Simon Segars, CEO of the Cambridge, England-based Arm, took the stage at last week’s Arm TechCon 2019 event in San Jose, California to tell the company’s ecosystem of partners about its future plans.

Arm designs the underlying architecture and semiconductor chip components for its partners, who license the technology and put it into a wide range of chips that drive just about everything electronic, from smart doorbells to energy-efficient Arm-based servers. Arm’s partners have shipped more than 150 billion chips to date, and in the next two years Segars expects 50 billion more to ship.

The world is undergoing nothing less than an electronics revolution, and Arm is at the center of it. The internet of things — everyday devices that are smart and connected — could reach more than a trillion units by 2035, Segars said.

These dynamics attracted Japan’s SoftBank and led to its $31 billion acquisition of Arm in 2016. SoftBank CEO Masayoshi Son said he was readying his company for the Singularity, or the day when AI exceeds the collective intelligence of humanity, in a few decades. But last year Son acknowledged that he might spin off Arm in an initial public offering, possibly within five years (by 2023).

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Segars is trying to run the company as usual in the meantime, with a near-doubling of the company’s staff to more than 6,500 people. At TechCon, he announced that Arm would fend off competition by enabling custom instructions for embedded centralized processing units (CPUs) to give chipmakers more flexibility in a changing world.

I sat down with a group of reporters at Arm TechCon 2019 last week to talk with Segars in a wide-ranging interview. We discussed the possible IPO, the custom instructions, Arm’s moves in IoT, its interest in security, and the state of competition.

This interview has been edited for length and clarity, and questions have been reordered by theme.

Custom instructions for Arm processors

Above: Simon Segars, Arm CEO, at a press group interview at Arm TechCon 2019.

Question: I talked to a couple of analysts who felt like the custom instructions were a nod toward the competition from RISC-V.

Simon Segars: The way we’re looking at it is that — chip design is evolving in multiple ways in parallel. You have consolidation going on amongst big chip companies, producing large players who are investing on the leading edge. They have the size and scale to build very complex devices. You have some OEMs who want to build chips. You have various smaller companies who are looking at how to create things much more optimized for specific applications, especially in this world of IoT. There’s a range of different solutions out there for how people can extend the capability of what an ARM processor does based on the workload.

Our inclusion of the custom instructions is based on feedback from the market. In some areas having a dedicated accelerator sitting in the memory map or sitting as a co-processor, that works very well. There are some other applications where doing that final optimization can make a big difference. We’ve listened to the market. We’ve thought long and hard about how we add that flexibility and maintain the benefits we’ve had for our entire history of standardization and that big software ecosystem we’ve developed. This seems like a good way to address all those needs. It’s really driven by the needs of the market more than anything else.

Question: How should we visualize what this new customization ability addresses?

Above: Arm custom instructions

Segars: The target market is actually quite broad. When you look at the biggest shippers of ARM-based microcontrollers today, it’s companies that have been around a long time. They have broad portfolios of microcontrollers where they’re taking, say, a Cortex-M3, M33, whatever, and building portfolios around them that produce hundreds of SKUs. They ship development boards. They ship a lot of software support to go with that, so that as a developer you have this library of functions prebuilt for you that you can integrate together in software, whatever application in particular you want to build.

I anticipate companies looking at particular markets, like motor control. We have these libraries today that are implemented using special ARM instructions. If, as we implement our Cortex-M33, we can add some special feature, maybe we can halve the run time of that library that does some operation to work out where to take the motor to next. Companies like that are going to do those optimizations and build them into the board support packages that they create.

There will be some others in the startup category that are going to focus on one specific thing, as opposed to a broad portfolio of MCUs that they’re largely shipping to distributors. They might have some market in mind where adding some instructions can, again, just optimize for that. Again, I think it’s going to be quite broadly applicable. We’re going to see big, classic MCU shippers adopting it, and we’re going to see smaller startups.

Question: How do you add custom instructions and still maintain the ecosystem?

Segars: We’re trying to enable the best of all worlds. One key thing is that the custom instructions that can be added are purely additive to the core instruction set. The operating system that might sit on top of this processor isn’t going to rely on custom instructions. It might call a routine where, if the custom instructions are there, it runs very efficiently, and if they’re not there, it goes and does something else. But the core operating system that you can take off the shelf and run, that will still run on every ARM processor, because all the instructions that are defined today are still there.

