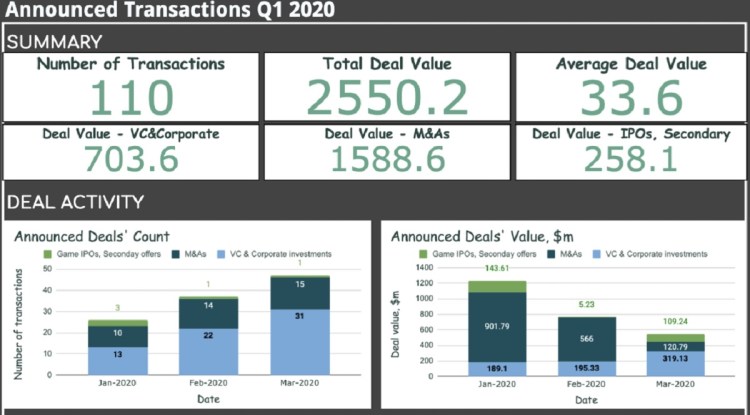

Investors and funds pumped more than $700 million game startups in the first quarter, though that amount is down from the same period last year. This is from data collected by Sergei Evdokimov, an investment associate at Mail.ru Games Ventures.

It was a big dip, but it’s not bad for a quarter with so much turmoil. In an email to GamesBeat, Evdokimov said we shouldn’t panic about it because lots of game investments never disclose the amounts raised. The public data is very spotty, and this number shows us a lot of activity in Q1, even though the coronavirus triggered lockdowns and stock market plummets in March. The data on games is spotty, but it’s all we have to go on. We’ll see data from other sources, but for now, let’s take a look at what Evdokimov has collected.

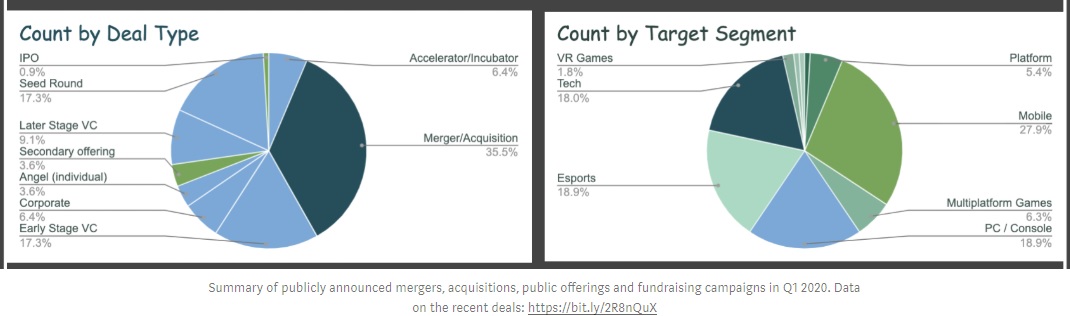

The volume of game merger and acquisition deals was $1.6 billion in the first quarter, compared to only $1 billion for the full six months of the first half of 2019. That was driven by big deals such as Scopely’s acquisition of FoxNext. Meanwhile, the first quarter investment amount of $700 million was down about 2.7 times from $3.8 billion in the first half of 2019 — where we can assume the average was $1.9 billion per quarter.

Last year, Evdokimov said that game investments totaled $7.2 billion, up from $6.8 billion the year before. Investors spent $2.8 billion on game acquisitions in 2019, which is a significant drop of 85% compared to $22.8 billion in 2018.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

The largest deals so far this year include Scopely’s acquisition of the FoxNext Games assets from Disney (rumored at around $250 million). Roblox raised $150 million at a post-money valuation of $4 billion. And Scopely itself raised $200 million at a $1.9 billion post-money valuation. In the first quarter, 20 gaming deals closed in California, with startups raising about $428 million. 10 more VC deals closed elsewhere in the U.S. for $40 million.

