As more people move to what could be termed a “decentralized life,” working remotely and moving from country to country with no fixed abode (me included), it is important to find new ways to transact, withdraw local currencies, and receive payments. And it is important to be able to do that in the most minimalist way possible.

Enter financial network Rapyd, a platform that digitizes cash and other local payment methods. Its cardless payment platform has launched to enable businesses and consumers access to a network of over 1 million endpoints across more than 100 countries, and in more than 70 currencies.

Importantly, Rapyd integrates with existing end-points without impact on the businesses.

“Rapyd was designed from the ground up with consideration for our merchants’ substantial investment in brand equity,” Rapyd CEO Arik Shtilman told me. “That’s why all of our solutions fit seamlessly into our merchants’ existing digital products so that they can offer their customers a 100 percent native experience.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

So how does Rapyd work, and who can use it?

Rapyd works in different ways depending on the end user.

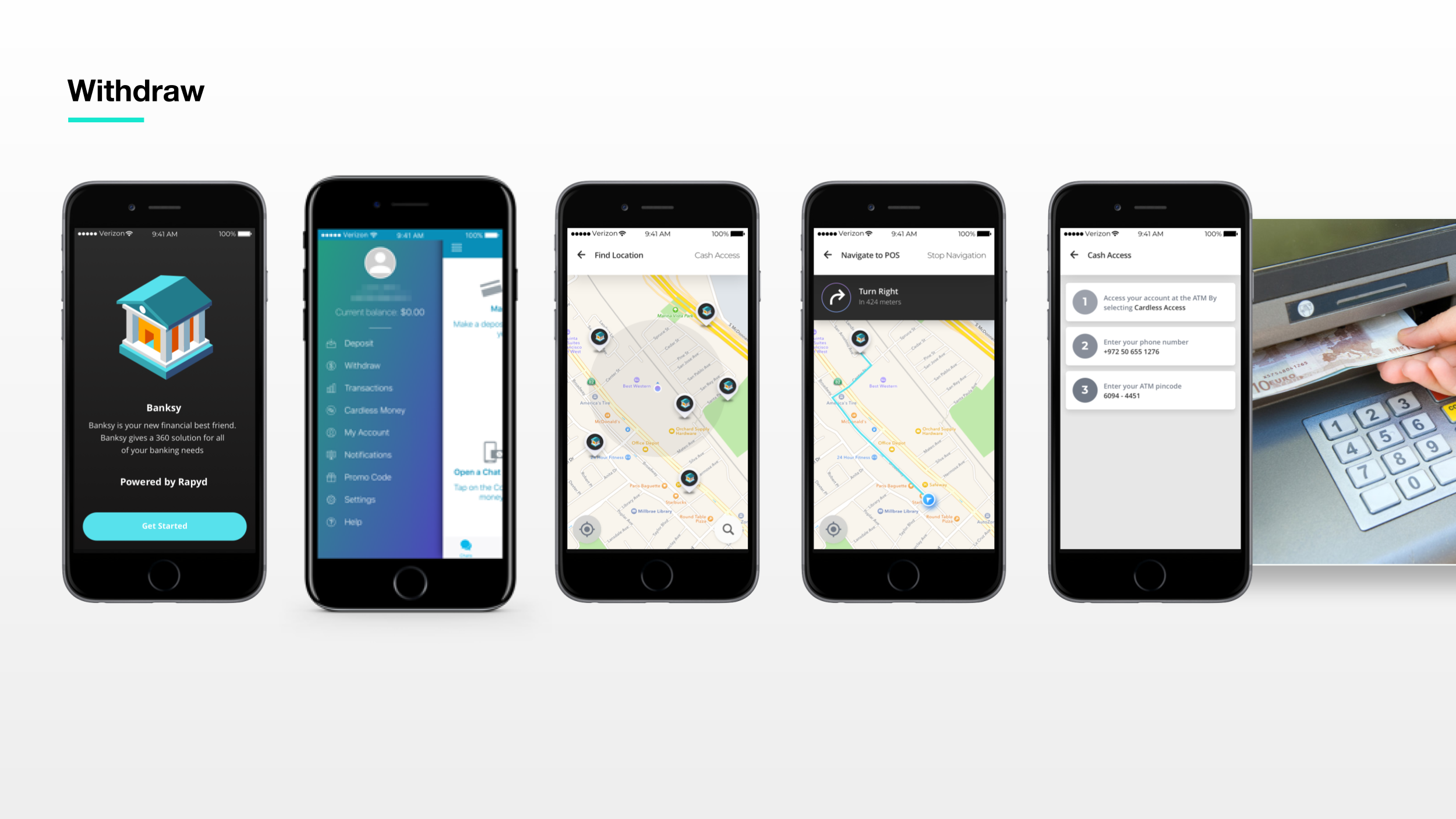

For businesses, they can accept payments from consumers via the platform using the Rapyd API. For mobile consumers, Rapyd enables cash deposits, withdrawals, and payments. Everything is cardless, using a smartphone throughout the process.

That includes access to ATMs, self-service kiosks, and retail stores, which brings up the question of how a smartphone can withdraw cash from an ATM.

“Users can cardlessly access cash by simply logging in to the merchant mobile app on their smartphone,” Shtilman said. “They select the ‘cardless money’ option, locate the nearest ATM, and use the mobile app to withdraw directly from the ATM.”

The API is not designed to compete with the likes of Stripe.

“Only 6 percent of the world’s population has a credit card, and companies such as Stripe cover that market well,” Shtilman said. “The Rapyd API is designed to help merchants serve the other 94 percent of the world through a single API. We offer 105 countries through a single integration and onboarding, with support for over 70 currencies.”

Rapyd also provides a service for its customers to pay or get paid, and in their preferred local payment method. Each transaction is fully digitalized, even if paid in cash, and the company is keen to point out that it meets all “know your customer” (KYC) and anti-money laundering (AML) regulatory requirements.

In essence, Rapyd is hoping to create a cloud service for payments that can be interacted with entirely through a smartphone. In fact, the company says that its platform goes further than payments.

“Rapyd is not limited to payment collection, and we do not see ourselves as a payment processor or a gateway, but rather Rapyd is the AWS of the fintech world,” Shtilman said. “We offer a unique set of services through an API that enables companies to build their own solution on top of our platform. Our offering includes things such as collection and disbursement of funds (cash, bank transfers, local wallets, and cards), digital KYC, e-wallet management, and more. Different customers use our API for different reasons. For example, an ecommerce customer might use us to collect funds from consumers, but on the other hand, a ride-sharing platform might use us to manage an e-wallet for its drivers and distribute their salaries through us.”

As with most products and services in this sector, Rapyd makes its money through transaction fees. There are different fees for each service, such as collection, disbursement, e-wallet management, digital KYC, and more.

And what’s next for Rapyd?

“We are growing very fast,” Shtilman said. “Currently, we have direct operations in Europe, U.S., and APAC [Asia-Pacific]. In the next 12 months, we will be expanding with a local operation in Mexico, Brazil, and several other key countries.”