Only the strong assets survive. That’s what I said after Bob Swan, the newly appointed CEO of Intel, talked about his view of paranoia in business — a legacy made famous by early Intel CEO Andy Grove, who believed “only the paranoid survive.”

I sat down with Swan and Intel executives Sandra Rivera (senior vice president of network platforms group) and Dan McNamara (senior vice president of programmable solutions group) last week, along with five other reporters. It was the first chance I had to sit down with Swan, who served as chief financial officer at Intel for a couple of years before he was named Intel’s acting CEO last year (after prior CEO Brian Krzanich left amid a personnel scandal). On January 31, Swan was named permanent CEO.

In advance of MWC Barcelona (formerly Mobile World Congress), Swan and his executives wanted to explain Intel’s strategy around 5G wireless networks, and how it will generate a tsunami of data that will be processed by Intel chips in both clients on the edge and servers in the datacenter.

I have now interviewed every CEO of Intel except for founding CEO Robert Noyce. By far, Swan is the most humble. He is the seventh CEO in Intel’s 50-year history, and he presides over a company with $70.8 billion in revenues and the biggest share of the PC and server microprocessor market.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Here’s an edited transcript of our interview.

Above: Intel CEO Bob Swan speaks with reporters in Palo Alto, California.

Bob Swan: We thought it would be interesting to have a discussion in advance of Mobile World Congress next week. It’s a bigger one for us than ever, because of the opportunity it represents, and also because of what’s important in that market right now and the transformation of the network, which is probably underappreciated by a lot of folks.

Let me start with what we’ve been up to as a company. We’ve been in the midst of a transformation, from a PC-centric to a data-centric company. That’s been going on for several years now. What that means is, we have a much broader range of products and services for our customers. We’re redefining and evolving what “Intel Inside” really means.

By Intel Inside, as you know, historically the brand Intel Inside was a (central processing unit) CPU inside of a PC. The way we look at the world today, it’s a CPU inside of a PC, inside of a datacenter, inside of an automobile, inside of industrial, inside of retail. With this explosion in needs and demand for data, whether it’s for consumers or for enterprises, we have more and more CPUs inside more and more devices. Where they go is much broader.

In addition to that, it’s not just about CPUs. The “Where” is much broader, but the “What” has expanded from CPUs to field programmable gate arrays (FPGAs) — you might know a thing or two about those — to GPUs, to modems, to memory. The reason for all of that technology is we go back to a world where we see the needs for data exploding. We have the capabilities, the wherewithal, the bandwidth to bring more and more technology. Intel’s broader array of products is powering the technologies that power the world. That’s what we’ve been up to for the last several years.

The implications of that are — the market that we’re going after is as big as it’s ever been. We talk about not being 90-plus percent market share of $60-plus billion total available market (TAM). We are talking about being more like a 25 percent market share of a TAM that’s $300 billion. Again, the expanded TAM is a function of more products, more technologies in more places. We’re looking at a $300 billion TAM. What that means for us is the prospects for growth are fairly significant, because the opportunities in front of us are relatively big, by bringing our core competencies, the things we’ve always done, into a much broader footprint.

Over the last three years — year 48, year 49, and year 50 in the company’s history — we’ve had record financial performance. We’ve essentially transitioned from a company that, five years ago, 70 percent of our revenues and profits and cash were derived from a PC, to today, where 50 percent, roughly, is derived from what we call this collection of data-centric businesses. Much bigger TAM, much more prospects for growth, and we believe a relatively decent tailwind as we look forward.

Above: Andy Grove, former CEO of Intel.

The third point I would make is, a big driver of that tailwind is 5G and the role that 5G will play in driving more innovation. Not just at the network, but at the edge. As communications and compute converge, it means the relative importance of the network is much higher. We have a relatively strong and growing position at the network, and those networks have to transform to deal with more and more data in a 5G world.

Transforming what we’re doing, much bigger TAM, much broader array of products and customers, and 5G, we believe, will be an accelerant of the innovation, which in turn will drive more demand for our products. Not just more demand for network-oriented products, but what it means — 5G will be an accelerant of the data that gets processed on billions and billions of connected devices at the edge. It’ll create needs for transformation of networks, but also needs for more compute, more storage, more analytics. That’s that broader TAM we’ve been going after for a couple of years now.

