Watch all the Transform 2020 sessions on-demand here.

I met Renee James more than a couple of decades ago, when she was the technical assistant to then Intel CEO Andy Grove, one of the legendary leaders of Silicon Valley. She kept notes on what she learned from Grove, and she rose through the ranks to become president of the world’s biggest chip maker. But she left Intel and the spotlight in February 2016.

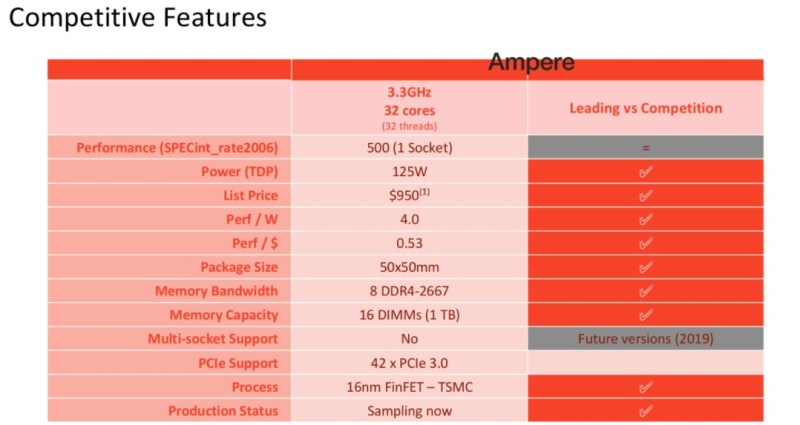

And now she’s back, as the CEO of Ampere, a new ARM-based chip company financed by the Carlyle Group. Ampere has hundreds of chip designers making server chips based on the ARM architecture that powers the world’s smartphones. The company promises to give Intel some serious competition in the sweet spot of the server market. The ARM-based chips have 32 cores and will run at speeds above 3 gigahertz on 125 watts of power. It’s a serious effort to provide an alternative form of computing in data centers with different kinds of work loads.

It’s a very ambitious plan, but James said in an interview with VentureBeat that she drew inspiration from her former mentor, Grove, before he passed away in March 2016.

“I remember every word he ever uttered,” she said. “In fact, he and I discussed this before he passed away. He said to me, ‘There’s a lot of easier businesses in the world than this one, but this is worthy.’ I remember everything he taught me, or I wouldn’t be doing this.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

James, who after leaving Intel took a job at the investment company Carlyle Group and is now heading Ampere, isn’t going head-on against Intel, which has 99 percent of the server chip market according to market researcher IDC. But she believes the market is ready to embrace alternative processors for certain kinds of workloads. The chips are expected to hit the market in the second half of this year.

Here’s an edited transcript of our interview.

Above: This is the first prototype from ARM-based processor designer Ampere.

Renee James: The company is named Ampere. We’re a new semiconductor company building hyperscale cloud processors to be used in storage as well as servers, based on ARM 64. We’re an ARM licensee, so we’re building our own cores and our own designs. Our first product is in sample now and out in the system. People are working on it. We have a presentation coming, in which you’ll see all of the workloads and software that are already running on it. It’s a 3-Ghz part, 125 watts, so it has excellent total cost of ownership (TCO), excellent price performance.

VentureBeat: I was just visiting some folks at XO, and they said, “You won’t believe it, but we’re seeing a lot of semiconductor startups.”

James: It’s a funny thing. For 10 years there were none. In the last couple of years there have been a bunch of accelerator chips that have gotten different levels of funding. You haven’t seen many CPU companies. When I looked into it and I was talking to VCs and raising money, I realized that there’s a lot of activity and innovation around accelerators for different workloads, but there aren’t a lot of people doing new CPUs. I think everyone in the industry knows that Broadcom sold theirs off. Others have gotten in and out. We’re pretty unique. We’re building microprocessors for servers.

VB: How long ago did you guys get started?

James: I finalized the acquisition about three or four months ago. We’ve been thinking about it and raising money for six to eight months. I acquired a team with a partially finished third-generation design, and I hired the impact engineering team, almost 300 people. I’ve hired a lot of people since then. We’re well on our way. The product is sampling, so it’s out. We’re working on the next design and the design after that, so we’ve brought on a second design team. We have quite a road map planned.

