Facebook recently produced a report on game marketing that represented its latest effort to understand the evolution of both gaming and gamers. The report delved into trends like hypercasual games, which are played in a matter of seconds and go viral for a couple of weeks.

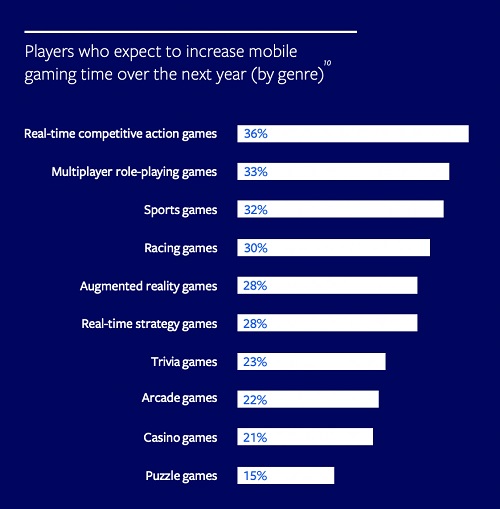

Gamers are shifting their habits, and big changes such as the coming bandwidth bonanza of 5G networks will likely change things even more. Facebook found in the report that gamers are likely to spend more time with mobile games in the coming year. And it found that gamers are forming loyal communities around their games and friend networks. They’re gravitating toward brands and intellectual properties that they can engage with across multiple media and platforms.

