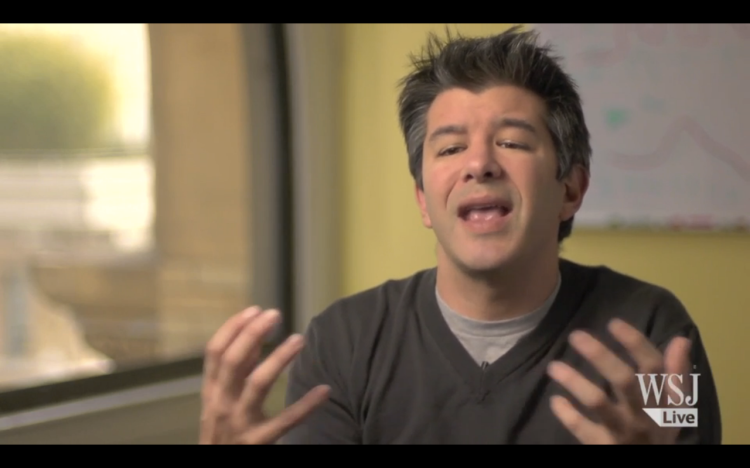

The downfall of Travis Kalanick should show the world of would-be tech entrepreneurs that they need better role models; that they need to stop looking up to the spoiled brats who lead some of Silicon Valley’s most hyped companies and the investors who fund their misbehavior.

Kalanick’s ouster last week from Uber is a watershed for Silicon Valley, something capable of shaking up its entrepreneurs and venture capitalists alike. For too long, its elite have gotten away with sexism, ageism, and, to coin a word, unethicalism. The cult of the entrepreneur idolized arrogant male founders who plundered and even sank companies; the more money they raised (and often lost), the higher the valuations their companies received and the more respect they gained. Corporate governance and social responsibility were treated as foreign concepts.

Uber was not the worst company in the tech industry; it was just the most visible and the one that got caught. Its investors have been rightfully humiliated for having their heads in the sand. This is because it has for so long been clear that Uber needs management that is more responsible — to its employees, its drivers, and its customers.

The trouble first surfaced in 2013, when complaints about male drivers’ assaulting female passengers met with denials of responsibility by the company. Then followed sexist “boober” comments by Kalanick; ads in France that pitched attractive female drivers; suggestions by an Uber executive that he would dig up dirt on a journalist; and then the rape of a woman passenger in New Delhi partly caused by a lax screening of drivers.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

But through all of this, Uber investors supported the company and accepted the ethical lapses as if they hadn’t happened. All that seemed to matter was that valuations were rising; the business, expanding. Who cared that a top Uber executive had secured a copy of the medical report of the Delhi rape victim and shared it with other company executives, including Kalanick, in an attempt to discredit her? The company was growing; investors were valuing it in the billions!

It took the allegations by a woman employee about rampant sexism at Uber headquarters for matters to reach a boiling point. And fortuitously, a board member illustrated the root of the problem by making a sexist remark at a meeting about eliminating sexism. The board was finally compelled to do something it should have done years ago: force Kalanick out and clean up its own act.

To be fair, there are many technology companies that are, in this regard, exemplary, including Salesforce, Microsoft, and Facebook. They are going to extremes to correct the problems with sexism that they had found to exist in their ranks. I know from discussions with executives such as Microsoft CEO Satya Nadella that they have been working hard and sincerely. Most tech companies also go to extremes to adhere to laws.

But the unethicalism problem that Uber’s investors knowingly tolerated shows how Silicon Valley’s elite too often think they are above law and ethics — and corporate social responsibility. The people who fund the offenders have simply not been held accountable, and they need to be.

The investors of Uber must have known it was rolling out services in cities and countries where it wasn’t permitted; that it had tracked a journalist’s trip to the Uber office in real time, illegally operated self-driving cars in SF, and “Greyballed” the police. And they must know that Uber’s business model is one that passes the costs and responsibilities of doing business onto its workers — some of whom are earning less than minimum wage and living in their cars. If they don’t know this, the investors are not doing their due diligence and fulfilling their responsibilities to their investors.

The money venture capitalists invest, after all, is not their own. It is raised from pension funds, universities, and state governments.

And then there is the problem of the composition of boards. Venture capitalists demand seats on boards as a condition for their investment but don’t usually fulfill their fiduciary duty to all shareholders and employees; they put the interests of their own funds ahead of those of the company. If they are going to take board seats, VCs must take responsibility for the employees as well as for the success and social responsibilities of the company — as board members are supposed to do.

Startups must also realize that they need diverse boards that provide balance and broad perspective, not chummy boys’ clubs dominated by venture capitalists.

Silicon Valley got a free pass when computers were just for nerds and hobbyists. Few cared about its arrogance and insularity. And the child geniuses behind that early innovation inspired so much awe that their frat-boy behavior was a topic of amusement. But now technology is everywhere; it is the underpinning of our economic growth. What is more, the public is investing billions of dollars in tech companies and expects professionalism, maturity, and corporate social responsibility.

There is no free pass for the tech industry anymore. It must grow up and clean house.

Vivek Wadhwa is Distinguished Fellow at Carnegie Mellon University Engineering at Silicon Valley. His new book, The Driver in the Driverless Car: How Our Technology Choices Will Create the Future discusses the choices we must make to build a great future.