We step back and look at — we feel great about our transformation. We’re a couple of years into it. Our TAM is as big as it’s ever been, and our capabilities are as broad and as diverse as they’ve ever been. We’re very excited about the investments we’ve been making and how well we believe we’re positioned as we go into 2019, where 5G begins to build out. Next week we’ll talk more about our products. Today is just to give you some context about what that all means. That’s the backdrop.

Sandra Rivera: As Bob indicated, data is growing. In fact, data is growing faster than at any other point in our history. We know that just in the last year, half of the world’s data has been created. But only between 2 and 4 percent of that data is actually utilized. This data-centric opportunity — to move, store, and process all that data and turn it into value — is a great opportunity that we’re driving forward in terms of our product portfolio and our technology innovations.

As Bob also mentioned, the network transformation is a critical part of how we enable all that data to be turned into value, because of that true convergence between computing and communications that’s accelerate by 5G. If you look at what we define as the network, between your devices and between the datacenters, there’s this thing called the network that not many people often think about. You can think about it like oxygen. You don’t miss it until it’s not there. You just have an assumption that, magically, your data shows up on your device and you’re able to download or upload that data.

Increasingly, because with 5G you have 1,000 times the bandwidth and 100 times the peak data rate capability and an order of magnitude lower latency, you’re now able to move compute much closer to that point of data creation and data consumption. For many issues — issues of bandwidth, issues of latency, issues of cost, issues of security, issues of data sovereignty — more and more of that data, really almost half of the data, is going to be dispositioned at the edge, and not in the distant datacenter or cloud someplace.

That dispositioning of that data requires a network that is a high-performance computing platform, where you can do data analytics, where you can disposition the data in terms of: Does it need to be moved someplace else? Can it be discarded at that point? Can it be used in some way to take action or make a decision? That’s the opportunity that we see building out around this edge, around where the network and the premises come together.

We have a broad portfolio of products, clearly built on our strength in computing, where networks are now a collection of high-performance computing platforms. With 5G, we see the same cloud-scale opportunity that we saw in the buildout of the cloud, where all of that edge opportunity, all of the access now becomes cloud platforms. They become computing platforms where you have analytics capability, where you’re moving the traffic, where you’re storing the traffic, where you’re processing all of that traffic.

We have products that we’re announcing next week, but really, network SOCs, edge SOC products, FPGA products that Dan will talk about to begin processing all that data, turn it into value, and allow that flow of traffic and the dispositioning of that data much closer to the point of data creation and data consumption, whether that’s a device we’re familiar with — a phone, a laptop, a tablet — or a new class of devices, as Bob mentioned. Robots, drones, factories, cities, smart lighting, smart cameras, smart sensors of all types. We’re very excited about that opportunity.

Above: Intel FPGA board

Dan McNamara: To speak to what Bob just talked about, we’ve been integrating and transforming for three years as part of Intel. We were formerly Altera. We joined at the beginning of 2016. If you recall, when that deal was announced, it was all about the cloud and the datacenter, in terms of FPGAs being able to accelerate the infrastructure of the datacenter and do some of the workloads in the cloud. That’s true, and we’re doing very well there.

What I believe was missed there was that the network was missed by everyone. The fact that FPGAs have spent — basically, we grew up in the network. FPGAs, for 20 years, have been a good — what I call a data shovel. It’s very good at packet processing and moving data with very high throughput and very low latency. We’ve traditionally been in the wired network. We’ve been in the wireless network from 2G to 3G to 4G. We’ve done very well there.

What Sandra is talking about — I can’t even use the word transformation strongly enough. It’s cloudification of the network. What’s exciting about this is the FPGA comes in and accelerates the network no matter where you are, whether you’re on an access pole with an antenna for 5G or you’re in the baseband or you’re in the core of the network. It sits right next to a Xeon processor.

If you think about what we bring to market as Intel — this is one of the devices we’re going to announce next week. This is a programmable accelerator card. It has a FPGA on it. It also has two network interface chips from Intel. You load this into a server with a complete software stack and IP availability. A service provider could leverage this in the core of their network by accelerating network functions or infrastructure, or at the edge. The world today is impatient and distracted. This latency need is important. FPGAs plus a Xeon processor or some of the SOCs we’re building are so pivotal in delivering this low latency and high bandwidth to the users.

This card is really tuned to both the core of the network and the edge or the base pan. If you think about a traditional network from a wireless standpoint, you have a radio head and then you have a baseband processor unit. That baseband unit is now getting virtualized, going to more of a software-based solution on the Xeon processors. This card gets plugged right in there and accelerates that whole chain.