We’re not enabling people to strip stuff out and risk having a C compiler spit out code that won’t work. There’s still that compatibility with the architecture. This is an opportunity to add things for — the regular code it’s never going to touch, but specific application optimizations could take advantage of this in a particular vendor’s set of support tools.

That isn’t very different, at the chip level, from what we have today. There may be, in an MCU, some accelerator that’s sitting completely outside the core. It sits in a memory map. Again, one of these library routines might call upon it to do something. If that accelerator isn’t there in Vendor B’s chip, it’s not going to do anything. Same principle applies here, but it’s more tightly integrated. For some functions we think that’s going to deliver significant performance uplift for very small overhead in silicon. That’s much more efficient than building a completely separate accelerator.

Question: Should we expect the majority of customers to do custom instructions?

Segars: No, I don’t think the majority. Like any instruction set check, when we look at the architecture — we’re going to put this in. What’s this used for? Who is going to use it? How do we support it? It’s a significant step to add something into the architecture, to change it. I think you’ll see companies think long and hard about it. Again, back to this mix of partners we have, bigger companies maybe standardize around a few optimizations, make sure there’s great support for it, and then you’ll have some small guys that focus on one thing. But I don’t think you’re going to suddenly see a million and one different variations.

A possible IPO

Above: Simon Segars expects a trillion internet of things devices by 2035.

Question: Do you have any updates about a new IPO?

Segars: At last year’s SoftBank AGM [annual general meeting], Masa said that in about five years, we’ll have an IPO of Arm. That’s not a hard and fast ruling, where on July 10, 2023 we’ll have an IPO. It’s not cast in stone.

What we’re doing is investing to make Arm a more valuable company. We’re investing to do that through the development of technologies, the development of our ecosystem, to ensure that we can grow with the growing opportunity that’s represented by IoT and AI and 5G and autonomous vehicles and continued growth in mobile. I think there are a number of these technologies that will drive growth for the semiconductor industry, and since we supply into that, we want to make sure we’re providing the building blocks for chip companies that want to serve those markets.

It feels to me that in that sort of 2023 time frame, we should be seeing the real fruits of that investment. We should be seeing revenues take off from the sale of those chips, and that should be flowing to the profitability of ARM. If all that comes together and the conditions are right, that would be a good time to have an IPO of Arm and release some of that back.

Question: You mentioned driving growth, having a mandate from SoftBank to drive growth and push forward as fast as you possibly can, and not be as concerned about quarterly earnings and so forth. What does that mean for Arm in terms of the overall attitude as you continue to drive growth?

Segars: For now, nothing has changed. We’ve been investing our profits in growing the company. Since the acquisition — as you know, prior to, we were a very profitable company. We operated with roughly 50% margins. We’ve taken that down significantly and invested our profitability in our growth to develop this long-term road map of compute solutions for these growing markets. None of that has changed relative to anything that’s gone on in the rest of the SoftBank portfolio. For us we’re continuing on that mission. It’s business as usual.

If and when Arm becomes a public company, the stake in the ground is 2023. That’s a while off. We need to have gone through this phase of investment, seeing the growth in the end markets, seeing how that growth in top-line converts and profitability — a lot of things need to fall into place for us to be in the right shape to go back to the public markets. We’re on a runway to do that. That’s not changed based on anything else that’s going on across the board.

Question: If you were to relist as a public company, where would you might like to do it?

Segars: It’s not something we’re spending any time as a board discussing. It’s still a long way away. If we were to relist, it would be in a market that takes a long-term view on technology. We had a great time being a public company previously, with a primary listing in London and a secondary listing in the U.S. The world is a different place from what it was in 1998 when we went public and that choice was made. We’ll determine how much closer.

Question: As a board member of SoftBank, can I ask you about the recent results of the investment in the Vision Fund?

Segars: The way the SoftBank group is organized, the business is run separately. I’m running Arm. Rajeev [Misra] is running Vision Fund. Masa is running Sprint. They’re separate companies. I’m not spending my days worrying about what’s going on at Vision Fund, nor is Rajeev, who runs the Vision Fund, spending his days worrying about what I’m doing. My primary focus is on delivering an Arm strategy.

The SoftBank group board, as you can imagine, is pretty interesting, and it’s a fascinating experience for me being part of that. The Vision Fund is going to do what it needs to do.

