Arm dominates the microprocessor architecture business, as its licensees have shipped 150 billion chips to date and are shipping 50 billion more in the next two years. But RISC-V is challenging that business with an open source ecosystem of its own, based on a new kind of processor architecture that was created by academics and is royalty free.

This month, 2,000 engineers attended the second annual RISC-V Summit in San Jose, California. The leaders of the effort, including nonprofit RISC-V Foundation CEO Calista Redmond, said they see billions of cores shipping in the future.

RISC-V started in 2010 at the University of California at Berkeley Par Lab Project, which needed an instruction set architecture that was simple, efficient, and extensible and had no constraints on sharing with others. Krste Asanovic (a founder of SiFive), Andrew Waterman, Yunsup Lee, and David Patterson created RISC-V and built their first chip in 2011. In 2014, they announced the project and gave it to the community.

RISC-V enables members to design processors and other chips that are compatible with software designed for the architecture, and it means licensees won’t have to pay a royalty to Arm. RISC-V is politically neutral, as it’s moving its base to Switzerland. That caught the attention of executives, including Infineon CEO Reinhard Ploss, according to RISC-V board member Patterson. With RISC-V, Chinese companies wouldn’t have to depend on Western technology, which became an issue when the U.S. imposed tariffs and Arm had to determine whether it could license U.S. technology to Huawei.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Perhaps because of this, RISC-V activity is picking up around the globe. Redmond said in an interview with VentureBeat that RISC-V is creating a technological revolution. It’s not clear how many RISC-V startups there are, but the group counts more than 100 member companies with fewer than 500 employees.

Here’s an edited transcript of our interview.

Above: Calista Redmond is CEO of the RISC-V Foundation.

VentureBeat: There was a little bit of comment about the burst of people in China that are interested [in RISC-V], partly because of what Huawei is doing.

Calista Redmond: I haven’t seen a burst of people in China. I’m not sure if someone else saw something I didn’t, but the membership has grown steadily at a global level … If you look at our line graph, it’s continuous. We didn’t see a spike at any particular point.

VentureBeat: The representation in China, what would you say about that? Where is it relative to the whole world?

Redmond: In terms of global members, we have [fewer] than 50. I don’t remember the exact number off the top of my head. It’s somewhere between 30 and 50. China has two groups of interested organizations that have 200 members. Some of those are also members of the global foundation, and some are just members of two RISC-V groups that have self-assembled in China. There’s CRVIC and CRVA. One is focused more on academic interests and one is focused more on industry interests. We collaborate with both of those groups on activities of global interest in China.

VentureBeat: There are all these different things that are appealing. Is it zero license fees, or … ?

Redmond: There’s no license fee. When you get to open source and you’re looking at the ISA spec, that’s open and freely available. You do need to be a member of the foundation to leverage the trademark, but everything is publicly available. There’s no license fee. A license fee would indicate a commercial relationship, and we’re a nonprofit foundation. We don’t have commercial relationships. The way that we generate revenue is through membership fees, which are not attributed in a royalty or license structure, like you would with traditional proprietary ISAs.

VentureBeat: Is this territory-free designation — it’s appealing to those who might face some kind of political border?

Redmond: When you open-source something, it’s globally open and available. That IP is not governed by a geographic jurisdiction. That’s how all open source works. That’s how global open standards have worked for 100 years.

Above: The expo floor at the RISC-V Summit. It’s small for now.

VentureBeat: This is a key difference between you and Arm, though. Someone might not choose Arm because of this distinction.

Redmond: Arm also has some open IP. So does Intel. So does Power. From a base building block, RISC-V does not have any other tangential requirements to it that you might find in other models. At its base, there are two areas that you make decisions in. One, technically, am I going to be able to accomplish what I need to for the workload I need to serve? Two, does the business model fit for my incredible investment and long-term strategic durability? It’s both of those pieces. More and more, technology decisions — you have lots of choice. It comes down to a business reason.

VentureBeat: David Patterson said the CEO of Infineon was interested, because you were moving the headquarters to Switzerland?