We’re very excited about what we bring as a total company to this transformation. One of the frustrations I’ve had over the last couple of years is I think people miss this about us. This is probably as big as anything we’re doing in the company. It’s just starting. We’re in the early innings of 5G. You’ll hear a lot about it next week at Mobile World Congress. We’re really just getting started. This is high-performance computing embedded in the network. It’s the cloudification of the network.

Above: Sandra Rivera is senior vice president of network platforms at Intel.

Question: Talking to your investors, talking to the analysts who look at what Intel is doing, bringing more computing into the network and into the mobile world makes perfect sense. They understand that. If you can get more Xeon into areas where it’s never been before, that can’t be a bad thing. Your competitors are saying the same thing, that edge computing is big. What they struggle with is, why do we need a modem? Why do we need to be in the client device business? That’s a tough business. You have to be all the way in or not. Is there an argument on that side?

Swan: I’ve heard that question before. [laughs] The way we think about the mobile internet itself, in the 5G world it becomes much more relevant in our minds. The investments over the last couple of years were to, first, get a technology that’s in the game. Second, to get a customer that appreciates the technology and makes us better by our interactions. But third, most important, is the relative value of the modem — not just in the device, but in this new 5G world we talk about. We think it becomes more important.

Again, it’s not just in the phone. It’s increasing these applications at the edge, whether it’s a modem in an automobile, a modem required to connect more and more devices at the edge. We think the relative importance of the modem going forward is larger, not smaller. We’ve been investing as much for positioning for 5G as the path to get there along the way. We announced, in the fall, that we’d be launching our 5G modem in the second half of this year. The primary use case in the early stages is in these devices we carry around, but our belief is that its application will be much broader through higher attach rates in a PC becoming more relevant, and in other devices at the edge. It becomes relatively more important going forward, not less important. It’s not just about building the IP to be in a phone, but building the IP to be — the other things we’re talking about, just a much broader set of applications.

Rivera: I would add to that, the connectivity is the onramp to the network. The more devices that are connected — we typically talk about the things we’re most familiar with, like phones and laptops and tablets. But increasingly, over time, there will be really not just the billions of people that are connected, but the tens of billions of things that are connected. The more connected devices, the more data that’s created, the more the network needs to keep up with all of that data, and the more opportunity we see opening up to us.

We see this proliferation of a large class of connected devices, whether it’s cars or drones or robots or cameras or meters in the city, as driving more data, and more need for an intelligent, flexible, programmable network. It really does become somewhat of a virtuous cycle. We’re driving more data. We’re interacting with those connected devices in the access, in the edge, in the core, and in the cloud.

Swan: Where investors have most anxiety is, we were catching up for a while. Catching up, in their minds, means not making any money. But now we’re at a stage where we have products that we believe are as good as anybody in the industry, as we migrate to 5G. But that’s more — we were behind and we’re caught up. Now the question is, do we have broader applications? It’s not just selling a device to primarily one customer. It’s selling the IP in a variety of different applications where you can make money.

In those three stages of evolution, stage one was very frustrating for the investor base. Stage two is a little more wait and see. For us, stage three is the, in our vernacular, the 8160 modem 5G enabled in more applications for more and more customers.

Above: Dan McNamara is senior vice president of programmable solutions group at Intel.

McNamara: Sandra and I were at a meeting just last week. It’s taking that IP and integrating it with a multi-core SOC that we’re looking at. It’s branching the IP into a different class of product, which would obviously not go into this, but into a small cell in town or something like that. We’re definitely looking at that.

Question: I heard a version of the earlier question, where we’re still at stage one or two because there isn’t a mobile SOC attached to that discrete modem, so that limits opportunities in edge, be they handsets or other connected devices. Is there some way to fill that gap at some point?

Swan: Through the mind of investors?

Question: Well, no. In the product line, is there —

Swan: I’m going to do investors and then have Sandra do product line. Again, I do this because it is a frequent question. I think investors have gone from the infuriated stage to, “Okay, I think I understand, but I’m a little bit uncomfortable until I see.” And now we’re trying to get them into the proof points of broader-based applications. They’ve come around partially, but they’re still in a wait-and-see mode, to see the product road map and the adoption and application at the end.

