Watch all the Transform 2020 sessions on-demand here.

Investments in London-based technology companies fell by 29 percent in 2018, but tech firms in the U.K. capital still managed to attract nearly double the amount raised by their counterparts in other European cities.

The annual findings were published by London’s promotional firm London & Partners, in tandem with data and research company PItchBook.

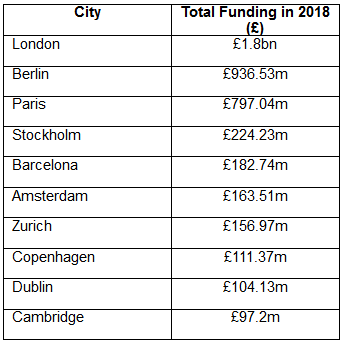

Despite the dark Brexit cloud looming over the U.K., London companies attracted £1.8 billion ($2.3 billion) last year — roughly 90 percent more than the £936.53 million ($1.2 billion) garnered by Berlin companies, which grabbed the number two spot. Paris, meanwhile, drew in £797 million ($1,017 billion) to nab third place, followed by Stockholm (£224.23 million/$286 million) and Barcelona (£182.74 million/$232 million).

This means London companies raised almost the same amount as the second, third, and fourth cities combined.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Above: European company investments (2018)

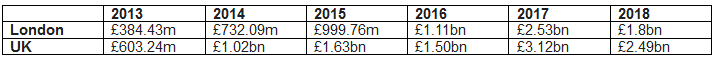

However, digging down into historical data reveals additional insights. In 2017, companies in the U.K. capital raised a bumper £2.45 billion ($3.13 billion) — double the 2016 figure and more than 3 times its nearest challenger in 2017, which was Paris with £565 million ($720 million).

In effect, this means London startups and scaleups raised 29 percent less in 2018 than they did in 2017. However, tech investments in London and the U.K. have been steadily increasing over the past five years, with 2017 perhaps serving as something of an outlier, due to a handful of particularly large funding rounds — Improbable raised $502 million, Deliveroo raised $385 million plus another $98 million, and Truphone grabbed $338 million.

We can also see from here that London represented around 72 percent of the total capital raised by U.K. startups in 2018, a figure roughly in line with previous years.

Above: London & U.K. startup raises: 2013 – 2018

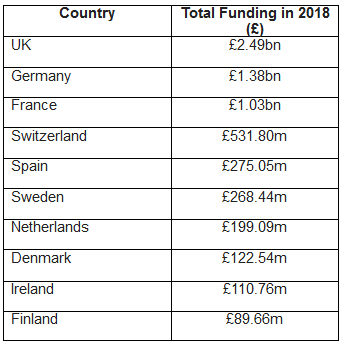

It’s also worth looking at the figures on a country-by-country basis — the U.K. secured nearly $2.5 billion in VC investments last year, around 80 percent more than Germany.

Above: European countries compared

Meanwhile, 17 U.K. companies went public in 2018, compared to 10 in Sweden, eight in France, and six in Germany.

The Brexit bulldozer

Some of the notable raises emerging from 2018 include London-based digital banking startup Revolut, which nabbed £177 million ($225 million), and London-based Culture Trip — a platform that uses artificial intelligence (AI) to surface relevant travel content — which raised £59 million ($75 million). Elsewhere, Bristol-based AI chip company Graphcore secured £153 million ($195 million).

In fact, investments in U.K. AI startups hit £736 million ($937 million) in 2018, according to PitchBook data, a 47 percent increase on the previous year.

“2018 was another great year for investment into London’s tech sector, and today’s figures demonstrate that London is a place where ambitious, international companies can thrive,” said London & Partners CEO Laura Citron. “With high levels of investment for growth sectors such as artificial intelligence, fintech, and big data, our research shows that London is producing game-changing companies and ideas to change the world.”

However, with Brexit officially set for March 29, 2019, it will be interesting to see what impact it will have on both London and the broader U.K. technology landscape. London is renowned as the fintech capital of Europe, and the sector was responsible for 60 percent of all investments in the U.K. capital last year. With Britain’s future role in Europe mired in uncertainty, things could be much different this year.

Looking at other cities across Europe in 2018, Berlin’s companies nearly doubled the £456 million ($581 million) they raised in 2017, while Parisian companies attracted over 40 percent more than the previous year.

It’s too early to say what these numbers mean, but over the next couple of years the impact of Brexit on London’s position in Europe will become clearer.

“These figures demonstrate that London is going from strength to strength as a global hub for technology, innovation, and creativity,” added Rajesh Agrawal, deputy mayor for business. “The fantastic success of our tech sector is rooted in our city’s openness and our diverse, international talent pool. Regardless of the outcome of Brexit, London will remain open to innovation, talent, and investment from all over the world.”