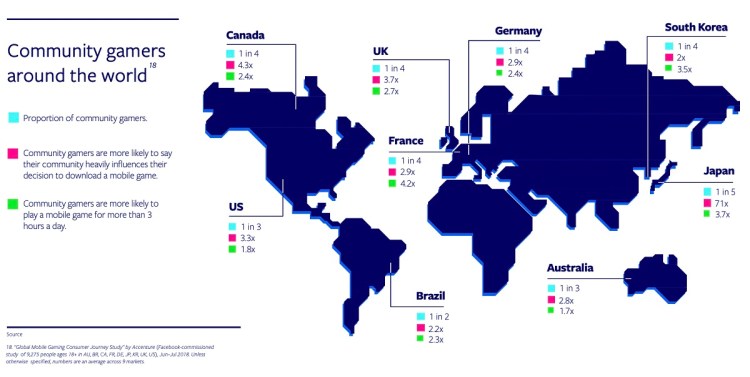

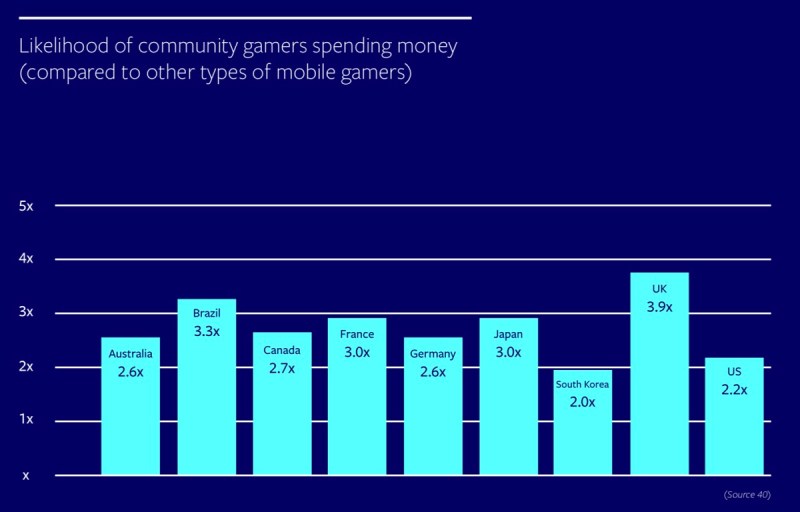

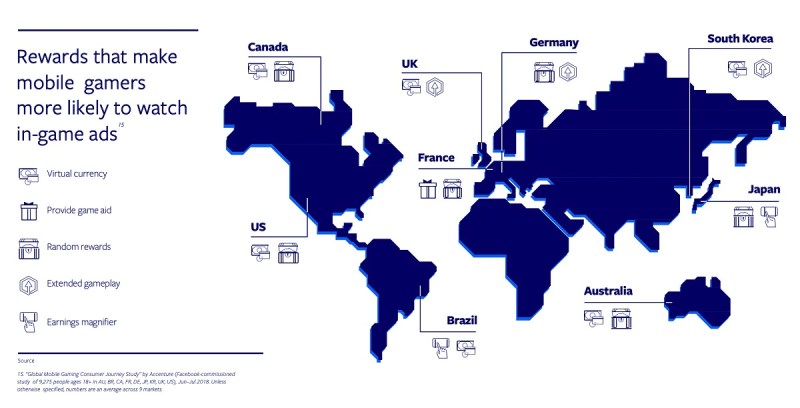

Facebook found that community gamers, or those that play mobile games with others, are more likely to spend money in games compared to other types of mobile gamers. And Facebook also found that rewards (from virtual currency to extended gameplay) are more likely to motivate mobile gamers around the world to watch in-game ads.

I talked with Rick Kelley, vice president of global gaming at Facebook, about the report and the trends that it illustrates.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Here’s an edited transcript of our interview.

Above: Rick Kelley, vice president of global gaming at Facebook.

GamesBeat: You folks recently published a gaming marketing report. What did you find?

Rick Kelley: We wanted to share that Facebook very much cares about gaming. That was part of the impetus for putting the report out. We’re committed to building community around gaming, a place where everyone can come and enjoy the gaming experience, whether that’s playing games, watching games, discovering new games to play, and interacting with other players through different aspects of our platform, such as groups or the video experience. We’re trying to explore some of these trends that impact the landscape and address some questions proactively that game developers might have.

Some of the highlights in the report dig into how gamer habits are evolving. New genres are expanding the pool of people that would identify as gamers. You probably know yourself that if you asked a room full of people, “How many of you identify as gamers?” you’d get a smaller percentage of people raising their hands, but then when you ask, “How many of you have played Words With Friends or Candy Crush?” a lot more hands go in the air. “How many of you watch their kids play video games?” More hands go in the air.

One of the things that we’ve discovered over the last 12 to 18 months is that the rise of hypercasual, with virtually no tutorials in something that’s really snackable — you can go in there and play games in a very lightweight way. That creates a funnel for people to play potentially more engaging games, from casual and on down the line. That’s something we’ve taken notice of.

Above: Voodoo is the king of hypercasual.

GamesBeat: I’m curious about hypercasual in one sense, more on the question of whether it’s good for the game industry and game developers. Some of the dynamics of it are so difficult, where a hot game that goes viral might last for two weeks and then it’s gone. Are these games cannibalizing in a way? Are they eating into the time people used to put into longer games? I’m unsure what to think about whether this new habit among consumers is good for the game industry or traditional game companies.

Kelley: I can only share my own perspective, and it probably wouldn’t be — I wouldn’t be representing Facebook as much, but giving you my own perspective. I just went down and spent a lot of time with Voodoo in Paris. I’m located in Dublin. We went there to film our latest installment of what we call Game Changers, where I interview different senior execs about different topics. My latest video is coming out tomorrow, probably, with the VP of games from Voodoo.

I look at it as — this is giving people content that they want. They’re playing it because it’s easy. It’s quick. They may not have been willing to play something that’s more sophisticated because they don’t have time. Maybe they don’t find it to be simple enough to engage them, because they might find a strategy game too confusing or too in-depth. I look at it as widening the funnel of people who play games.

You’re right. A game may only last two weeks, if that, but people might be playing two or three games within the genre. They’re exploring different types, whether it’s sliding down a wider slide or — what was interesting about talking to them was that game was not all that well-received until they added some minor functionality where you could have the guy shoot off the end. That added a lot more engagement and enjoyment. If people are getting enjoyment from these hypercasual games and finding them interesting, then I think that’s going to be a good thing for our industry. It’s bringing developers more revenue streams, because it’s all ad-related.

Above: Hyper-casual games are taking off in mobile.

This is one of the other trends we see within Facebook, how 2019 was a big year for diversifying revenue streams beyond just in-app payments. We started to see developers that never would have placed an ad in front of users, out of fear of forcing them to churn — now all of a sudden they say this is a great way to monetize the 96 percent of players who’ll never buy goods within a game. In fact, through a rewarded video ad or a playable interstitial, for example, you’re bringing enjoyment and fun and a reward — everybody wins with a rewarded video. The developer, the advertiser, and the player, who now has some value that they can use within the game. Compared to streaming and TV and other services, where an ad might be an interruptive experience, this is one where there’s a value proposition brought back to the person consuming the ad.

