GamesBeat: On 5G, it starts a bit in 2019, and really picks up by 2020, right? It seems like a gradual start.

Shoham: Exactly. It’s going to be a long wait until the market actually implements it. But again, what we’ll see is more and more bigger titles, in terms of size, because of the availability of bandwidth to download. That used to be a limitation in the past. It’s already almost not a limitation anymore. You’ll see more and more buyers with a game that weighs 700 megabytes, and they’ll target even users who aren’t on wi-fi, which wasn’t the case in the past.

That makes a big difference in the market, when you have 5G with an unlimited data package and a powerful phone. Why wait for wi-fi to download a gigabyte worth of game? You can just download it on the bus. There’s no reason not to.

GamesBeat: You can do a lot more with the cloud as well at some point, right?

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Shoham: There can be a lot more services that are server-to-server, that don’t necessarily need to be pre-cached or need the client to download something. That will just be available. There will be much more robust and sophisticated ad units that aren’t necessarily on your device. They’ll be streamed, or they’ll be HTML5 or whatever it is. You’ll be able to see them and interact with them because you have a very fast connection.

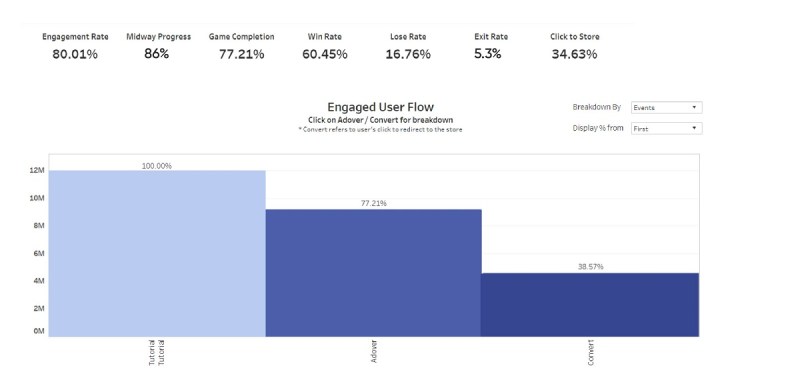

Above: IronSource’s in-ad data

GamesBeat: I was playing one of the first voice-driven car games, a trivia game from Drivetime. I wonder how big an opportunity that’s going to be.

Shoham: It’s a good question. There are a lot of fans around everything that has to do with voice activation in the Alexa or Google Home world. For us it’s still an unknown, to be very honest about it. We haven’t seen a lot of our clients or other gaming companies going that route. It’s a niche. The hardware platforms are pushing a lot of the developers and software makers to build more content and more applications toward those products. For us it’s still an unknown.

GamesBeat: It seems like a 5G-related phenomenon. You could only really do that with that much bandwidth.

Shoham: Already more and more phones are being built that are 5G-compatible. It’ll happen.

GamesBeat: With some of these changes, are you expecting a lot to change in terms of who are the biggest game companies?

Shoham: Yes, I think there is. That relates to what we talked about before around the barrier to entry. Today the barrier to entry is changing, mainly because of hyper-casual. A game with a very deep core loop and metagame, it’s not easy to build a successful game like that today. But to go and build the next big hit in hyper-casual, we see that all the time. Studios pop up from nowhere and go to the top of the charts because of how well they can do their user acquisition and monetization. The barrier to entry is going down, because those games don’t require such complex core game mechanics.

Look at the top charts, the top 20 or top 30. You see a lot of names there that you haven’t seen a month ago. It used to be the case that you’d see the giants, the companies you know, dominating the charts all the time. We’re not there anymore. It’s already changing. Now you have giants within the hyper-casual world, Voodoo and KetchApp and so on. But still, we see newcomers getting there without a lot of investment, without a huge team, without necessarily being the most experienced team in the world. They’re just generating the next hit game, being super viral, and doing user acquisition in an effective, efficient way.

