Ethos, a company that’s using predictive analytics and big data to issue life insurance policies, has raised $60 million in a series C round of funding led by Alphabet’s venture capital (VC) arm GV, with participation from Sequoia Capital, Accel, and Goldman Sachs.

An Ethos spokesperson told VentureBeat that it was valued at nearly $500 million at its latest funding round.

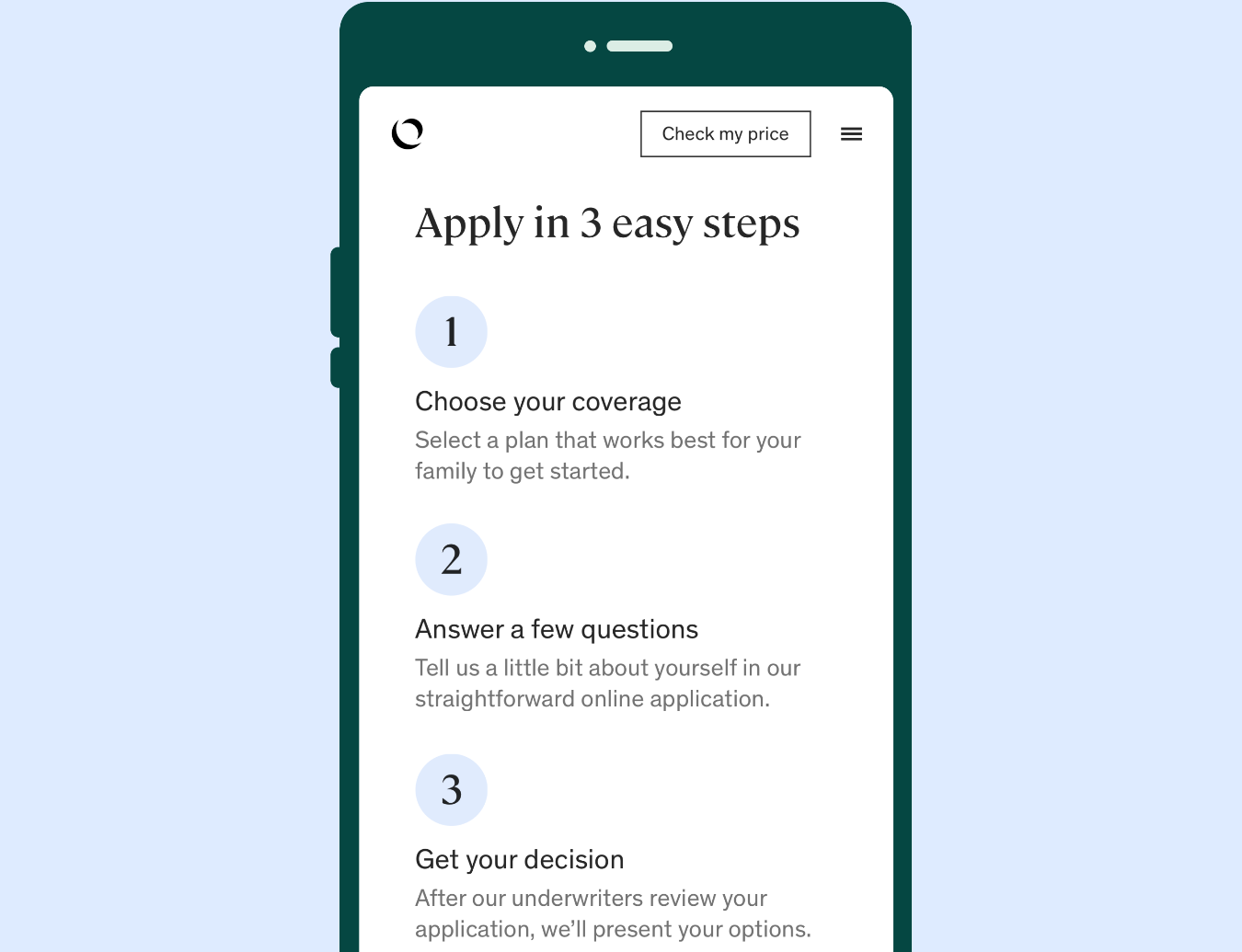

The typical life insurance application process is a lengthy, time-consuming endeavor, involving reams of paperwork and medical exams — and all this driven by commission-incentivized salespeople looking to shoehorn their client onto the most lucrative plan. Ethos is pitching itself as the antitheses of all this, with an application process it says takes a matter of minutes and requires no medical exams “for most applicants.” The user answers some questions about their health and medical history, with Ethos verifying this against a person’s medical and pharmaceutical records — this data is “algorithmically analyzed to understand the assumed mortality for each individual,” Ethos cofounder and CEO Peter Colis told VentureBeat.

Above: Ethos: application process

The San Francisco-based company is also quick to point out that its sales agents don’t work on commission. “You can rest assured that you are getting the best recommendations for you and your family,” the company pronounces on its FAQ page.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“Getting life insurance is one of the most selfless financial choices someone can make,” Colis added. “You shouldn’t have to endure what’s essentially a medical and financial strip search in order to protect your family.”

Ethos, which was founded in 2016, only offers so-called “term” life insurance, which means the applicant pays for (and thus is covered for) a set time period, rather than their whole life. The company leans on life insurance partners such as Assurity for manual underwriting, with Ethos applying its analytics to automatically assess and approve “a percentage” of its customers. In effect, Ethos looks at people in similar situations to predict how likely someone else is to die prematurely during the term of their insurance plan.

“Because we have a modern predictive analytics component, our ability to underwrite only gets stronger as our pool of applicants and data grows,” Colis said. “This is why the majority of our clients don’t have to undergo a physical medical exam, and it’s also what allows us to cut down application time dramatically from around 10 weeks to 10 minutes.”

A core selling point of Ethos is that it promises to remove some of the barriers to garnering coverage — more than 40% of Americans currently have no life insurance plan, according to some reports. Moreover, Ethos said that it uses machine learning to analyze customer data to ensure that they are paying the right amount based on their personal circumstances and mortality risk, rather than what a sales agent bestows upon them.

