Freightos today announced a $44.4 million investment round as the Israeli startup continues its push to bring the unwieldy logistics industry into the modern age.

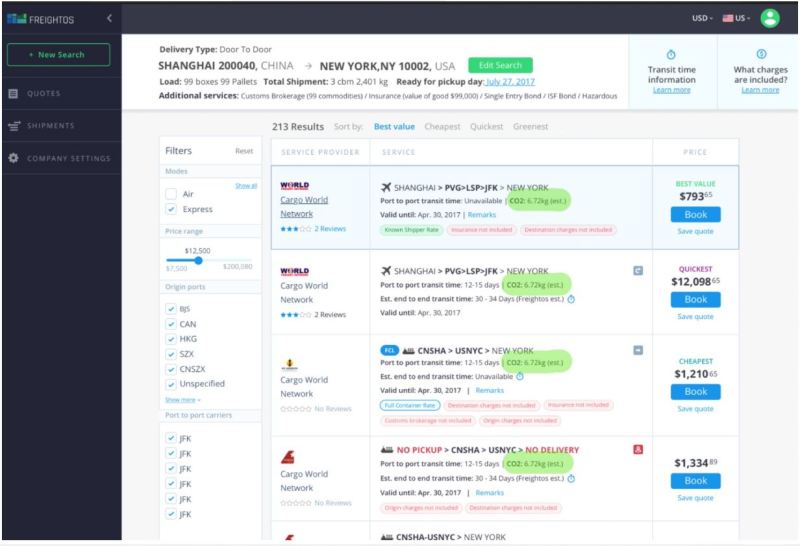

Launched in 2016, Freightos offers a cloud-based logistics service and shipping marketplace aimed at making it easier for all parties in the shipping ecosystem to order and organize freight movement — from an overseas factory to the final retail destination. The company is betting it can increase bookings by providing greater transparency and real-time information.

“From small freight forwarders to global carriers and from niche ecommerce vendors to Fortune 500 retailers and manufacturers, Freightos means transparency, efficiency, and automation for supply chains,” said CEO and founder Zvi Schreiber, in a statement. “The meteoric growth of the Freightos marketplace and success of our platform for freight rate management and digital sales shows that importers and exporters are looking for radically better freight services, while carriers and forwarders are eager to deliver by leveraging technology.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

The company has now raised a total of $94.4 million and is seeking to sign up more logistics providers. The latest round was led by the Singapore Exchange (SGX), which enables trading of currency, stocks, and other financial assets. SGX officials said they hope to work with Freightos to develop financial instruments to facilitate greater shipping transparency and risk mitigation.

“Freightos is at the forefront of a new wave of solutions for price discovery and digital marketplaces in global freight — an industry at the heart of the global economy,” said Michael Syn, head of derivatives at SGX, in statement. “SGX is excited by the potential to develop risk management tools and services and build on Singapore’s unique position in the trade ecosystem to bridge the physical and financial markets.”