Rivera: Clearly, the network opportunity benefits from the more and more connected devices that are out there. The focus beyond the phones for us has been in these CPE devices, this fixed wireless access opportunity that’s enabled by 5G in gateway platforms, which we are announcing next week with a number of different partners, a number of other CPE device manufacturers bringing gateway devices to the market.

We also have done, over the past two years, over 125 trials in 20 different countries where having the modem IP allowed us to learn about the use cases and the usage models and what was needed in terms of the access and the edge and the core of the network. We enhanced our product portfolio on the network infrastructure side, as it also informed a lot of the capabilities we were putting into our multi-mode 5G modem, which is unique. It’s 5G, 4G, 3G, 2G. It’s 5G in standalone and non-standalone modes. It has carrier augmentation within it. It has sub-6GHz. It has millimeter-wave. It’s a very robust multi-mode modem.

We’re excited to be able to see the entire application, the entire service creation capability, from the modem through access, edge, core, and cloud. We think we’re in a unique position, to be able to see all that and drive forward a lot of the use case innovation happening with 5G, because we’ve been a part of it end-to-end, from the beginning.

Question: Just to clarify, you have a processor business in the company in various forms, and a modem business. Right now they’re separate? That’s the part I’m not clear about. Every single vendor of modems at some point has integrated an SOC. It’s not a discrete part. It seems like for edge computing, from handsets to other powered devices, it has to be an integrated product in some way. Is there are a road map on which that happens for Intel?

Rivera: Today it’s a discrete modem opportunity. The opportunity to, again, be in all of those different types of endpoint devices — we’ll see where the market will go in terms of what’s required, in terms of further integration. But we are enabling, through a lot of our partnerships and other announcements we have next week — with Fibocom, we have an M.2 modem module to go into all of these different classes of devices as well. We see our opportunity growing, but we’re looking to the market to be the arbiter of where the unique value and differentiation is for us with the integrators. For the moment it’s a discrete modem.

Above: Intel FPGA board

Question: How are you set for timing and speed relative to Qualcomm? They’re saying they’ll be on a second or third generation by the time Intel has its first.

Rivera: The fact is that most of the volume curve will come in 2020, and we’ll be in the market in 2020. We’ll launch to customers at the end of this year, and then the volume ramp really begins in 2020. What’s happening between now and then is the network is getting conditioned and ready for all of those devices. That’s a very different time scale than [for] devices.

The network transformation, this convergence of computing with the connectivity element of it, the platforms that we’re creating for multiple applications — hosting and AI and data analytics capabilities — this cloudification of the network that Dan talked about, that’s a huge opportunity. In 2022, that’s $24 billion of network logic silicon. There is no huge MSS player. It’s highly fragmented. But the market is coming to the areas where we have both technology and market leadership. It’s high-performance servers. It’s virtualization. It’s cloud compute.

Question: It seems like, though, some of the customers want to get the marketing advantage of being able to announce first. Samsung this week says, “Hey, we have a 5G phone.” They seem to be very impatient to get stuff announced.

Rivera: That’s great. Clearly the evolution of — part of 5G is a faster phone. But if you look at previous generations of wireless technology, 4G was all about faster data on your phones. Whereas 5G will be smarter data in your network. We’re missing the real disruptive innovations happening on the network infrastructure side and the huge market opportunity — really looking at how disruptive cloud computing was and how that’s happening in terms of network computing, as well.

We love all of the devices, because again, that drives more network opportunity. But we believe that we’ll be there when the market really needs it.

McNamara: As we mentioned, it’s early innings. If you look at it today, a lot of people are already talking about growth due to 5G, and it really is early. We believe that from modems to SOC technology to custom ASIC technology and the server business, we’re extremely well-positioned going forward.

Above: The iPhone XR sits between the iPhone XS (left) and an iPhone 7 Plus (right).

Question: To what extent is the modem business in particular tied to Apple’s future in the modem business? They’re doing their own modem development. Are you envisioning a future where that big customer might not be there anymore, and you have to retool and realign the way that business goes forward?

Swan: One of the things we’d like you to walk away with is, 5G to drive modem volume is not the way we think about the world. 5G to drive the effectiveness and the efficiency of the network at the edge will drive lots more demand and use of data over time. We have a broad portfolio, whether it’s the cloud, whether it’s the network, whether it’s the PCs. 5G is going to drive more and more demand for the collection of capabilities we have.

