Nvidia didn’t have a great week. It reported earnings that fell short of Wall Street’s expectations on Thursday, and by Friday the company’s stock price had fallen 18 percent, shaving $23 billion in market value and leaving the company with a $99 billion valuation.

The reason? Crypto miners stopped buying graphics cards, resulting in an inventory bubble for Nvidia’s mid-range Pascal graphics cards. It may take a quarter or two to eliminate the inventory bubble. On Thursday afternoon, I talked to Jensen Huang, CEO of Nvidia, who was puzzled at the reaction to the earnings miss, which included a $57 million charge related to the “post-crypto falloff.”

In an analyst call, Nvidia said midrange Pascal gaming cards saw an anomaly, where both channel prices and inventory levels remained higher than expected. When prices finally fell, demand for graphics cards didn’t rise as quickly as expected. Huang said in an earnings call that this was a surprise.

Rather than ship more cards into the flooded channel, Nvidia is holding off, waiting for the cards in the channel to sell. Huang said this could take a quarter or two, partly because he doesn’t know how much Nvidia’s rival, Advanced Micro Devices, shipped into the channel.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

In October, AMD also said it had lower-than-expected graphics chip sales, prompting its stock price to fall 22 percent. And Nvidia said it would scale back expectations for sales of game-related graphics cards, reducing expectations from $1.7 billion a quarter in sales to about $1.1 billion. That’s a huge drop.

This is all happening while Nvidia is trying to ship its new RTX graphics cards at the high-end, and that’s not easy because only one game, Battlefield V, exploits the real-time ray tracing that is built into the Turing architecture that the card uses. I tried to parse what happened in a conversation with Huang.

Here’s an edited transcript of our interview.

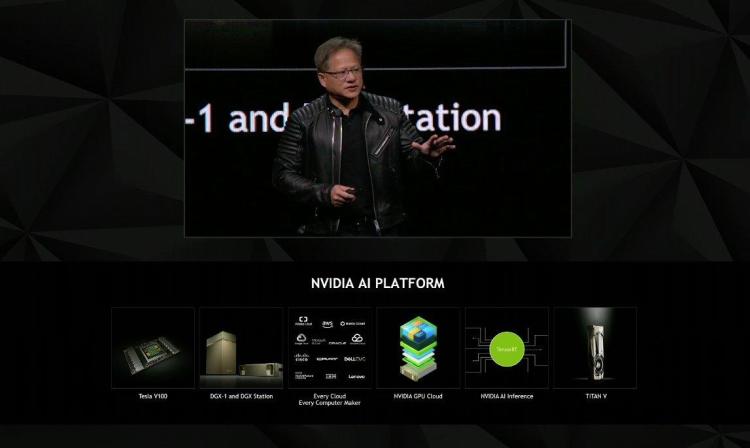

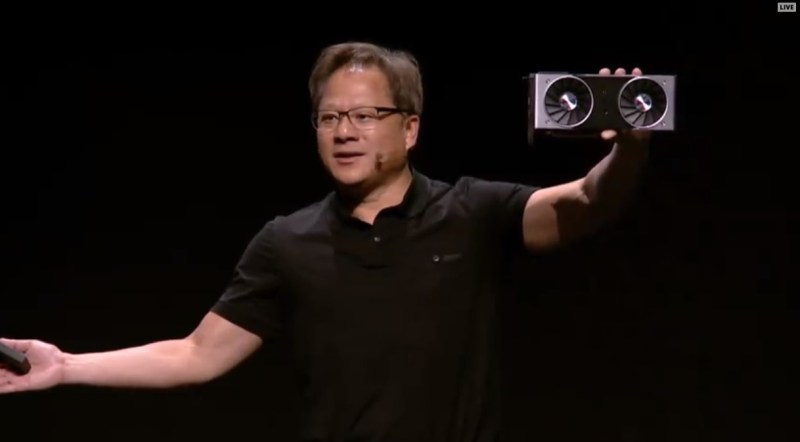

Above: Nvidia CEO Jensen Huang shows off the Nvidia GeForce RTX 2080 Ti at Gamescom 2018.

