testsetset

IronSource has a broad view of what is happening in mobile user acquisition, brand advertising, games, adtech, and even 5G technology. And that’s why I thought it would be interesting to talk with Tal Shoham, chief operating officer for developer solutions at IronSource.

Shoham made some predictions about what will happen across categories as changes in one field — such as the introduction of 5G wireless data technology — can create opportunities, like making connected hardcore games on mobile devices more viable. We talked about IronSource’s expectations for the year.

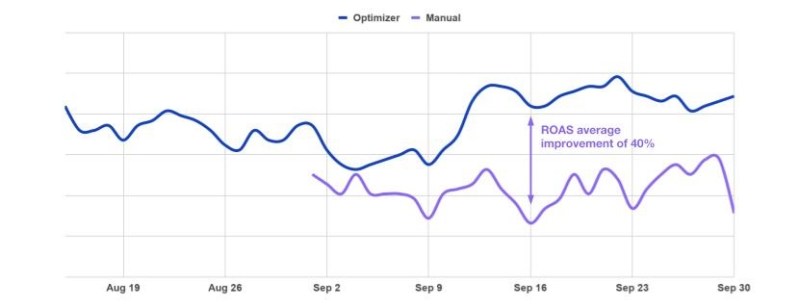

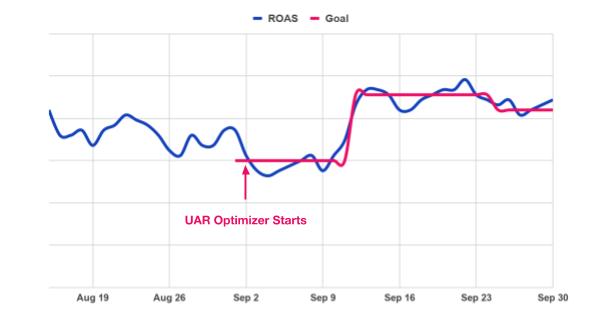

And we also noted that IronSource is introducing a new tool dubbed the ROAS Optimizer, which helps mobile marketers figure out return on advertising spend (ROAS) using both in-app purchase data and user-level ad revenue data. IronSource is launching this tool today to enable user acquisition managers to automatically bid on dynamic CPI (cost per install) rates to hit their desired ROAS goals.

The tool is one of many that can help simplify the hard task of getting new users for mobile apps and games. And it fits with Shoham’s prediction that finding users through advertising is becoming more and more complex.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“There’s no difference between advertising in-app and advertising in traditional channels. In both, there are different qualities of users stemming from a variety of different factors, and advertisers must know how to bid according to those users,” said Shoham.

Here’s an edited transcript of our interview.

Above: Tal Shoham, COO of mobile at IronSource.

GamesBeat: What are the top predictions you have to talk about?

Tal Shoham: The first thing we thought about is everything that evolves the technology in terms of internet and communications technology. 5G and everything that has to do with upgraded phones and unlimited packages of data. We see that starting to affect the newest tech that’s being produced. That’s not a hyper-casual prediction at all. It has nothing to do with hyper-casual, actually. Hyper-casual can run on all phones.

This trend, in terms of 5G — phones could have crazy capabilities like unlimited packages. We feel that will create more advanced hardcore games that need those capabilities to live. We already see some of them — with games like PUBG or Fortnite — hardcore 3D games that need to be online all the time and you mainly play on strong phones. With old phones they’re not a great experience. That’s one prediction, everything around tech upgrades, richer content, upgraded phones, and unlimited packages of data.

GamesBeat: Tell me another prediction.

Shoham: The second thing I’d say is that everything that has to do with user acquisition and monetization, in terms of the teams themselves within gaming companies — we feel that’s going to become much more in sync, up to the point where it will be one team in many of the companies we’re talking to. This definitely has to do with hyper-casual games, because with hyper-casual, the user acquisition and monetization will usually be on the same team. We see that with all the leading hyper-casual game companies.

It’s one person who takes care of user acquisition and monetization per title, which is very different than what we’re used to with the triple-A studios, the hardcore studios, and even the mid-core or casual studios. A lot of the companies we work with are already consolidating the teams in charge of user acquisition and monetization, or they’re working a much more synched way than they used to.

It doesn’t need to be ad monetization or in-app purchase monetization, but usually this is relevant for heavy ad monetization revenue games. That’s happening more and more. The hyper-casual trend, again, is pushing this a lot more, because there the user acquisition and monetization go hand in hand. The return on ad spend is being calculated by the monetization team, which is in charge of ads, much more than on other teams.