In a subset of that, our belief is that with the IP that we’ve built, have been building, and will launch later this year — the IP associated with the modem will become more important. The application, the demand for that modem will not just be with one customer in one device, but with other customers, other applications, other devices. That’s where we see the optionality of what a modem means in a 5G world.

Along the way, the general rule for customers is they want the best product and the best technology. If we don’t have it in this world, and they have the capabilities, then they’re going to figure out either how to do it themselves or how to use somebody else’s. That’s competition. That’s a game that — we feel comfortable in that world. Being complacent with it will work against us, so we won’t. We’re always maybe more paranoid internally than what we read in the press about ensuring we’re building the best products. Customers will maybe entertain other ideas along the way, but they’ll always come to us because we have capabilities that are better than anything else in the world.

We’ll deal with consequences along the way, but to go back to my first point, this isn’t about the modem. It’s a piece, but in our minds it’s a much bigger play for the collection of capabilities that we offer.

Question: You mentioned that you’d be launching to customers later this year. Do you mean a discrete modem in a phone later this year, or do you mean other products that are not that discrete modem?

Rivera: Both, actually. We’re focused on the different devices that we talked about. Gateways are being announced this week, CPE devices, devices that we expect in terms of always-connected PCs, as well as some of the opportunities that we have in smart industrial types of applications. We see a lot of opportunity in all of the trials that we’ve done over the last couple of years, and those products will start coming to market later this year and ramping up into next year.

Question: To be absolutely clear, will there be a discrete modem in a phone that will come to this market this year for sale to consumers? Or are you going to start sampling it to customers?

Rivera: We’ll be sampling, and we’ll see products in the market in 2020 with our modem.

Above: Bob Swan is the 7th CEO of Intel.

Question: On the licensing of 5G modem IP, as you may have seen, the licensing models that exist around that have been under a bit of a challenge lately. If this is really a big revenue opportunity, how are you going to do it differently than other California chip design companies do it, so as not to run into some of those same challenges that have happened?

Swan: Our model relative to other California-based players is just completely different. We monetize, in today’s world, the sale of that hardware, and the value that hardware plays within the device it goes into. Ours is not a licensing-based model. Royalty streams that are charged against the cost of the entire device, that’s a model that, as you know, has caused quite a bit of friction in the market. Friction for others is opportunities for us, is kind of how we look at it. Our approach has been completely different. It’s a little more challenging, but it’s different.

Question: What is the plan to monetize the IP, then? Is it flat licensing fees, or another structure?

Swan: It’s going to depend on the use case. The expectation and the belief in broader-based adoption of a variety of applications — depending on how that modem would be used in the device, whatever the device is, our expectation is it’s going to evolve quite a bit. We’re going to be flexible so that it meets the needs of the evolving customer base and meets the desires of our shareholders. We’re going to evolve how this thing plays out in a 5G world.

Question: You mentioned paranoia. I was interested in talking about what it’s like to be CEO, and whether paranoia is still a good way to govern Intel.

Swan: When you’re trying to lead a business, paranoia is a pretty constructive characteristic to have. No matter where you are, it’s a constructive way to think. It can be a liability when it paralyzes you, and it can be an incredible strength or an asset — am I allowed to use financial terms still? — if it’s used in a constructive way. I’d say the constructive way is a little bit of the fabric inside our company. Is the customer going to do it themselves? What are we going to do? Will we be paralyzed by it, or will we move faster to build better products so they’ll never entertain that idea?

Whether you’re running the comms business or running the FPGA business or running the company as a whole, I think we’ve used paranoia, based on our predecessors, as a real weapon and strategic advantage. We’ve used it to build the best products and the best technologies as quickly as we can. I think it’s a healthy part of the company.

Question: Only the strong assets survive?

