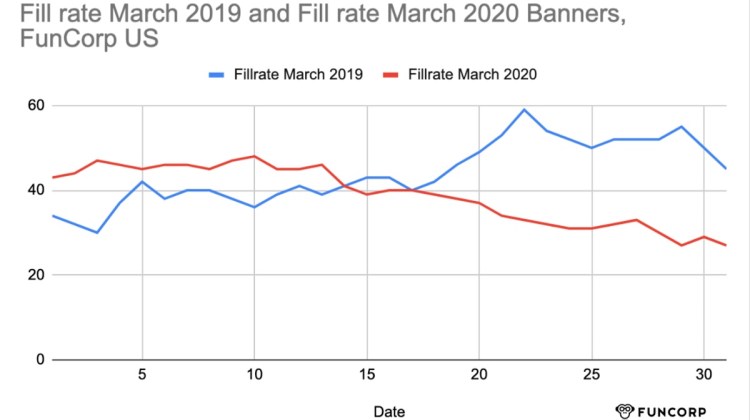

Mobile ad revenues fell 50% during March as the pandemic grew and marketers cut back on their spending across dozens of ad networks, according to ad monetization firm FunCorp.

FunCorp chief operating officer Denis Litvinov said in an email that data from inside the company and from partners covering 27 big ad networks and demand-side platforms (which help advertisers find inventory for mobile ads) showed a big slowdown in March compared to both February 2020 and March 2019.

Ad rates are about the same as they were before COVID-19, and audiences for mobile actually grew during the pandemic, Litvinov said, but mobile marketers started pulling money from banner ads and native ads.

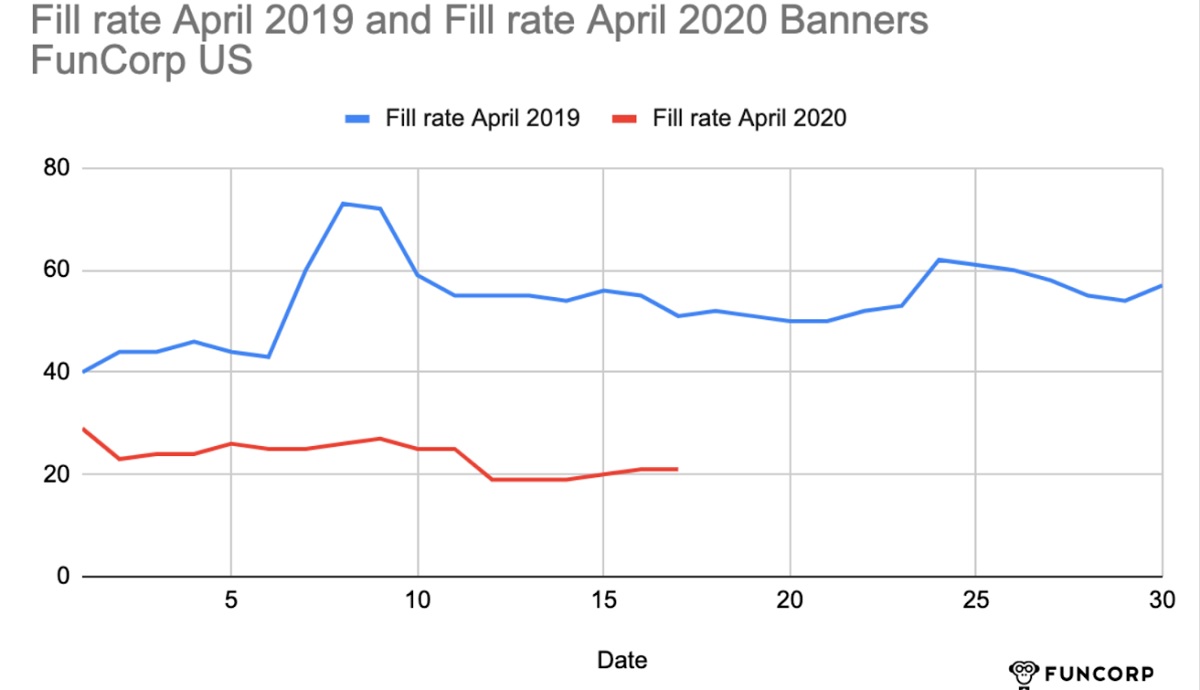

The high tiers of those paying more than $3 cost per mile (CPM, a proxy for ad rates) for banner ads and $5 CPM for native ads fell significantly in March. Mid-tier advertising revenue also fell, while low-tier advertising revenue was about the same. The decline started in the middle of March as lockdown began around the world.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Litvinov said Cyprus-based FunCorp’s daily revenues are down 45% to 50% from plans (January and February achieved key performance indicators, or KPIs) and revenues are down 35% to 40% from the same period in 2019. Meanwhile, the audience has actually been growing.

Above: FunCorp: Mobile ad revenues fell 50% during March as the pandemic grew.

“With so many unknown factors arising from this unprecedented global event, it’s too soon to answer” questions about the precise effect the pandemic will have on ad revenues, Litvinov said. “However, when it comes to mobile app usage, there are clear signs of increasing audience activity due to quarantine. Although this is a positive for some businesses, things aren’t that simple.”

Lockdown and shelter-in-place orders are leading to dramatically reduced consumption, precipitating the decline in advertising, he said. And unstable companies are laying off a lot of people, who as a result aren’t likely to be shopping much.

“We haven’t seen such a decline for 10 years, or all of our company’s presence in this market,” Litvinov said. “And we think that the revenues can fall further, even more, taking into account possible advertising networks bankruptcy which, without the patronage of large companies, are doomed to death.”

Nicole DeMeo, founder of Outfront Solutions and a veteran marketer, advises caution.

“Cutting your advertising budget by 50% sounds like people are taking a sledgehammer to their marketing budgets when really they need to use a scalpel,” she said in an email. “Smart marketers are taking heed of dozens of studies over the past 100 years that prove that communicating during a recession delivers better ROI than you can typically expect even in good times.”