Sweden’s Stillfront Group acquired Storm8 for $300 million. Embracer Group bought Saber Interactive for $150 million. And Tencent acquired two-thirds of Funcom for $100 million.

Impact on investments

Evdokimov said the data showed that aggregate VC fund deal flow remained strong in Q1 and was largely unaffected by the economic slowdown brought on by COVID-19.

We can explain the level of dealmaking activity despite the recent economic slowdown by the longer longer lead and closing time compared to the public market, meaning that many deals announced in March were negotiated prior to the economic downturn.

However, he said we should expect a decline in the venture fund deals over the next few months.

The reasons for this possible decline include macroeconomic uncertainty caused by oil price volatility, a sudden rise in the unemployment rates (more than 16 million people out of work) and new data of COVID-19 patients. And the lack of in-person meetings slows down sourcing and negotiation activity.

Registering companies and getting government approval for the deals could also face delays, and we could also see limitations on due diligence procedures impacting the deal quality.

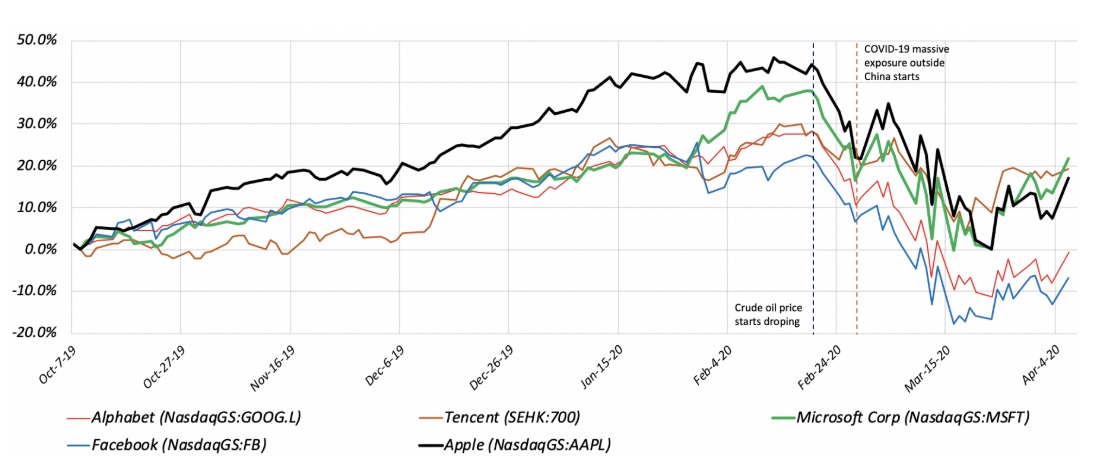

Above: Big game platforms have seen their share prices drop.

On the other hand, he said that strategic investors (like big corporate players and platform companies) have shown a strong improvement in financial position over the past few years. The bigger companies have also experienced huge growth in the gaming software sales (as many people are stuck at home), and they may react differently and increase their stakes in promising gaming companies at much lower valuations.

He said we shouldn’t expect the immediate increase in corporate investment activity since the majority of large gaming corporations will take time to determine the consequences of economic deterioration on stock prices

He also said production may face delays. And it will take time to automate remote working processes and to properly assess the changing player behavior.

Overall, most likely VC funds will focus on keeping the existing portfolio companies afloat and provide capital to their portfolio rather than establishing new relationships, he said.

At the same time, some strategic investors will pull back, focusing only on the existing portfolio, but those with the dedicated investment teams and strong financial position will continue investing prudently.

Moreover, he said it is the right moment to continue consolidating the market by acquiring later-stage companies that are likely to observe substantial valuation reductions being often valued relative to public peers, which fell in price.

When it comes to game investments, the environment has changed in favor of venture capitalists, rather than startups, in my own view. Valuations are going to falling in the coming months, as they do during recessions. Entrepreneurs may have to deal with the fact that their companies are less valuable than they were just a short time ago, based on what I’ve been told by game investors.