Quality assurance testing of mobile apps is anything but a walk in the park. Emulators — software engines that mimic the behavior of hardware — don’t consistently scale well. And with thousands of different handsets being made and sold by hundreds of manufacturers and carriers throughout the globe, thorough real-world testing would seem infeasible on its face.

HeadSpin begs to differ. The three-year-old Palo Alto startup, which uses artificial intelligence (AI) and a network of roughly 22,000 devices in 150 locations to enable wide-scale app analytics, today announced a $20 million Series B funding round led by Iconiq — an early investor in GitLab, Snowflake, and Pendo — with participation from Battery Ventures, EQT Ventures, and a number of individual investors. They join existing backers GV, Telstra Ventures, Danhua Capital, Nexus Ventures Partners, NextWorld Capital, and others.

The infusion of new cash will be used to grow the company’s engineering workforce and “address growing demands from customers around the world,” according to a statement provided to VentureBeat.

HeadSpin, which was cofounded by Google, Zynga, Palantir, Quora, and Amazon veterans Manish Lachwani and Brien Colwell, provides access to a powerful AI engine that automatically flags high-priority compatibility issues across servers, content delivery services, devices, and apps. It complements the aforementioned network of tens of thousands of devices — dubbed the Mobile Performance Platform (MPP) — purpose-built for app testing and monitoring.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Above: The HeadSpin Performance Management dashboard.

HeadSpin counts tech giants like Tinder, DocuSign, Akamai, Telstra, and Dell among its clients and says it captures 60 percent of issues automatically and that its more than 1 billion users see an average 60 percent and 25 percent improvement in app reliability and user interface issues, respectively.

That might sound too good to be true, but Lachwani, who also serves as HeadSpin’s CEO, is no novice in this mobile industry. He was the principal architect of Amazon’s Kindle and helped develop the first Kindle OS, and Appurify — his first startup (which Google later acquired) — used hosted software to test automation with real devices.

The MPP’s novel architecture integrates with more than 30 testing frameworks and enables remote control of devices within the network without the need for a software development kit (SDK) or local team support. And HeadSpin’s core product offerings — Performance Management and Continuous Monitoring — offer visualizations that pinpoint performance issues like slow downloads and duplicate messages, plus automated anomaly alerts and built-in support for audio playback, SMS, messaging, voice call, and speech recognition testing.

They’re designed to work with business intelligence dashboards and bug tracking services like Jira and ServiceNow.

“HeadSpin [takes[ the guesswork out of what causes weak customer experience, such as why it takes 10 seconds for an app to load,” said Bryan Li, director of engineering at Tinder. “Before HeadSpin, it took a long time to find a root cause, and meanwhile, there was finger-pointing going on between carriers, app developers, and device manufacturers. But now we have a single version of truth and all partners can work together and solve performance problems more efficiently.”

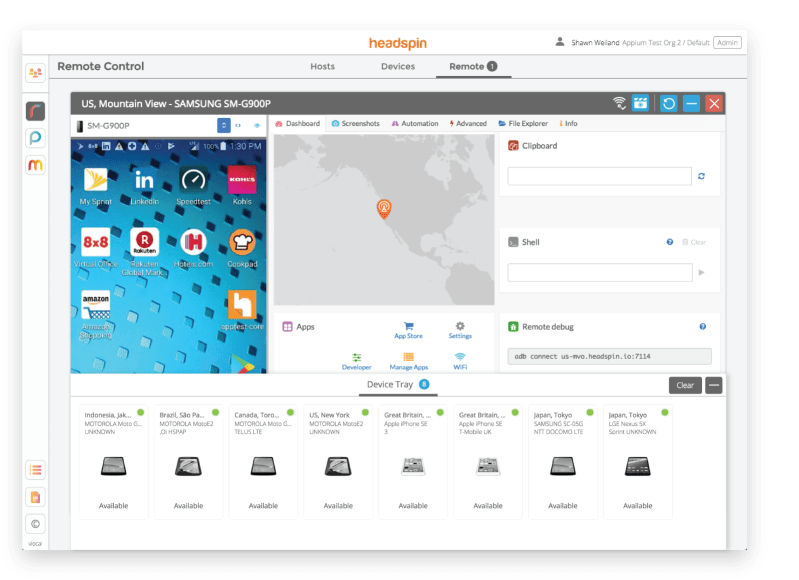

Above: Remote testing in HeadSpin.

HeadSpin isn’t without significant competition. Amazon’s AWS Device Farm, which launched in 2015, similarly enables Android, iOS, Fire OS, and web developers to test real-world mobile devices in the AWS cloud and offers comparable remote access features and automated performance testing. Google’s Test Lab for Android (formerly Google Cloud Test Lab), a platform exclusively for Android testing, natively integrates with Android Studio and Google’s Firebase console. And Xamarin, which Microsoft recently acquired, targets apps developed using the C# programming language.

But HeadSpin’s investors are confident it’s got a shot at the healthy cloud testing market, which is expected to grow to $10.24 billion by 2022.

“What HeadSpin has been able to achieve in its first three years is remarkable, and it has already attracted dozens of major clients across the mobile ecosystem,” said Will Griffith, founding partner at Iconiq. “The company is quickly becoming the new standard of record for all mobile ecosystem players going forward. It’s one of the fastest-scaling software companies we’ve seen.”