I first met Otto Berkes when he was one of the founders of Microsoft’s Xbox team, alongside three other crazy Microsoft colleagues. They hatched a crazy scheme to get Microsoft in the console business, and now it’s a multibillion-dollar enterprise. I wrote a book about them and the work they did as intrapreneurs, or a team creating a startup within a big company. And many years later, Berkes is still focused on innovation and intrapreneurship.

Berkes left Microsoft in 2011. Then he joined HBO to help usher it into the digital age with HBO Go. In 2015, he joined CA Technologies, one of the largest enterprise software companies, which dates back to the mainframe era. He serves as an executive vice president and chief technology officer. His goal in the past couple of years is to turn CA into a “modern software factory.”

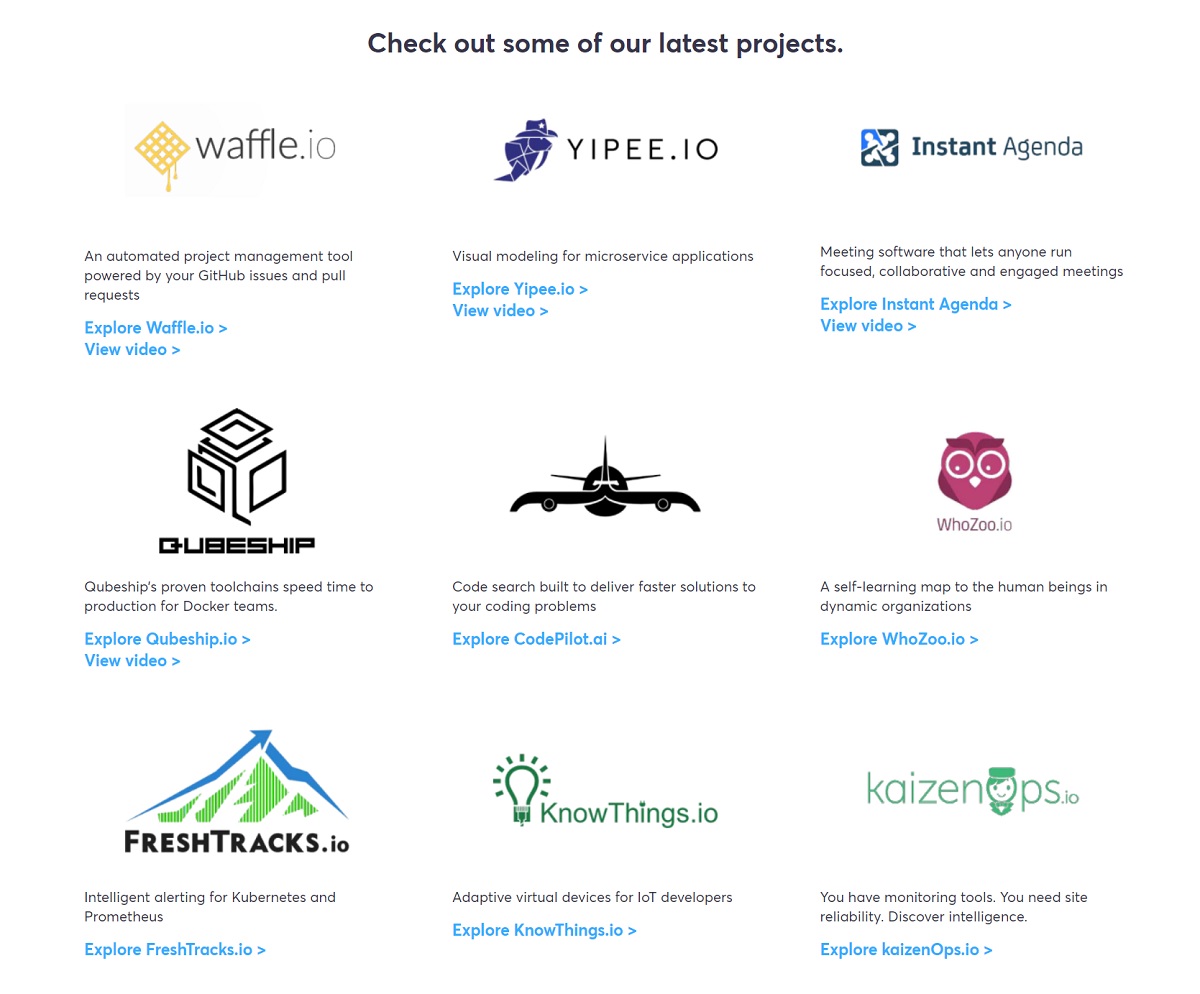

While he works in New York, he helped start the CA Accelerator in Menlo Park, California, which fosters startups within the company and helps them get internal funding and traction. The goal is to give employees risk-free entrepreneurial experience and a chance to create new revenue streams for the big company. It’s a very enlightened approach to entrepreneurialism at a $4 billion company that was founded in 1976.

Here’s an edited transcript of our interview.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Above: Otto Berkes

VentureBeat: How long have you been here now?

Otto Berkes: I joined in June of 2015, so I’m into my third year.

VB: What are your responsibilities?

Berkes: Helping set the strategic technical direction of the company, to really spearhead the types of product incubations that will take us forward into the future. Getting back to the accelerator program. We can talk about that in a bit more detail. Also, advanced research. What I would put into the university type of research. Further out into the future. Not product development, but pure research.

VB: I was familiar with what CA used to be, but I don’t know what it is today.

Berkes: That’s a good topic of discussion. That’s the reason I came on board, really. I had a number of conversations with our CEO, Mike Gregoire, really trying to understand what Mike was trying to do. The thing that caught my attention and my imagination was — his goal, his desire was to bring and build new product innovation capabilities and new product development into the company. Build that capability to augment what CA has been traditionally doing, which is acquiring businesses and bringing them into the CA portfolio.

He really wanted to build the capability, in addition to that, to build new organic businesses from the ground up. I love the challenge of that, and also the promise around the ability to do that, to help drive the transformation of CA as a business and a culture.