With as much progress we’ve seen — one stat is we had one and a half times as many publishers on the audience network in 2018 in than we did in 2017. The attitude toward this is changing. This is strengthening the bottom line of these developers, because they’re able to monetize more users, and in different ways. That’s a good thing for the games community, because that will be reinvested into new games and more sophisticated games.

The other point that I think about when we talk about hypercasual — you look at a game like Archero, out of Habby in China. That’s a fairly hypercasual game that has more casual mechanics, in-game payments and ads. They were looking at what Voodoo does and saying, “I want to be the next Voodoo.” They came up with their own slightly altered approach to building a game. Now the Voodoo guys are looking at what Habby is doing and thinking about doing something more sophisticated like that. It’s an industry where you see people recognize that various gameplay means a diversity of games, and that’s a good thing overall.

GamesBeat: It’s similar to the debate when casual games arrived, comparing them to hardcore. Maybe it’s a different variation of the same discussion.

Kelley: A bit, right? I guess you always have that — arrogance is the wrong word, maybe, but the first mover, someone who plays a certain type of game, they have a hard time accepting a new genre that may not be as in-depth, or that may invite other kinds of people into the game community. But if we have more people playing games, that just leads to the growth of the industry. It’s a $160 billion industry now. It’s bigger than movies, TV, radio, and the NBA, NFL, MLB, and NHL all combined. That’s a cool place to be, and we never would have gotten there if we had just continued to appeal to the same kind of users with the same kind of gameplay.

GamesBeat: Hopping around to another point about the strengthening of brands, it seems like there’s a — when I think of esports players, how they specialize in playing only one game, and how the people who follow them are extremely interested in that one game, I wonder if that’s the opposite direction from hypercasual, where people are focusing on fewer games, but they’re playing them for a lot longer, a lot more often. Call of Duty fans, all they care about is Call of Duty 365 days a year. I wonder whether there’s some data that shows this concentration around brands is another change in habits, where people who used to play a lot of games just play one game.

Kelley: If you look at IP — and maybe that’s one way of looking at this — people have a strong appetite for familiar IP. I look at my business, which is the ad world, the marketing world for the game industry. I know that a disproportionate amount of spend in the ad world is on games that were launched in 2017 and earlier.

You would think that the effort to push that new game out there in a significant way would surpass the traditional “older” games, but what we find is that these existing IP, whether it’s Call of Duty, more of a console experience, or FIFA or Candy Crush — these IP people recognize, they’re super passionate about them. They’ll continue to invest their time and their money into playing these games.

But I don’t know if it’s exclusive. You mentioned esports players and whether or not they play one title all day long. Even if I look at the behavior of my kids in my home, they love Fortnite, but they still deviate to playing Clash Royale sometimes on their mobile. That’s where you have different devices, and the proliferation of 4G and cross-platform, which means they can play different games depending on what they’re doing. I do think that people tend to play more than one game at a time, and maybe it’s the people that are really paid to play some of these games, whether they’re streamers or esports fanatics, that tend to really gravitate toward a one-game-only experience.

Above: Players are planning on playing more and more mobile games.

An experience that we haven’t seen yet, that we should see, if I’m forecasting what we might see in 2020 — if you have a Call of Duty, for example, why would we not see a hypercasual type of experience with some Call of Duty IP? Or something that widens the funnel and can be used as a marketing experience for that game. I think of that as a playable for a more sophisticated title. We haven’t seen that a ton, but I think it’s a smart way to create new marketing mechanisms, new types of marketing creative. Think about more bite-sized gaming experiences that involve the IP of a more in-depth game.

GamesBeat: It must be one of the reasons that Call of Duty mobile is taking off, with 100 million downloads or more. 170 million now? That’s an interesting opportunity. It also reminds me — when Blizzard announced a new Diablo game, everyone thought it would be Diablo for PC, and it turned out to be a Diablo mobile game. The fans were furious about that. The next year they announced Diablo IV for the PC, but it didn’t turn out so well for the mobile game. Sometimes it seems if you go too far toward casual, that’s a risky move.

Kelley: It was also an experience like — you look at Fallout, as another example. Four years ago at E3 they launched the Fallout mobile game, which led to a more in-depth game on console. I think people enjoy playing IP that they recognize. Coming back to some of the information in the report, marketers need to figure out how they can leverage that and continue investing in that.

