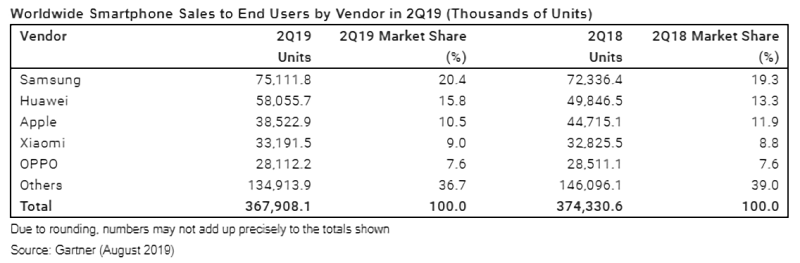

Global smartphone sales remain on a slow but steady decline, according to analysts at Gartner. The U.K. firm today published a report showing that they dipped 1.7% in Q2 2019, totaling 368 million units (down from 374 million units the same quarter a year ago). Among the top five vendors, Huawei and Samsung experienced the steepest uptick at 16.5% and 3.8%, respectively, leading them to account for more than a third of total smartphone sales worldwide.

Gartner notes that Huawei’s inclusion on the U.S. Department of Commerce’s Bureau of Industry and Security Entity List in mid-May, which effectively banned its devices from U.S. communications networks, sharply affected the Beijing company’s smartphone sales in Q2 2019, although they recovered slightly after those restrictions were eased in August. But in Greater China, “strong promotion” and “brand positioning” reportedly helped Huawei sell 31% more smartphones in the region compared with Q1 2019, a record.

As for Samsung, it managed to get 75 million handsets out the door to bolster its global Q2 2019 market share to 20.4% (from 19.3% in Q2 2018), in line with shipping estimates. Gartner attributes the gains to demand for the tech giant’s Galaxy A series devices and revamped entry-level and mid-range lineups, noting that sales for the flagship Galaxy S10 weakened during the quarter. On the other hand, Apple saw sales of its iPhone lineup slip by 13.8% year-over-year to 38 million units for 10.5% of the market (compared with 11.9% in Q2 2018), continuing a slowdown spurred by a shift in business priorities from hardware to services.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

That jibes with findings from Canalys released in July, which showed that Apple’s Q2 sales in China alone fell 14% to 5.7 million units as Huawei’s sales rose 31% to 37.3 million units. The report’s authors credited the dynamic to both Chinese consumers’ patriotism and the Hauwei’s “advanced technology.”

On the subject of Huawei, the tech giant saw its market share reach 15.8% this quarter (up from 13.3% in Q2 2018), with Xiaomi bringing up the rear with a 9% share (up from 8.8%). Oppo nabbed the fifth-place finish with a 7.6% slice (unchanged from the quarter prior), while vendors occupying the amalgamated “other” category saw their combined market share fall from 39% in Q2 2018 to 36.7% in Q2 2019.

China and Brazil

The Chinese and Brazilian smartphone markets were slightly rosier than the rest of the world, as alluded to earlier. China held the top spot with 101 million sales in Q2 2019 (up 0.5% from Q2 2018), motivated at least in part by incoming 5G phone models from a range of original equipment manufacturers (OEMs). Sales in Brazil hit 10.8 million, and in fact, Brazil was the only other country in the top five to exhibit growth (1.3% year-over-year).

India notched total smartphone sales of around 35.7 million in Q2 2019, giving it a market share of 9.7% in Q2 2019. But that represented a 2.3% year-over-year decline, perhaps the result of slowing consumer upgrades from feature phones to smartphones.

Gartner anticipates that globally, handset sales will remain weak for the rest of the year, with total sales to end users hitting 1.5 billion units in 2019.

“Demand for high-end smartphones has slowed at a [greater] rate,” said Gartner senior research director Anshul Gupta. “To try to boost smartphone replacements, we’ve seen manufacturers bringing premium features such as multi-lens front/back cameras, bezel-less displays, and large batteries from their flagship smartphones into lower-priced models.”