VB: What is most of the business now?

Berkes: It’s core enterprise software. We have a number of pillars. Going backward in time, we still have a significant portion of our business in mainframe, which is the company’s starting point. We have a very strong performance management portfolio, API management. We have a strong security portfolio. We’ve also pivoted into agile: agile development, agile testing.

Automation is a core pillar. Getting back to our acquisition strategy, one of our big acquisitions over the past year was a company called Automic, a clever play on the space. But they’re one of the leaders in business process automation and development automation as well. We’re investing heavily there.

Another big acquisition for us this year is in the area of security, really trying to get ahead of where security is going. The days of just endpoint security and security as a barrier between the outside world and the enterprise — that model doesn’t work anymore. Veracode is the company we acquired. It’s a really exciting acquisition, because it focuses on code security. Businesses are writing more and more code that they’re delivering all the way out to customers in the form of applications and backend services that go with them. How do you make sure you’re not introducing security vulnerabilities at the code level? Veracode is 100 percent focused on addressing that problem.

It’s a good example of what we’re seeing in the industry. Sometimes it’s referred to as “shift left.” The focus is increasingly moving away from infrastructure and infrastructure management to code development and user experience development and developers.

Above: The Waffle.io team at CA’s accelerator.

VB: Who do you guys mostly compete with, then? IBM?

Berkes: Certainly IBM, HP, what you think of as the traditional competitors, but also newer entrants that tend to be single-product companies, folks like Apigee, App Dynamics. That’s two examples that are direct competitors to us. At the same time we also have a partnership with IBM. You know how the industry gets like that. You compete with them on one hand and partner strongly with them on the other.

VB: How long has the accelerator been around?

Berkes: A little less than two years.

VB: What are some of the dimensions of running that?

Berkes: A couple of dimensions to it. One, and this is just a core attribute that I designed in, was that it’s not a program that was done in isolation. For example, we build up a process by which anyone across the entire company can submit an idea and potentially pitch it to the investment committee. Ideas can come from anyone. It doesn’t have to come from the product organization. I can come from marketing or sales or a combination of areas in the company. We wanted to build the broadest possible funnel, because a good idea can come from anywhere.

