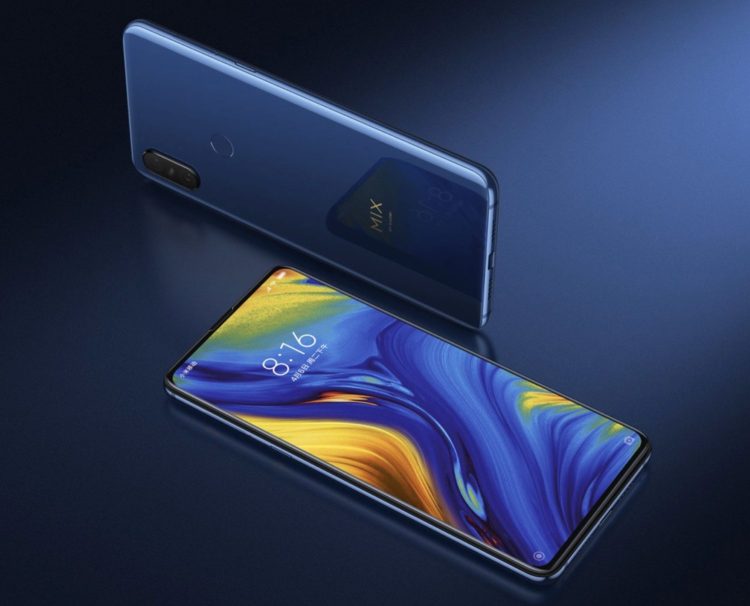

Chinese smartphone brands — led by Xiaomi — are increasing their dominance in India, while Apple’s continued investment in the country hasn’t yet shown signs of paying off.

In a new report from Canalys, the overall market for smartphone sales in India slipped in the third quarter by 1 percent compared to the same period in 2017, only the second such drop in its history.

That wasn’t a problem for Xiaomi, which shipped more than 12 million smartphones in the three months ending September 30, up 30 percent from Q3 2017. Samsung remained second in the market with 9.3 million phones shipped, a drop of 2 percent year-over-year. Chinese brands Vivo and Oppo were next, with 4.5 million and 3.6 million phones shipped, respectively.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

India has become the world’s second largest smartphone market after China. But with a penetration rate less than half that of China, India’s seen as a massive opportunity for the world’s handset makers.

As such, Apple has been attempting to make greater inroads in the country of late. It has opened production facilities in India and has focused on new stores, deals, and apps that target local users. But according to Canalys, Apple has still failed to crack the top 5 vendors in the country. Instead, it remains stuck in the “Others” category, which collectively saw phones shipped fall from 13 million in Q3 2017 to 8.5 million in Q3 2018.

The report noted that overall sales were affected by a late Diwali holiday, rising fuel costs, and currency exchange fluctuations.

Canalys also highlighted the fact that India’s Micromax jumped into the top 5 sellers by shipping 2.6 million phones in Q3, up 5 times from Q2. The report credits government orders of Micromax phones for giving it a boost.

“The Micromax deal is due to a well-known market force — patriotism,” said Canalys Analyst TuanAnh Nguyen in a statement. “The meteoric rise of Huawei, Oppo, Vivo, and Xiaomi, and the flagging popularity of Apple in China is a prime example. While Micromax is not likely to displace Xiaomi, or even Oppo and Vivo in India in the near future, its return marks a shift in the strategies of local vendors. Should more governments follow in Chhattisgarh’s footsteps, local vendors will find themselves relevant again, especially in increasing the crucial total available market for Indian smartphones.”