One of the other things — it’s not necessarily IP from their game. We’ve seen, this year, an older game, the Game of Thrones game, be relaunched around the final season of the TV series. It was almost a relaunch or reinvigoration of the game because of some of the offline events taking place. Harry Potter was another example. When these entertainment studios reintroduce a new version of the movie or TV show, it’s a great opportunity for games to reinvigorate their audience and find new members. We’ve put a lot of focus internally on, how do we recognize what these events might be and help developers and advertisers wrap themselves around what’s happening in the offline world?

GamesBeat: On diversifying monetization, would you then say that it’s important for companies like Activision or EA, in addition to companies that are already focused on that, mobile-focused companies like Zynga?

Kelley: If you look at Activision Blizzard, they see a huge important in diversifying their revenue streams, which is one of the reasons they bought King. They have sustainable revenue through their mobile business. They’ve perfected how to do the marketing there. They’re seeing new revenue come through the King acquisition in the form of ads, to the point where the Activision and Blizzard sides of the house are looking at how they can create more of an ad inventory or ad experience within the more traditional titles they have.

Also, they’ve made massive investments in things like the Overwatch League and esports in generation, which bring in new revenue streams, but also new ad experiences. I absolutely believe that diversification of revenue streams is important for them. Now, those are still perhaps a little bit different from how mobile game studios are looking to do it. They have the benefit of the offline communities.

Above: Community gamers are more likely to spend money in mobile games.

GamesBeat: If you look into 5G more, what are some more of the opportunities you expect game companies to exploit with 5G?

Kelley: It’s much more sophisticated graphics, and then the big one is cross-platform. It’ll be platform-agnostic, because everything will live in the cloud. PlayStation and Xbox are banking on streaming gaming services. Google Stadia is obviously based around streaming. It doesn’t necessarily have to be a living room experience. It could be whatever device we’re talking about.

I’m excited to see how — no longer is it going to have to rely on the game engine behind the scenes dictating where the game is played or how it’s distributed. This will be something that, as you start to see enhanced speeds around the world — this will be more content for people that have access to that.

The other thing is, let’s take a look at India. India, for the longest time, they had smartphones. They just didn’t have the speed of internet access that allowed them to have content in a reasonable amount of time. Then you have a mobile phone provider called Jio that was introduced to the market about two years ago, which made 4G accessible to just about everyone at relatively low cost. That’s led to an explosion of content on mobile phones. Gameplay in India has risen, and game developers in India are starting to take hold, because there’s more of an opportunity to reach people. With 5G it just becomes an extension of that, on the back end, as far as the type of games that can be played through a streaming service.

GamesBeat: What kind of expectations for change do you see there? How soon do you think 5G reaches 10 percent of the market or 20 percent or 50 percent?

Kelley: That’s a good question, and I don’t know. You’ll see the developing nations obviously follow the U.S. and Europe. Here in Ireland we have one area of 5G in downtown Dublin. It’s going to be a while. We consider ourselves a first-world nation, but these investments by the carriers — they’ll use this to compete against each other, but I can’t predict how fast it’ll take place.

Above: Rewards make gamers more likely to watch mobile ads.

GamesBeat: If you look at these trends, it seems to be pretty well aligned with what Facebook is doing in games. The strategy for Facebook to prepare for these changes, is that more of the same?

Kelley: The point of the report was not to tie it back to our products or how we could use it to sell our services. It’s more about how we can add value to our developers in terms of categorizing the trends we see and making them aware. Our job is to put this in the hands of our partners and people within the gaming community so that they can recognize and use the information to make decisions around how they go to market with their games, or decide to monetize their games.

Certainly we have an added — giving more developers the courage to introduce ads within their games, where still some of them are holding off on doing that — we haven’t talked about the benefits of live ops, and how much more sophisticated around measurement and creating individualistic gameplay — I think that’s something that people hear about, but the term “live ops” means different things to different people. One way we’re looking to add value to the game community is, how can we bring more insights into lifetime value and ways that developers can enhance their lifetime value through resources that we have?

I can’t say that these are all directly tied back to our strategies as an organization. Creators is a big one, and that’s certainly a movement that’s exploding in 2019. We’re looking to bring more creators onto our platform. But there’s not really a monetization hook with advertisers right now around creators. We simply want to match the right creators with the right brands, finding creators that speak to the values that the game studios have themselves.