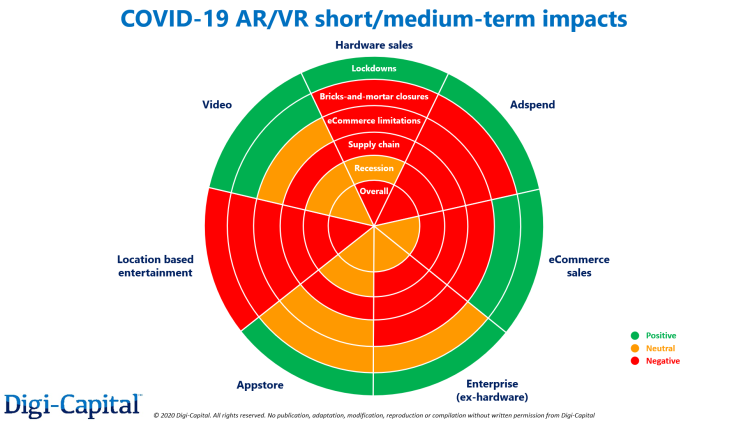

What does all of this mean for augmented reality?

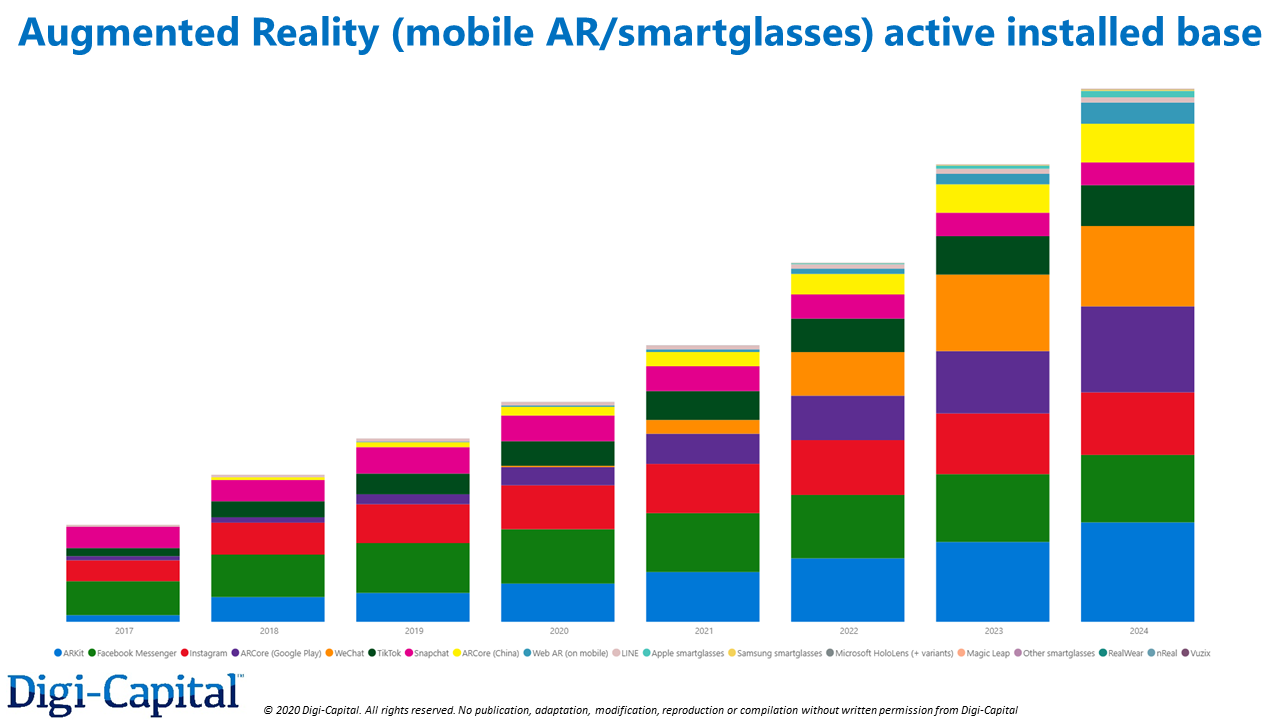

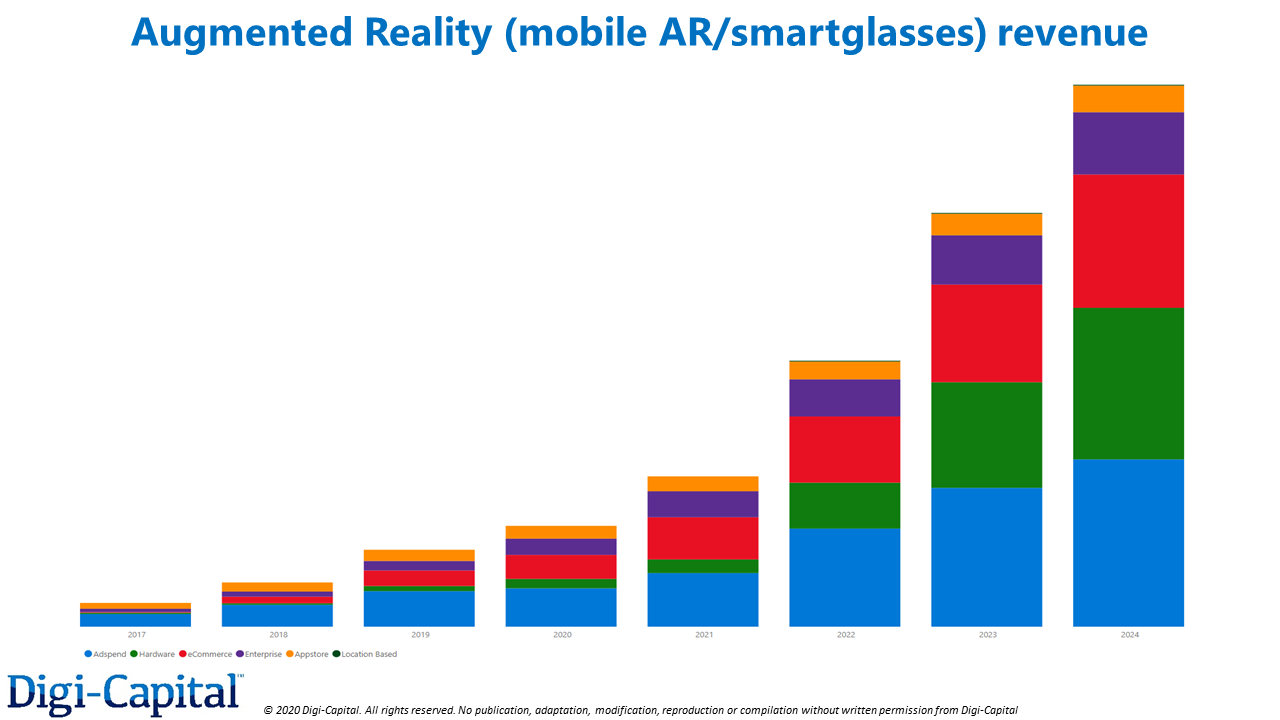

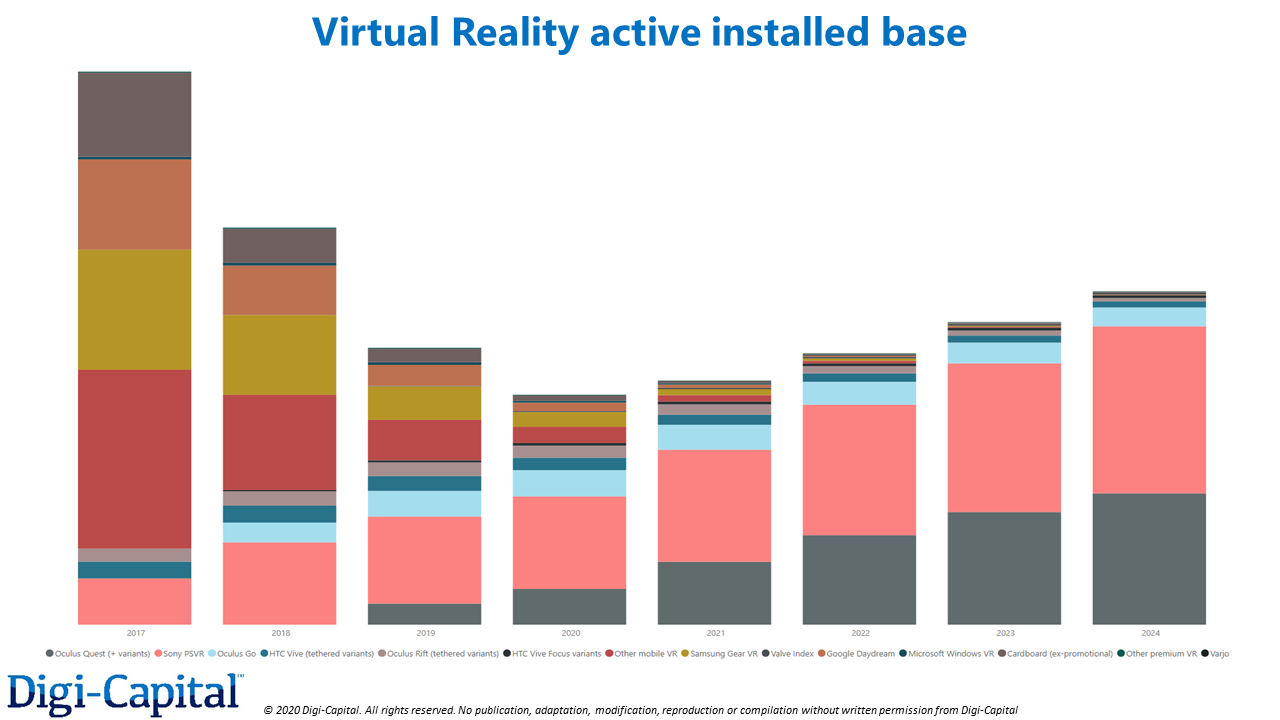

Above: (Note: Free charts do not include numbers, axes and data from subscriber version, with underlying hard data sourced directly from companies and reliable secondary sources. Specific data points are referenced in the rest of the text. Methodology in companion Augmented/Virtual Reality Report Q2 2020)

The augmented reality market could still grow from an active installed base approaching 900 million and over $8 billion revenue in 2019, to an augmented reality forecast over two and a half-billion active installed base and nearly $60 billion revenue by 2024. This is despite short to medium-term negative impacts from COVID-19.

