The PC market is still declining, according to research firms Gartner and IDC. While the two agreed on that 2018 was negative, they disagreed on who shipped more PCs: HP or Lenovo. As with the year before, Dell was indisputably third.

Both firms continue to be optimistic about the PC market, despite more quarters and years in the red than in the black. For 2017, Gartner and IDC argued that computers had hit rock bottom, and that a turnaround was due. While 2018 saw a positive Q2 and a flat Q3, overall the year was still down.

(Gartner also shares U.S.-specific figures and in Q3 found that Microsoft had broken into the top 5 PC vendors. The company held onto this position in Q4, showing that it wasn’t just a one-time blip. But that’s U.S.-only — Microsoft still doesn’t appear on worldwide charts.)

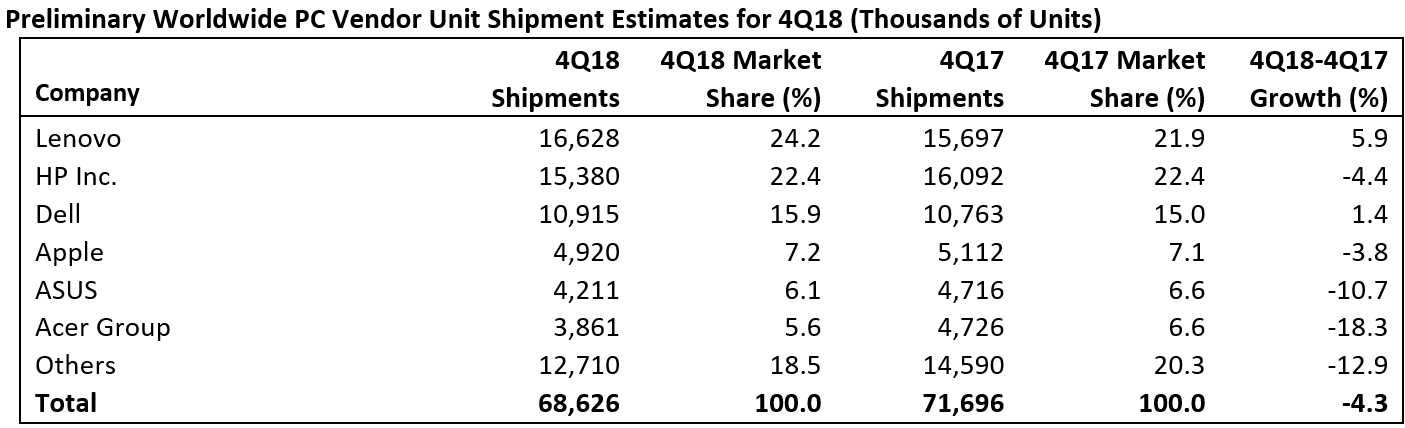

Q4 2018

Gartner estimates worldwide PC shipments fell 4.3 percent to 68.6 million units in Q4 2018. The top six vendors were Lenovo, HP, Dell, Apple, Asus, and Acer. As you can see in the chart below, Gartner found that only Lenovo and Dell increased their PC shipments. HP, Apple, Asus, and Acer all shipped fewer computers. The rest of the market was down 12.9 percent.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Meanwhile, IDC estimates worldwide PC shipments fell 3.7 percent to 68.1 million units in the fourth quarter. The top five vendors in IDC’s results were Lenovo, HP, Dell, Apple, and Acer. IDC agrees with Gartner on the trajectory of the top companies. The rest of the market was down 11.2 percent. The exact numbers, for your perusal:

It’s worth noting that some of Lenovo’s numbers are due in part to the inclusion of units from its joint venture with Fujitsu, formed in May 2018. Those numbers affect the full year results as well.

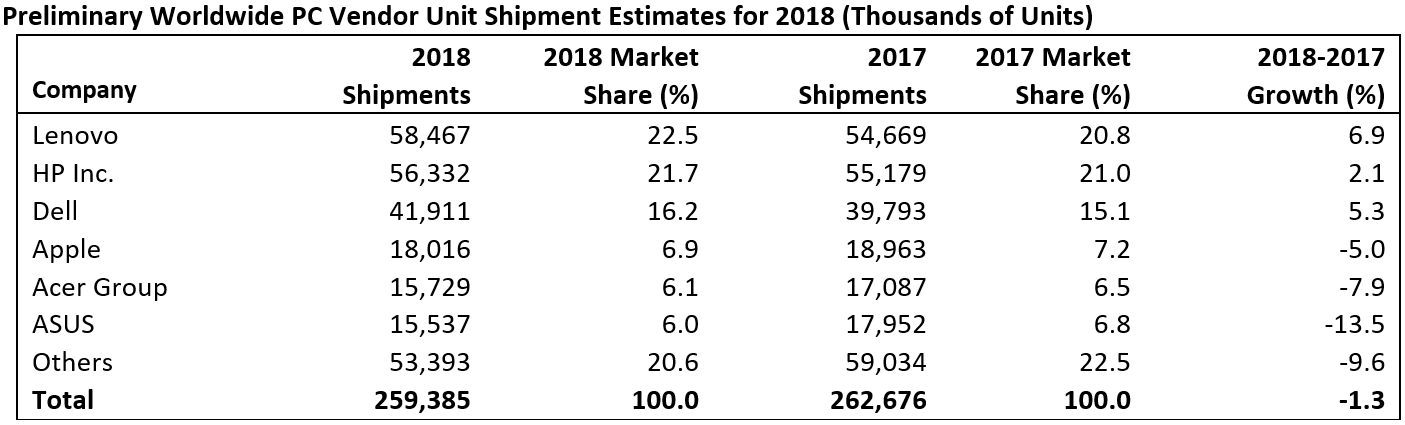

2018

Gartner found that 2018 was the seventh year of annual declines, although the drop was less steep than the past three years. The trio of companies leading the pack grew, while the other trio shrunk:

IDC’s full year results also showed a clear separation from the leaders and the runners up:

Gartner found that worldwide PC shipments totaled 259.4 million units in 2018, a 1.3 percent decrease from 2017. Companies continue to buy PCs, but consumers continue to be hard to convince.

“The majority of the PC shipment decline in 2018 was due to weak consumer PC shipments,” Gartner principal analyst Mikako Kitagawa said in a statement. “Consumer shipments accounted for approximately 40 percent of PC shipments in 2018 compared with representing 49 percent of shipments in 2014. …The market stabilization in 2018 was attributed to consistent business PC growth, driven by the Windows 10 upgrade.”

IDC found that the PC market only shrank 0.4 percent to 258.5 million units, but warned the U.S.-China trade war could make things worse.

“The ongoing economic tensions between China and the United States continue to create a lot of uncertainty in the business environment in China,” IDC research manager Maciek Gornicki said in a statement. “As demand for Chinese products in the U.S. drops, this particularly impacts businesses of all sizes from the manufacturing sector in China, which, in turn, translates to a drop in IT purchases by these companies. As a result, the PC market in China is expected to suffer bigger declines throughout the year. And if the trade war escalates further, we should expect spillover of the impact to other countries, particularly due to the expected fluctuations of the exchange rates impacting businesses across the region.”