Above: League of Legends is an esports mainstay.

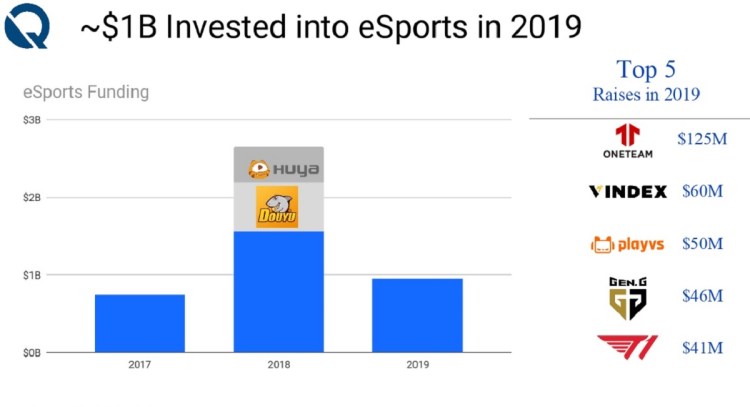

GamesBeat: Riot Games has said that, even with all of the success of League of Legends, that they are not making money in esports. It makes me wonder if anybody is making money in esports yet? That’s hard to fathom, given how many hundreds of millions of fans are involved in it.

Soltys: That’s what we’re seeing with a lot of companies. But it’s across the board. It’s hard to say that nobody’s making money. We’ve seen companies that are. It’s hard to say that they’re making extreme amounts of cash flow, because it’s a growth industry. We’re in the early stages of it. Everybody is reinvesting to keep up with that growth.

Perkins: When I was at one of your GamesBeat conferences, you asked a good question, and one of the panelists said, “We’re not even on first base. We’re not even up to bat yet.” That’s still the case.

The question would be, for Riot, if they’re not making money, are they planning on exiting the esports space? I doubt it. In the long run, there’s an investment that could turn into massive amounts of profit, like we see in other companies. I don’t know how they measure it, so it’s tough to know if you’re comparing apples to oranges with Activision Blizzard and other companies in that space and what Epic is doing with their support of esports. We just don’t know at this point. But everyone is investing a lot, and I think the return on investment is going to be substantial.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Even though Riot says they’re not making money specifically in esports, they have to be making money because of their exposure in esports. There’s a lot to come. That’s the exciting part about what we’re doing now, and in the industry as a whole. There’s plenty of great stuff to come. That’s why we’re keeping a close eye on the data and how it evolves. Quarter by quarter it’s going to change, no question.

GamesBeat: So there’s no doubt that Riot has a good business? It has League of Legends and it’s making a lot of money in that. It’s investing in esports and that’s going to pay off someday.

Perkins: Yes, yes. That’s our view.

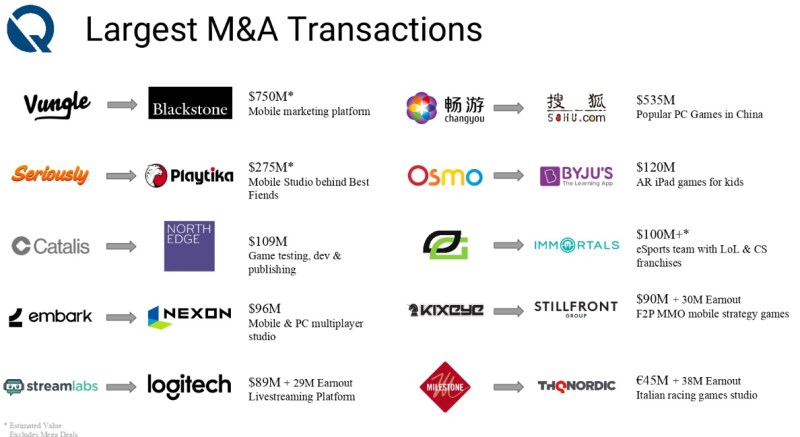

Above: The biggest deals across all of gaming recently.

GamesBeat: As far as teams go, what sort of opportunity do you see there? I have seen some investors like Andreesen Horowitz, they came out and said, “We looked at a lot of teams, but we couldn’t really justify the valuations there.” They’re trying to find other ways to invest instead of just teams. Maybe they’re an exception, but it’s interesting that they didn’t think teams were going to be on this path to making a lot of money. What feedback are you getting from investors as far as whether teams themselves are a good idea to invest in?

