Last week, I made my way to the Microsoft Reactor in San Francisco for the VR Arcade conference. I moderated a panel on investing in virtual reality, augmented reality, and mixed reality. It was a far different environment for that kind of conversation than in 2016 or earlier.

The event itself represented a pivot. Since consumer VR hasn’t taken off as much as expected, companies have shifted gears in augmented reality on smartphones or the VR arcade market. We are holding our own GamesBeat Summit 2019 conference on April 23-24 in Los Angeles at a “micro-amusement park” dubbed Two Bit Circus. Such places are sprouting up all over.

Do these VR arcades represent a good investment, or are seasoned investors looking into other opportunities. We asked that question on our panel.

My panelists included Stephen Saltzman, founder of Saltzman Strategies & Alliances; Yasushi Komori, a partner at the GFR Fund; Angelo Del Priore, a partner at HP Tech Ventures; and Amy LaMeyer, a partner at the WXR Fund.

Here’s an edited transcript of our interview.

Above: VR investment panelists (left to right): Angelo Del Priore, Amy LaMeyer, Stephen Saltzman, and Yasushi Komori.

Stephen Saltzman: I first got into VR when I was at Intel Capital. I became managing director for VR, gaming, and location-based entertainment investments at Intel Capital. Starting in January, I became founder and principal and sole employee at Saltzman Strategies and Alliances, which is a consulting firm.

Yasushi Komori: I’m at GFR Fund. We started looking into the VR area three years ago. On the whole, we’re an entertainment technology-focused fund, so we’re also looking into esports and other areas.

Angelo Del Priore: I’m at HP Tech Ventures, where we do VC investments for Hewlett-Packard. I focus on the AR, VR, gaming, and education spaces. Our last investment in the space was Mojo Vision.

Amy LaMeyer: I’ve been the spatial computing space for three years, first as an angel investor and now as a partner in WXR Fund. We invest in the spatial computing and AR spaces.

GamesBeat: Can you talk about some of the more interesting investments you’ve gotten into?

LaMeyer: One that’s somewhat potentially relevant to this space is Tribe XR. You can learn how to DJ in virtual reality. You have an array of equipment in the virtual space, and with that hardware you can actually DJ. They’re working on other experiences as well, but they’ve started with DJing.

Saltzman: My last VR investment for Intel was SoReal. Sam Wong’s been on a few of the panels at this conference. After spending two years analyzing location-based VR, I thought it was not only the most exciting approach, but also the smartest business model. It’s showing th power of the founders, because of their position in the Chinese entertainment industry. They can get other people to build out their experiences for them.

Del Priore: We don’t actually announce a lot of our investments, because why would we want our competition to know? [laughs] Mojo Vision hasn’t even announced what they’re doing yet. But I would say that you can look at who we’ve partnered with and get an idea of where we’re going. We’re ready to build another side of VR.

