As blockchain technology expands across industries, new applications of distributed ledgers and smart contracts are arising almost every day. Today is no different.

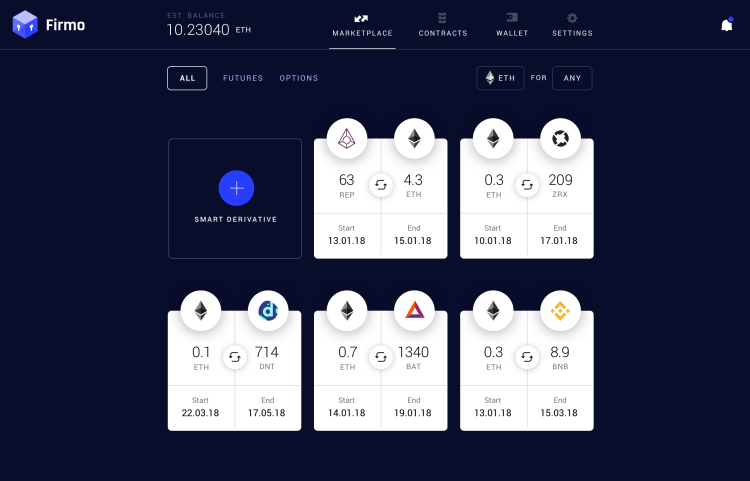

Firmo — which specialize in bringing financial contracts to the blockchain — has created a cryptocurrency infrastructure with the launch of its contract engine today. Providing exchanges with a significant degree of safety and security, the Firmo platform enables the creation of smart derivatives and financial instruments, something that hardly exists on most blockchains.

Founder and CEO Dr. Omri Ross is an assistant professor in Blockchain Technology at the University of Copenhagen and holds a Ph.D. in financial mathematics from the University of Cambridge.

In essence, the idea is a simple one. Firmo acts as a protocol layer and offers all the major blockchain platforms, exchanges, and liquidity networks, such as Bancor, the ability to construct automated financial contracts that are enforceable.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“We support most derivatives traded on the traditional markets,” Ross told me. “This includes options on a variety of underlying futures and swaps on digital assets. The importance of running such products on the blockchain is that it will offer a decentralized solution for these markets. As an example, consider a decentralized CME Group or CBOE on the blockchain.”

Over the counter (OTC) derivatives make up a substantial marketplace. While declining slightly in recent months, the notional value is still estimated to be more than $500 trillion.

To date, the blockchain landscape has lacked a secure infrastructure to support financial derivatives. By enabling a crypto-economy that supports derivatives, Firmo allows for decentralized futures market contracts, cryptocurrency swaps, condition-based crypto-asset hedging, and OTC derivatives.

“At the first stage, we will support any asset that is tokenized on the Ethereum platform, meaning anything that can be represented as an ERC20 token,” Ross said. “This allows us to represent traditional asset classes, such as the USD, through the Maker Dai or other stable coins.”

With today’s announcement, Firmo is providing an infrastructure for the creation of derivatives and financial instruments on crypto-assets. Firmo’s Protocol, FirmoLang, is written in Haskell and has been formally verified with the Coq proof assistant, which suggests it has high-security standards.

So what’s next for the company?

“Our platform is intuitive, secure, and blockchain agnostic,” Ross said. “We will create compilers for a variety of blockchains and plan to extend our offerings for the traditional markets, offering conventional institutions access to execute secure financial instruments on the blockchain. We believe that providing secure, intuitive, and blockchain-agnostic infrastructure is the key to advancing the blockchain space.”

Firmo was launched in 2017 and is headquartered in Gibraltar.