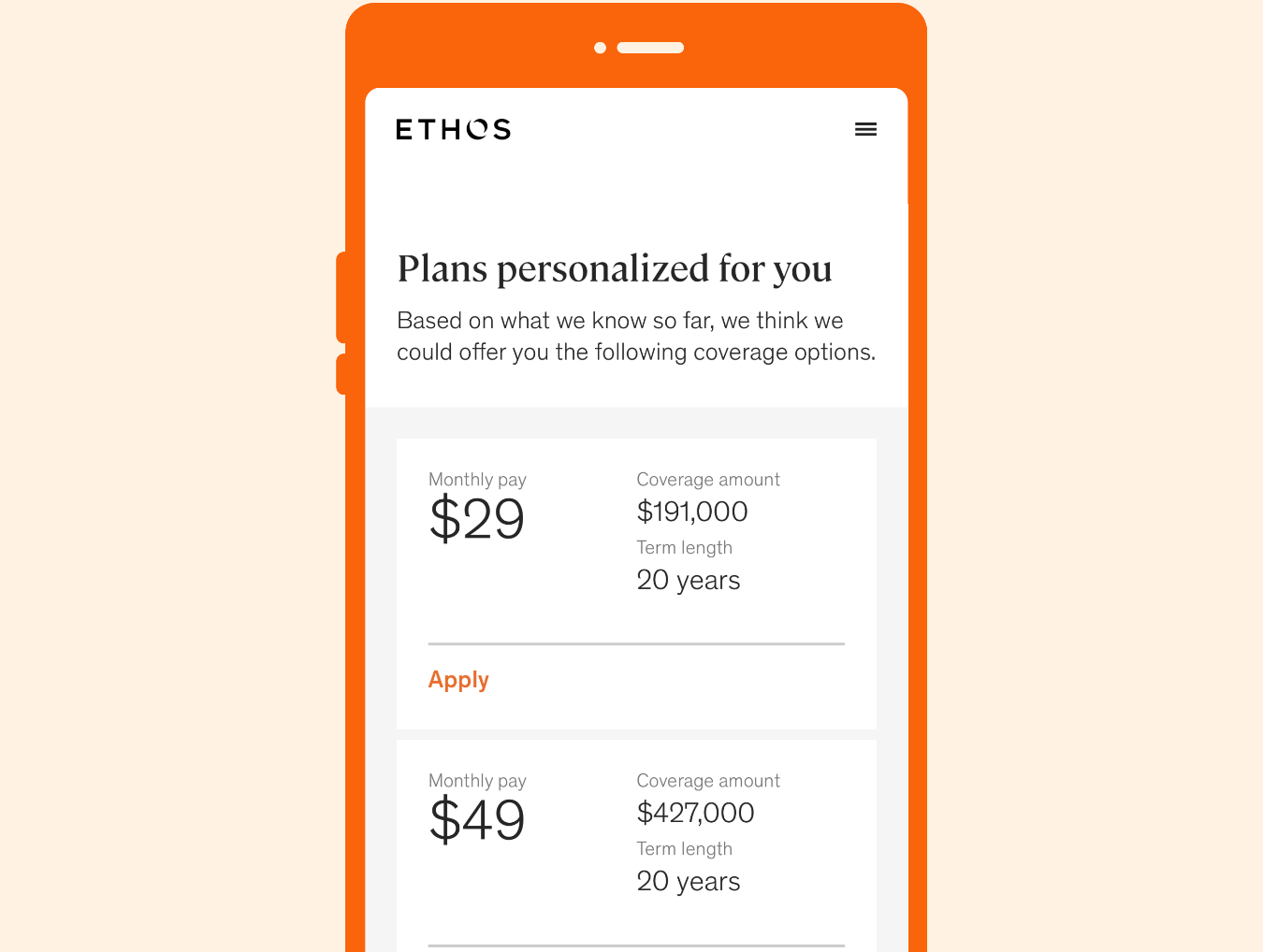

Above: Ethos: Personalized quotes

“Roughly 50 percent of the customers who have right-sized policies end up with a smaller monthly premium,” Colis continued. “This practice is in direct opposition to the traditional model of sales-incentivized agents.”

Big business

The broader insurance technology (“insurtech”) market has seen some big investments in recent times, with the likes of car insurance startup Root recently closing a $350 million round of funding at a $3.65 billion valuation, while others such as Lemonade, GetSafe, and Embroker have all closed sizable funding rounds of late. According to Crunchbase, a record $2.5 billion was plowed into U.S. insurance startups last year.

With a specific focus on life insurance — arguably one of the most crucial forms of insurance, particularly for families that rely on a single breadwinner — Ethos has managed to attract major investors over multiple rounds, while also drawing in some names you would not usually associate with an unsexy industry such as this. Indeed, prior to now, Ethos had raised around $45 million from investment vehicles belonging to rapper Jay Z, actors Will Smith and Robert Downey Jr., and basketball powerhouse Kevin Durant, in addition to traditional VC firms including GV, Sequoia, and Accel.

“Since our original investment in Ethos last year, we’ve been consistently impressed by the company’s commitment to growth, customer traction, and execution to-date,” added GV partner Tyson Clark. “With the company’s product differentiation and singular approach to modern life insurance, Ethos is well-positioned to disrupt a $100+ billion industry.”

While Ethos would not divulge any figures, the company did say that it has quadrupled its revenue since last October, and it will use its fresh cash injection to hire more technical staff, and further develop its product.