testsetset

The market for virtual reality hardware is officially shifting away from budget-priced, low-performance headsets, Strategy Analytics said today, as demand has evaporated for Google’s Cardboard and Daydream products, as well as Samsung’s Gear VR. Consequently, midrange to high-end headsets from Sony, Facebook’s Oculus, and HTC earned 77% of all revenue generated globally by VR headsets last year, while prior top vendors fought for shrinking shares of the lowest-end pie.

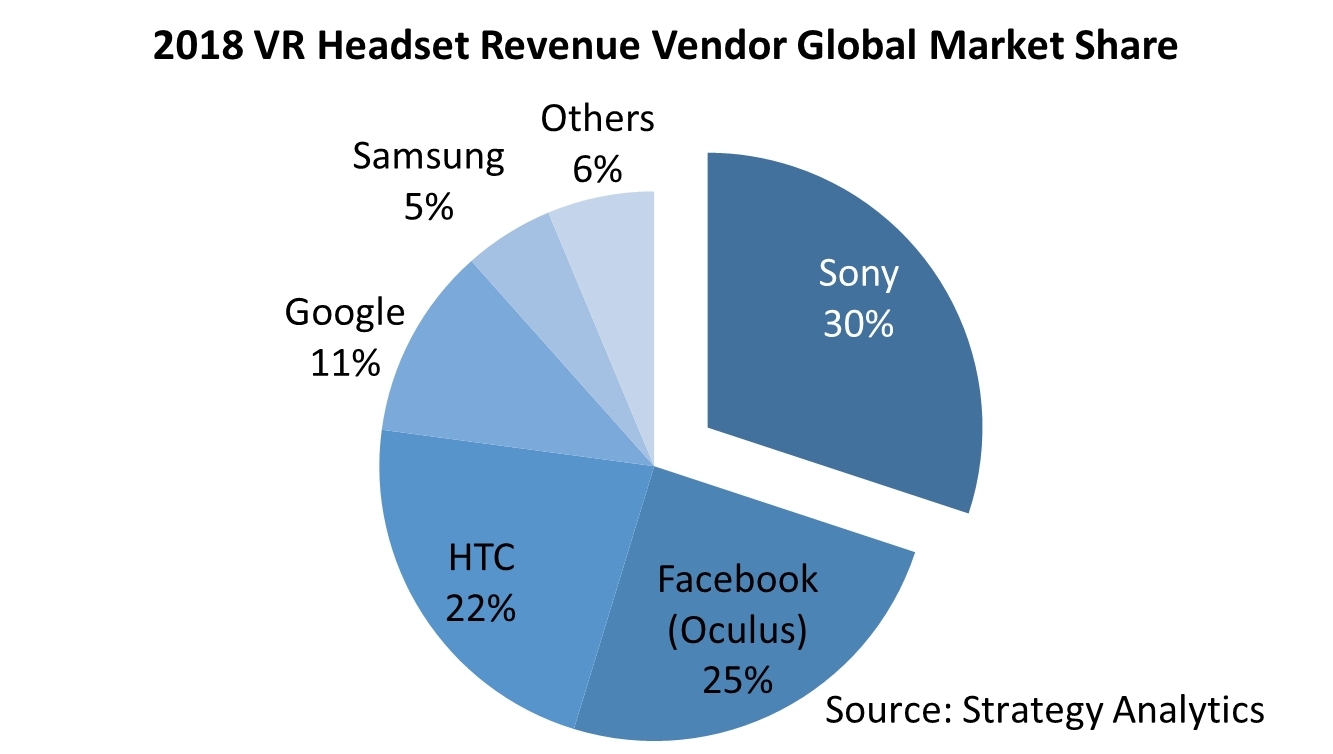

Depending on how one parses data from the firm’s latest report, there’s either good news for top players or bad news for the VR industry as a whole. Sony’s PlayStation VR led what appears to be strong demand for tethered VR headsets, with a market revenue share of 30% compared with Oculus’ 25% and HTC’s 22% — far more than Google’s 11% and Samsung’s 5% shares, with “others” holding the remaining 6%. Strategy Analytics suggests that Sony’s numbers will likely continue to grow thanks to the promise of PS5 support for PSVR, while HTC and Facebook will be aided by enterprise and education adoption of their platforms.

The big losers are Google, which fell in share from 21% to 11% year-over-year, and Samsung, which has all but given up on trying to bundle its Gear VR accessories with smartphones. Discontinuation of their low-end options’ giveaways and bundles led to an over 50% decline in year-over-year headset unit shipments, from 2017’s 31 million down to 15 million in 2018, though the numbers counted “headsets” made mostly from cardboard, and lacking any processing or display hardware. As such, that steep unit drop represented only a tiny revenue decline for VR hardware: down from $1.9 billion in 2017 to $1.8 billion in 2018.

“The simple devices helped to drive demand, but their time is coming to an end,” explained Strategy Analytics’ executive director David MacQueen. “[O]ur research shows that consumers who have tried VR really enjoy the experience, and are seeking out higher quality experiences with better headsets. … The real winners in 2018 and 2019 have come from the higher price tier, higher quality VR headset market segments, primarily those that are PC- or Console-tethered.”

Going forward, the firm expects VR to play a key role in demonstrating the power of 5G networks, though it says the right way to use VR to market 5G is challenging. “The right market entry strategy could define the winners and losers when it comes to VR and 5G,” the firm’s VP David Kerr suggests.

Next-generation cellular virtual reality will benefit from several technologies: high bandwidth to support content in dual screens, low latency to eliminate viewer nausea with head position changes, and gaze tracking to determine focus and peripheral view areas. Actually demonstrating these technologies to consumers will require carriers and hardware makers to establish better public demonstration areas — a key limitation of prior VR marketing that has arguably held the market back from growth despite improvements in both hardware and prices.