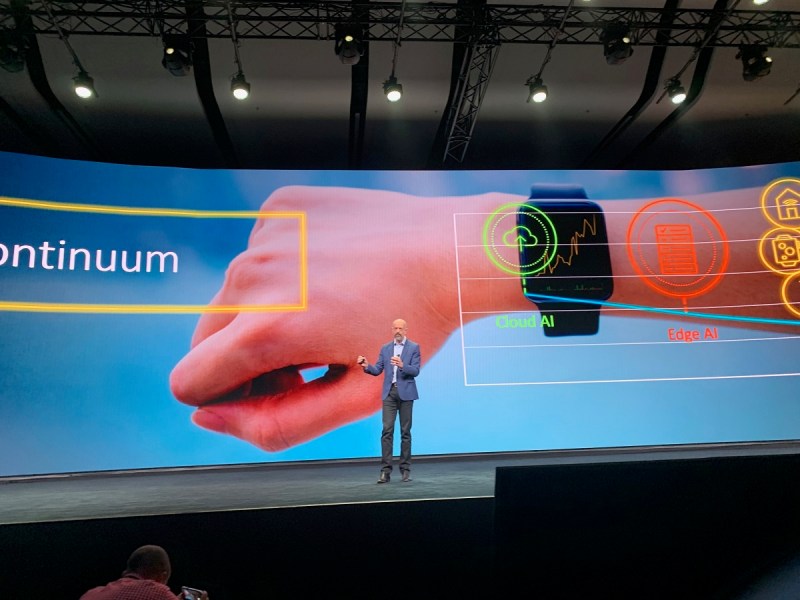

The IoT market

Above: Simon Segars expects Arm’s partners to ship 50 billion chips in the next two years.

Question: You talked about how the new area of expansion for you is this emerging market in IoT. How is that business going?

Segars: It’s something we saw a long time ago, pre-acquisition. Thinking about IoT, what the challenges are in bringing IoT devices onto the network. We’ve spent the last three years since acquisition accelerating our work in that area. Last year we did a couple of acquisitions to complete a platform approach that we’re taking to market.

We’re looking at, in a sophisticated IoT device — it’s going to be running some software workload. You need to worry about keeping that up to date. Security threats come up all the time. All of these computers have security updates pushed to them every other day, it seems at the moment. There’s a future where everything that is connected to the network is going to have to be managed in a similar way. Part of the infrastructure we’ve been building is to enable that.

Our IP down to the chip needs to allow for secure code to be installed on the chip, to allow for over-the-air software updates, even in a microcontroller. An operating system that can run on top provides those features through our API, and then you plan a service that can run on it. That’s part of the platform as well.

Those devices are connected, obviously. Increasingly they’ll be connected over a cellular network. That connection needs managing. One of the acquisitions we did last year was for a company that has built a platform that enables cellular-connected devices like phones to be managed over the mobile network. When you have that connected, you have this data coming from it. You need to ingest that and organize it so you can build a specific application that’s going to enable you to get something out of the data coming in from this physical thing.

We’re putting all of that together. The acquisitions we did last year went well. They’ve grown very nicely in the last four months. We’re engaging with people who want to build sophisticated IoT solutions, who really care about security, who really care about understanding that what they’re talking to is the genuine device, and not some counterfeit thing that’s spamming the network. The delivery of that, the rollout of those solutions, takes some time.

We’re pleased with the progress. We’re finding customers that really care about the future, that we think are going to be important, that are going to be found in everything. We’re working closely with them.