In some companies this is still completely isolated. We just had a few meetings with companies in London where the marketing and monetization teams are not in sync at all, which is something that can happen in a game that’s heavy on ad monetization. But that’s not happening in the hyper-casual world.

Above: Hyper casual games are taking off.

GamesBeat: What else have you got?

Shoham: The third prediction we talked about, and that we feel strongly about, is publishing. We see that as a huge trend in the last year. More and more game companies are going into publishing, meaning not necessarily building the title, the application, the game themselves, but finding someone else to build it and doing everything else. That means marketing, everything having to do with monetization, helping with localization, helping with design here and there, giving all kinds of pointers. We see that becoming a huge trend.

It’s happening not only with gaming companies. We also see what happened with AppLovin. They started Lion Studios, a big notion around that. We see it with more and more game companies. In the hyper-casual world, of course, it’s very strong. It happens all the time. Voodoo, Ketchapp, all these guys, this is one of their biggest value propositions in the market: the fact that they don’t build all their games. They build only a small portion of their games. But we also see it with companies like Miniclip and others.

That’s going to become stronger and stronger. With the barriers to entry, the capabilities you need to build a game on your own or with a small team — when you find a publisher that becomes more and more available. For us to take part in that, we don’t see that it makes sense as a technology vendor or a mediation provider, and an ad network as well. But we see it as a strong trend. We’re seeing it in a lot of other companies we’re talking to, both gaming companies and other companies.

Above: Alex Yazdi (right) and Gabriel Rivaud of Voodoo at Casual Connect Europe.

GamesBeat: How did people start coming up with the distinction between casual and hyper-casual? Did a particular game blaze that trail?

Shoham: The main difference is that hyper-casual games are usually much more simple. They don’t need a lot of resources to run them. They’re not complicated. You look at examples like Crossy Road or Flappy Bird. Flappy Bird broke the market back in the day. They’re games where you don’t need a team of 10-15 people. You can build them with one, two, three developers. It doesn’t need months of work. You can build them in a couple of weeks, once you have an idea. You don’t need a lot of designers. It’s a very simple design that you can build in a very short production time. Likewise, the gameplay is very simple. It usually starts from the same point as you finished the last time. We do see hyper-casual level-based games as well, though.

Finally, the majority of the revenue, more than 80 to 90 percent, comes from ad monetization rather than in-app purchases. That’s probably the biggest differentiator compared to casual, mid-core, and hardcore. You have casual games from King and others where the majority of the revenue comes from IAP. In hyper-casual it’s the opposite. The revenue for those companies is coming from interstitials, rewarded video, banner ads, and maybe a bit of removing ads as an in-app purchase. But only 10 or 20 percent, or even in some cases 2-5 percent, comes from IAP, which is a huge difference in the economy of a game, how a game is built, and how much you need as far as rewards or currency within the game. There’s not necessarily a big incentive for players to purchase a currency and convert that into IAP when you monetize primarily with ads.

Another prediction we can talk about, then, is what’s going to be the future of hyper-casual? We do see, with some of the clients we have and some of their games, that hyper-casual is probably going to evolve into something else. It’s not going to stay as simple as it is. The next generation of hyper-casual, or hyper-casual 2.0 — we’ll see publishers adding more layers of depth, metagame layers and other features to hyper-casual games. It makes a lot of sense.

One thing I feel very strongly about — a lot of the things that are working well for casual games, in terms of how to monetize users and drive them into IAP, are going to penetrate more into the hyper-casual world. We’ll see a more balanced economy. Instead of 90 percent coming from ads, it’ll be more like 50-50. There are a few good examples of companies already doing this, either with IAP or subscriptions or removing ads or whatever it is. There will be more layers to push users toward IAP and other monetization. We feel that’s going to be much more beneficial for Google and Apple, because they see a cut of that. They’re pushing toward that route. We predict that hyper-casual will become a bit more similar to casual, with an emphasis on functionalities that casual has as well to monetize users with IAP.

Another interesting trend or prediction we see is automation. Automation is very big. A lot of the companies out there are working on it. Game developers are trying to automate as many tasks as possible in the casual and hyper-casual world, and also in platform and technology development. For instance, one of the strongest products we released this year was something that allows you as a UA buyer to set all of your bids automatically according to the results of your campaign. You can change 20,000 or 30,000 different bids every day in an automated way, which is far more manual work than a UA manager could ever do.

Above: ROAS average improvement

This is not only coming from us. Facebook has these types of products. We see other automation tools for user acquisition, to buy on multiple platforms. We see a lot of automation being done on creative, because creative is so big and so important. We see a lot of engines to help you with creative, with app store optimization, being rolled out.

