Mobile banking startup N26 has raised a whopping $300 million in a series D round of funding led by Insight Venture Partners, with participation from Singaporean sovereign wealth fund GIC and a handful of existing investors.

This raise officially elevates N26 to the much-coveted unicorn club, with a valuation of $2.7 billion.

Founded in 2013 as Number26, the Berlin-based fintech startup rebranded as N26 in 2016, just as it obtained its own banking license. The pitch behind N26 is one of speed and efficiency — it’s available only on mobile and the web, and it promises that anyone can open an account within minutes of applying.

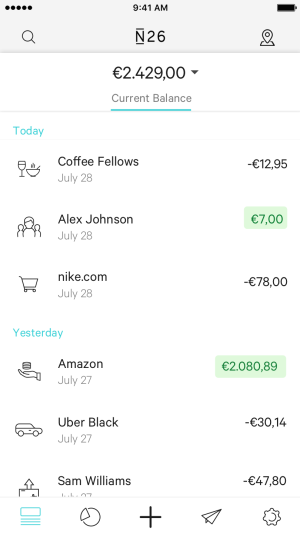

Above: N26 Account

Delay

N26 launched originally in Germany and Austria, but it has been gradually expanding across Europe and now claims more than 2 million customers in 24 European markets. Notably, N26 announced way back in 2017 that it was gearing up to launch in the U.S., its first non-European market, however that never quite materialized. The company revealed a few months ago that it was instead pushing its U.S. launch date back to the first quarter of 2019.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Prior to now, N26 had raised around $215 million, including a $160 million tranche less than a year ago, and it already has some big-name investors, including China’s Tencent and Peter Thiel’s Valar Ventures. Its fresh cash injection will be used primarily to spearhead its march into the U.S., which it now expects to happen in the first half of 2019.

“It’s increasingly rare these days to come across such a massive industry [that] hasn’t experienced disruption by technology,” explained Harley Miller, principal at Insight Venture Partners. “N26 is the clear market leader in the European mobile banking industry; the company is ideally positioned to expand to the U.S. market this year and build a formidable global digital consumer brand.”

Challenger

N26 is one of a number of “challenger banks” to emerge in Europe. The U.K. is at the forefront, counting Monzo, which has raised roughly $270 million; Starling Bank, which has raised nearly $100 million; and Atom Bank, which has raised around $470 million. The U.S., too, has several mobile-first banking services, such as Simple, which was acquired by Spain’s BBVA back in 2014. Then there is San Francisco-based Chime, which has raised north of $100 million since its inception in 2013.

Similar to Chime, N26 isn’t expected to have its own banking license in place when it launches, though it hasn’t revealed which partner it will use.

In Europe, N26 has systematically sought to “rebundle” the banking industry by piecing together various third-party platforms and services. While it began life as a simple bank account, N26 now offers more “add-on” services — it partnered with TransferWise, giving N26 customers access to cheap international money transfer tools and launched a new investment product with Vaamo and a savings account in partnership with Raisin. It then went on to add insurance to the mix, courtesy of a tie-up with German insurance platform Clark.

It’s not entirely clear what form N26 plans to take in the U.S., but the company previously indicated it would focus on a mobile-first checking account that will include a bank card, money transfers, cash withdrawals, and other features “tailored to the U.S. market.” That was its spiel in 2017, at least, but plans may have changed since then.

This latest raise also represents a boon for the German fintech startup sphere. The U.K. has traditionally served as the fintech capital of Europe, but with Brexit looming, Berlin and other cities across Europe will be eager to position themselves as the place to set up shop. Financial service companies are already preparing for the worst-case scenario — around $800 billion in assets have been transferred out of the U.K. since the 2016 Brexit referendum, and yesterday London-based fintech firm TransferWise revealed it was opening a Brussels office and applying for a Belgian license to ensure it can continue to operate in Europe post-Brexit.

N26 last year launched in the U.K., which represents its first non-Eurozone market. But with the U.S. in its crosshairs, N26 is now looking to “reach over 100 million customers worldwide in the coming years,” according to a company statement.