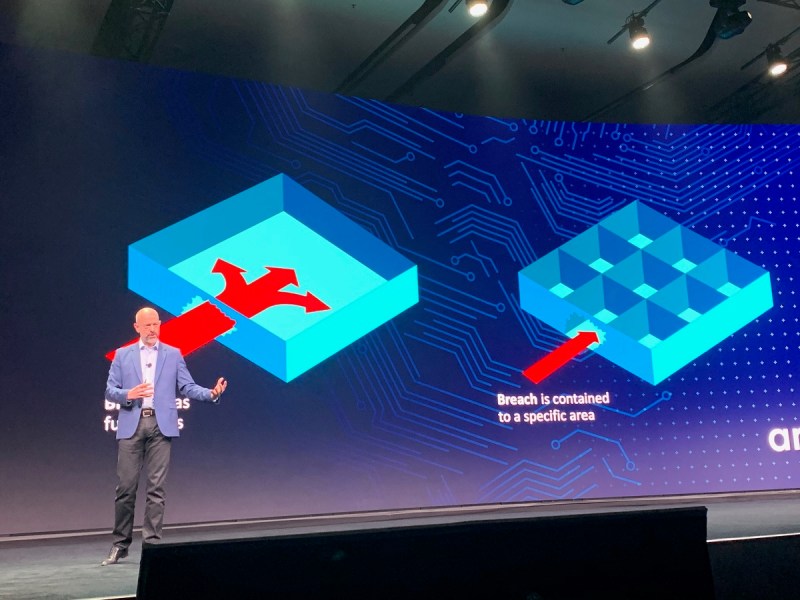

A bigger focus on security

Above: Security is increasingly important to the Arm ecosystem.

Question: There’s been an increased focus on security. What is driving that? What do you see as the drivers?

Segars: In a world of billions of connected things, the level of security threat that introduces is something that we just don’t seem to talk about. There aren’t many of these things, really, in the world, relative to what we anticipated with IoT. These are all managed devices. People are now building, very quickly, IoT-like things that have no security in them at all.

As we saw the other day, when I was talking about — the security cameras at Amazon, someone had done something with them, taken them all apart and realized that they’re all horrific from a security point of view. As a consumer, how do you know? And the answer is you don’t. He was going to fix it. In something that isn’t a managed device, you can’t do that. Too bad.

Our view has been that if that situation continues, and people start deploying insecure IoT devices, then bad security incidents will happen. People will lose faith in IoT. That will be a limiter to the growth of the market. We want to try to build a world where IoT has great security, and the industry that provides it — which is a combination of us as an IP company, chip companies, software companies, service providers — collectively takes responsibility to provide good service.

That’s why we’ve been making a big deal out of this. We do think it starts down on the device. We want to help build secure devices. But it does require a lot of cooperation across the industry to make all this in a way that people can trust it.

Question: If your software is not secure, though, it doesn’t matter whether the device isn’t secure, right?

Segars: Increasingly, as systems get more sophisticated, it is the interaction of hardware and software that can lead to security vulnerabilities. You take Spectre and Meltdown. That was a class of security attack that nobody had thought of before. I sat down with our chief architect and explained it to him. Who in their right mind thought of that? But somebody did.

Some things like Spectre and Meltdown can be fixed relatively easily without a hardware change. But other things are actually about the interaction of the hardware and the software. You cannot look at each component in isolation. You have to think about the system and the interaction of the different components of the system. That’s why collaboration is required across all the companies in the supply chain.

The competitive picture and Arm’s outlook

Above: Sensors will be everywhere.

Question: What do you think, in general, about some of the push some companies have, like Apple, to go vertical and depend less on anybody else? They have a pattern of building everything in-house. What are the consequences of that for you and for the market?

Segars: There’s a class of OEM that is building their own silicon. I don’t think you’re going to see lots of companies do it. You have to be big. You have to have scale. You have identify some way you’re going to differentiate your product as a result of doing that.

I think the merchant semiconductor market has a pretty good future ahead of it. As I just said, developing these chips is incredibly complex. It takes a lot of time. You don’t just decide to go and do this. But we are seeing some companies pick up chip design teams and start to work where they see some opportunity to innovate and differentiate.

I’d say most that we know of are looking to license our technology in order to help them get there. Many of the teams being picked up have experience of using Arm. Typically people are building quite sophisticated things where the breadth of our IP offering, the quality of what we do, the support that we can provide, is really useful to people as they look to build these complex systems.

This, to us, expands our market, expands our customer base, gives us different people to go and work with, people our building end systems, which is in itself a useful source of input to help drive our road map. It’s a trend, and it’s one that we’re looking to work with and engage with.

Question: I wanted to check in with you on some numbers, like when the next 50 billion chips ship and when you get to that trillion IoT devices. Are there any timelines or changes to timelines there?

Segars: No. As I said this morning, we’re on a run rate that predicts about 50 billion chips in the next two years. We’ve previously said a trillion connected devices by 2035. At the moment we’re seeing the industry dip a little bit because of everything that’s going on in the world, but I think — the 2035 number might be wrong by a couple of years, but ballpark, that’s what we anticipate.

Question: What about the singularity?

Segars: What do you think?

Question: I don’t think you like talking about that as much as some people.

Above: Dipti Vachani, senior vice president at Arm, gives a keynote at Arm TechCon 2019.