One reason that’s happening is because more and more game developers and publishers have more and more apps or games or titles to monetize and promote. They need some sort of automation tool to manage all of that. You can’t have a team of thousands of people all managing campaigns and optimization and creative and so on. That’s a big trend that we’re seeing all the time.

A big prediction regarding is that we feel ads are becoming much more sophisticated as time goes on. It’s just going to become more and more extreme. The new creatives, the new types of ad units, the new experiences for users, we’re going to see more and more. We already see 360 ads, augmented reality, virtual reality, playable ads, all kind of rich media formats. We see that all the time. We feel there will be much more innovation in technology there. It will follow what I said about automation and upgraded technology, with phones being able to process more advanced media.

What’s happened in the last couple of years is already insane when it comes to ad formats. We’ve seen playable ads. Facebook just launched their beta for playables. It’s happening more and more on the big platforms. They’re adopting more and more sophisticated ad formats. All that will just become more extreme.

The last thing we feel we’re going to see more and more is that IAP-heavy game companies, hardcore game companies, companies that generate 100 percent of their revenue from IAP, will open up their doors for advertising in their games. We already see this in some of the giants. You wouldn’t have expected that some of these guys would ever have ads, but they do.

There’s a couple of reasons for this. One, users are already used to seeing rewarded video in a lot of the games they play. It’s not a weird thing for a user anymore to get some sort of reward or currency or extra move for watching a video, watching an ad. Users see this in so many games. It’s become a very strong format for monetizing users. We feel that more and more IAP-heavy companies are opening up to that format, and for ads in general.

Above: ROAS vs goal comparison

We also feel that the technology has evolved dramatically in terms of how to segment and who to show ads and how to cap and how to pay for ads. You don’t have to treat all your users in the same way, which was the case a few years ago. Now game developers can implement much more sophisticated and granular ways of monetizing users with ads. It doesn’t necessarily harm gameplay or treat paying users very differently from non-paying users. You can segment users from different countries and different age groups to give them the best experience for those specific cohorts without harming the core loop of the game or IAP.

A lot of the giants are doing experiments, and those experiments will lead to adopting ad monetization in more titles, more studios, and more games. Once two or three or four of the giants implement this, the rest will follow quite rapidly. It’s already happening. We’re just in the beginning, but in 2019 and 2020, it’s going to happen much more.

GamesBeat: When Blizzard had their BlizzCon event and showed off the Diablo Immortal mobile game, the fans kind of went crazy because it wasn’t a PC game. That crowd, to me, seems like they’re not about to accept any kind of monetization in a game other than paying for it. I wonder whether there’s still a deep divide between hardcore gamers and mobile gamers.

Shoham: There is. You’re right that there is. The hyper-casual, casual, mid-core gamers are used to seeing ads, reacting to ads, watching rewarded video, getting all kinds of different rewards. That’s part of every game they’re playing, and usually they play more than one game. They interact with it, and they like it. They actually look for it. There’s certainly a big difference.

The hardcore gaming companies, the hardcore games, are not using ads at all yet. Those types of users, if they’re hardcore users, are not used to seeing that. But the mentality and the math stay the same in terms of — even in a game that’s super hardcore, from Blizzard or any other developer, you still have, at most, maybe 7 percent paying users. You still have 90 to 95 percent of users that will never pay. Maybe they’ll watch a short video to win more coins or gems or a new item. Maybe that’s something they’re willing to do.

Above: Diablo Immortal

A lot of these companies were heavily against implementing rewarded video until they tried it, and then they said, “Wow, this isn’t doing that bad. The users like it. They’re asking for it now.” Something that’s important to remember, when we’re talking about rewarded video, is that it’s user-initiated. You’re not actually deciding for the user that they’ll watch a video. The user sees a button that says, “Watch the video and earn whatever.” They decide to click on the button. Because of that flow, because it’s user-initiated, if users don’t like it they just won’t see it anymore. If they like it they’ll click on it.

From what we see, users love it. They’re willing to click and watch. It’s a great way to give them a taste of all kinds of virtual goods. It’s a great way to create longer sessions, because users now have something to use or spend. It’s a great way to convert a non-paying user to a paying user, because you give them a small taste of some virtual goods, and maybe now they’ll be willing to pay for that. And of course it’s a great way to monetize the non-paying users, which is the majority of your supply. It’s a weird win-win situation for everyone with rewarded products.

Above: IronSource

GamesBeat: As far as improvements in Facebook and Google’s UAC optimization tools, does that leave much room for third-party optimization for Facebook and Google?