VB: How much of the time since then has gone into this project? Is it just the past year or so, or less?

James: I left on February 1, 2016. It was announced earlier. I worked for the Carlyle Group in private equity. I’ve worked for them for two years. They’re the backers of this, the primary backer, although there are other investors. I started working on this probably inside of 2017. 2016 and the first part of 2017 I was doing other deals and things for Carlyle as an operating executive.

VB: How much has been invested in this? Is it a new investment that you’re leading?

James: It’s a new investment, yes. We’re not talking about the amount. If you travel around the valley and ask people how much money they invest in semis, they’ll tell you anything from nothing to not that much. To do this kind of work, it takes a tremendous amount of investment. We raised quite a bit of money.

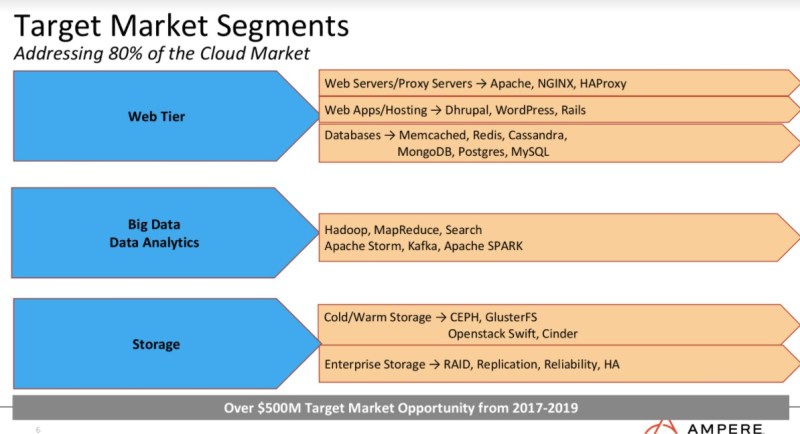

Above: Ampere’s target markets

VB: So it’s more like private equity money than venture capital money.

James: Right. ARM licenses are more than most VCs give in a round. It’s a PE-backed startup.

VB: Where did this team come from?

James: There was an announcement that Carlyle had acquired assets out of Macom. Macom had this team that was working on this, and it wasn’t a business they wanted to go into. It was a team they’d inherited through a different acquisition. We’d been looking at it. When I decided I wanted to start the company I looked at a bunch of different teams that were available, technologies I could purchase to get started. This was one of them. Macom is a semiconductor company out of Boston that has a lot of networking and other assets. They’re public.

VB: Were they already doing a CPU, or were they doing something else?

James: It’s a long history, but the team had been part of a company that did network chips. They had started thinking about doing CPUs, a bit like what Cavium is trying to do, and Marvell, the new merger, from that point of view. Macom bought the entire company, and they said, “We only want to do networking. We don’t want to do CPUs. We don’t understand that business and it’s too much money.” They were looking to sell that off, and we bought that. We were looking at other CPU teams that were available in the Valley, coming from other large companies.

VB: The company that Macom bought, was that Applied Micro?

James: Right. Those guys work for me now. They’ve been on a very long journey, but now they’re out of the dark. In addition to those guys, we’ve hired people from Apple, people from Intel, people from AMD. We have a senior fellow from AMD. We have a really interesting group, a lot of really talented folks. If you knew the Applied Micro guys, you know they’re talented.

Above: Andy Grove, former CEO of Intel.

VB: It’s been a long time since you were helping Andy Grove out there. Did you remember anything he said?

James: I remember every word he ever uttered. In fact, he and I discussed this before he passed away. He said to me, “There’s a lot of easier businesses in the world than this one, but this is worthy.” I remember everything he taught me, or I wouldn’t be doing this.

VB: How did it feel to wrap your head around competing with the likes of Intel?

James: I don’t actually look at it that way. I look at it as investing in what comes next. We’re not building quantum computing. We’re not building high-performance computing. We’re not building legacy enterprise. We’re not building PCs. The list of things I’m not doing that Intel does it long. Intel is the best at what they do and no one knows that better than I do. I would never start a company and raise this much money to go do what Intel does. That’s ridiculous.