Swan: [laughs]

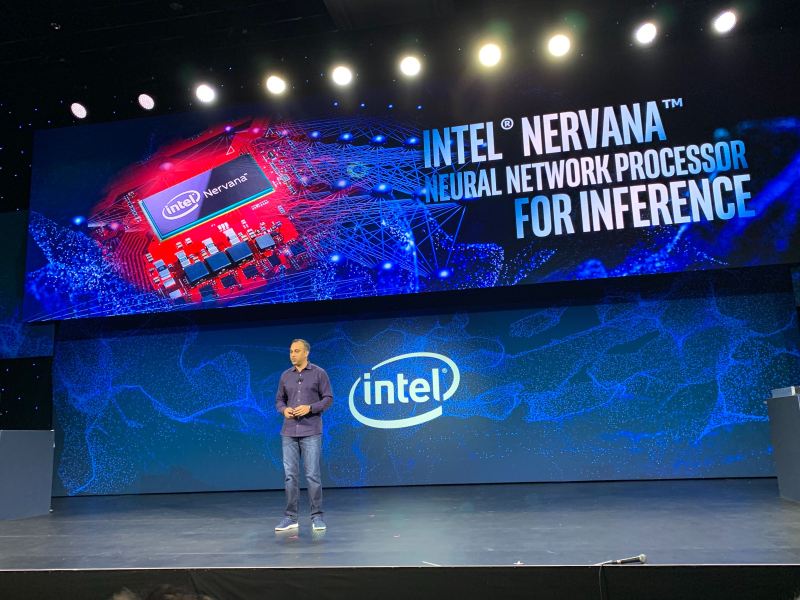

Above: Intel Nervana

Question: A lot of investors and analysts have seen you being in the CEO role as a sign that the company is going to move toward a more financially rigorous view of its business. When you look at acquisitions, you’ll look very carefully at what that does to profits, the accretive value of those things. Can you articulate a bit about what your philosophy is along those lines, how you envision looking at the business itself and whether you value — the financial people say maybe you value financial stuff more than R&D stuff. Can you give us a sense of that?

Swan: First, I didn’t show up last week. I’ve been fortunate to be in the company for a couple of years, and fortunate to work with Sandra and Dan and Bryan before, and the rest of the leadership team, to carve out a strategy that we think is extremely attractive for our investors. Also, a belief that in executing that strategy, we have to be both innovative and disciplined in how we deploy our money, whether it’s organically for the products we’re developing, or inorganically through capabilities we add.

If you put numbers to that strategy, it means if we want to play in a much bigger TAM and drive many more returns, we’ll continue to invest in R&D and we’ll continue to do acquisitions. There’s no question about that. If you think about how we do that, if we’re redeploying our R&D capital toward the higher-growth data-centric collection of businesses, and we execute well, revenue grows faster and all dollars, all spending, doesn’t have to grow in line with revenue.

What we’ve been able to do over the last three years is add $12 billion in revenue on $200 million more in costs, with R&D going up $1.4 billion. That’s the equation that we’ve embarked on. As a result, our earnings have grown dramatically, and not because of Bob the CFO. It’s because the team realized that we have big ambitions. To capitalize on those, we have to execute better and faster, because we’re going into areas that weren’t necessarily our historical 90 percent share. In doing so, we make real tradeoffs. Revenue from $59 billion to $71 billion. Spending as a percentage of revenue from 36 to 29. A much broader portfolio, and what we believe is a much bigger wind at our back based on those investments. We’ve done it all by increasing R&D dramatically during that time frame.

How do you navigate that? When we do things like the Mobileye acquisition a year and a half ago, we said, “We’re going to invest in autonomous driving because we think it’s going to use our technology, our IP, in a much bigger way than people can imagine. But in doing so we’re going to make tradeoffs.” The tradeoffs are things like, security isn’t as important as it once was. We have a wonderful ICAP portfolio where we’ve monetized a series of assets that became, over time, more financial assets than strategic assets. We exited some new device businesses, like wearables. We made a series of tradeoffs to free up financial capital to invest in strategic opportunities to accelerate the rate of growth of the business and allow us to transform from a PC-centric company to a data-centric company and evolve the definition of what Intel Inside means.

That’s the journey we’ve been on for a few years. We’re going to be extremely disciplined in how we do that. Not to cut off our nose to spite our face, but to execute against our opportunities. Doing 15 things great is hard. Deciphering the five things that are of critical importance and doing them great, and then really deciphering whether the next 10 are of real critical value, that’s the challenge we’ve been on. Getting comfortable stopping stuff, knowing we’re not going to get everything right, being able to say, “We gave it a shot. It didn’t work. Let’s get on with it and move on.” That’s what the team has been doing over the course of the last several years. That will continue.