Question: This is more prosaic. What do you think of the future of Arm in the clients?

Segars: Windows Arm laptops, obviously there was phase one, or let’s call that phase zero. The phase we’re in now — actually, I think the last two years, that was phase one. Your Lenovo device there is really good. That’s a great machine, running Windows 10. I’ve been using this for a while. It does everything. The battery lasts a really long time.

The new version that just launched, the Surface Pro X, frustratingly enough I haven’t had a chance to play with that yet. But knowing what has been coming down the pipe, I think that’s going to be a great platform. Hopefully it’s going to rule the market for Windows running on Arm processors, following those designs. That’s great.

Question: Have you reached a critical mass there?

Segars: Time will tell. But Microsoft building a first-party device, I think — they’ve done a lot of work on software, to the point where in a blind test, other than the lack of stickers on that thing, you couldn’t tell. And similarly, in the datacenter, a lot of work has gone into getting processor performance and the software ecosystem going. It’s the same thing. It’s about hardware and software coming together, to the point where chips can be deployed in the data center. Amazon did that last year. That’s gone very well. We’re expecting a bright future for that, and we’re expecting others to come into that market.

Question: Moore’s law is slowing down, getting toward its end here. We have all this worry about climate change. I wonder whether or not that slowing of Moore’s law is happening right when we need it more, in order to combat climate change. It seems like a fairly dark trend. I don’t know if you see anything brighter.

Segars: And PG&E is going to switch off half the electricity in Silicon Valley. The keynotes tomorrow might not be so visually appealing. I mean, Moore’s law aside, I think that the deployment of IoT and the AI processing of data can do a lot to help with some of the issues of climate change. We’ve been a believer, and publicly outspoken, on the role that technology can play in addressing all of the U.N. global goals, whether it’s to do with climate change, quality of water, education, whatever. If you look across the global goals, technology can help with all of them.

There’s a lot of inefficiency. This thermostat cranking out freezing cold air when we’re all not enjoying it — a wall switch would help here. But there’s really a lot of inefficiency in the world. There’s low-hanging fruit here that doesn’t take much to address. We have the technologies we need for that now.

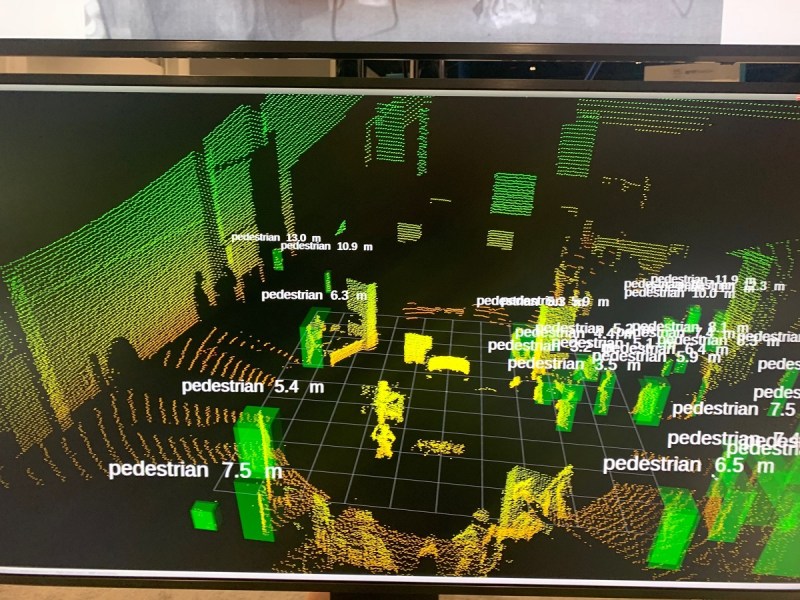

Above: Yep, it’s like a supercomputer in this self-driving car. VSI Labs’ full stack of AV technology in the trunk of their research vehicle.

Question: It seems like a big buzzword these days is heterogeneous computing. Clearly you’re invested in this idea that as Moore’s law slows down, people are going to use more of these different strategies to squeeze out more computing power at a certain workload capacity. Does that mean that you need to cooperate more with people who might traditionally have been competitors? Do you see more partnerships in the future? People are using totally different types of things to build devices. Does there need to be more collaboration?