I’m doing what I think comes next. I think this is the next platform for the cloud. I’ve had people say, “But it’s too late. It’s already done.” I have to remind them that I worked on the project to make Pentium Pro into an enterprise product when everyone told me that enterprise was done. “It’s done. We use Sun. We use DEC. It’s done.” Not so done, actually? I don’t think we’re over. I think we get to invent the next thing. It’s only over until it isn’t. You know who that sounds like.

VB: Where are you based?

James: Santa Clara, Great America Parkway. We have people in Bangalore, Vietnam, and Portland, Oregon as well.

VB: What is the headcount more like now, beyond that 300?

James: Oh, yes. We’re not 20 people in a garage, even though we’re a startup.

VB: ARM-based servers, can you talk more about that opportunity? It seems like it went up a hype curve and then leveled out, maybe took a dip. Are you feeling like it’s back on track?

James: There was a lot of hope, and it might have been a little premature. Up until this generation of technology, it really wasn’t, I would say, at parity for the enterprise. It wasn’t 64-bit. It didn’t have a lot of the features you need. What’s new now is that the ARM architecture has evolved. The other part is that you have to get it built somewhere. You need a high-performance process and high-performance transistors. Not everyone can build those. We use [contract chip manufacturer] TSMC. It’s a 16-nanometer TSMC part. Our next part will be a 7-nanometer TSMC part.

There’s been a lot of evolution in established semiconductor manufacturing in the last five years. If you look at the hype curve on ARM for the last five to eight years, I agree with you. You’re always thankful to those that came before you, even if some of them died off. They were pioneers. We’re at a point where parity has been achieved, so it’s feasible.

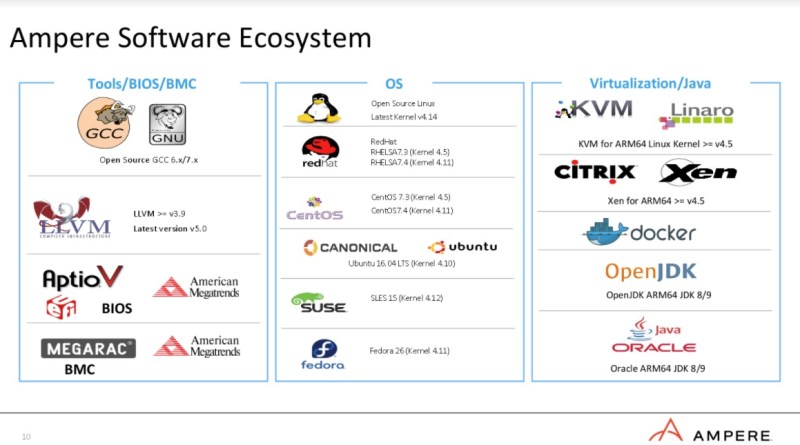

The other thing is, the software ecosystem has completely changed in the last several years. If you were building an ARM part to go into legacy enterprise with a calcified legacy software stack, that’s a tough row to hoe. If you’re building a new part with a new approach to memory and bandwidth and throughput for cloud workloads like in-memory databases and Java and containers and AI, that’s a very different machine. You get to start fresh. It’s fun, right? Every day it’s the beginning again, when we first started building processors for the enterprise.

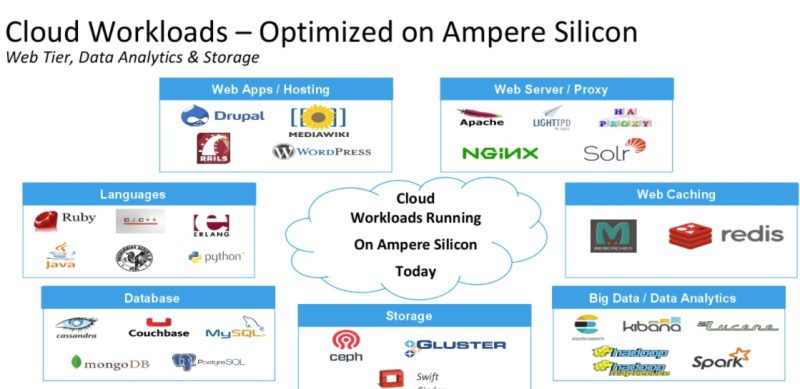

Above: Ampere is targeting a variety of workloads in the data center.