To capitalize on the opportunities, we don’t want to get too distracted by doing a gazillion things, but we don’t want to be so penny wise and pound foolish that we’re not investing for the future. I think we have a reasonably good balance on that now. Investors are hoping that we’re going to be better and better. Again, year 48, year 49, year 50, record years. Much bigger market than we’ve ever had in the history of the company. Dramatically redeployed how we’re spending that money. It’s a bigger and bigger opportunity to have more growth. We’re just really scrutinizing every other nickel or euro or yen we spend so we don’t have to grow those in line with revenue. That’s what we’ve been doing as a team.

Above: Intel Gen11 has advanced features like foveated rendering, where the peripheral parts of an image are fuzzy in the name of better performance.

Question: Can you relate that to your three stages of investor grief, or whatever it was you described? Or one stage of investor grief and two stages of delight. You have this bigger pond and you’re throwing a few rocks into it. People are asking, “Well, now what?” You talked about modem, where you are in modem, but what about these other things? How can you phrase these investments and explain where you are and when you’re going to get the returns? Are these up-front investments in mode, for example? Are these things you expect to continue?

Swan: I would characterize big bets that we’ve made to expand our TAM, just to use our internal vernacular a bit. The big bets have been memory, modem, and Mobileye. I’ll take Mobileye off the table for a second, because it’s a great investment. We’re extremely excited. It’s in the notes this morning as accretive to earnings. We think we have a gem of a business that’s doing wonderful things on its own and pulling Intel’s technology so we’ll be a leader in autonomous driving. It’s growing like a weed and it’s making a bunch of money. I don’t get many questions on that anymore. We did when we made the acquisition, but I think the questions we get under the big bet umbrella are modem, which we talked about, and memory.

On memory, there are a few things we think are relatively important. With more and more capabilities of compute — enhanced processing, enhanced analytics, AI functionality built into the processing capabilities — over time, memory can be a constraint on all the incremental power you get from the CPU. We’ve thought that unless there’s disruptive memory, being able to capitalize on all this additional compute is not going to be worth it.

We’ve made investment in memory in two ways. It’s not in what we characterize as the commodity aspects of the business. It’s in the technology that’s more disruptive on two fronts. One, leveraging our process capabilities, manufacturing capabilities, and Moore’s Law to use a process technology called floating gate, which basically means, economically, that we can get more output per dollar of input in the 3D NAND world. Floating gate stacking technology allows us, we believe, to get cost per gigabyte because of technology, not because of lower price in the 3D NAND world. It’s disruptive technology, leveraging Moore’s Law capabilities over time.

That part of the business has scaled extremely well. It’s been profitable for the last couple of years. But we’ve been reinvesting that 3D NAND profit from leading process technologies into Optane. Optane, in our mind, is a differentiating technology that will keep pace with the innovations on the CPU, so memory doesn’t become a constraint on CPU performance. That’s been a fairly significant investment. It continues to be one.

We’re rolling out a product — the Optane technology is appropriate for both the datacenter and the CPU, but we’re primarily doing it for the datacenter world and the workloads that particularly the cloud guys have to deal with. We launched a product at the end of last year that we call Cascade Lake that leverages CPU and Optane technology. That’s at very early stages, but the belief is world-class process capability on 3D NAND to drive as good economics as we can at lower invested capital, and using that money to invest in Optane that enhances our capabilities for inside the datacenter. These are not my words, but we’ve been in the investment stage, the high-anxiety stage of that for the last couple of years with the investor community. That makes them a little bit anxious.

One thing we did over the course of 2017 and 2018 is we think we have something special, disruptive technology, in a commodity-oriented world. Rather than using our investors’ money to build out our facility in China, we went and asked our customers: “We’d like to use your money.” For us, it was a bit of a test. Maybe the intersection of brilliant technologists and financial people — hey, if it’s so good, why do I have to go out and ask investors if we can use their money? Why don’t you ask customers?

To make a long story short, we’ve gotten what we call strategic supply agreements, where customers gave us $3 billion between 2017 and 2018 that was used to help build out the capacity in Dalian. That’s technology as a differentiator, both manufacturing technology and enhancing the role we play in the datacenter world. Then using our customers’ money to fund the earlier stages of the development, so it’s not as painful for shareholders. We got to a decent balance in the early stages of the otherwise painful path of significant up-front capital for long-term returns.

Above: Intel’s new hyperfast Optane 900P SSD storage.

Question: The general sense now is that you’re still very sub-scale, and therefore this investment phase is going to be quite an intense one for a long period of time. Obviously, the NAND market will do what the NAND market does. Looking ahead over the next three years, what is that investment cycle going to be like in memory?