In terms of active installed bases, messaging based mobile AR is forecast to grow from over 600 million in 2019 to over 1.3 billion by 2024, OS based mobile AR from over 200 million in 2019 to over 1 billion by 2024, followed by web-based mobile AR (at a much higher growth rate). This could see all mobile AR platforms combined active installed base grow from less than 900 million in 2019 to over 2.5 billion in 5 years’ time. (Note: Total figures for active installed base types inherently involve double-counting, exaggerating total figures due to users active on more than one platform. However, this enables direct comparison between different platform types and platforms.)

Smartphone tethered consumer smartglasses’ installed base could be in the low tens of millions of units by 2024 (if Apple launches in late 2022, so lower if it doesn’t). At the same time, the enterprise smartglasses market could remain in the hundreds of thousands of units through 2021, not reaching millions of units until 2024.

Ad spend could remain the largest revenue driver for AR through 2024, driven by messaging based mobile AR’s active installed base. If Apple launches smartphone tethered smartglasses in late 2022, it might provide the catalyst for hardware revenue to become the second largest AR business model, passing ecommerce through 2024. Enterprise software/services (ex-hardware) could also grow substantially through 2024. Lastly, app store IAP/premium revenues from both games and non-games apps and location-based entertainment round out the consumer mix.

And virtual reality?