The other thing that we really focused on was to have it be a very repeatable process. We built a framework that uses lean startup methodologies to have a very well-defined process for bringing ideas in, incubating them, and either continuing to fund them, if they’re getting traction and making progress, or early exit and using those resources to bring in other ideas.

One of the important aspects, I felt, that was necessary to really create something to create something durable and repeatable and high value, was the governance model. We have an angel committee that evaluates pitches to determine whether they should come in or not. That committee also is along for the entire journey, for each incubation. That committee isn’t just comprised of folks from my organization. It includes a broad swath of leadership from across the entire company. Again, to make sure we’ve got a diversity of viewpoints and opinions to help both guide and evaluate the incubations that come through.

We have, as part of the process, monthly reviews of each incubation. I felt strongly that it was important to have a very tight feedback loop around these new business ideas that are often in greenfield areas, that are going to iterate and pivot both frequently and rapidly, and to make sure that we had the right support structure around the challenging and dynamic nature of startups.

VB: What about outside investors? Do you bring them in at all?

Berkes: We don’t. This is purely an internal development pipeline. The idea was to be able to build completely self-contained businesses within the company and really be able to focus on capturing the ideas there.

VB: Do you absorb them all, or do you then, at some point, seek to spin them out?

Berkes: We are open to spin-out, if for some reason we generate a high-value business and it just doesn’t fit CA’s strategy at the time they’re ready to be incorporated into the broader organization.

Let me spend a minute on that. A startup, a classic external VC-funded startup, is going to go through a number of rounds of investment. The exit is either an acquisition by another company or an IPO. Our exit is a bit different, because these are already CA employees. These are incubations that are entirely contained within the walls of the company. Our exit is into the mainstream business units, one of the BUs. Getting back to your original question, if we’ve got a great-looking business that doesn’t quite fit one of the BUs for whatever reason, we’d absolutely explore spinning that out. The goal here is to generate business value for the company. Whatever the best route for that is, it’s something we’d explore.

VB: Are you getting to some being at that stage now?

Berkes: It takes, realistically, four to five years — three if you’re super lucky — to really incubate something all the way from an idea to a proven business that’s scaling in a high-growth way. We’ve only been at this for less than two years. Our pipeline isn’t quite full. It’s going to take another — call it 12 to 24 months to really fill up the pipeline.

That said, we have had one exit. It was a little bit different from an exit of a product. In this case it was an exit of a technology platform. It’s a bit of an interesting story. We had an incubation that, as a product, as a stand-alone business, we decided it just wasn’t going to work. But in the journey of getting to that point, the team had built a technology platform where we said, “Hey, there’s something of potentially permanent value here. Let’s not discard it with the business that didn’t work out. Let’s see if there’s a way to leverage that value, either as an externally facing product or as an internal technology.”

We went the internal route. We exited that platform, which we call Jarvis — it’s an advanced analytics platform – into the product organization, where it’s been incorporated as the analytics engine for several products that are on the market. Absolutely a successful exit. A bit of a hybrid. But the goal here is ultimately to generate business value for the company, and we were able to do that effectively.

We currently have 11 incubations up and running inside the company now. They’re geographically distributed. The management of all the incubations is out of this office. Howard, who led you around, has all the incubations reporting in to him. He is the top-level manager for the incubations. But we allow them to be wherever the idea happens to originate. We have a number, for example, in the Boulder-Denver area in Colorado.

VB: And then you only take CA employee ideas, or do you take them from outside as well?

Berkes: Currently it’s intended to capture internally generated ideas. It makes it so much easier in terms of IP, and ultimately we want to make sure we harness the full potential of our employee base.

Above: CA’s accelerator has internal startups.

VB: So they don’t just go off to Sand Hill Road and raise their own money, do you have an incentive for them to stay inside? Is there some reward if they exit?

Berkes: There are a couple of aspects to that. There are soft incentives, if you will, and then hard incentives. One of the advantages that we have, you don’t have to leave your colleagues. You don’t have to leave the environment you know. You don’t have to leave your benefits behind to pursue an idea. You can stay within the company. We make it very easy to come into the accelerator and have that be your full-time job, continuing to be a CA employee. That’s a benefit.