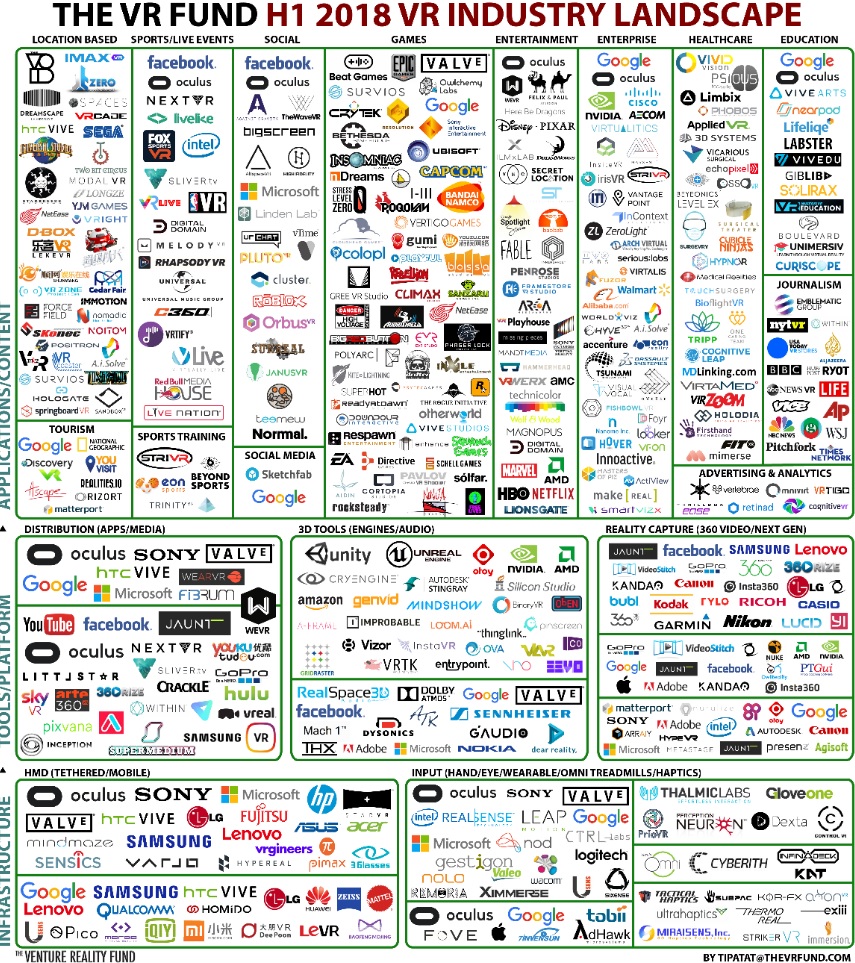

Above: The VR Fund’s VR industry landscape for the first half of 2018.

GamesBeat: And you did invest in the Venture Reality Fund, right?

Del Priore: Oh, yes. The VR Fund is amazing.

GamesBeat: We’re in the gap of disappointment or trough of disillusionment? One question is, how is today different from 2014 or 2016? What expectations should startups have when dealing with investors now?

Del Priore: You’re going to face some tougher, more pointed questions that go really in-depth about your business and the economics. How is it going to play out? I was a VP of biz dev at a startup, and I know the financial situation could change tomorrow, but I still, before I write that check–I’m going to go through line by line asking, “What is the rationale for this?”

An example I always use, say you want to sell to doctors at hospitals in the United States. Okay, how many hospitals are there in this country? How many doctors at each hospital? You have to be able to answer those basic questions. Once you have the money, you’re in control.

GamesBeat: Also why are you still investing in VR when you could be doing esports or blockchain games or other things?

Del Priore: Well, we do other things too. We’re corporate strategic, right? I need to make money and gain strategic insights and optionality. HP has a VR business where there’s now a VP in charge of VR and AR. He’s pointing me toward areas that are interesting, and I’m going out–from a strategic perspective, if you’re an amazing technology with some IP or other thing that I don’t have, because we’re not all working 80 hours a week without layers of bureaucracy–that’s why I’m doing it. That VP wants us to double our share in gaming and double our share in VR. I can help him do that by investigating different companies in the space.

Saltzman: For me, the big difference between 2016 and now is that the tourists are gone. If somebody is still investing in VR now, it’s because they actually understand it. They’re compelled by it. Whether it’s entertainment or medical training or industrial design or architecture, anything where you have to think in 3D, it’s more natural to do it in VR than it is with a keyboard and a mouse, flat out. The people who are still around and actively investing, it’s because they understand it. They totally get it.

What that means, with the tourists gone, is you don’t have absurd deals going on at crazy valuations. A lot of startups think those crazy valuations were a good thing. They weren’t. The protections, the downside protections built into those mean that you get washed out on the next round when you can’t support the valuation that your Series A came in at. It’s much healthier for the entrepreneurs as well, when you’re in this kind of environment where people can pay a fair valuation and then grow organically and add value more naturally.

Komori: As we all know, the market growth has been smaller than expected, but we’ve seen some companies that have still been very successful. They tend to be the ones that have focused on building virtual worlds for entertainment, platforms that can bridge both PC and virtual reality. That kind of cross-platform entertainment seems to be where the market is going.

LaMeyer: The other thing that’s pretty obvious is that we’re coming into the second generation of hardware. We’re getting closer to a cost and a comfort level that can reach more of a mass market.

Above: Concrete Genie is coming for the PSVR in the fall of 2019.

GamesBeat: How do you look at location-based entertainment and VR arcades as investment within this larger VR and AR space? It almost seemed like a lot of these sprung up as the pivot for the original VR companies. When consumer VR didn’t take off as well as expected, people figured that the arcades would take off. What do you think about this space and that pivot strategy?

LaMeyer: It’s been a way to get more people to try virtual reality who hadn’t before. Yesterday we were talking a bit more about different generations trying VR and having more fun with that. I’d expect it to work in that way as well.

Saltzman: One of the biggest aspects is, people who actually think they’re in a VR business are going to fail. VR is a technology. Nobody successful was in the dot-com business. They were in the bookselling business or the travel business. If you understand the customer and what you can do for them and how that’s genuinely helpful, that’s great. VR becomes a tool toward doing that.

Within location-based VR, the most compelling ones I’ve seen give people a chance to rest their eyes from the headsets. They have board games. They have food and beverage. They have light shows. They have other ways for people to socialize and interact. Again, it’s just a technology. It enables amazing things, but that’s not the end goal. It’s just the way to solve the end problem.

Del Priore: I completely agree with what he’s saying. It’s a grind, but going beyond operations, learning what people want, the pizza or the hamburger, and actually sweating those details–that’s more important than sweating the details of whether a wireless headset is working today or not. That’s another kind of operational challenge.

Above: Nomadic is leading the way in mixed reality with Arizona Sunshine: Rampage.