Segars: I’m certain that solving complex problems that we face is going to require more collaboration. I think AVCC [Autonomous Vehicle Computing Consortium] is an example of that. Most of the companies involved are ones we’ve had some relationship with in the past, but we’re now forming a consortium together to work on that hard problem. That’s an example of what, for Arm, is actually a kind of constant development of the collaboration that we do. That’s a fundamental principle of Arm’s development over the last 21 years.

When I think about heterogeneous computing, again, I can point to examples where we have, years ago, 20 years ago, worked on — how does an Arm processor sitting next to a DSP chip — how do you program it? How do you develop it? We’ve done work on tools chains to enable you to look through one interface into the different processors that might be on one chip. We work with people with whom we sometimes compete, and we sometimes collaborate. That’s just the way our bit of the industry works.

Question: So you don’t see a change in the way you operate?

Segars: I don’t think it’s any kind of step change. The players might change, but it’s what we’ve always done. We’ve focused on people doing ever more sophisticated chips. Heterogeneous isn’t a new thing. It’s been around from — those first modems that Arm got our designs into that really grew the company, that’s a heterogeneous computing model. It’s an Arm CPU and a DSP. Pretty soon there was another one tucked in there to do Wi-Fi and Bluetooth. That’s been our life. The players might change, but the principles behind that are incredibly familiar ground for us.

Question: Do you see a tipping point or a catalyst for IoT, or is it something that’s just going to gradually grow, and before we know it, everything around us is connected? Is it 5G that will make this all happen?

Segars: I think it is a gradual thing. There are lots of things connected over Bluetooth and Wi-Fi today. 5G is about as close to a catalyst as it comes, because hooking something up through a Wi-Fi network — you’re probably doing it at home. You get your password out and punch it in through some horrific user interface and you hope you never have to change it again. There’s an element of pain and difficulty associated with that.

For me, the promise of 5G is the ability to connect those things directly to a server on the network. You can’t do that today. I was talking to somebody three weeks ago now who’s — I don’t remember the exact application, but they’re putting IoT things into cars. They accidentally took down an AT&T tower because of all these devices suddenly trying to connect to it. That’s because the network just wasn’t designed for it. 5G is designed to be able to do that. That’s going to remove a lot of pain in how devices get into the network.

We have a view that through all the technologies we’re putting together, you can design an IoT thing, build it in a factory wherever in the world, take it to some other market, it switches on, it works out who the local service provider is, it gets attached to that network at local rates, and it talks to service that needs to support it. All you’ve done is switch it on. You haven’t had to associate the device with a network or a person or a service. That’s what the world is today.

There is a mass simplification ahead of us that relies on chips being built the right way and entities getting together in the right way, service sitting on the back end, 5G. Those things are all going to come together. We won’t wake up one day and shazam, here it is. It will be a gradual rollout. But that’s where I think we’re headed.

Question: When you talk about gradual, do you mean the next couple of years?

Segars: Yeah, yeah. For 5G to be completely ubiquitous, that’s going to take a long time. I got a stat this morning. There are more than 1,000 city trials being run on 5G today. That’s a lot. There are 80 different operators. But still, global penetration of 5G is a fraction of LTE. I can’t remember the stats, but you can look at how quickly it took to roll out 3G to a point where 70% of the world’s population had that, and compare it to LTE, which I think is faster. 5G is going to be interesting to look at how quickly that rolls out.

Meanwhile, you’ll talk to people who think 5G is this glorious thing that will allow self-driving cars to operate and talk to the cloud and whatnot. But there will be large parts of the surface where you don’t have coverage and you have to do computing locally. This is going to be a gradual, multi-year evolution.

Question: Are you happy with where 5G is at the moment?

Segars: As I said in my keynote, there seems to be a lot of negativity around 5G and accusations that it’s all hype. But I look at what operators have been saying for the last couple of years. They’re doing it. 5G is rolling out. It’s slower in some countries than others, but it’s rolling out.

Arm’s view of the automotive market

Above: Self-driving cars need a standards body to get to the finish line. Minneapolis-based VSI Labs’ research vehicle at ARM TechCon.

Question: Part of today’s presentation was about the automotive market. That’s another market where we’ve seen a lot of hype and interest and overall excitement, and maybe not enough material advances and deployments as we were led to expect two or three years ago. It seems to me that bringing people together makes sense conceptually, but it’s also a tacit admission that there’s a long way to go still.