Redmond: We’ve had remarks made from different companies, different geographies, that indicate to us that they would be more open to investing in RISC-V if they felt that that gave them some level of comfort. The incorporation in Delaware as it is today — first of all, none of us lives in Delaware. Moving it from Delaware to Switzerland has no fundamental difference. We are not circumventing any regulations. We are not an insurance policy. We are fundamentally doing it because it calms some of the concerns that we have seen in the greater community.

VentureBeat: There’s a perception when you’re a U.S. nonprofit, as opposed to a neutral nonprofit.

Redmond: Could regulations change? Who knows, in the future? But they haven’t changed in decades of open source software development. I don’t think they’re going to change in hardware.

VentureBeat: The numbers of chips — are you going to start counting how much progress you’re making every year?

Redmond: The counts that have been surfacing and the reports that you’ve seen have been on cores, not on chips. RISC-V is more focused on cores, just as an equalizer in what we can count versus chips, because a chip may have two cores or it may have 30 cores. Now, Chips Alliance or another group may be more interested in chips, but then they probably need to delineate between different kinds — multi-threaded, whatever.

Above: RISC-V board members, (left to right): Krste Asanovic, Zvonimir Bandic, Ted Speers, Calista Redmond, Frans Sijstermans, and Rob Oshana.

VentureBeat: Is there a long run there that matters? You’re not a measurable percentage of Arm’s shipments, right?

Redmond: I don’t think we’re competing head to head with Arm or Intel or Power or anything in that way. I get what you’re looking at. We’re sort of — the sweet spot for RISC-V is starting in this space where there isn’t a current entrenched participant. Arm came in on mobile when there was no clear leader in that space. Intel survived and dominated in servers and desktops amongst many competitors.

I don’t think that there is a declared winner yet in embedded or in some of the new IoT spaces, or AI. That’s where I think you’re going to see the most adoption of RISC-V initially. Then you’ll see an additional rise after that where RISC-V may be looked at in the next generations of some of those architectures that had previously been there. But most companies don’t like to rip and replace prior investments.

VentureBeat: The Samsung talk seemed interesting, where they’re not going to replace old things, but they’re adding this in.

Redmond: They’re focused on the next generation. You heard them talk a lot about 5G. Modems, sensors, automotive. That’s just it, right? You’re seeing a lot of these companies start to diversify into the adjacent spaces of their core businesses. In those adjacent spaces, that’s exactly the point I was getting to earlier. That’s how you’re starting to see the advances that RISC-V is making, in those new spaces.

VentureBeat: I guess that’s how you gain market share. You’re not replacing things, but as the new things you’re in take off, they become a bigger part of the market.

Redmond: And where do you think the fastest growth rates are? Old spaces or new spaces? Probably those new spaces have attractive growth rates. Not always, but often.

Above: RISC-V co-creator Krste Asanovic at the RISC-V Summit.

VentureBeat: Do you then have to do anything to prioritize that particular space?

Redmond: It’s an interesting question. From our start, we started working on the base building blocks. Here’s your core, your basic ISA. Here are these extensions that you can pick and choose off the menu, what you’d like to include. Then, as we’ve matured as an organization, we’re starting to go up from that into software. As we get into software, we need to prioritize implementation stacks so that you have a single homogenous kind of perspective on that, from which of course you can diverge at any point in the path, but here’s our recommended path to take a fully open approach. Those implementations could be in embedded. They could be in mobile. They could be some of the scale-out HPC-type of realm. But we are starting to look at that — more so, as we look into the software side, as we look deeply at the extensions.

VentureBeat: As far as people taking RISC-V seriously, what would you point to as the milestones that are getting you into more conversations or into more doors?

Redmond: Nvidia is already including it as part of their core product.

VentureBeat: They came on board in 2016?

Redmond: I don’t remember the exact date, but it’s definitely out there. They’re up to millions of cores at this point. Western Digital, a billion cores. The trajectory, as more large organizations come on board, as well as the startups start to make progress — the level of investment in startups is continuing to grow. The VC spend on RISC-V is starting to grow. You see some of those early successes with the likes of SiFive.