GamesBeat: Do we have enough of the right technologies arriving now, like the Oculus Quest, in order to make some of these LBE applications more interesting? Or do you feel like the space still needs more technology?

Saltzman: I’d say both. Oculus Quest is great for some types of experiences, like Modal’s Ping!, which is their play on Pong. It’s a noticeably lower-fidelity experience, but it’s untethered, which is really cool. What’s coming is going to be more hybrid rendering, which enables that kind of lighter, self-contained device to also receive streams from something rendered to be a richer, more immersive experience. That’s what people pay for. For LBE it’s about, are you actually more entertaining than laser tag or bowling or ice skating or any of the hundred other options people have in large city?

Del Priore: You have to look at your operating expenses. If you’re charging people a dollar a minute, 75 cents a minute, you’re going to have to either take down your costs, which is super hard–you’re paying fixed rent. The hardware is nice, so it’s getting better. Or you have to go back to the question of what else you can sell to the customer while they’re here hanging out and waiting for a game. Whether it’s ice cream or a drink, just something else along those lines.

GamesBeat: How do VR companies get your money?

Komori: We’re a very entertainment-focused fund. We’re very interested in the idea of virtual existence. People nowadays are moving more and more from the physical world to the virtual world. We’re interested in the area of virtual beings, digital humans, but that’s not the only type of work we’re interested in. We want to see examples of what will be the new kind of entertainment in the virtual world.

Question: The question for us is timing. We have a lot of traction as a VR curriculum company. We can probably break even this year, but we might then miss an opportunity to scale. What advice would you have? Are we better off going while the iron’s hot or waiting for people to be more excited about the space in a year, raising a Series A or an intermediate round?

Del Priore: As an outsider, I would say you want to really de-risk. If you have nine months of profitability–at the end of the day, I’m thinking like a banker. I want to say yes, but I’m looking for all these reasons to say no. I want to keep pressure-testing. If you’ve only been profitable for, say, four months, it’s hard to get around that.

Above: Virtuix and Funovation are targeting VR arcades. It’s an example of a VR pivot.

Question: Where do you see the amount of money you’re looking to invest in some of your businesses right now? Whether things are overvalued or undervalued is always a question for the market to solve, but where do you think is the right valuation for you to invest in the companies you’re looking at right now?

Saltzman: For me, the amount of the investment is always tied to, what does the company need? What are they trying to do? Particular at Intel Capital, there was the luxury of being truly stage-agnostic. The question goes back to, what are you trying to do? Why does the world need you to do that? Most important, why are you the team to do that? If you can answer those questions, the stage becomes more of a valuation discussion.

LaMeyer: What you’re going to do with the money is what matters.

Saltzman: What’s implied there is, to the earlier comment about traction–if you have 30 locations, if you have proof cases in different types of locations–if you now need a big bucket of money to go replicate what you’ve already proven what works as a model and really franchise this at scale, that’s a much easier story for an investor. It’s more digestible than, “Well, we don’t know if this is going to work, but we think it would be cool. How about a bunch of money to let us try to see if it works?”

Question: How did Sandbox raise $68 million from Andreessen? What does that mean to you? What should we be learning from that?

Saltzman: I do not have an answer to that question. [laughs]

Del Priore: They’re zigging when everyone else is zagging. I looked at them six months ago and didn’t see it. They see it. We’ll wait a couple of years and see what happens. Most of the other prior big LBE checks have been coming from strategics — MGM, AMC, and so on. I don’t know.

Above: Jurassic world VR Expedition

GamesBeat: They have all of that return on Oculus to spend somewhere else.

Question: Are funds that are supporting women founders outside of AR and spatial computing?

LaMeyer: Absolutely. Female Founders Fund and others. There are female funders backing female founders.

Saltzman: Also, credible VCs should be agnostic as to the gender of the founders. They should be looking at whether you know this business, whether you’re the right people to execute this plan and if it’s a plan worth executing.

Question: They should be, but given that women received 2.2 percent of funding last year–

Saltzman: I’m not arguing that that’s a huge problem in this industry. This industry is famous for its blind spots. But I would add — and I’m not there anymore, so this is not self-serving — that Intel Capital has a diversity fund specifically for women and underrepresented minorities. It’s not that that fund is held to any lesser standard. That would be insulting. It’s just to let people know that there’s actually–if you need an introduction I’m happy to make introductions there.

Above: Marvel’s Iron Man VR

Question: Is HP generally investing in companies that are obviously helping the business model, or do you look outside for companies that are just supporting hardware sales?

Del Priore: We’re very much a core strategic, so if you have the best drone company, I’m still not going to invest in it. Some of the investments are very close-in. There’s a clear line to what HP is doing today. Some of the investments you kind of have to squint your eyes — HP could be in that space in a couple of years or then some. Anything around the next compute paradigm in AR/VR/XR clearly is something we’re going to be looking at. There’s not going to be any kind of commercial tie to that.