Soltys: Andreesen, of course, is extremely smart, and they’re extremely successful in broader tech. I think what you’re seeing play out a bit is investors knowing the spaces that they know and staying in those spaces, continuing to invest that way because that’s brought them success and they understand the fundamentals. Andreesen is an exceptional technology firm. They’re comfortable investing more on the esports infrastructure layer, understanding the flows there.

A lot of the teams have funders and management teams coming in from traditional sports. They’re familiar with the team model, maybe geographic locations for teams, dealing with players and coaches, trading players, and other things built into that model. Those are the guys that are comfortable investing on the team side. As an intelligent investor, you pave the way into your own space that you’re familiar with, that you understand, where you have proven success. I think that’s their perspective.

GamesBeat: As far as opportunities in the game industry, we’ve talked a lot about esports, but it seems like there’s a lot of choice that game investors have. They can do PC, consoles, Switch, esports, cloud gaming. There are lots of ways to get involved in the industry in some way. That seems like it’s at a record high. It presents people with a fair amount of complexity as far as investing in games.

Perkins: That’s what we’re here to sort out. Some of the companies in the industry, whether they’re developers or publishers or investors, or whatever other infrastructure companies–one of our key jobs is to sort that out for the different companies we work with. It boils down to–from my perspective, I’ve always been a supporter of independent content developers. I’m looking for the one in 100 that really is exemplary in terms of breaking through and providing great content, great gameplay, and the infrastructure that’s going to support delivering that great content to a worldwide market.

The other thing is–I’ve done many deals in Asia. To see what they’re looking for–they want to be in the west. Some of them definitely want to bring western content to Asia. But now there’s been a shift. They want to be in the western markets, to understand the tastes and the gameplay that’s done so well in the west. Not necessarily thinking about how to bring those games to China and Korea anymore, but just getting more involved in the western markets.

It depends on the company, where their strengths are. They have to have a very clear understanding of how they’re going to get to the market. There’s a lot of independent developers out there, especially in central and eastern Europe, that are doing $3-4 million in revenue, but could be doing $20-30 million with the right partner in the rest of Europe, in North America, and maybe in Asia. We’re just trying to help them steer and build value, position them, get them in contact with the right people, and run a professional approach to improving the market for them, as well as their buyers or investors.

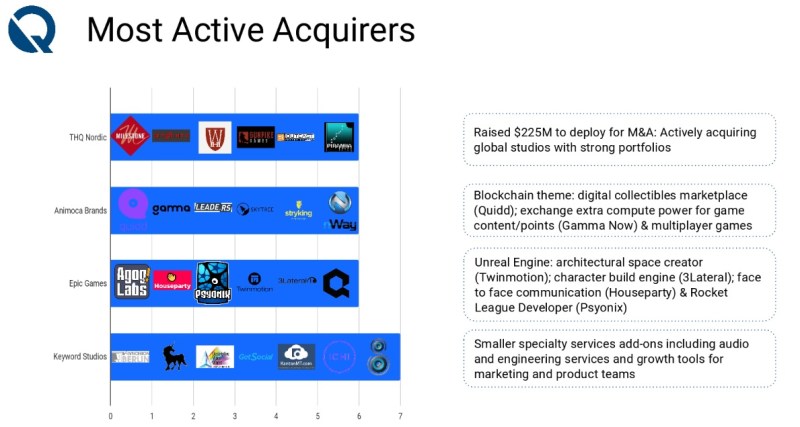

Above: The biggest buyers in esports.

GamesBeat: You probably have to keep a close watch on where Tencent is going. They’re such a big company, carrying so much weight, and it seems like they are way out in front on a lot of investments. They’ve slowed down a little. It seems like other companies like NetEase are trying to step up.

Perkins: From what we can see, NetEase is being very aggressive. And we’ve seen a couple of European companies getting very aggressive as well. They’re not the size of Tencent, and there are Korean companies that tend to be a little more conservative than maybe the Chinese companies or central European companies. But yes, Tencent is obviously pushing forward aggressively.

Soltys: What we’re also seeing more broadly is there’s a strong amount of activity from the top tech and top gaming companies out there. It’s picking up more recently. We’ve seen Google acquiring studios to support the Stadia effort. PlayStation is doing similar deals. Microsoft is doing similar deals. Facebook, Twitch, Epic, they’re really going out and helping build out that infrastructure layer for themselves, continuing to drive pathways there.