VentureBeat: Is that something you’ve figured out yet, how many startups are going?

Redmond: No, but we have about 100 companies that [have fewer] than 500 people in the organization today. I talk to new startups constantly. I would wager that a strong percentage — I don’t know what that percentage would be — of our individual members are also looking at RISC-V as an area to do a startup business.

Above: The keynote crowd at the RISC-V Summit.

VentureBeat: It’s probably true, then, that a large percentage of chip design startups are going to be RISC-V? Or at least processor designs?

Redmond: It’s difficult to start on a different architecture. There are higher barriers to entry if you want to go Arm or Intel or something else. We’re really equalizing there.

VentureBeat: Because you’re going into established markets?

Redmond: No. We bring an established and growing community and ecosystem and partners and tools and resources and reference designs and cores and extensions. We have all of those pieces that give you a running start as an entrepreneur without the burden of licensing royalties or other commitments to your business. It is a much easier business and technical decision to make.

VentureBeat: I detect a certain nervousness at Arm, even though both sides are saying that they’re not directly competing with each other. It’s the way Intel used to talk about the x86 startups.

Redmond: It’s like we’re all at the same dance. The music has changed a little bit, and now we’re trying to figure out how we all move in that space. It’s an interesting dynamic. There are adjustments going on across companies. You see it at Intel, at Arm, at Power. RISC-V is just the latest to show up at the party, and we’ve come at it with a completely different approach.

VentureBeat: This other thing about momentum — if you cause the other guys to change in some way, you’re having an impact in the market. If Arm starts doing these custom instructions because you guys provide an alternative, that’s a change in the market.

Redmond: Another interesting perspective is, where do you see different architectures all in the same chip? It’s possible for Arm and RISC-V to coexist. How do you navigate that frontier? That was really interesting with the OmniXtend fabric from Western Digital. Do you want to share memory, share network, share storage? Here’s how we can do this across multiple architectures.

What RISC-V has brought to the game is you’re no longer locked into one architecture choice. Which also means you’re not locked into one vendor. That vendor lock-in is something the industry has been concerned about for decades.

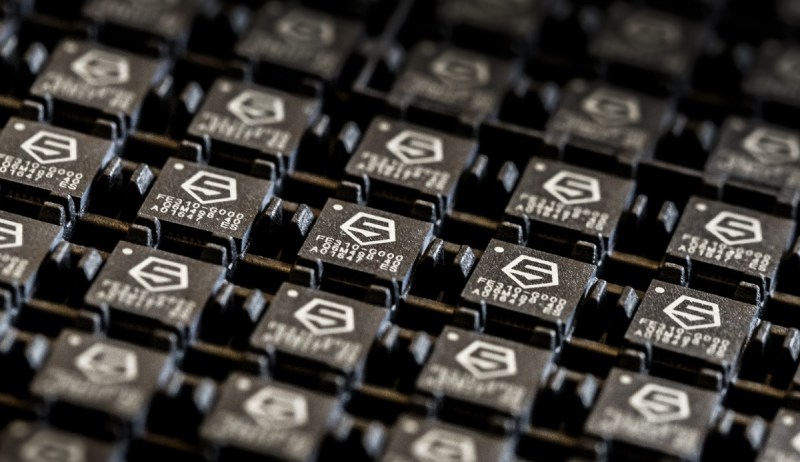

Above: SiFive is making licensable RISC-V CPUs.

VentureBeat: They made that strong statement about how memory doesn’t need to be tied to a processor.

Redmond: Right. Look at what happened in the software space. It was that lock-in that really gave a significant nudge to the open source movement in the first place.

VentureBeat: I remember the days when Microsoft was going around the world getting Windows declared the operating system of entire countries.

Redmond: Right, right. It’s interesting to see how they as an organization have shifted as well. They’ve started to embrace — business models need to evolve. You look back at the Industrial Revolution. At some point we thought coal trains were the greatest, but eventually we got to airplanes. It’s the same in our space.