GamesBeat: I don’t know if it bothers you, but that’s a big swing in your stock price after hours there.

Jensen Huang: Well, I can’t control my stock price. And so — no, no, we just have to look past it. We have to focus on things we can control. I would say that, gosh, Q2 was pretty great from that perspective. The crypto hangover is surely a surprise, with how long it’s going to last. It was a surprise.

GamesBeat: I wanted to try to get into that a little and make it more understandable to people. I was saying — if all these people were enthusiastic about crypto and they started mining and this started blowing up around December 2017, when the price of bitcoin goes down, those people who’d been buying up all this mining GPU equipment — it’s maybe 11 months ago that they started not needing their GPUs anymore. I wonder why the overhang is coming so far forward in time, to now, with you guys being surprised by something happening in the market.

Huang: You’ve got your dates wrong. In fact, crypto was strong even through a lot of Q2.

GamesBeat: But I think people were mining a lot of stuff besides Bitcoin. They were trying to pivot….

Huang: But we were never in the Bitcoin business. We’re in Ethereum. We’re in the alternative points. Ethereum was still red hot through May and June.

GamesBeat: This thing happens where it gets mined out as well, right? You get diminishing returns on mining at the same time as the price is going down. It’s a kind of double effect there, I guess. And then these people eventually start selling all their stuff on the secondary market. “I’m going to sell off all my excess GPUs.” And that causes these things to keep happening, this cascading effect.

Huang: Yeah, I don’t know. It’s — I don’t know that the inventory is from resale. The inventory is just from fresh products. There’s plenty of fresh products in the channel.

GamesBeat: I also thought it was never really more than a tenth of your revenue. It does surprise me that it can come back and have this bigger effect.

Huang: Because it’s not just my inventory. It’s AMD’s inventory as well. I think the part that we didn’t estimate was the amount of inventory that they put into the channel.

Above: See the realistic reflection on the side of the car in Battlefield V with Nvidia RTX.

GamesBeat: So there’s just a lot of stuff out there collectively now to work through, even though on a quarterly basis, it didn’t seem to be that big a piece of anybody’s revenue.

Huang: My point is that we just don’t know — when we’re going through what we see as our own sales, and what the percentage of Bitcoin is in our own sales, what we don’t know is how much inventory AMD pushed into the channel. There’s no way for us to calculate that.

GamesBeat: How do we get to larger numbers that actually affect the quarterly results, though? Again, it seemed, in the past, that it was described as a small part of revenue, and now it’s something that can affect one or two quarters worth of inventory. It’s hard for me to understand why it makes a big difference.

Huang: Take a moment — let me just — the 1060 is the number one selling GPU in the world, and the 580 is the number 24. The gaming demand is such that the 580 demand is relatively small. If they decide to build a whole bunch of GPUs, 580s, for crypto, and then they shove that into the channel, then the market would be disproportionate, to us. Usually we would see — call it 90 percent us and 10 percent them. Now all of sudden the inventory in the channel could be very different. It could be 50 percent them and 50 percent us. Do you see what I’m saying? But there are so many people writing about inventories, Dean. Why waste your life on it?

GamesBeat: [laughs] I guess?

Huang: You’re going to be one of 74 people who write about inventories tomorrow.

Above: Nvidia’s real-time ray tracing demo with Captain Phasma.

GamesBeat: I’m just trying to understand how this comes back to cause a $20 billion swing in a stock price.

Huang: It shouldn’t! It shouldn’t! I know! It shouldn’t! There you go. I think that’s more magical. Where it ends up, who knows? I think that it’s as surprising to shareholders as it was surprising to us. But it’s going to sort itself out. Our data center business is doing great. I believe the future of gaming is still good. Our pro business is doing great. Our self-driving car business is doing great. Those things are eventually going to get sorted out.

GamesBeat: And the Battlefield V players are happy.

Huang: Yeah, yeah. [laughs] Exactly.