PayPal is opening its Xoom international money transfer service outside the U.S., starting with Canada.

Xoom, for the uninitiated, allows you to send money, add credit to mobile phones, or pay bills to anyone in more than 130 countries, with Xoom taking a 3.93 percent cut.

Founded out of San Francisco in 2001, Xoom went on to raise more than $100 million in funding ahead of its IPO in 2013, before being brought back to the private sphere by PayPal, which bought the service for $890 million in 2015. A year later, PayPal integrated itself with Xoom.

So far, Xoom has only been open to payments emanating from the U.S., but its Canada launch today kick-starts a broader international rollout with more markets being added in the coming months. PayPal wouldn’t confirm which markets would be next.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“The traditional methods of sending money abroad are slow, expensive and stressful for both the sender and the receiver,” noted Xoom VP and general manager Julian King. “Senders are often faced with worry about when, or if, their money will reach their loved ones. As a disruptive digital remittance provider, Xoom is helping to eliminate these inconveniences so it’s fast and easy for Canadians to send money abroad for cash pickups, bank deposits, reloading prepaid phones and paying bills for loved ones back home — all from the comfort of their homes or from their mobile devices.”

Remittance

A number of players exist within the international money transfer realm, including established giants such as Western Union and MoneyGram, while several well-funded fintech startups have emerged in recent years to help people send money abroad. Indeed, London-based WorldRemit and TransferWise have raised more than $700 million between them.

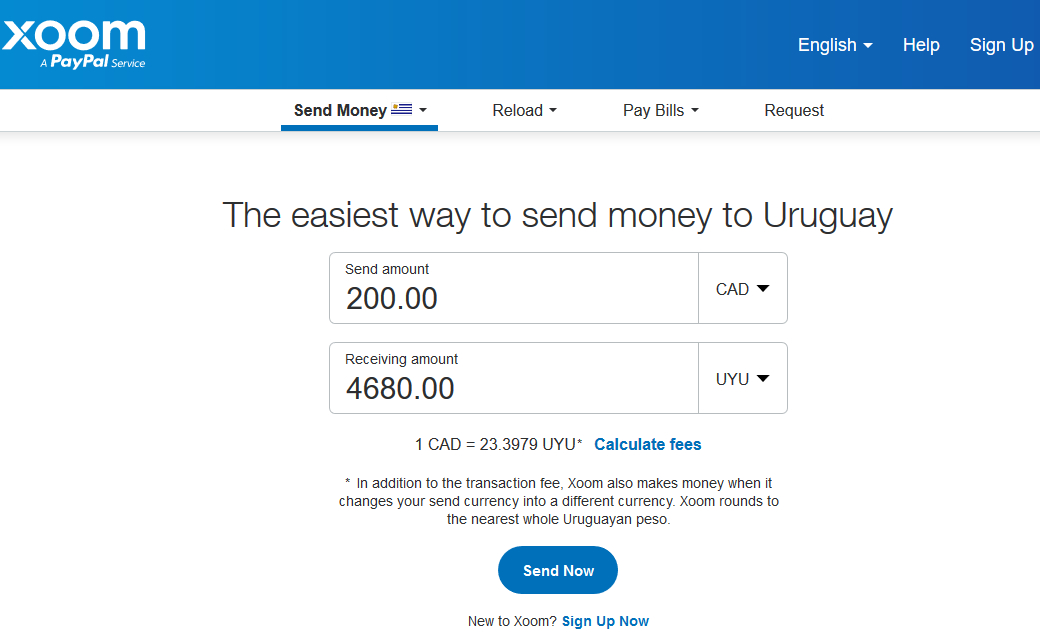

Above: Xoom homepage

The global remittance market — payments made by an individual working abroad to someone in their home country — grew seven percent last year to $617 billion, according to World Bank data, and is expected to increase by a further 10.3 percent this year to around $690 billion. Remittances account for more global payments each year than foreign aid, and play a crucial part in international development.

India tops the remittance recipient market, accounting for some $80 billion received this year, and Canada is home to one of the biggest Indian diasporas anywhere in the world. Moreover, some $24 billion is sent from Canada to other countries each year, so opening to Canada makes a great deal of sense as a starting point in Xoom’s global expansion.

From today, Xoom users in Canada can send up to $12,500 CAD in a single transaction to any of the 130+ supported countries, either directly to a bank account or as cash for pick-up or delivery. Existing PayPal users in Canada can log in to Xoom with their PayPal credentials.