Segars: It’s interesting. I actually think the automotive industry has changed an enormous amount in a very short space of time. It’s two things that are going on. One is electrification and the other is autonomy. What Elon Musk has done with Tesla, if you want to talk about a catalyst, that is something that’s driven a lot of change.

Car OEMs have been around, in some cases, more than 100 years. They’ve spent their lives worrying about petrol engines and gearboxes and buying stuff from tier one suppliers. That’s all radically changing. We had one of them in the office the other day saying, “Yeah, we need to become a software company. We’re hiring all these software engineers. That’s the future. We’re changing our supply chains. It’s all about compute now. Despite the fact that you, Arm, are at the bottom of this supply chain that supplies all this stuff to us, we want to work you and build a relationship because we care about the processing.” A lot of the stuff they’re anticipating is going to run on our technology.

Question: And they have high hopes for reuse.

Segars: Yeah, absolutely. They’re thinking about how to get supplied with technology in the future, because they know how it was, but the thing they’re going to be building in the future is going to be radically different. They want commonality of platform with choice of supplier so they can benefit from standardized architecture, and yet competitive forces that give a better solution at the end of the day.

I look at all of that and it’s actually quite staggering, how a pretty staid industry that produced a platform and what you’re driving today is technology that was good seven years ago — all of that is changing very quickly. I think there was a lot of underestimation of what it was going to take to build a compute platform capable of driving a car under any set of circumstances, and doing it better than a human. That’s such a hard problem. When the light’s failing and it’s raining — I got in mine this morning and it said, “Lane avoidance features are limited. If the problem persists, contact Tesla.” There’s mist on the sensor and it stops that from working. It’s no good. If you take the steering wheel away that’s a problem.

There are certainly trivial problems, but there’s also just a ton of challenges to creating a fully autonomous car. The consortium we just launched, I hope, is going to address some of those issues and bring some of the players together to go and work on them. Everyone realizes they’re not going to do this on their own.

Above: Arm’s alliance for self-driving cars.

Question: I felt like the Autonomous Vehicle Computing Consortium had a kind of depressing message about it. Some of these cars seem to be stuck in prototyping. There’s a need for the consortium because progress isn’t there.

Segars: I look at it a little differently. I’ll give you the glass-half-full version. The rack of servers in the back of a car that’s driving around here right now, think of that as a prototyping platform for the software. There comes a point where that software can’t run on a rack of servers in the back of a car, because that’s clearly unscalable. It needs to get migrated to a small, low-power, low-cost, multi-supply-chain solution that can then scale up to millions of cars.

The glass-half-full, then, would be that the software is reaching a point where it’s time to think about how you turn that very unscalable, inefficient set of hardware into something that’s going to work for the mass market. Now, I think that’s quite a long journey, and people want to start migrating some of the software they’ve been working on. This consortium has come together to work out, architecturally, what that should look like and provide that solution into the market. I think it’s actually — this represents a powerful evolutionary step to start working toward not a prototype, but something that can go into mass production.

Question: Tesla already seems to be there.

Segars: We’re talking about full autonomy, solving the problem of enabling the car to do anything under any circumstances. Everyone is a long way from that.

Question: Can we evolve beyond that competitive position that we saw when — we had chip companies, some of them your customers, some of them your competitors, talking about how the other gang were idiots and they had the magic solution. Has that calmed down a bit now?

Segars: We don’t hear that so much nowadays, no. Maybe a dose of reality about how hard this is has settled in.

Question: Where’s the sweet spot for you in that arena? Clearly there’s full autonomy, stage five or whatever you call it, and then these other stages. Do you want to position the company in the lead-up to full autonomy, or do you see the most opportunity elsewhere?

Segars: We think about time frames. Arm technology is already used in a lot of automotive electronics. High-end cars have a couple of hundred microprocessors in them. Not all of them are Arm, but many of them are. We have great positioning in IVI, and we’re increasingly in more and more ADAS systems. We anticipate ADAS systems getting more sophisticated with every generation. Through our partners we’re in a great position. We have a technology road map and our ecosystem to deliver into that. I expect more Arm technology to be shipped into or through the conventional supply chains of automotive than there is now.

Meanwhile, you have people coming at this autonomy challenge from the other end. Forget all that, let’s put a rack of servers in the back of a car and write a boatload of software and work out how to do it, and then we’ll scale it. We’re working with both ends of that. They’ll meet in the middle, probably, but we’re working on both ends of it. The near term opportunity, we have more Arm technology improving cars that get safer and safer. That’s good. And we have an eye on this long-term prize.