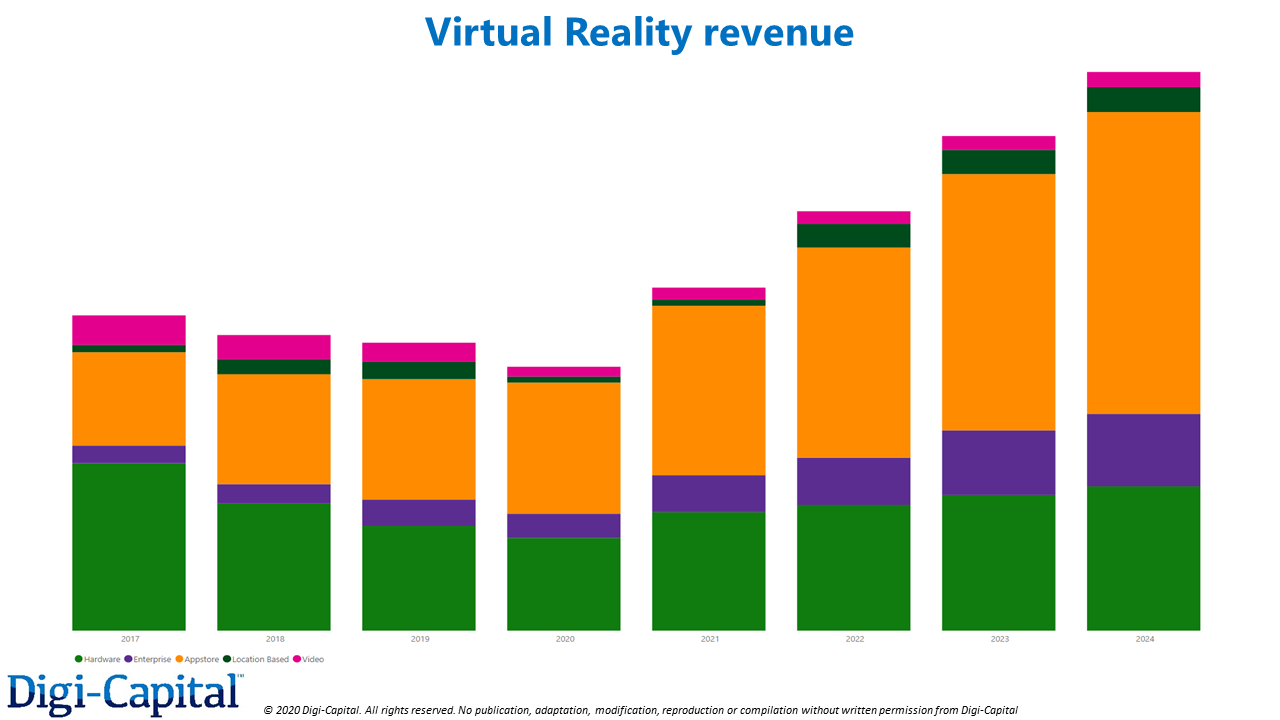

Digi-Capital’s revised VR forecast is that the market might not have an inflection point in the medium-term, instead delivering steady growth to the 10 million-to-15 million active installed base range and approaching $6 billion revenue by 2024.

Premium/standalone VR’s installed base incorporates both cumulative premium/standalone VR sales and natural device attrition. Due to relatively low sales and significant attrition rates (compared to mass market platforms like mobile and console), the total active installed base for premium/standalone VR might only top 10 million units by 2023.

Mobile/standalone VR installed base incorporates both cumulative mobile/standalone VR sales and natural device attrition. It is worth noting that much of the negative impact for total VR active installed base in the last few years has come from relatively high mobile/standalone VR headset attrition. Combined with the exit of major players like Samsung, this effectively leaves Facebook as the last man standing in this segment with Oculus Go.

VR revenue comes primarily from entertainment, and this should remain driven by premium/standalone VR more than mobile/standalone VR due to installed bases and unit economics. Games software and hardware sales revenue dominate, followed by enterprise (ex-hardware), location-based entertainment, non-games apps, and video revenue streams.

Where to from here?

The long-term future of AR/VR could still be bright, but the market was already in a transitional period before the COVID-19 crisis. It looks like the market might shake out over the next two years without an imminent catalyst for high growth, before Apple potentially launches smartphone tethered smartglasses in late 2022 (again depending on Tim Cook and friends).

As a result of the factors discussed above, Digi-Capital’s 2020 and 2021 full-year forecasts have each seen reductions in the $1.5 billion to $2 billion range compared to pre-COVID-19 levels. It’s worth noting that growth for the total AR/VR market remains forecast for both this year and next year, but at a slower rate than anticipated pre-crisis.

In the long-term we’re still looking at a potential $65 billion market by 2024 after the crisis has ended, but that version of AR/VR won’t be the finished article. This might take a lightweight pair of standalone smartglasses, capable of replacing your iPhone at the same price. There are formidable technical and content challenges to reach that vision of AR/VR, and there’s the short and medium-term market to navigate first. Let’s hope that as many folks as possible make it safely through the crisis, to rebuild and move forward on the other side.

(Full analysis in Digi-Capital’s new 378 page Augmented/Virtual Reality Report Q2 2020 and 500,000+ data point AR/VR Analytics Platform at www.digi-capital.com)