The pandemic has interrupted our lives. I sincerely hope that you are all well. During this time, it seems like a small thing that physical events like the Game Developers Conference and the Electronic Entertainment Expo — and the physical version of the GamesBeat Summit — have disappeared. But as we work from home, it’s even more important to reach out to each other and connect as a community.

We’ve shifted our GamesBeat Summit Digital to an online-only event on April 28-29, and we’re keeping our theme of “The Dawn of a New Generation.” But as we planned this change in real time, we also adapted the content, as this new generation isn’t what we had in mind.

All of gaming is adapting to the dramatic change brought about by the coronavirus. We have had a shift in our available personal time, where we are no longer commuting to offices or traveling or going out to restaurants. We are, however, still able to entertain or distract ourselves with games, and the value of that can’t be underestimated for our mental wellness, as we are isolated in our homes for an unknown amount of time. Gaming is one of our lifelines. And this moment means gaming will climb up a notch in the world when it comes to awareness and pervasiveness. Sure, porn, streaming movies, and other online activities are benefiting as well. But Reed Hastings, CEO of Netflix, famously remarked that Fortnite was his biggest competition for users’ time.

“People are finding those moments again, whether it’s in Roblox or Minecraft or Call of Duty: Warzone or Animal Crossing, where you can feel that human connectivity,” said Peter Levin, cofounder of Griffin Gaming Partners, in an interview. “It can be a lighter conversation which is separate and different from the Zoom conference calls we are doing all day. The publishers I talk to say they are seeing dramatic spikes in the games.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Above: Peter Levin is cofounder of Griffin Gaming Partners.

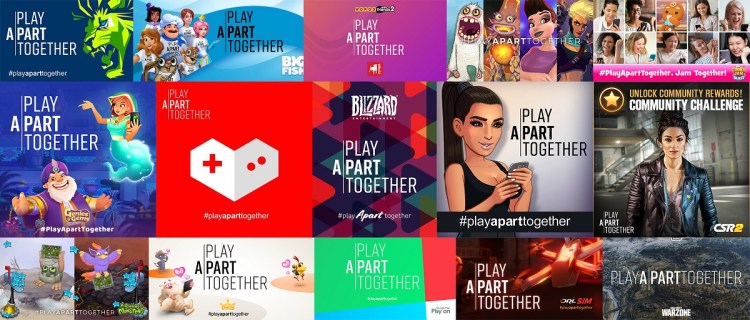

Online gaming and mobile games are experiencing huge surges. And while it’s a very sad and difficult time, the silver lining is that games are pulling us together, giving us relief from reality, and even sharing important information for us to stay safe, as we see in the PlayTogetherApart campaign that dozens of game companies have joined on behalf of the World Health Organization’s plea for social distancing.

As Andreea Enache, one of our moderators and head of global business development at Blind Squirrel Games, said in a prep call, “Everyone has hit pause except for gaming.”

Esports companies have pivoted to make their businesses entirely digital, as online gaming has seen a surge while traditional sports is on hold. VR and AR companies are looking to repurpose themselves with new generations of immersive and remote technologies. Some cloud gaming operators like Google Stadia are even making services available for free. Many of our talks at our online conference will reflect what we’re learning in real time.

Billions of people already play games. And now games have a chance to further eclipse all other media in terms of numbers, engagement, and overall business. The competition is all about how we spend our time, and games have been winning that battle, with a lot of potential to make gains among non-gamers during a time when other options are limited.

But can that hold up against the weight of the distractions we face and our challenging macroeconomics? Games have been recession resistant. But are they depression resistant?

We’ll be talking about how companies can best navigate this environment, and the transition to new platforms, new markets, new business models, and wider opportunities. And we’ll try harder than ever to connect people in a community.

Just what are those talks about

Above: Jenova Chen is cofounder of Thatgamecompany, creator of games like Journey, Flower, Flow, and Sky.

Josh Yguado, president of Jam City, will talk about how gaming will become the center of entertainment in a conversation with Amy Allison of Skydance Interactive. Javier Ferreira, co-CEO of Scopely, will also speak with Michael Metzger of Drake Star about doing free-to-play games right.

Elan Lee of Exploding Kittens and Theresa Duringer of Temple Gates Games are talking about games that are made in quarantine, and how they will be different. Lee makes tabletop games as well as digital versions of those games, but he said the hardest thing is to envision games that play like tabletop games but have no physical contact between the players.

Rob Dyer of Capcom will talk about console cycles with Mike Vorhaus of Vorhaus Advisors. Greg Borrud will discuss the real-world games of the future.

We’ve also got a couple of panels about the pivoting and the mainstreaming of esports, which has the opportunity to get more content on TV while traditional sports and other kinds of content are sidelined. We have investor panels with veterans like David Gardner of London Venture Partners and Jon Goldman of Greycroft and GC Tracker Fund, and they will discuss how things like a panic in the stock market can ultimately affect whether VCs will give money to game startups. From seed investors like Shanti Bergel to buyers like Chris Petrovic of Zynga to uber investors like Mitch Lasky of Benchmark, we’ll have the whole food chain of game investment covered.

Above: Women in games breakfast at GamesBeat Summit Digital.