What’s also interesting is that something we’ve observed in technology more broadly is also happening in gaming. You have the private equity element coming in. Now that we have companies that are steadily growing, certainly profitable, that helps the private equity guys come in and write checks. That’s also attracting interest and creating some interesting transactions in that space.

As a bifurcation of that, companies that have private equity backing or significant venture capital backing, they are also doing deals in turn. You have a new generation of companies that are starting to do deals, as well as a new set of investors that have come into gaming in a big way. All this activity that we counted on — we saw a lot of it coming from Tencent and some of the Asia players — that’s picking back up in the west, introducing new groups to gaming. That’s also part of the disruption element, more from a financial perspective. It’s leading to a lot of activity and a lot of opportunities for companies to think about growth and where their funding is coming from.

GamesBeat: On the esports side again, the public companies seem to be pretty small right now. MTG is one of those. I assume you’re expecting to see more public companies in that space in the future?

Soltys: We’re talking with some Canadian partners of ours, and there are a lot of smaller companies in esports that are approaching the TSX and various stock markets in the United States to fundraise, even at very early stages. Low single-digit millions in revenue is enough to allow them to go raise money publicly, which is a super low threshold to go public in our view, but it’s another avenue to raise money. There’s a lot of smaller, growing esports companies out there, and with time we’ll see those mature and grow larger.

Perkins: That’s happening in the U.K. You’re seeing relatively smaller-sized companies going public to raise money and acquire more content, studios, that sort of thing. That’s happening quite a bit, as well as in Canada. It seems to be easier for them to do that now. It’ll provide more activity. It’s already red hot, but more activity in the M&A market.

Above: Gaming index for public game company valuations

GamesBeat: Is there anything you see as on a downslope, whether it’s VR games or crowdfunding or any other areas that had their peaks in recent years, and never really exploded?

Soltys: Speaking for myself personally, I don’t know if you’re familiar with the hype cycle that Gartner puts out for emerging tech, but there’s a slide in the pack that I included just for fun, with our view of where we see the gaming ecosystem evolving. VR and AR, to us, is starting to actually get pretty interesting again. The headsets have caught up. It’s becoming a technology that’s affordable for a broader consumer base today. It still has a ways to go, but the games and content are incredible. Facebook is leading the charge, investing so much, that it’s starting to be interesting to look at how people are interacting with that.

Blockchain had some life, some spotlight from the industry. I think it’s very early. I’m not convinced yet that there is a super exceptional and different way of using blockchain that can’t be solved through means we already have today. I’m still waiting to see something in blockchain that does an extraordinary thing because of blockchain, rather than in addition to it. That’s one thing that’s still very early and slightly overhyped. A lot of folks are talking about it and thinking about how to include it in their games or their development cycles, but I don’t think it’s a needed application in its current form.

Perkins: Until VR becomes mainstream and I see it in homes that I know, I’m not sure it’s quite there yet. It’s just not mainstream yet. There has to be some evolutionary changes in terms of price point, technology, and games that art supported in that market. That’s just kitchen table research, but from an M&A standpoint, we’re not getting a lot of activity in that space. It’s still in the early stages in terms of platform providers, content providers, that sort of thing. But it’s got a bright future. Facebook is leading the way.

GamesBeat: Are there any other key points you want to make?

Soltys: On esports, to finish that off, although we spent a lot of time there–one thing we’ve been seeing a lot of, and I think it’s super positive for the industry, is just the amount of partnerships that are happening across different sub-segments of esports. Even companies in the same space that are partnering up together and doing some pretty cool concepts and things together, where they both come from their points of strength and cross-pollinate ideas.

It’s a really early industry. The teams that are working together, I think that’s good for both those respective industries today, but also for the industry more broadly. You start to have those ingrained relationships between folks. As the industry matures, they’ll be the leaders in the space and have a firm grasp of what’s happening. We’ve seen a lot of that, which is awesome to see, and certainly not very common. Maybe outside of gaming, but it’s not that common to have that broad swath of partnerships. That’s a positive development that further fuses together the value and growth potential for esports.

Perkins: Also, it’s not just esports. I think we’ll see some very interesting, unusual partnerships in the game industry, which will hopefully improve the industry even more. Behind the scenes, we’re seeing some unique relationships. It’s going to be very interesting.