Popular password-management company 1Password has raised $200 million in a series A round of funding led by Accel, with participation from Slack Fund and Atlassian founders Scott Farquhar and Mike Cannon-Brookes, among other angel investors.

This is the first time 1Password has raised any outside investment in its 14-year history, and according to Dealroom data it represents the biggest series A round ever in the security sector, and is in the top 50 series A rounds overall.

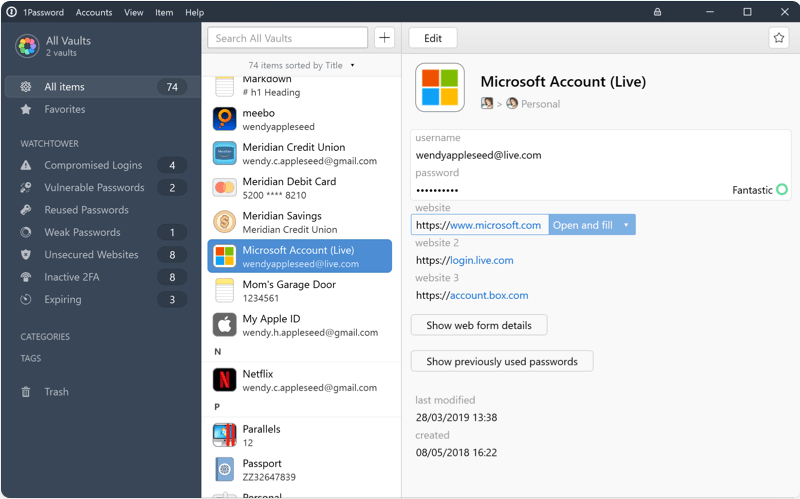

Founded out of Toronto, Canada in 2005, 1Password is one of a number of companies dedicated to storing passwords securely, allowing users to log into myriad online services with a single click. The platform can also be used to store other private documents, such as software licenses, credit cards, and driver’s licenses.

Above: 1Password

Breaches

Barely a day goes by without some form of data breach hitting the headlines, and poor password management is a significant factor. In the consumer realm, individuals are prone to reusing the same passwords across multiple services, and if one of those services is hacked the perpetrator can reuse the same credentials to access victims’ other accounts. To help counter this, a number of online tools can warn you if your login credentials have been leaked, such as Have I Been Pwned? (HIBP) and Google’s recently launched Password Checkup Chrome extension.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

For businesses, poor password hygiene is a major driving force behind security breaches, with 81% of all breaches said to be due to compromised passwords. This is where 1Password is building much of its business — encouraging “unguessable” passwords that users don’t have to memorize or write down. Although consumers represent a big part of its target market, 1Password claims thousands of business customers use the enterprise incarnation of the service, including Dropbox, IBM, and one of its new investors — Slack.

“We started 1Password to solve a problem we all feel every day: the hassle of creating and remembering complicated passwords to access the apps we need,” said 1Password CEO Jeff Shiner. “Companies try to enforce strong password policies with unreasonably complex requirements that people can’t follow or remember. As a result, most of them create schemes to get around these rules by reusing the same password everywhere or adding subtle variations. This puts your employees and businesses at risk.”

1Password has clearly managed just fine without external funding — it’s been profitable for years based entirely on organic growth. But an extra $200 million in the bank puts it in a stronger position to scale its enterprise-focused business. For context, rival Dashlane raised $110 million earlier this year, and it also has the business sphere in its sights. So 1Password is clearly taking this opportunity to bolster its coffers in the chase for more corporate dollars.

“We don’t come across companies like 1Password very often, especially in an era of growth at all costs,” Accel partner Arun Mathew added. “Like Atlassian and Qualtrics, the 1Password team impressed us by building a business that’s not only scaling extremely quickly but also has been profitable since day one — and that’s why today we’re making the biggest single investment in Accel’s more than 35-year history.”

This article was updated 18/11/19 to include Dealroom data