Watch all the Transform 2020 sessions on-demand here.

Expense reporting is a significant time sink for enterprises. It takes 20 minutes on average to complete a single report, according to Concur, and 18 minutes on average to correct an erroneous one. It’s also costly — late, lost, and fraudulent filings incur an estimated $2.8 billion per year in collective expenses.

The answer, according to AppZen cofounder and CEO Anant Kale, lies in artificial intelligence (AI). The automated expensing startup today announced a $35 million Series B funding round led by Lightspeed Venture Partners, with existing investors Redpoint Ventures and Resolute Ventures participating. The round brings AppZen’s total funding to more than $52 million.

Kale said that AppZen will use the capital to expand its team in San Jose and Chandler, Arizona and to grow its product suite from expenses into invoices and contracts.

“We’ve helped our customers detect more than $40 million in incorrect expenses in a little over a year and have grown rapidly, adding 600 companies on our platform this year alone,” he told VentureBeat via email. “AppZen is at the forefront of transforming the CFO organization using AI to bring in more efficiency, reduce spend, and improve compliance. These funds will help us keep pace with this rate of growth — hiring the best of the best to take the business to the next level, better serve our customers, and expand our product suite to cover a wider range of CFO processes.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

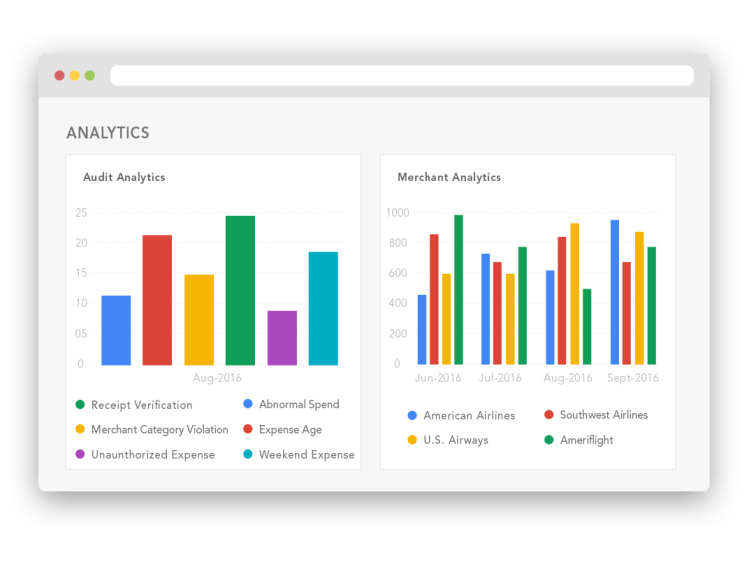

Above: A dashboard showing expense trends over time.

AppZen’s Expense Audit platform, which integrates with Workday, Oracle, Coupa, Concur, and other reporting services, leverages algorithms to eliminate the need for managers and auditors to approve travel receipts line-by-line. It assigns employees a score — the AppZen Behavioral Index — tabulated from each report, receipt, and travel document they’ve submitted over the course of a trip. Taking into account hundreds of internal and web data sources, Expense Audit’s Insights feature can recognize and authorize reimbursements for items within clients’ approved list (e.g., travel), and highlight possible infractions (alcoholic beverages) that warrant a closer look.

Within the Expense Audit dashboard, managers can filter expenses between policies, cost centers, and departments and quickly drill down to top spending areas and high-risk employees. And when the AI doesn’t get it right, they can mark false positives.

According to AppZen, its technology improves financial risk detection by a factor of 10 and cuts human resources required to process expense reports by up to 90 percent.

“The current status quo is expense report auditors sample 2 to 3 percent of reports submitted,” Ryan Floersch, senior director of product marketing, told VentureBeat in an interview conducted earlier this year. “AppZen Insights brings it up to 100 percent off the bat.”

AppZen isn’t the only startup applying machine learning to expensing, of course. Pleo offers a prepaid MasterCard product that tracks employee spending and automatically categorizes transactions. And London-based Soldo’s platform lets clients lay out different expense criteria for each employee, contractor, and spending department.

But six-year-old AppZen has early momentum on its side. Its customers include Fortune 1,000 heavy hitters like Amazon, Citi, Hitachi, Salesforce, Comcast, Intuit, Airbus, and CBS. The company has raised $52 million in funding to date.

“We remain focused on our goal to become the AI platform that audits all business processes in real time, driven by the organization’s CFO,” Kale said. “The AI-driven future of work has matured to the back office, transforming the workplace to make companies more efficient and pleasant places to work.”