo: Payments and fundraising, as I said, is one application. If you’re Frank Yiannas, and your world revolves around the quality of food, that’s your currency. It’s like saying the only application for the Linux OS is an ATM. An ATM is a really good thing, but it’s not the only thing. People are jumping tracks. I think tokenization can be used to help incentivize these ecosystems. That’s good. There is certainly life around using blockchain-based crypto environments to generate funds. There are use cases like True Tickets. Whether cryptocurrencies and ICOs are working or not, that idea has legs. If crypto dies, or if crypto quadruples, it’s still valuable if you’re in the event business.

Could they do an event ICO ticket where you own a piece of a Rolling Stones show? Maybe they could. But that’s a funding model. Blockchain is not indigenous to funding models. You can use it to create one hell of a decentralized funding model. But it’s a technology to help foster that as one very powerful use case.

Quite frankly, I think there are three killer applications that I’ve seen. One is payments. Maybe that’s the only one that’s proven itself so far as a blockchain thing. Bitcoin has been running since 2008 or whatever. It’s pretty strong. Digital identity is number two. Number three is supply chain. Those are killer apps. This technology was made to at least serve those things.

The other thing is, those three things are fairly pervasive across industries. Every industry needs payments. Every industry needs to identify and verify and validate. Every industry has some form of supply chain, whether it’s a drug being produced and you’re trying to show what the steps are in a clinical trial, or the authenticity of a drug, that it hasn’t been counterfeited, or spinach or mangoes. Those three are killer apps.

VentureBeat: The interesting question to me is whether or not governments should be supporting something that ultimately wants to get rid of centralized authority. We need regulation on some of these things, but eventually they might push themselves into obsolescence.

Cuomo: As I mentioned before, the difference between Bitcoin and blockchain is better understood by government. I think our government could learn some lessons from other governments out there that have been more progressive toward the use of blockchain for land registries and identity, like in Dubai.

The cool part is–I’m biased, yes, but a lot of the core technology, when you look at the ripples here in California around things like cross-border payments–the Hyperledger Project is anchored here in the Valley, with Intel and IBM as big contributors. There’s a lot of startups. There’s a lot of innovation in the space of blockchain, similar to the innovation that happened in the early web. Our government should take advantage–while they’re looking at what to regulate, which is probably more on the currency and payments side, they shouldn’t wait for that to be all set up before they embrace.

If I never have to go to the DMV to register a car, or if I never have to go through title insurance when I refinance my mortgage–come on! Don’t you know that I own this house? Do I really have to provide it for the fiftieth time? Can we at least address that while the regulators look at everything else?