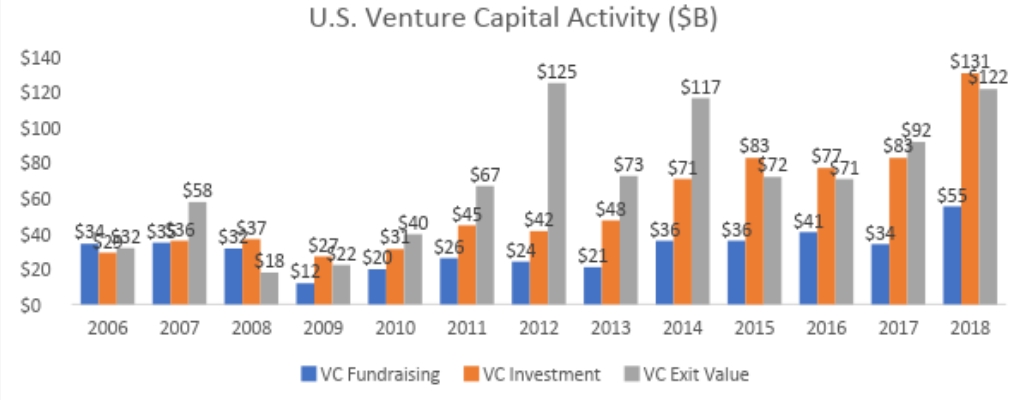

PitchBook and NVCA released the 4Q 2018 Venture Monitor Thursday, and the headlines since have focused on what was a blockbuster year for capital raised by VC funds, invested into startups, and exited from VC-backed companies.

Limited partners committed $56 billion to 256 U.S. venture funds closed last year; nearly 8,383 venture-backed companies raised more than $130 billion in financing; and 864 venture-backed exits surpassed a combined value of $120 billion. It was a historical year indeed!

The venture industry’s metamorphosis

On the heels of a strong five-year run for the VC market, 2018’s excitement and pace of activity kept venture investors and entrepreneurs busy driving innovation and creating transformative companies in the U.S. But the industry has evolved over the past five years and even more so since the 2009 and 2010 doldrums of the post global financial crisis. Whether we’ve reached a new normal or the peak ahead of a cooling off period, two key themes emerged from our year-end industry statistics.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

First, in the past five to six years, we’ve seen a notable trend of bigger funds, bigger investments, bigger valuations, and bigger exits. At the same time, we witnessed a peak and then decline in the number of funds, investments, and exits. The seed rounds of today look similar to the Series A rounds we saw earlier in the decade, and median pre-money valuations have more than doubled since 2013 for Series A, B, C, and D+ rounds, with the median of the latter seeing a 3x increase. Similarly, the median exit size has doubled since 2014 for venture-backed IPOs, PE-sponsored buyouts of VC-backed companies, and disclosed strategic acquisitions.

It may be a “chicken or egg” phenomenon, but the median venture fund closed has nearly tripled since 2014 ($82 million). While an influx of available capital has certainly put the industry in a position of power to fund innovation, these trends do raise a question for limited partners, venture investors, and entrepreneurs: How sustainable is this and how does it impact capital efficiency?

Second, the diversity of the types of investors participating in startup funding has grown significantly and played a major role in capital supply to the ecosystem. Nontraditional investors like SoftBank and sovereign wealth funds have been a driving force. At the same time, investment involvement from corporate venture capital (CVC) has risen, and PE investors have picked up the pace of both minority and majority (i.e., financial acquisitions) investments in later/growth stage companies.

As a result, experienced traditional VCs have had to keep pace, and many have raised larger follow-on funds — and at a faster pace — to support growing startups, where unicorns and mega-deals are having a big impact. At the same time, an influx of first-time funds (many that spun out of other firms) are raising larger vehicles and have factored into increasing fund sizes and a concentration of capital in fewer VCs across the board. The prominence of maturing angel investors, accelerators, and incubators have also played a role in shifting the funding dynamics at the earlier stage of the venture cycle.

Two other notable trends in VC

Software continues to eat the world and attract the lion’s share of VC activity, but life science activity has seen significant growth. Last year, more than $23 billion was invested across 1,308 deals in life science startups, a record high for both metrics. What’s more, healthtech drew a significant portion of angel/seed investing in Q4, highlighting investor interest in funding groundbreaking technologies to meet some of the biggest challenges and opportunities in the sector.

Thanks to life science companies having a strong run on the public markets (minus the Q4 volatility), venture-backed companies in the sector have also seen a healthy exit environment — Moderna Therapeutics’ Q4 IPO represented the biggest biotech public listing ever, and healthcare companies accounted for seven of the 10 largest IPOs in Q4.

Not surprisingly, California, Massachusetts, and New York continue their dominance of venture investment activity, attracting 79 percent of total U.S. capital invested and 53 percent of the number of U.S. deals completed last year. Sentiments from investors — both in those three states and in others — point to increasing operating costs and higher valuations in CA+MA+NY, signaling optimism for more investment in emerging ecosystems, which also have the benefits of a growing talent pool, maturing networks and ecosystems, and more favorable pricing.

Notable investments and exits in emerging ecosystems: Cary, NC-based Epic Games attracted the fourth largest investment in the U.S. last year ($1.25 billion); Ann Arbor, MI-based Duo Security was the second largest M&A in Q4 ($2.35 billion); and Columbia, MD-based Tenable’s July IPO at a $2.1 billion post-money valuation was the biggest of Q3.

Economic volatility and regulatory uncertainty

Public market volatility in Q4 certainly gave pause to the global financial world, and there’s been chatter of its potential correction and the trickle-down effect on the VC market. Several unicorn companies also announced plans at the end of the year to go public in 2019, a warm welcome for distributions. While VCs aren’t in the game of timing the market, they will be equipped with funds to weather a potential recalibration and continue — though perhaps at a decelerated pace — to be an important source of capital and sweat equity for startups, given the amount of dry powder available (about $76 billion as of Q1 2018).

If creating the next big thing and navigating economic volatility wasn’t enough of a concern for the venture ecosystem, regulatory uncertainty continues to reign. Cyclical turns and market corrections are inevitable, but the number of venture-backed IPOs has not kept pace with the near all-time highs both the public and private markets have witnessed recently. NVCA and other organizations have continued to push for policy solutions to address the many issues startups face when going public. These efforts led to the passage of the JOBS and Investor Confidence Act of 2018 (“JOBS 3.0”) in July through the House. The Act included several provisions to encourage capital formation for U.S. startups and to seek solutions to issues small capitalization companies face on the public markets.

Foreign investment legislation has perhaps been the biggest curveball VC firms and startups faced in 2018. And more regulations and enforcement will unfold in 2019. The Foreign Investment Risk Review Modernization Act (FIRRMA) expanded the scope of the Committee on Foreign Investment into the United States (CFIUS) to include minority investments in U.S. companies. The new, expanded CFIUS authority is already causing friction in the fund formation process (through foreign LPs) and the company financing process (through foreign co-investors). If you’re a venture investor or startup not familiar with this new law and its implications, please get in touch with NVCA!

After a banner year for VC in 2018, 2019 hasn’t started off on the best footing with a government shutdown still in effect, threatening to delay IPOs. However, the venture industry has shown its resilience in the past with both economic and regulatory uncertainty, and we expect that resilience to take effect again, if and when the time comes.

Bobby Franklin is President and CEO of the National Venture Capital Association (NVCA).