Swan: The difference over the next couple of years versus the past is we have returns coming in. Before, we had losses and capital and scaling. Now we have, in essence, what we said on 2019. We haven’t really commented beyond that. We have sufficient capacity in NAND to grow into, but we need to build some self-sufficiency for our Optane product, because we’re going it alone, as opposed to sharing a facility with Micron. Beyond that, it’ll be a function of the adoption of our products by customers and our ability to continue to make them.

Rivera: We see a high level of interest and anticipation on Cascade Lake with Optane persistent memory for large in-memory database types of applications, which are not just about the cloud service provider, but clearly about our enterprise customers, as well. With 5G and with moving that compute closer to the endpoints, building out of those edge platforms, we see applications for video streaming, for cloud gaming, for a lot of content caching that will happen with that persistent memory with Cascade Lake on those platforms.

All these use cases that either economically couldn’t be delivered before — or from a technology and performance capability you can think about cloud gaming, or you can think about virtualized CDNs. That is a growth opportunity that demands high bandwidth, low latency, the ability to cache and store content much closer to the endpoint. That really is enabled by 5G. We’re harvesting a lot of those investments, even in areas where historically you wouldn’t think about where we could use that kind of capability. Our customers are pretty excited about the new things they’ll be able to do with the combination of the transformation of the network, 5G, and then disruptive technology like Cascade Lake with persistent memory.

Question: Do you have a similar justification to Optane for investing in a standalone (graphics processing unit) GPU?

Swan: Similar in that we see a real demand in a big and growing market, both PC and datacenter. With differentiating technology, we can make money. So yes, similar. The market opportunity, we think we can build some differentiated technology by leveraging — rather than just doing new … how do we use some of the technology we built for integrated graphics and pull that into a discrete offering, so the capital investment isn’t as great? We’re not going into a green field. The market is relatively big. We think we can make good money. Those three criteria — what’s similar? Obviously memory and GPUs are different customers, different dynamics. But the consistent themes are those three.

Question: On the Dalian customer financing, that $3 billion, how much was from Chinese customers? Separately, how much incentive money did you get from the Chinese government? And on both of those, how much, if any, of that is at risk going forward, given the trade situation?

Swan: On the first question, we have several strategic supply agreements. They give us their money and they commit to demand. That lowers our up-front capital and lowers our beta. But we haven’t said where that money comes from. The range of customers, we haven’t really defined that.

In Dalian, or in China, for the building of the fab, the incentives come in, generically, two ways. One is rebates as we build out the facilities. We’ve talked about that. I don’t remember the number. But it comes in chunks in the early stages of development. We had one of those chunks coming in Q2 or Q3 of last year. Those will run out rather quickly, so they can’t get those back. We’ve secured those. The second form of incentives is more tax-oriented going forward. That becomes a function of the amount of volume we put through the fab.

On the ability to withdraw the tax incentives, there’s real mutual interest for tax incentives to continue. I don’t see that as, frankly, an issue. I think the issue is more — to the extent that the powers that be conclude tariffs make any sense at all in leveling the playing field, if you have product coming from China that has higher tariffs on it, all else being equal, prices go up in the market. The good news is, lots of the supply comes from China, so everybody will be impacted by tariffs. The bad news is, it’s not good for global trade.

We’ve earned the tax incentives that are a part of all of our — whether it’s Israel or Ireland or China — that’s a natural construct of what we look for in terms of economic advantages for putting high-paying jobs and a lot of capital into these locations. There’s mutual benefit for that. I don’t see any risk. The risk is more when you start to put tariffs on product coming from some places in the world versus others. We’ll see.

We’re in the midst of what we believe is an extremely exciting transformation, from a PC-centric to a data-centric company. We have the biggest TAM we’ve had in the history of the company. We’ve set three record years of financial performance. We play an increasing role in the success of our customers because we have a more diverse set of technologies and IP to help them grow their respective businesses or enhance their capabilities. We really believe that 5G is a transformative technology that impacts not whether modem makes money or not — but even more, impacts, ultimately, the increasing demand for data.

With increasing demand for data, whether it’s what we do in the cloud — increasingly the role that Sandra and Dan and their teams play in the network and what we do at the edge, we just characterize as 5G, as the tailwind across the entire TAM, not just slices of the TAM. We’re pretty excited about the laundry list of things we’ll talk about next week.