The other benefit you have is the wealth of experience that we have as a company. When you come in as an incubation, we put together an advisory team, on a very custom basis, to help your incubation along. If you have special expertise you need from finance or marketing or sales, or if you have special requirements from an HR perspective, we can pull from a very broad base of talent and create essentially a tiger team to help your incubation along. Yes, external startups have advisory teams, but we can draw from an incredibly broad base of talent within the company to help you succeed.

We have also de-risked the process of coming into the accelerator and doing a real startup. We have an incubation rotation program that, for a certain period of time, guarantees your return to your original organization if things don’t work out. It’s very much a safe landing model.

There’s also a component to the accelerator that creates a lot of value. No matter how things turn out for any employee that comes in, we put together a really rich program, an education and support program, to build new skills for people coming in to do this. No one wakes up and becomes an entrepreneur and has all those skills overnight. We have boot camps. We have training programs. We have very much hands-on support to get people skills they didn’t have before. In many ways it’s a leadership and skills development program as much as it’s a means to grow new businesses.

Given that fact, for incubations that don’t work out, our expectation — and we provide a lot of help in this process — is that these folks go back into CA smarter, with new skills, having been enriched by the experience. Ultimately, over the long run, we make the company more effective, having built the muscle memory for what it looks like to do new organic product development.

On the hard side of the equation, you asked about the reward piece. We have established a reward structure for founders that we’ve been — it’s been challenging to come up with something that works within the construct of a large-scale business like CA, but also is competitive with doing an external VC. We’ve been working and collaborating with our finance team, our legal team, and our HR team, and we’ve come up with a founder reward that uses startup best practices to model something similar to what the typical exit would look like.

We’re not going to be as rich on the high side as a unicorn. But we have something we think is quite compelling to an innovator who comes in and builds a successful business.

VB: They could make, I don’t know, millions, depending?

Berkes: It depends on the business, absolutely, depends on the outcome. It’s a revenue-based model. Think of it as revenue sharing for some period of time. Each one is going to be different, but if they build some incredible business that’s scaling up, they’ll get more than one that’s good, but not as high-performing.

VB: The one you described, that seems like a one-time purchase that becomes a feature of some other product. Is the revenue-sharing hard to figure out?

Berkes: That’s going to be the outlier. The tech transfer that looks more like a technology acquisition tuck-in — that’s going to be the exception rather than the norm. We’re trying to build businesses that have real revenue tied to them.

The interesting thing to note is that the 11 incubations we have in the pipeline, all of them came in before we had that financial reward structure in place. That’s worth noting. Yeah, it’s great to get the financial upside, but really, the thing that gets people in the door is their passion. They have an idea. They want to pursue it. They want to create an impact in the market and something new, something meaningful. They’re coming for the impact. It’s great that we’ve been able to get this hard reward structure in place, but that’s not the primary motivator, at least with the cohort we have.

VB: Do you have any lessons out of the Xbox case, since that was an internal project as well?

Berkes: Yes. I’ve actually been thinking about —

Above: CA’s intrapreneurs.

VB: What’s your bonus out of that?

Berkes: [laughs] You don’t want to talk about that. I wish I’d gotten a rev share out of there, but no such luck. Again, my primary motivation wasn’t a financial one. We were passionate about this idea, going down a different path and making an industry impact.

Xbox is an interesting contrast to this kind of incubation. It’s an important distinction to make. Xbox was absolutely all about fast follow. There were existing, well-defined competitors in the market. The market segment was well-defined. The market opportunity was well-defined. Yes, you had to put something out on the market that was compelling, that had some unique differentiation, but there wasn’t a question that there was a console market, an interactive entertainment market that was large and growing.

At the opposite end of the spectrum here, where the incubations are in a greenfield, they’re not even sure sometimes who the target market segment is. The business model may be unclear or undefined. It’s very much a different type of process, where they’re trying to find out if there’s a there there, with the business they’re trying to incubate.