Shoham: Definitely. I’ll divide my answer into a few parts. First of all, there’s a lot of room for third-party companies to help with optimization on those giant platforms for UAC. You see a lot of companies out there where this is their bread and butter, helping small user acquisition teams — or big ones, for that matter — to better manage their inventory and campaigns running on Facebook and so on. There’s a lot of room there, a lot of help to provide around creative, how to target, what audience groups to create. Even though those platforms are optimizing and improving, there’s still a lot of room for third parties to optimize the buy on those platform.

The second part is there are a lot more platforms out there. There’s IronSource. There’s Unity. There’s AppLovin. The list goes on and on in terms of huge ad networks and supply sources. All those platforms are becoming bigger and bigger. They’re growing dramatically year over year. There’s a lot of room for third-party optimization tools on those platforms as well, or for those platforms to increase how much they invest in optimization tools for their inventory.

That’s what we’re doing at IronSource, as an example. We released all these amazing optimization tools this year. Those tools help developers optimize their buy on IronSource, but not only on IronSource. As a mediation platform, we also provide data and tools for our clients to optimize the way they buy on other platforms.

If somebody’s using our mediation platform, as a quick example, and enjoying the user-level ad revenue we provide — this revenue is something that helps developers better understand lifetime value and return on ad spend for the campaigns they’re running, and not only with IronSource, but also with other companies. They now know, because of the mediation platform, the true value of each user coming from ads, which they didn’t know before. Now, they can utilize that data on Facebook, Google, IronSource, and other platforms in ways that are much more granular, much more accurate. This is quite big and quite disruptive as far as what it’s done in the market, and again, it’s in the family of third-party optimization tools for measurement, or whatever you want to call it.

GamesBeat: On 5G, it starts a bit in 2019, and really picks up by 2020, right? It seems like a gradual start.

Shoham: Exactly. It’s going to be a long wait until the market actually implements it. But again, what we’ll see is more and more bigger titles, in terms of size, because of the availability of bandwidth to download. That used to be a limitation in the past. It’s already almost not a limitation anymore. You’ll see more and more buyers with a game that weighs 700 megabytes, and they’ll target even users who aren’t on wi-fi, which wasn’t the case in the past.

That makes a big difference in the market, when you have 5G with an unlimited data package and a powerful phone. Why wait for wi-fi to download a gigabyte worth of game? You can just download it on the bus. There’s no reason not to.

GamesBeat: You can do a lot more with the cloud as well at some point, right?

Shoham: There can be a lot more services that are server-to-server, that don’t necessarily need to be pre-cached or need the client to download something. That will just be available. There will be much more robust and sophisticated ad units that aren’t necessarily on your device. They’ll be streamed, or they’ll be HTML5 or whatever it is. You’ll be able to see them and interact with them because you have a very fast connection.

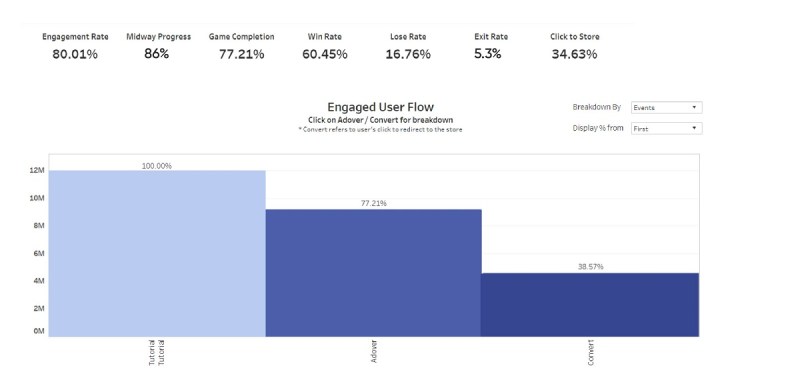

Above: IronSource’s in-ad data

GamesBeat: I was playing one of the first voice-driven car games, a trivia game from Drivetime. I wonder how big an opportunity that’s going to be.

Shoham: It’s a good question. There are a lot of fans around everything that has to do with voice activation in the Alexa or Google Home world. For us it’s still an unknown, to be very honest about it. We haven’t seen a lot of our clients or other gaming companies going that route. It’s a niche. The hardware platforms are pushing a lot of the developers and software makers to build more content and more applications toward those products. For us it’s still an unknown.

GamesBeat: It seems like a 5G-related phenomenon. You could only really do that with that much bandwidth.

Shoham: Already more and more phones are being built that are 5G-compatible. It’ll happen.