The giants in the hyper-casual world, two years ago you didn’t even know their name. Voodoo came out of nowhere. They existed for many years before they blew up, but you didn’t know about their titles. All of a sudden they’re dominating and they’re raising $200 million. It’s insane. They’re a great company, by the way. We’re working with them very closely. A lot of other hyper-casual companies need to look at them and try to learn from them.

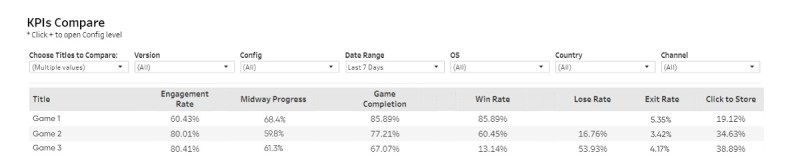

Above: IronSource’s in-ad platform.

GamesBeat: As far as the makeup of the adtech industry itself, what do you see happening there? Has some of the consolidation slowed down, or do you expect more?

Shoham: I can tell you what we’re planning at IronSource, which reflects what we feel will happen with the rest of the market as well. We’re focusing on building a lot more tools for developers, mainly for game developers. That’s our core focus, giving them everything they need to manage their business and become scalable. We want to give them all the tools we can imagine. We call it our growth engine. That’s what we’ve been building in the past few years and continue to build. It includes mediation, but it also includes many other tools as well.

We can talk about analytics and other tools we’re building. We’re either adding that to the platform by building it ourselves, or adopting other technologies and working with other companies, but that’s our approach. We see ourselves evolving into a platform that will answer a lot of the core needs and solve a lot of the core problems for game developers and game companies out there, big and small. That’s where we’re pivoting for the next few years in terms of product road maps, how much we’re investing, and so on.

We feel that some other companies are going there as well. Some aren’t. You can see what’s happening with AppLovin. They’re going in a whole new direction, becoming a game developer themselves. Tapjoy bought a small mediation company. Some of the adtech leaders are still looking at how to evolve and add more services to make their products stickier and solve more problems for their clients.

We’re much more than an adtech company in terms of what we provide with our services and how deeply embedded we are in any gaming company that works with us, especially if they’re using our mediation platform and the rest of the tools we provide. We’re much more of a technological partner, a monetization platform. We manage everything — user acquisition, monetization, analytics. We provide insights that you can take action upon. You can understand your ecosystem better, what’s happening with your game and why users aren’t interacting with ads or why they are. That’s how we see the platform and ourselves. We cover the biggest problems and the biggest needs that game developers have.

We’re going to invest much more in 2019, 2020, and 2021. We have a long-term road map for the next three years that includes a lot of the things I was just talking about, whether building from zero or looking for opportunities in the market for acquisition.

GamesBeat: Folks like Bidalgo are talking about automating a lot of the creative process for ads. Do you see that as an area where adtech companies can offer more to their customers?

Shoham: Definitely. I talked about that earlier as one of our predictions or trends. A lot of adtech companies out there are investing in creative and creative automation — building more, having A/B/C/D tests for certain creatives. They’re making small tweaks that you might not necessarily see or understand as a user, but you can see the effect in the ads, and I see that a huge opportunity for game companies.

At IronSource we have a team of around 50 people building creative and working on creative. That’s a huge investment from our end. They’re working on automation, technological tools, or just building as many assets as possible. We’re working on something very interesting that we’re calling an in-ad analytics platform. We released it in the middle of year and talked about how to analyze an ad, a creative.

The way we analyze is exactly how you analyze a full game. We analyze heat maps, where users click, the drop-off point. If the game in a playable ad is too hard, you see the effect on users in how many installs come from the ad. If the game is too easy, you see that as well. We treat our ads and creatives exactly like a game company would treat a game, looking at all the metrics. That’s a service we provide to everyone building creatives with us. I’m sure that more and more companies will become more sophisticated there as well, because it’s bringing a lot of good results.