A large part of the reason why I was excited to follow lean startup best practices — because the danger with this kind of greenfield incubation is that you invest too much too soon. Then you find out, oh, well, actually there isn’t a viable business model here. Or we build the wrong thing. We forgot to talk to customers before we started building something and didn’t get enough market validation. We try to never invest ahead of data that tells us we should continue to invest.

In fact, we structured it — we have two very lightweight seed rounds, and then three more significant series rounds. The seed rounds are all about making sure that you’ve identified a problem that customers actually have. Also, importantly, if that’s true, then you can actually create a solution to that problem, a viable solution to that problem. That’s what those two seed rounds are about. We’ve structured them such that — we’re talking up to maybe a maximum of four people in those two series rounds. We’re not actually building anything at that point. We’re making sure that we’ve identified an opportunity that’s actually worth pursuing at the next step, which is to build something.

The rubber really starts hitting the road with series A. Series A is all about building a minimum viable product. The keyword there is “minimum.” Only what you need. Leave out the bells and whistles. Build the minimal chunk of value that will help you determine whether or not customers are actually going to adopt this product idea or not.

Along the way there’s the potential for pivots, but — start out with an MVP, and if you start getting market traction, go to series B and C. By the time you get to series C, if you happen to make it — and most incubations, to be clear, will not, just like any VC — you’ve proven the business model. You’ve proven market growth and market traction. You’ve demonstrated that there is a great product-market fit. You’re ready to scale up at that point. That’s the point at which we exit the business into the mainstream product organizations.

Above: CA’s Silicon Valley office.

VB: There’s a centralized structure, and then at some point you release it to a business unit?

Berkes: Correct. It’s really a pipeline.

VB: Does this fall under R&D then, as far as the whole organization?

Berkes: It does, strictly speaking, and it’s a component of our overall R&D strategy just like the university research. We think of it in terms of time horizons. The university research, we think of it as horizon three. It’s further out into the future before it has a real business impact. The accelerator we think of as horizon two. It’s a nascent market. It’s a technology inflection point that’s just starting to happen. It could be mainstream within, say, three to five years. And then horizon one, that’s our core product portfolio. That’s in the here and now. Obviously that’s the biggest chunk of our focus.

VB: It seems like there’s a lot of change going on. AI is infusing into everything now. That makes it a good time to do something like this.

Berkes: Absolutely. Starting with our university research portfolio, the vast majority of those projects have AI or machine intelligence as a part of their activity. Looking at the accelerator, a significant portion of the accelerator projects either rely on AI foundationally, or machine learning, as a big part of the value proposition. Our horizon one and our mainstream businesses, we’re incorporating machine learning and machine intelligence into those products as well.

A great example is our privileged access management solution. In the past year or so, we incorporated a chunk of machine learning technology into that solution that allows real time risk assessment when someone’s trying to log in to a critical piece of infrastructure. You don’t just have the typical multi-factor type of access, but actually look at other environmental variables, the context around the access request, to make a risk assessment based on historical patterns and other variables to say, “We’re going to need to do some more checking on this request. The IP is different. The location is different. There are some anomalous behaviors we’re seeing.” It’s a great example of the fact that AI, machine learning, machine intelligence is just going to start infusing not just new products, but existing products and lines of business.

VB: Are the accelerator projects reflecting that as well?

Berkes: Absolutely. A big chunk of them have machine learning and machine intelligence as a core part of their technology and the reason they’re able to bring the incubation forward.

Above: CA’s approach to funding startups is focused on internal teams.

VB: All these years later, is there something that you often will pull out as an experience from Xbox, when you’re coaching somebody or talking to someone who’s starting out?

Berkes: It was a formative experience for me. Certainly in terms of how to get something new off the ground and how to get buy-in for something new. Reflecting back on that, number one, without that truly team-level collaboration, and having a different set of skills, starting with the four of us but then much more broadly as the idea of took off as a network effect — it was truly a team effort that I think benefited from a diversity of viewpoints. That’s definitely stuck with me. It’s influenced my approach to the accelerator.

I mentioned the angel team. I wanted to build that kind of diversity of viewpoints and experience and background into that critical piece of the accelerator governance. It makes for better outcomes. It makes for more robust outcomes.