GamesBeat: With some of these changes, are you expecting a lot to change in terms of who are the biggest game companies?

Shoham: Yes, I think there is. That relates to what we talked about before around the barrier to entry. Today the barrier to entry is changing, mainly because of hyper-casual. A game with a very deep core loop and metagame, it’s not easy to build a successful game like that today. But to go and build the next big hit in hyper-casual, we see that all the time. Studios pop up from nowhere and go to the top of the charts because of how well they can do their user acquisition and monetization. The barrier to entry is going down, because those games don’t require such complex core game mechanics.

Look at the top charts, the top 20 or top 30. You see a lot of names there that you haven’t seen a month ago. It used to be the case that you’d see the giants, the companies you know, dominating the charts all the time. We’re not there anymore. It’s already changing. Now you have giants within the hyper-casual world, Voodoo and KetchApp and so on. But still, we see newcomers getting there without a lot of investment, without a huge team, without necessarily being the most experienced team in the world. They’re just generating the next hit game, being super viral, and doing user acquisition in an effective, efficient way.

The giants in the hyper-casual world, two years ago you didn’t even know their name. Voodoo came out of nowhere. They existed for many years before they blew up, but you didn’t know about their titles. All of a sudden they’re dominating and they’re raising $200 million. It’s insane. They’re a great company, by the way. We’re working with them very closely. A lot of other hyper-casual companies need to look at them and try to learn from them.

Above: IronSource’s in-ad platform.

GamesBeat: As far as the makeup of the adtech industry itself, what do you see happening there? Has some of the consolidation slowed down, or do you expect more?

Shoham: I can tell you what we’re planning at IronSource, which reflects what we feel will happen with the rest of the market as well. We’re focusing on building a lot more tools for developers, mainly for game developers. That’s our core focus, giving them everything they need to manage their business and become scalable. We want to give them all the tools we can imagine. We call it our growth engine. That’s what we’ve been building in the past few years and continue to build. It includes mediation, but it also includes many other tools as well.

We can talk about analytics and other tools we’re building. We’re either adding that to the platform by building it ourselves, or adopting other technologies and working with other companies, but that’s our approach. We see ourselves evolving into a platform that will answer a lot of the core needs and solve a lot of the core problems for game developers and game companies out there, big and small. That’s where we’re pivoting for the next few years in terms of product road maps, how much we’re investing, and so on.

We feel that some other companies are going there as well. Some aren’t. You can see what’s happening with AppLovin. They’re going in a whole new direction, becoming a game developer themselves. Tapjoy bought a small mediation company. Some of the adtech leaders are still looking at how to evolve and add more services to make their products stickier and solve more problems for their clients.

We’re much more than an adtech company in terms of what we provide with our services and how deeply embedded we are in any gaming company that works with us, especially if they’re using our mediation platform and the rest of the tools we provide. We’re much more of a technological partner, a monetization platform. We manage everything — user acquisition, monetization, analytics. We provide insights that you can take action upon. You can understand your ecosystem better, what’s happening with your game and why users aren’t interacting with ads or why they are. That’s how we see the platform and ourselves. We cover the biggest problems and the biggest needs that game developers have.

We’re going to invest much more in 2019, 2020, and 2021. We have a long-term road map for the next three years that includes a lot of the things I was just talking about, whether building from zero or looking for opportunities in the market for acquisition.

GamesBeat: Folks like Bidalgo are talking about automating a lot of the creative process for ads. Do you see that as an area where adtech companies can offer more to their customers?

Shoham: Definitely. I talked about that earlier as one of our predictions or trends. A lot of adtech companies out there are investing in creative and creative automation — building more, having A/B/C/D tests for certain creatives. They’re making small tweaks that you might not necessarily see or understand as a user, but you can see the effect in the ads, and I see that a huge opportunity for game companies.

At IronSource we have a team of around 50 people building creative and working on creative. That’s a huge investment from our end. They’re working on automation, technological tools, or just building as many assets as possible. We’re working on something very interesting that we’re calling an in-ad analytics platform. We released it in the middle of year and talked about how to analyze an ad, a creative.

The way we analyze is exactly how you analyze a full game. We analyze heat maps, where users click, the drop-off point. If the game in a playable ad is too hard, you see the effect on users in how many installs come from the ad. If the game is too easy, you see that as well. We treat our ads and creatives exactly like a game company would treat a game, looking at all the metrics. That’s a service we provide to everyone building creatives with us. I’m sure that more and more companies will become more sophisticated there as well, because it’s bringing a lot of good results.