Sometimes people think semis are boring, but personally I think they’re fun. Every time I read an article about all these awesome things people are doing with technology that never could have been done before — I wish people would write more about why we can do those things. We can do that because we built this stuff. Every time you order a Lyft, something that I personally worked on somewhere does something. That’s cool.

We have a lot of young, optimistic, wonderful people, five to seven years in the industry, brand new interns out of college. They have absolutely no legacy in their brains. We can invent anything and do anything. And then there’s a few of us who’ve done this many times. My analogy for our leadership team is we’re climbing Mount Everest. Two of us have been to the top before. The rest of them are tied to ropes coming with us. But they’re young and they’ll have to carry a lot of stuff for us.

Yesterday we had this meeting and a whole bunch of them were talking about doing all this stuff. Finally I had to cut in and say, “How big is this die? You don’t build things that big!” They’re unconstrained. I love it. It’s so much fun. I’m probably the only person who’ll ever talk to you about how much fun semis are.

VB: How did it become too capital-intensive to do a semi startup? Has that changed at all? A lot of things seem to have made the semiconductor startups disappear.

James: None of those things have changed. It’s still exorbitantly expensive. The mask sets are very expensive. The technology is getting harder. More expertise is required, not less. The reason you can’t just wake up and be in semis, unless you’ve been in semis before, is because you need people who know what they’re doing. All of these young, enthusiastic people, the hundreds it takes to build one of these things, they need leaders who’ve been there before.

Designing something for a 7nm process with multiple layers and the complexity of the mask set and the RTL has only gone up. It’s expensive. It’s hard. The barrier to entry is high. But the people who are trying it, whether they’re doing accelerators — notwithstanding Jensen, who’s been in this business longer than I have – if you look at the leaders of the well-funded, venture-backed or other startups in accelerators, they’re all people who’ve done this before. There’s a reason. Part of the mission of this company is to teach the next generation how to do this. Sadly, it hasn’t gotten any cheaper.

VB: The ARM 64 opportunity here, is it getting better for a particular reason? As opposed to, say, a year or a few years ago.

James: It continues to evolve each generation, but remember, we’re a licensee. We build our own cores. The designers continue to do more. The base architecture evolves. The process technology continues to evolve. Our semiconductor partners are evolving. The combination and the confluence of all those things makes each generation that much better.

It’s a 3GHz part, 125 watts, with eight channels of DDR and a terabyte of memory. That’s a screaming machine for cloud. A terabyte of memory is in the sweet spot for the middle of the server road map, which is exactly where we aim to be. We’re not going to be the highest performance, but we’ll be right in the sweet spot.

Above: Ampere’s partners

VB: How many transistors are we talking about here?

James: You’re the only reporter that has asked me that. We’re not talking about the transistor budget yet or the size of the die or any of those things that people used to ask about new things. [laughs]

VB: Can we assume it’s in the billions of transistors, though?

James: You can assume it’s a modern microprocessor. It is equivalent to other things out there in the world. It’s a TSMC 16nm part. It’s 32 cores. You can imagine there are billions of transistors out there.

VB: What’s the road map for shipping?

James: Sampling now, shipping this year. Our next product is right on its heels because we have parallel teams, and then the third product is a couple of years out after that. We have three products in process, the fourth in definition. We’re cranking along. We’ve very much been wanting to get some work done until we have samples and we’re ready to tell the world. Mostly we’re recruiting. People are starting to ask what we’re doing, though, and partners were wanting to be able to say our name, so it became obvious that we needed to get out there and say hello to the world. We’re here.

VB: Besides ARM and TSMC, do you have other significant partners out there?

James: You’ll see in the press release — Oracle, Microsoft, Lenovo, and a couple of others we’re waiting on.

VB: Are you describing the investment in any way? You’re not saying a number, but are you talking about who joined in?

James: Carlyle managed that, and that’s always private. They don’t disclose. They’re the biggest and only named investor. In PE they don’t usually name the amount, but since it’s PE-backed, you can imagine the scale of investment.

Above: Greg Favor, former chip designer at companies like AMD and Montalvo, is a fellow at Ampere.

VB: Do you have some other execs that joined from particular backgrounds, like Intel or AMD?