VB: Are you guys also baking in some racial and gender diversity in some way?

Berkes: We’re trying. It’s tough, just given the talent pool. We’re focused on that. We just came back from our leadership offsite for the office of the CTO. We have an offsite every four months, three times a year. That was one of the topics. How can we encourage and foster more founders to come in who are women, women cofounders, ethnically diverse as well? We have a couple of ideas. We’d love to see more diversity in the accelerator itself.

Obviously we’re fostering greater diversity within CA as a whole through a number of both internally facing and externally facing programs. It’s a work in progress. But again — this was something that was a really great topic in the panel discussion that we had at CA World, if you go back. It was one of the most exciting topics of that panel. The importance of diversity as a business enabler — it’s not something you do for appearances. It’s something you do because it’s a necessity for your business. You want to tap into the broadest possible pool of talent, but also, it’s going to give you the best outcomes.

Above: Waffle.io is a startup within CA.

VB: Is there anything else you want to cover on this topic?

Berkes: In terms of the seed and series, Waffle.io is the most mature, not surprisingly. It’s the one that’s been in flight the longest. It’s in series B. It’s an interesting product. What it tries to do, what it does, is takes the management burden off developers who are using GitHub as their source code development tool. It automates the process of tracking their flow of work through a project. It’s had 145,000 signups. It’s gotten a lot of traction in the GitHub developer community. It’s pathfinding its way to being a successful revenue-generating business. The last six months it’s had 500 percent growth.

That’s a good one to look at online, just to get a feel of what these things look like. Hopefully the impression you’ll get is, “This looks like an external startup.”

VB: What else are you doing personally?

Berkes: I wrote a book on digital transformation called Digitally Remastered. One of the central theses in the book around transformation is the need for a modern software factory embedded in the enterprise — the ability to build modern, customer-facing software experiences, not just as a business optimization function, but as a business driver. Look at any industry. Look at banking. It’s all about digital banking and applications and engaging with customers through digital channels. The modern software factory — the umbrella is the concept around building modern software development and experienced development capabilities.

VB: Was HBO your last stop before this?

Berkes: Yeah. I was there about four years. I took that company through their own digital transformation, which by the way was incredibly eye-opening and formative. It really informed my joining CA, because it was the first non-technology company I’d ever worked for. I came on board specifically to help the company navigate through digital disruption and digital transformation.

VB: HBO Go and the like?

Berkes: Yeah, everything behind HBO Go, all the applications, the back end services and infrastructure. What I found, that I realize is not the exception but rather the norm, is that non-technology enterprises are all struggling to use technology and use software in ways that are often foreign to them. The typical use of “IT” — the typical use of technology has been to optimize their businesses. But the new use of technology — getting back to the modern software factory and software development — is to use technology to drive their businesses, to create new businesses.

Which is a very different use of technology. It’s no longer just about back office systems. It’s about creating customer-facing user experiences. How do you engage directly with customers through digital channels? That’s a very different set of capabilities, a very different approach to culture. Moving from, for example, waterfall development to agile development, bringing in user experience and being able to understand user experience is a core competency.

The exciting thing to me about CA is that it’s a company whose mission is to help companies move to a very different mode of using technology to drive their businesses forward. This is central to what I talk about in Digitally Remastered. It’s not just transforming how we use technology, not just transforming the culture that goes along with it. It’s rethinking, fundamentally, the role of technology and software in the context of the business.

That transformation applies to us. The genesis of this floor was in fact the accelerator. I’m like, “Look, we need a space that looks, feels, and operates like a startup, if we’re going to drive a startup mindset and a startup culture.”

VB: Do some of those startup people move here, then, just to be part of the accelerator process?

Berkes: They come in and spend chunks of time here. But we’ve got development centers across North America and the rest of the world. We don’t require them to move. Although if they would like to, we’re more than happy to accommodate them here.

VB: Is it better to have your spot in New York as opposed to here?

Berkes: I spend so much time traveling. In many ways, New York is optimal just because I have three airports to pick from. I spend a lot of my time on the road.