Question: Are you confident that it will happen, that it isn’t just one of these flying-car things that we’re always seeing the day after tomorrow?

Segars: Yeah, I look at the focus on it, the progress being made. There are many cars out there that can drive themselves — not in all circumstances, but in a lot of circumstances. You can do it. Like all things, there comes a point where you get into optimization. I don’t think we’re quite there yet, but when I look at the progress being made, it gives me confidence that it’s going to happen.

Arm’s hiring

Above: The beard is about two months old.

Question: Last year you said you had a surge in hiring after SoftBank acquired you.

Segars: Yeah, we hired a couple of thousand people.

Question: Where are you today? Are you hiring more than just a year ago?

Segars: Yeah, we’ve grown in the last 12 months. Total number of people in Arm is about 6,500, and we’re continuing to grow. When SoftBank made the offer to acquire Arm, there was a commitment made to double our U.K. headcount over a five-year period. We’re three years into that, and we have about 1,000 more net people to hire into the U.K. to meet that objective.

Question: What areas are you hiring into?

Segars: Broadly, our sales team is relatively small. There’s about 150 people in the Arm sales team, because there aren’t that many semiconductor companies. We know them all really well. The majority of the hiring we’re doing is in engineering. That’s our life’s blood, the IP we create.

International challenges

Question: How is Brexit for you?

Segars: How is Brexit for anyone? Our concern — Brexit actually doesn’t affect our business very much. We don’t export physical things. We’re not worried about border controls messing up exporting things. But for us, consistently, we’ve always said that the risk of Brexit for us is in the ability to hire people from all across Europe to come work for Arm in the U.K., which we’ve done extensively over the years. We hope we’ll continue to be able to do that.

Question: Does the threat of trade war between China and the U.S. also jeopardize that talent pool? China produces a hell of a lot of engineering talent that comes through these days.

Segars: That’s not really changing our ability to hire, say, Chinese graduates into the U.K. It causes immigration challenges in the U.S., of course. But Brexit doesn’t affect that. It’s more that right now, as you know, if you’re a European citizen you can go and work in any country in the EU the next day. If we have to suddenly go through extensive visa processing to hire people in, that’s a delay, and that always affects things.

Question: Are you balancing your operations from an engineering point of view because of any restrictions that could be placed on U.S.-based companies?

Segars: No. We have a number of teams in different offices around the world. We take a long-term view on that. You don’t just uproot in one place and put it down somewhere else, because it takes a long time to develop the skills and the talent and the experience you need. We’re not about to make any radical changes.

Arm’s pricing

Above: Autonomous cars produce a huge amount of data. LiDAR point cloud demonstration by VSI Labs at TechCon.

Question: I would ask a bit about the flexible terms and whether that’s going to push customers to negotiate with you at a different time. If I think from a customer perspective, I pay you a very modest fee to get started, but when it comes time to really negotiate the final royalty on a per-chip basis, I’m already committed, which creates a different position than if I were negotiating both of those things up front in a discussion about licensing and royalties. To bring that up a few levels, if that program takes off, do you expect it to have an impact on the kind of royalties you get? Do you think they will be higher on net, especially given that these are smaller, cheaper chips that we’re talking about? Sometimes as much as just 50 cents a chip.

Segars: Well, we make chips that sell for even less than that. Net, I’m not really expecting this to change the fundamental economics of the access to the IP, or the royalty per chip that we get down the road. If you’re implying that the point we’re negotiating, someone is completely committed, and therefore we might take that as an opportunity to charge more, we would never do such a dishonorable thing.

We’re trying to encourage people to use more of our IP, design more variants of chips, and enable flexibility in the way that they access our IP, to make sure that the thing they end up taking out of that factory is optimized for their application and they’re not making some decisions based on paper simulation of what they’re doing. It’s actual system design that they’ve gone through.

Price-wise, we operate under the assumption that it’s make versus buy, that there will always be choice, and if we charge too much for what we do, then ultimately people are going to find alternate solutions if it’s beyond the threshold of pain. If we make people’s chips uneconomic, then they’re going to find different ways to design the technology.

Question: Is part of the program a pricing plan, so that people know exactly what they’re buying into?

Segars: You get a price in front. There’s going to be no surprises. It’ll be transparent.