James: Yes, we have several. That’s in the release as well, but briefly, Atiq Bajwa, who was the chief architect for pretty much every platform at Intel, joined us out of retirement. Rohit Vidwans, who was head of hardware engineering at Intel, also joined us to run our hardware engineering. We have a senior fellow from AMD, Greg Favor, as a senior fellow here. He architected some of the very best parts of our generation. Greg is very good, very skilled.

We have several other executives that joined from AMD, Marvell, and other places. We have fewer Intel people, honestly. We have some very senior Intel people who were retired. Our CFO is from Apple, and before that was also at Intel, but he was most recently working at Apple for several years as their hardware finance controller. The team has pretty diverse backgrounds.

I find the AMD guys really interesting. For all those years you never knew what they knew, and now they’re on my team. They’re good, very good. It’s amazing. We have a lot of AMD people. It’s been fun, because a lot of people who competed against each other are all together now.

Above: Ampere’s first chip has some impressive specs.

VB: Is it fun for you to be coming back in the spotlight?

James: Well, I don’t know about that, about the spotlight part. What I like, I love being in leadership and I love working in a team. I like invention. You know, because you’ve interviewed me over my whole career, that the whole process of innovation — when I talk about it, I get so excited that it’s insane. I love when we make something happen, make something work that’s never worked. When someone says, “You can’t do that,” and then we make it work.

My first job was working with Microsoft and people said, “You can’t make video work on a PC like it does on a Mac.” When we saw that first video, five frames per second playing back on Windows 95, I thought, “We just changed the world.” I could have quit right then and made an amazing contribution to this industry. It set the tone for my whole career. “No, we can make that work. We can make video decode in real time on a 386 or 486 or Pentium.” People said you needed accelerator hardware. We said no.

That’s my thing. That’s why I find this whole thing so exciting, because everyone tells me how insane it is. All that does is egg me on. [laughs] Every time someone says we’ll never start up a new CPU company, I say, “Watch.” That’s my deal.

VB: Were you tempted to go into AI? Or in some ways is this taking advantage of the AI wave?

James: It’s taking advantage of the AI wave in a huge way. The architecture of our approach is very much a memory-intensive, memory throughput-oriented design. Our point of view is, there will be generations where you need accelerators as partners to what we’ve built, and we think that over the horizon we’ll continue to improve.

Like we’ve done for many generations, things will migrate to where they should belong. Whether it should be on an accelerator it should be in the core, we don’t know yet. It’s too early. The frameworks are all brand new. We don’t know what wins. That’s one of the driving forces, because we know, with absolutely assurance — you don’t even have to predict it — that machine learning will be used in every application going forward.

We know the intensity. We know the requirements. You see that our partners are Oracle and Microsoft, big software companies. You would expect me, based on my background, to be super workload focused. Software is our differentiator. We’re very focused on making workloads work best on our product. It’s that simple.

Above: Atiq Bajwa is a former chip designer from Intel, now chief architect at Ampere.

VB: When you left Intel, I imagine this kind of startup wasn’t really in your thinking back then. Did you go down a certain path of thinking to get from leaving Intel to running this?

James: I did. I went down the path of thinking I wanted to maybe run a software company. Not necessarily start my own, but take one of the big software company jobs. I have to admit that I kept getting really excited about machine learning, about the cloud, about the changes in software. The things I cared about all along. What’s coming next?

I missed it. I missed the invention. I missed the ability to invent the future. A lot of really important companies in the Valley are really interesting, but they take the innovation and then they make it better, or they develop an application on it. But to really invent what’s possible — it reminded me of when people used to say, “Wouldn’t it be great if we could sequence human DNA?” We didn’t have enough compute power. Then, when we did, we did it, and the first time we did it in a couple of days — instead of months or weeks or whatever — it changed everything. It allowed you to be able to do predictive cancer treatment.

I thought, “You know what? I’m not done. I want to do this still.” I just missed it. Then I started messing around. When you’re in private equity you get to see a lot of deal flow. I was seeing different semiconductors coming through, either to be carved out or to be funded. It made me realize there was a lot of activity out there and maybe I should go look at some of it. Carlyle was super supportive. This is risky, but they’re very supportive. It just kind of evolved.