Chatbots are the most accessible way to leverage AI, and major brands are demonstrating how they can create powerful, engaging human-to-AI experiences and transform customer service. Join Western Union’s chief customer experience officer and others at this VB Live event to dive right into the chatbot phenomenon — and leave with actionable ideas on implementing AI-powered customer support.

“I’m looking at ways we can improve our customer care experience, how we can provide more digital self-service tools to our customers, and bots fall under that category,” says Stanley Yung, chief customer experience officer at Western Union, the global money transfer giant, operating in 200 countries around the world, with about $300 billion moved in principal in nearly 130 currencies across all its services.

While their business still remains primarily retail-based, Yung says, they want to also create digital relationships with their customers to communicate with them, engage them, meet their needs in better ways — and even set the stage for a transition into fully digital transactions.

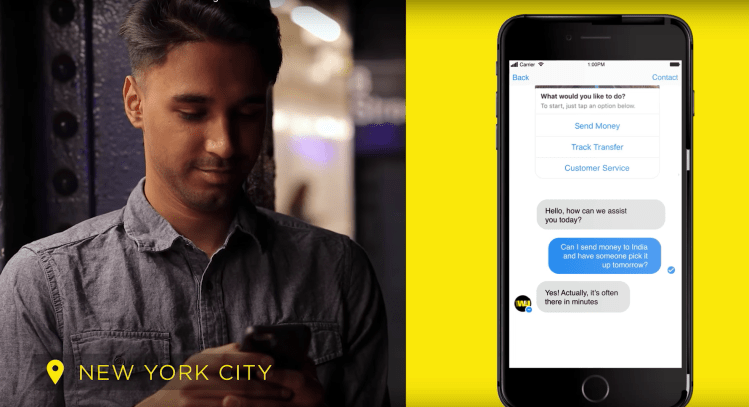

Their self-service Facebook Messenger bot is a significant lever for digitizing their retail customer base, he says.

“We have this philosophy that we want to be where our customers are, and integrate into their lives in the most seamless way possible,” he says.

Way back in the day, it was all about opening up more agent locations on the high street, and in stores like Safeway where their customers spent time. Then it was their online banking accounts, at their banks, and then the mobile app in the app stores and WU.com.

“In a lot of ways, I see the bot as being just one more application of that,” Yung says. “If customers are used to having conversations in Messenger, and in fact they may be corresponding with their receivers in Messenger, it may be a natural contextualization of our service to have the bot in there so you can continue the conversation.”

The Western Union Messenger bot has been in the market for about a year now, and is dominantly focused on customer service functions. Through the Messenger interface, a customer can perform a number of actions, including sending money, checking the status of a transaction, and finding physical agent locations.

“For these customers who are using Messenger today, we are looking for new ways we can engage them, especially around serving some of their customer service needs,” he adds. “We have some customer traction there, with the easy stuff. Hard stuff, we’re not there yet, but we’re thinking about ways we can expand and accelerate our capabilities.”

The long-term view, he says, is you can manage the easy issues, and increasingly some of the moderately hard issues, with the bot, but for the truly hard issues that you’re always going to need a live agent for, the bot is still an invaluable tool. Bot interactions can be used to do some of the heavy lifting in the information collection and upfront authentication and qualification of customers, so that by the time the customer gets handed off to a live agent, it’s smooth sailing from there.

That significantly reduces the volume on live agents, saves costs on the agent interaction downstream, and reduces hold time. And it’s one of the classic uses of the bot, to manage some of the easier parts of an interaction, such that you can save on average handling time when you get to a live person.

“You should be able to invest in more time on the truly hard issues, and upskill the agents on the truly hard issues, so the overall customer experience ends up being a better one,” Yung explains.

And while their retail and digital customer bases are quite different, the company sees them converging over time, he says, because the majority of them in their major send markets use smartphones, and are digitally savvy. Yung looks at them as “cash-preferring” in the short term, but it’s the customer segment with the most opportunities to be served with digital tools, like the bot.

“Because we do have a lot of very tech savvy people today, if you play things out two, three, four years from now, you’ll see a lot more convergence across the retail and digital parts of our business,” he says.

Learn more about how to create the powerful, engaging human-to-AI agent experience that customers expect — and how to implement the seamless handoff to a human customer service agent when the issue turns out to be complex — with this VB Live event. You’ll dive right into the chatbot phenomenon, and leave with actionable ideas on implementing AI-powered customer support.

Don’t miss out!

Attend this VB Live event to learn:

- The real truth about AI and customer service

- How big brands are using AI and chatbots to resolve customer issues more quickly and effectively

- How bots and humans can work together to optimize customer support

- How to assess whether your organization is bot-ready

Speakers:

- Jaime Gilliam-Swartz, Senior Director, Voice of the Customer and Shared Services, Lyft

- Stanley Yung, Chief Customer Experience Officer, Western Union

- Jessica Groopman, Industry Analyst & Founding Partner, Kaleido Insights

- Rachael Brownell, Moderator, VentureBeat

-

Sponsored by Chatkit.