Jeferson Valadares, CEO of Doppio Voice, hopes that voice-driven games will become more popular as people stay wary of touching screens. Neil Young of N3twork and Bing Gordon of Kleiner Perkins will talk about how they foresee a $1 trillion mobile game industry in the future. That may sound fanciful now, but years ago they predicted we would see $1 billion mobile games, and that came to pass. We’ll get a glimpse of Asia’s gaming market in sessions led by Lisa Cosmas Hanson of Niko Partners.

Mike Morhaime, who built Blizzard Entertainment into one of the industry juggernauts, can reflect on powering through past recessions. We’ll talk to companies on the fringe of the industry like virtual reality firms, blockchain game startups, and even those trying to look beyond the current crisis to create virtual beings, or digital humans, like Edward Saatchi of Fable Studios. Sam Englebardt of Galaxy Interactive will lead a discussion about the Metaverse.

We will also have talks that aren’t different because of the coronavirus, like Jenova Chen’s solo talk about Thatgamecompany creating a wholesome community in the mobile game Sky, and Jesse Houston will talk about how Phoenix Labs made Dauntless into a full crossplay game. Glen Schofield of Striking Distance Studios will talk about creativity, and Chethan Ramachandran will speak about Skillprint’s ability to build out a gamer’s DNA. We’re also quite proud to host a Women in Gaming breakfast, with a panel moderated by Andrea Rene of What’s Good Gaming and featuring Kellee Santiago of Niantic, Nonny de la Peña of Emblematic Group, and Elizabeth Howard of Aspyr.

Our emcees will include me, Michael Chang of NCSoft, and Andrea Rene.

Gaming’s strength

When it comes to game investments, the environment has changed in favor of venture capitalists, rather than startups. Valuations are going to falling in the coming months, as they do during recessions. Entrepreneurs may have to deal with the fact that their companies are less valuable than they were just a short time ago.

To invest, seed investors have to believe that some other investors will be ready to commit Series A and Series B rounds to their startups. And those investors have to believe that exits are possible, mostly through acquisitions. But the investments have still been flowing, and it looks like games are faring better than other forms of entertainment in Hollywood.

More than $700 million was invested in game startups in the first quarter, though that amount is down from the year earlier period, according to data collected by Sergei Evdokimov, investment associate at Mail.ru Games Ventures. And the volume of game merger and acquisition deals was $1.6 billion in the first quarter, compared to only $1 billion for the full six month of the first half of 2019.

The real test is whether the force of the coronavirus, which has thrown 16 million people out of work, can suppress the demand for games and the enthusiasm of investors, starting in the second and third quarters of 2020. If containment measures work, the impact on those people can be short lived, as people will be able to get back to work. Fortunately, most game studios say they can still function with employees working from home, in contrast with movie makers or TV shows.

You can still expect a lot of game companies to fail, especially startups. The Layoff.fyi tracker reports that 212 startups have laid off more than 19,000 people since the crisis began. Many companies that are short on cash will find it easier to be acquired than to go it alone. So strategic investors who have big war chests will consolidate the market.

Yet we have plenty of chance for prosperity amid the ruins. Cowen & Co. said in a note to investors that the game business held up strong in previous recessions in 2001 and 2008-2009. During 2001, sales of the Xbox and Gamecube helped boost hardware sales 64% and software by 9%. In 2008, sales grew 24% in the U.S. but declined 9% in 2009, Cowen said.

Other indicators are good. Nielsen said 29% of gamers in the U.S. are playing with their friends more often. Roblox is seeing huge gains as more kids play while they’re out of school and parents are lax about enforcing game-playing restrictions. The costs of acquiring new users has suddenly dropped, as people are more willing to try out new games now as other things don’t compete for their attention. In mid-March, Verizon said gaming usage was up 75% during peak hours since the quarantines started.

Above: Doom Eternal comes out on PC, consoles, and Stadia on March 20.

Bethesda said that Doom Eternal “shattered records” when it debuted on March 20, while Disney had to push off its debut of its live-action film Mulan. Comcast said that games such as Call of Duty: Warzone pushed game downloads up 50% to 80% recently, even as overall internet traffic was up 32%. Rumors persisted in some countries that operators had to throttle gaming traffic to make sure the overall internet held up. Doron Nir, CEO of StreamElements and one of our solo talk speakers, noted that Twitch has grown 20% in March in hours watched compared to February.

Players are also talking about games more. Twitter said that in the second half of March, it saw a 71% increase in conversation volume and a 38% increase in unique authors related to games. The U.S. specifically has seen an 89% increase in conversation and a 50% increase in unique authors related to games.

All of these gains are not just going to evaporate overnight as the world (eventually) goes back to normal. It may take a long time for that normality to return, and even then, the world will likely be skewed toward digital, rather than physical interaction. This is gaming’s opportunity to make permanent gains, Levin said. And I agree.

The point is that game companies are going into one of the worst disasters of our time from a position of strength, unlike movie theaters or leveraged entertainment companies that are on the verge of bankruptcy. Other companies and industries will be pushed to the brink. But the game companies could very well merge from this experience stronger. And that’s good, as we need something to create jobs and careers for decades to come in this new economy.